Separation Agreement Template South Carolina For Employees

Description

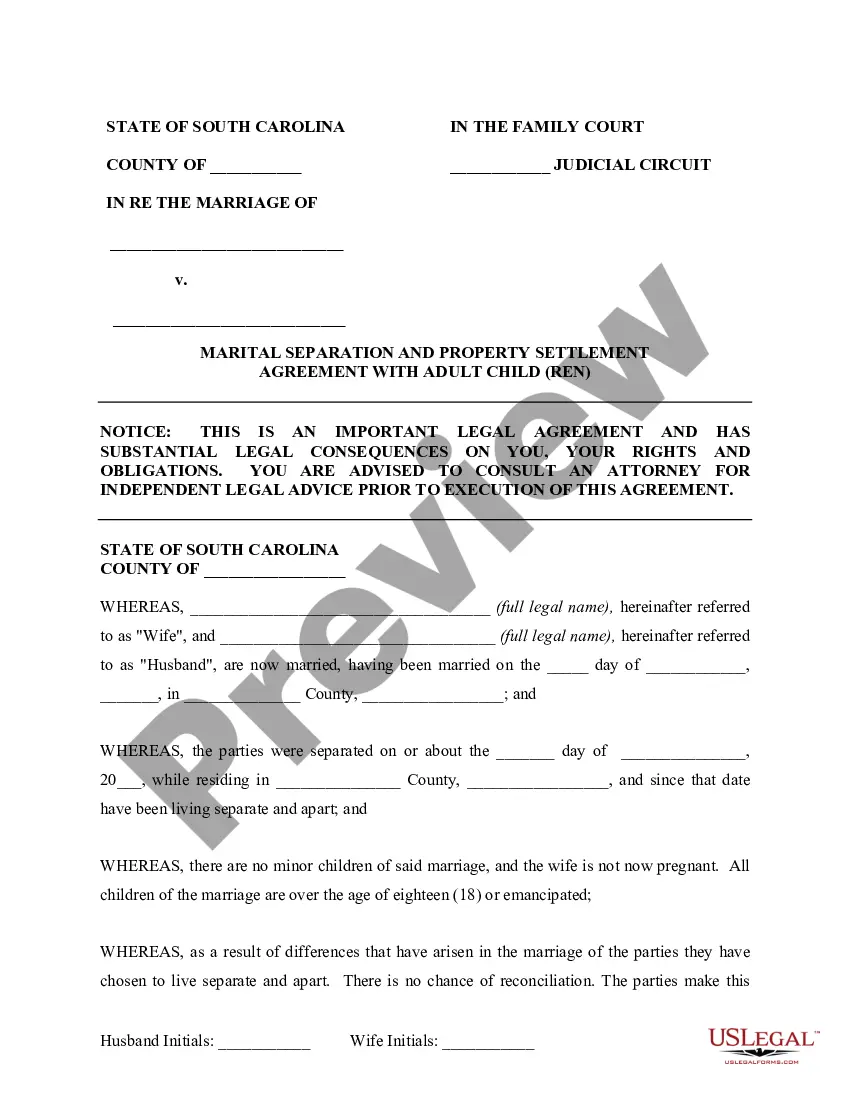

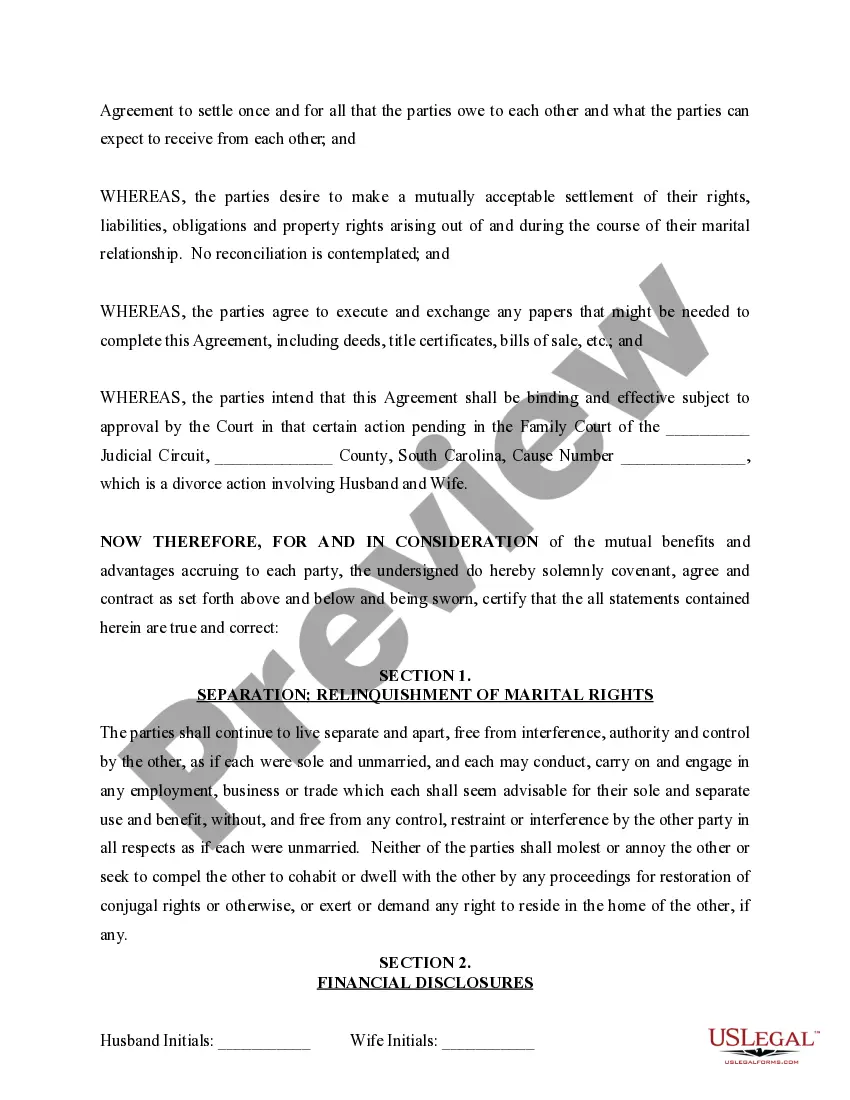

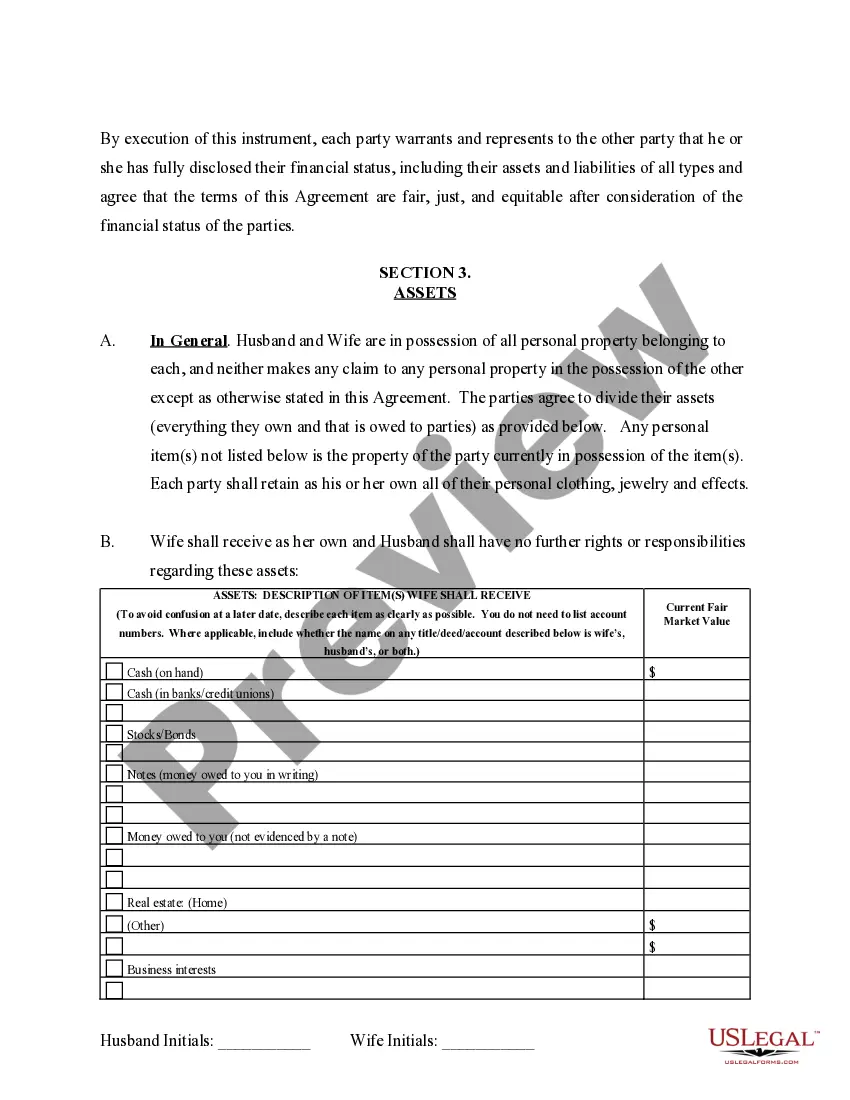

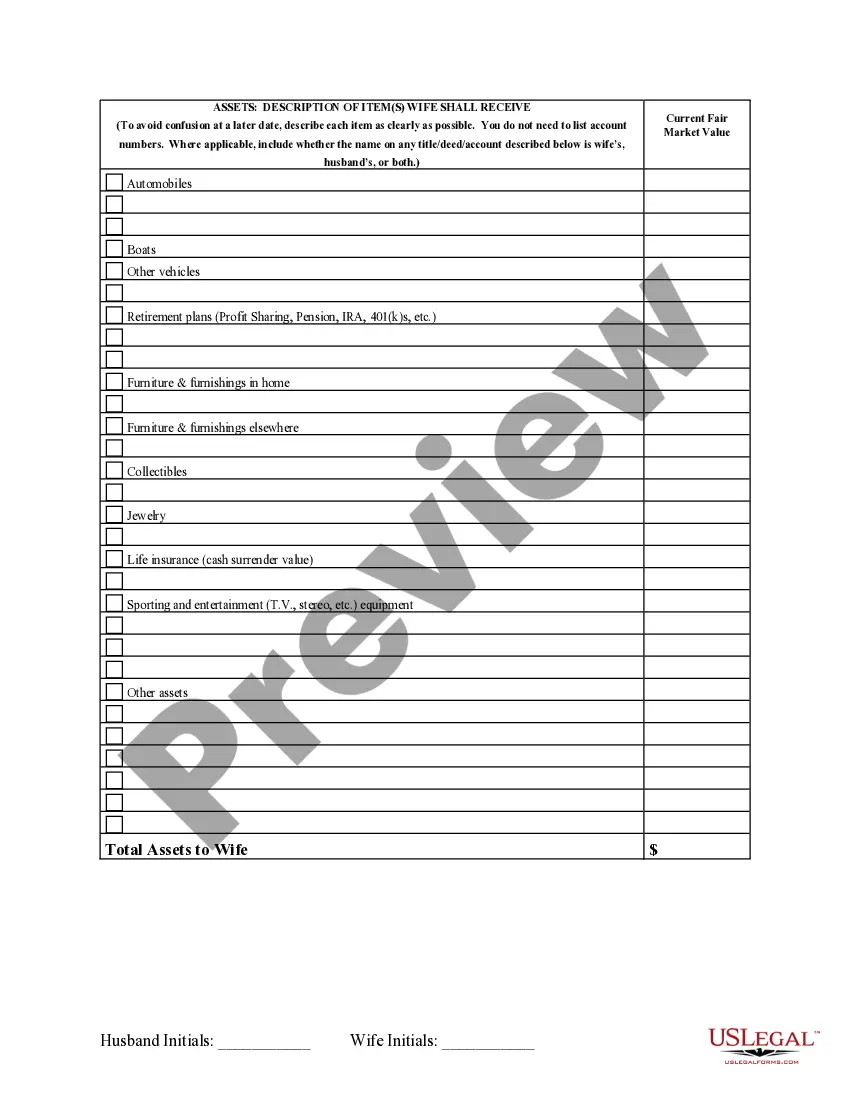

How to fill out South Carolina Marital Domestic Separation And Property Settlement Agreement Adult Children?

Acquiring legal forms that adhere to national and local regulations is essential, and the web provides a multitude of selections to choose from.

However, what is the advantage of spending time hunting for the properly formulated Separation Agreement Template South Carolina For Employees sample online when the US Legal Forms digital repository already compiles such forms in one location.

US Legal Forms is the largest online legal directory boasting over 85,000 customizable forms created by legal professionals for any business or personal circumstances.

