Closing Costs With Fha Loan

Description

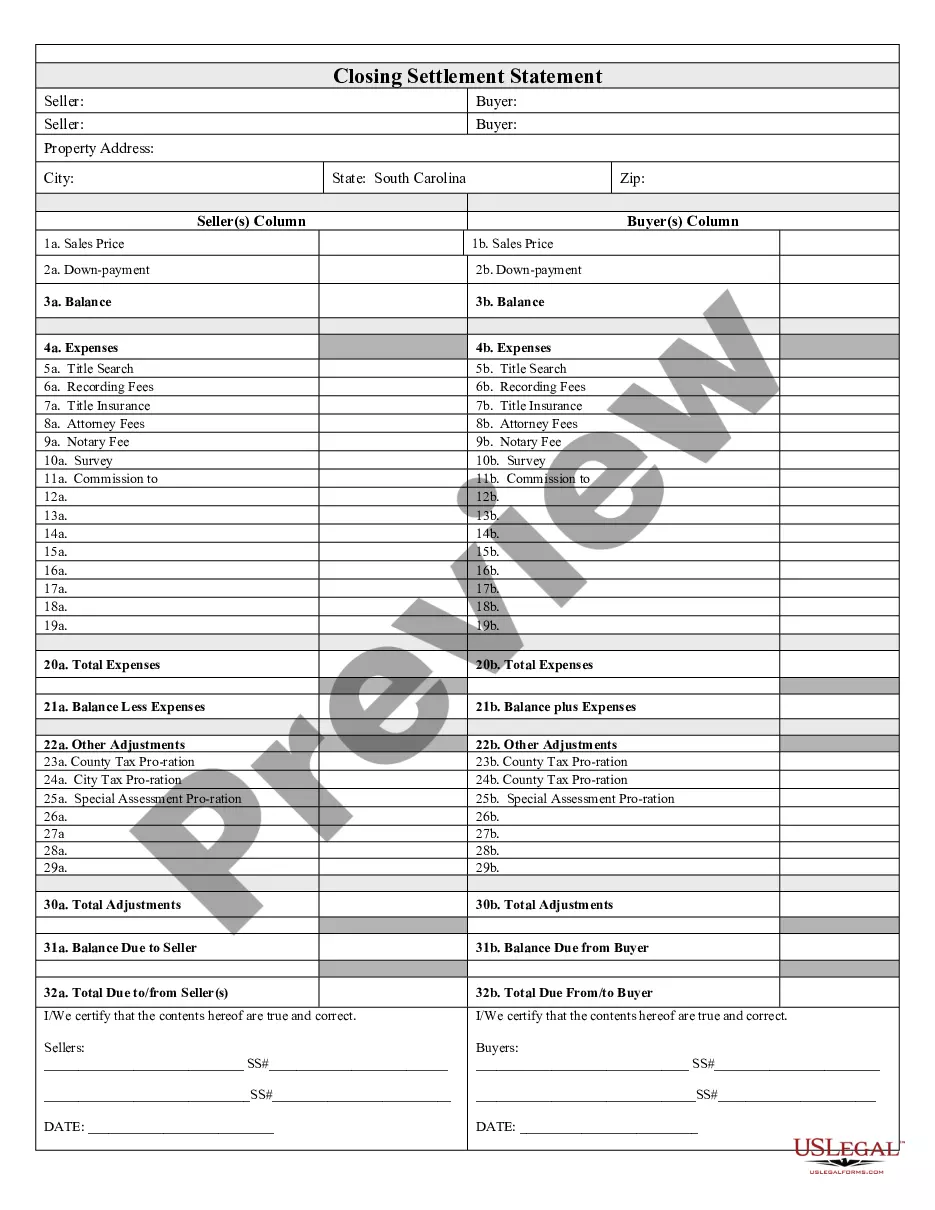

How to fill out South Carolina Closing Statement?

