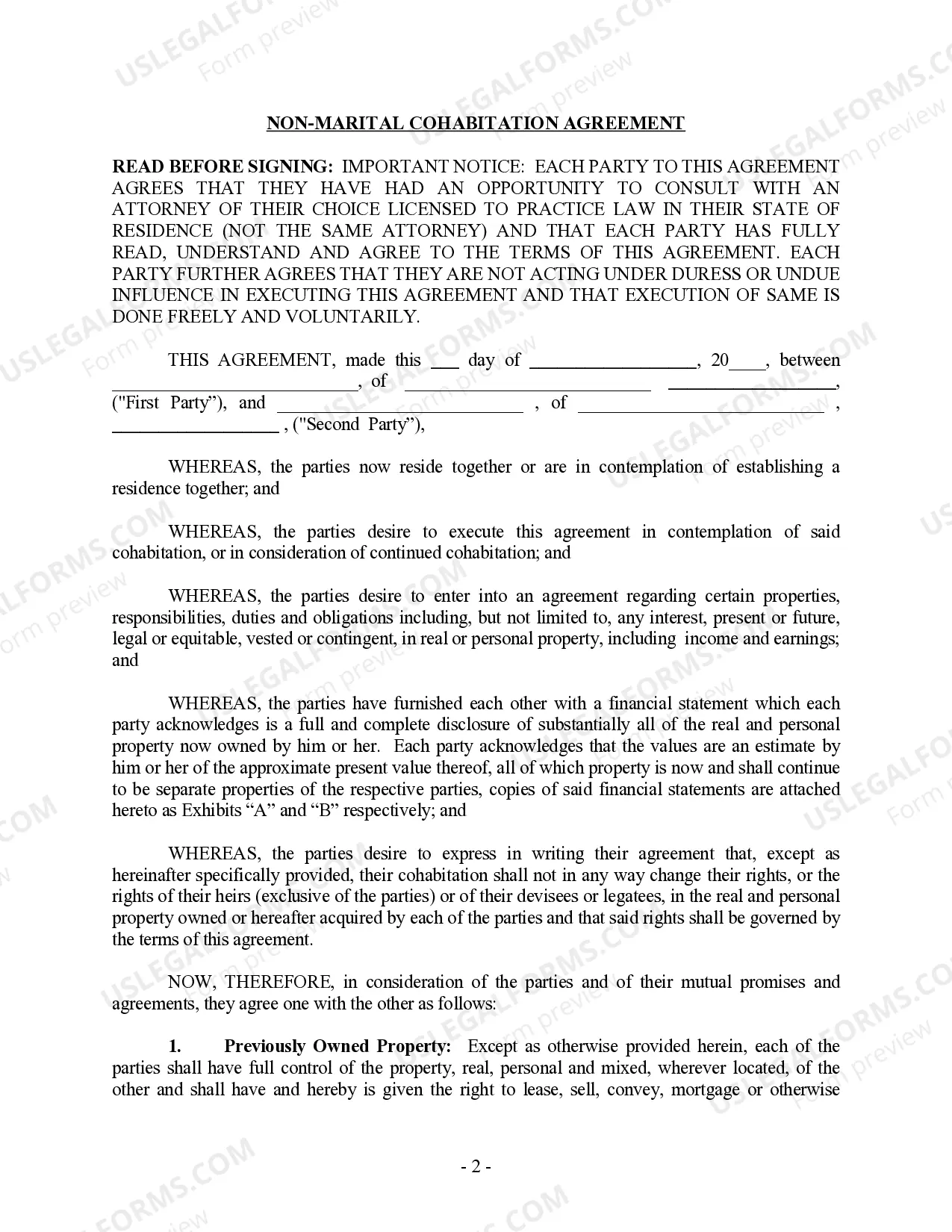

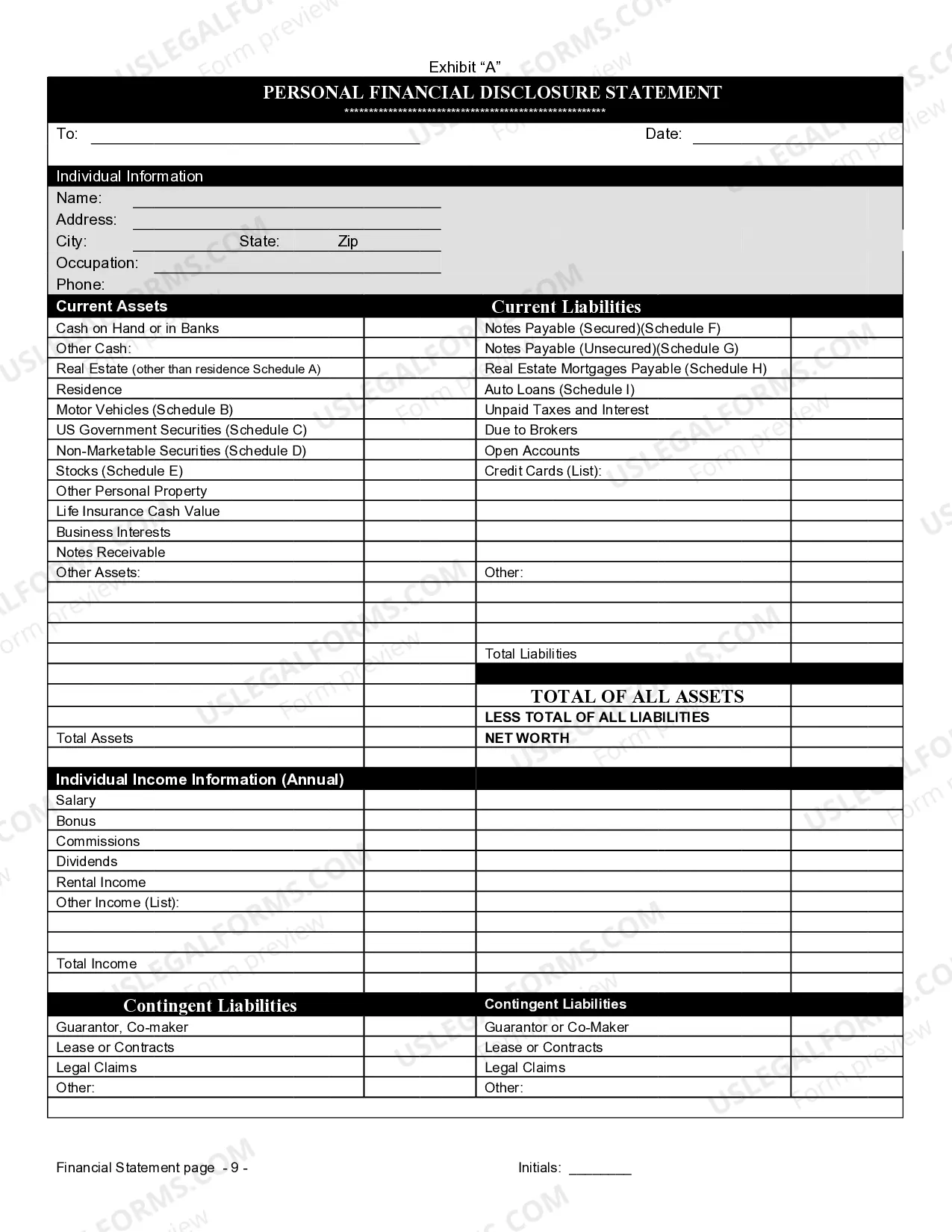