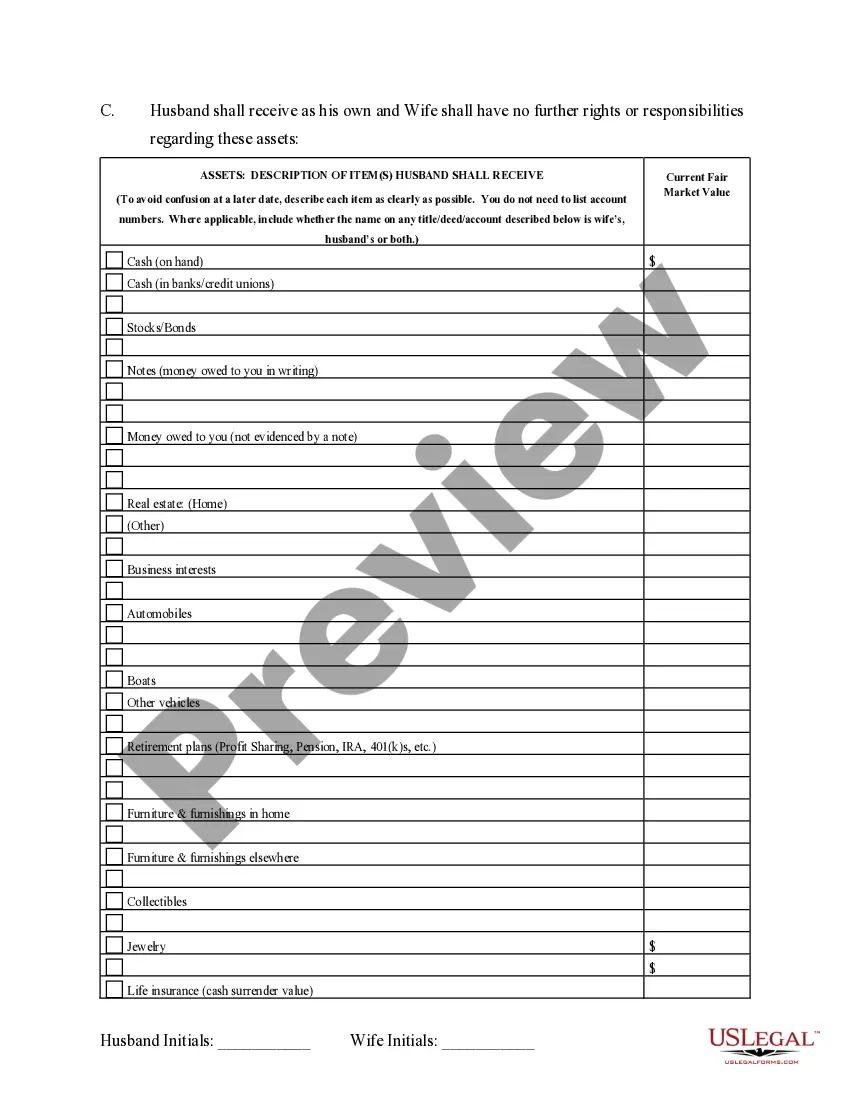

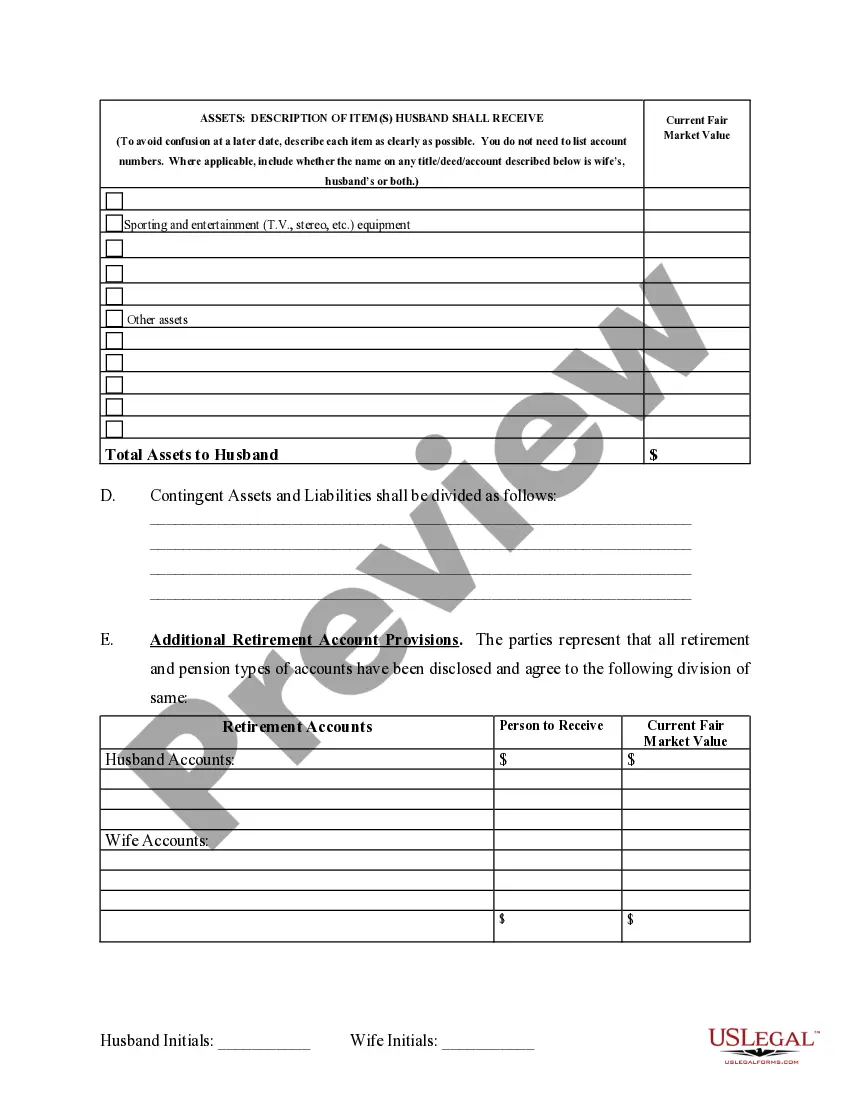

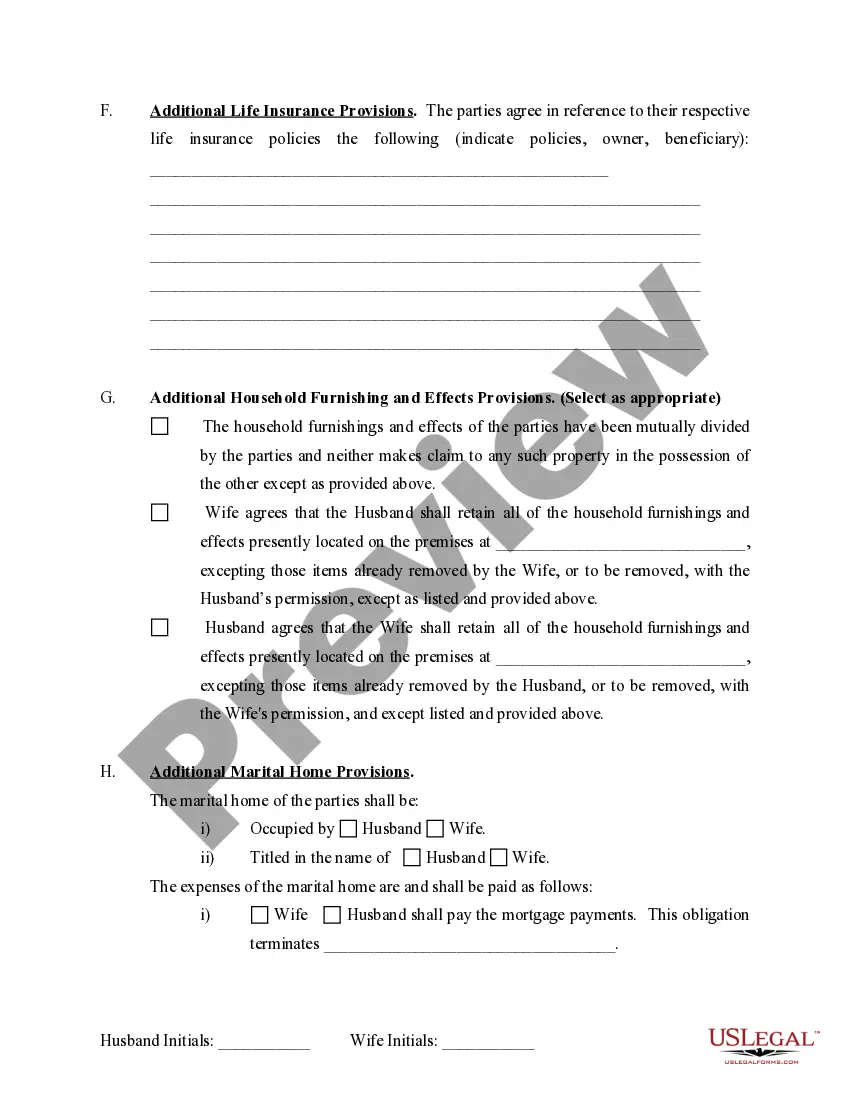

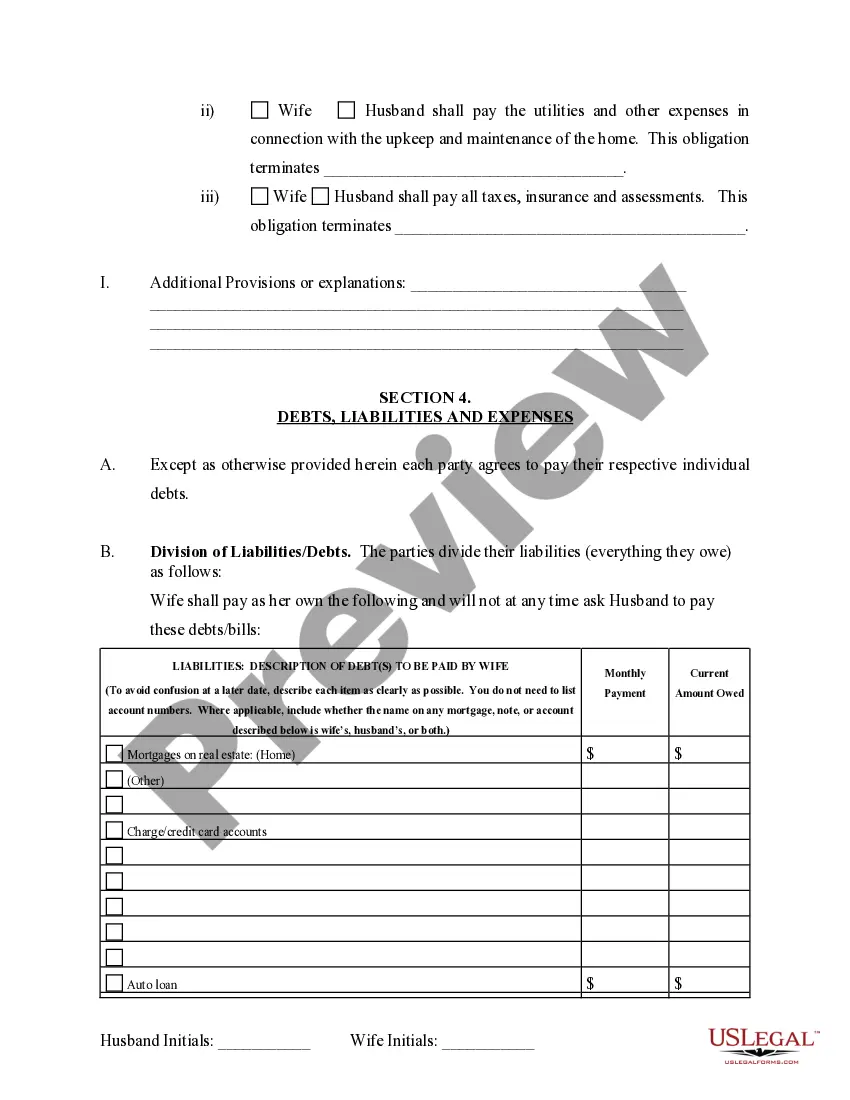

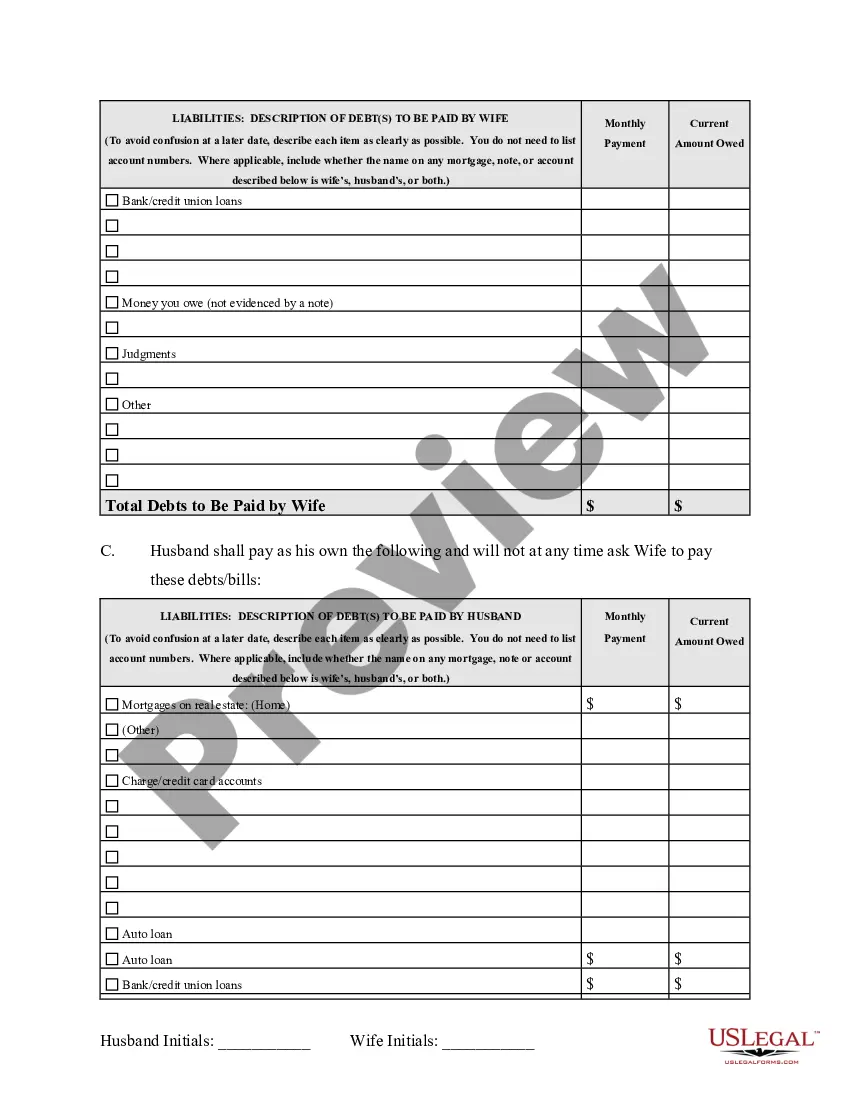

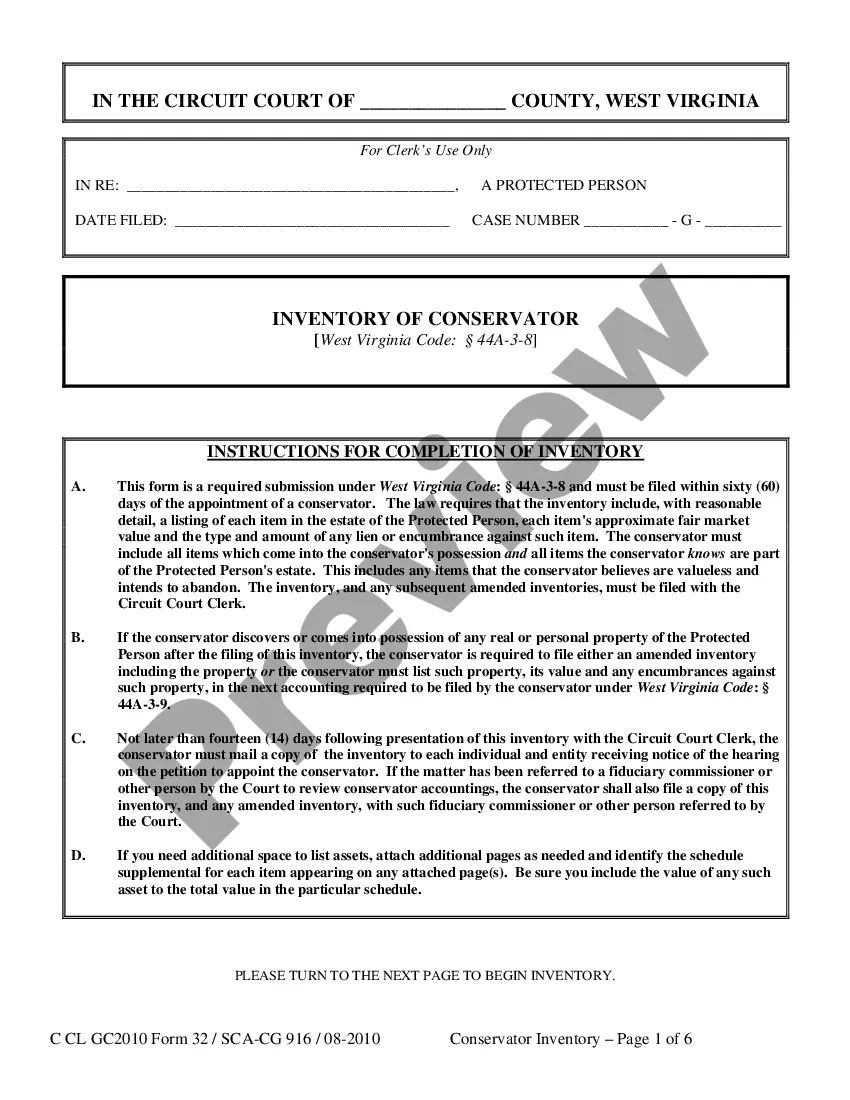

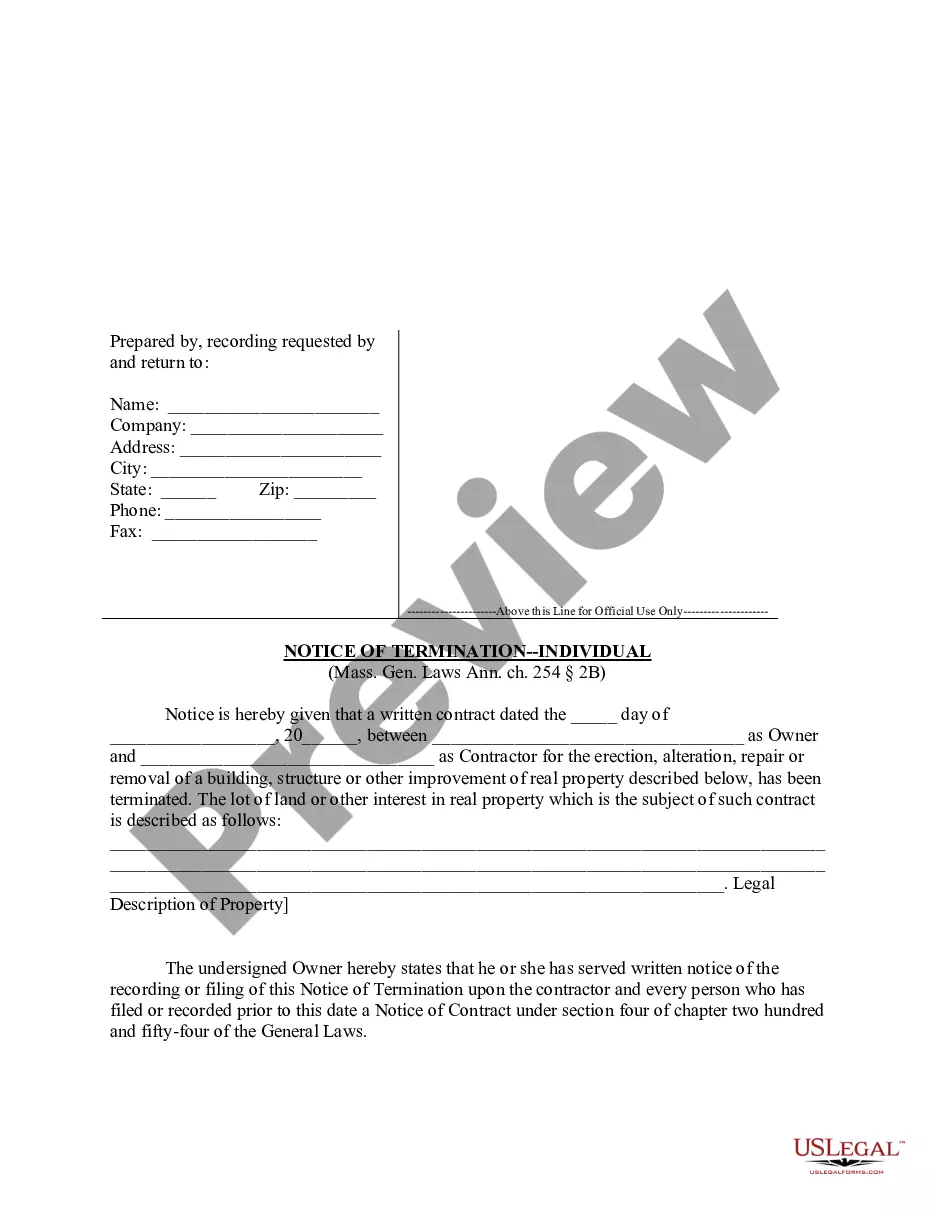

Examine the template using the Preview option or through the text outline to ensure it satisfies your requirements.

- They are straightforward to navigate with all documents organized by state and intended use.

- Our experts stay informed about legislative changes, ensuring your documents are consistently current and compliant when acquiring a Separation Agreement Template South Carolina For Employees from our site.

- Retrieving a Separation Agreement Template South Carolina For Employees is swift and simple for both existing and new users.