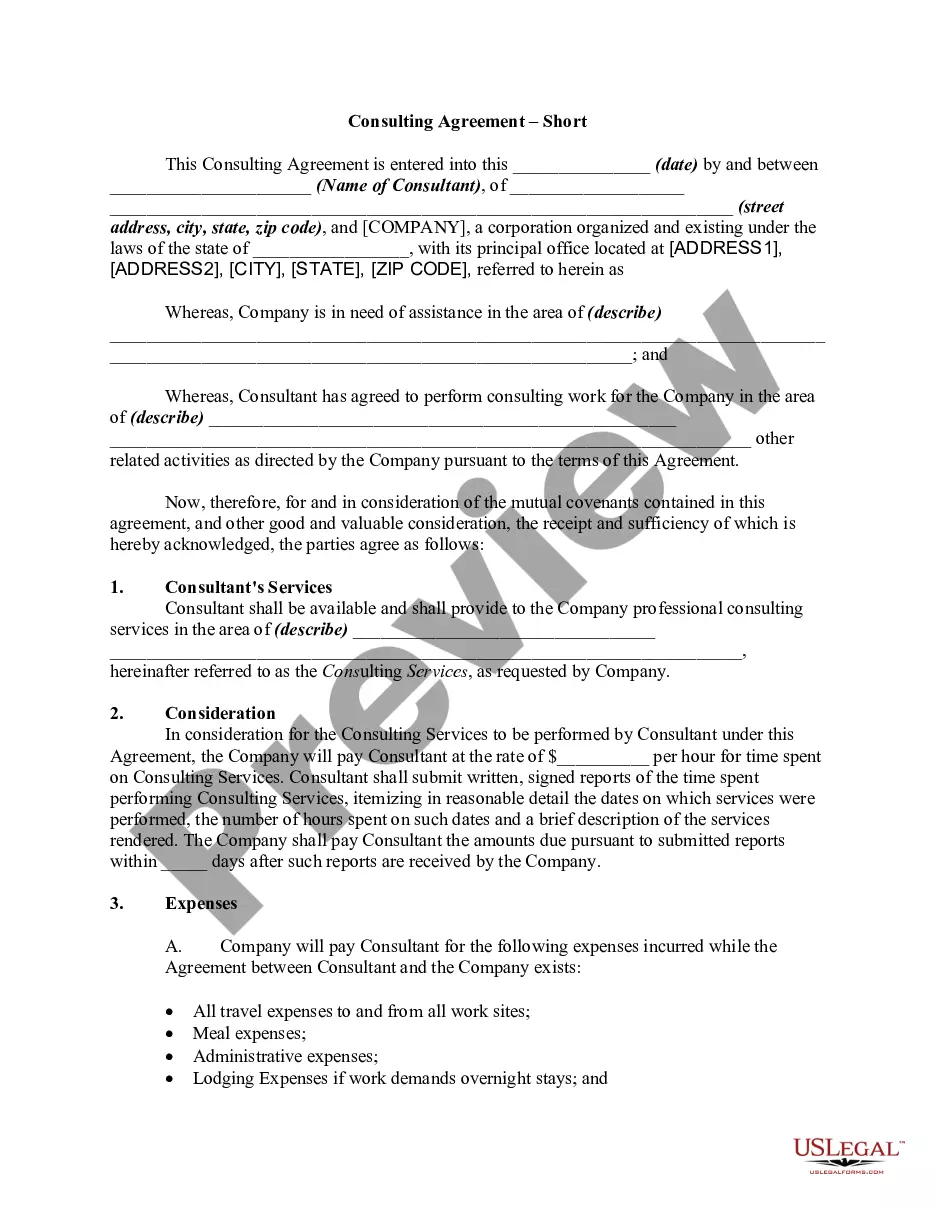

The Closing Expenses Involved With FHA Loan showcased on this page is a reusable formal format crafted by professional attorneys in accordance with federal and state laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 confirmed, state-specific documents for any commercial and personal situation. It’s the fastest, easiest, and most dependable method to acquire the documents you require, as the service ensures bank-level data security and anti-malware protection.

Select the format you prefer for your Closing Expenses Involved With FHA Loan (PDF, Word, RTF) and save the example on your device. Complete and sign the documentation.

- Search for the document you require and examine it.

- Browse through the file you searched for and preview it or review the form description to confirm it meets your needs. If it does not, utilize the search bar to locate the suitable one. Click Buy Now when you have identified the template you need.

- Subscribe and Log In.

- Select the pricing plan that fits your needs and create an account. Use PayPal or a credit card to make a swift payment. If you already possess an account, Log In and check your subscription to proceed.

- Obtain the fillable template.

Form popularity

FAQ

The maximum for closing costs with an FHA loan can vary based on your loan amount, location, and lender. Typically, FHA regulations allow closing costs to range between 2% to 5% of the loan amount. Additionally, many lenders may cover part of these costs or offer assistance programs to help buyers manage expenses. Using platforms like USLegalForms can help streamline the process of understanding and estimating your specific closing costs with an FHA loan.

Closing costs are typically 3% ? 6% of the loan amount. This means that if you take out a mortgage worth $200,000, you can expect to add closing costs of about $6,000 ? $12,000 to your total cost. Closing costs don't include your down payment, but you may be able to negotiate them.

You can generally expect the total to be between 1 and 5% of the price you are paying to buy your home. Payment for closing costs can sometimes be financed with your loan, in which case it will be subject to interest charges. Alternatively, you can pay your closing costs in cash, similar to your down payment.

Closing costs explained Most experts agree you should try to set aside roughly 3% of your home's purchase price to cover closing costs. While the down payment and mortgage default insurance are considered closing costs, they are not factored in for purposes of the 3% calculation.

MIP is mortgage insurance required for Federal Housing Administration (FHA) insured loans. When closing on a home using an FHA loan, all debtors are subjected to an upfront charge of the MIP in a percentage amount of the sales price of the home.

How To Avoid Or Reduce Some Of Your Closing Costs: 10 Ways To Save Negotiate With Your Lender. ... Negotiate With The Seller. ... Lower Your Down Payment. ... Consider A No-Closing-Cost Mortgage. ... Refinance Your Mortgage. ... Shop Around For Other Lenders. ... Buy For Sale By Owner (FSBO) ... Take Advantage Of A Rebate Program.