- If you possess an account with an active subscription, Log In and save the document sample you need in your chosen format.

- For newcomers to our website, follow these steps.

Form popularity

FAQ

No, South Carolina does not require a 30-day notice for separation from employment. Like the two-week notice, providing a longer notice period is typically a matter of workplace etiquette rather than a legal obligation. A separation agreement template South Carolina for employees can assist in ensuring everything is properly addressed when leaving your position, regardless of the notice period.

As mentioned earlier, South Carolina does not legally mandate a two weeks' notice before termination or resignation. However, it is considered a best practice for maintaining professionalism. Using a separation agreement template South Carolina for employees can be beneficial in outlining any terms or conditions, regardless of notice periods.

In South Carolina, there is no legal requirement for employees to provide two weeks' notice when resigning. However, giving notice is often encouraged as a professional courtesy and may positively influence recommendations from former employers. If you are considering leaving your job, using a separation agreement template South Carolina for employees can help you navigate the process more smoothly.

A socially disadvantaged farmer or rancher is a farmer or rancher who is a member of a group whose members have been subject to racial, ethnic, or gender prejudice because of their identity as members of a group without regard to their individual qualities.

CCC-860, Socially Disadvantaged, Limited Resource, Beginning Farmer, and Veteran Farmer or Rancher Certification. This form is used for farmers to identify themselves as belonging to one of the following USDA-defined groups. Farmers only need to complete this form once.

FARM OPERATING PLAN FOR AN INDIVIDUAL This form is to be completed by, or on behalf of, an individual who is seeking benefits from the Farm Service Agency (FSA) as an individual (and not as part of an entity) under one or more programs that are subject to the regulations at 7 CFR Part 1400.

A CCC loan involves a farmer pledging bushels of grain as collateral for a loan. The loan allows the farmer to create cashflow without the need to sell the grain. If prices rise, the grain can be sold, and the loan (and interest) paid off with the farmer keeping the balance.

The Commodity Credit Corporation (CCC) is a Government-owned and operated entity that was created to stabilize, support, and protect farm income and prices. CCC also helps maintain balanced and adequate supplies of agricultural commodities and aids in their orderly distribution.

Form FSA-510, Request for an Exception to the $125,000 Payment Limitation for Certain Programs. Form CCC-860, Socially Disadvantaged, Limited Resource, Beginning and Veteran Farmer or Rancher Certification, for the applicable program year.

Producers use this form to assign payments under various Commodity Credit Corporation (CCC) or Farm Service Agency (FSA) programs.