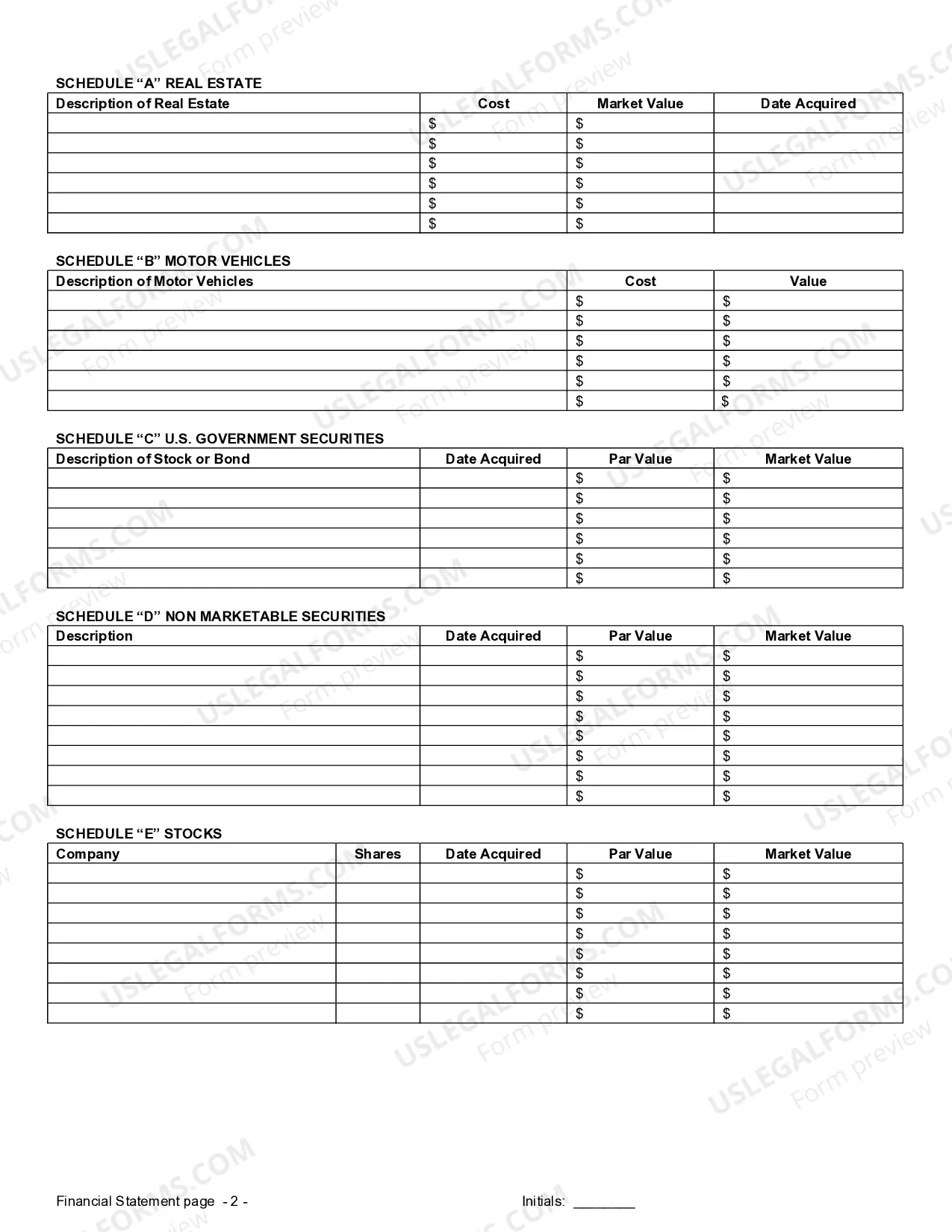

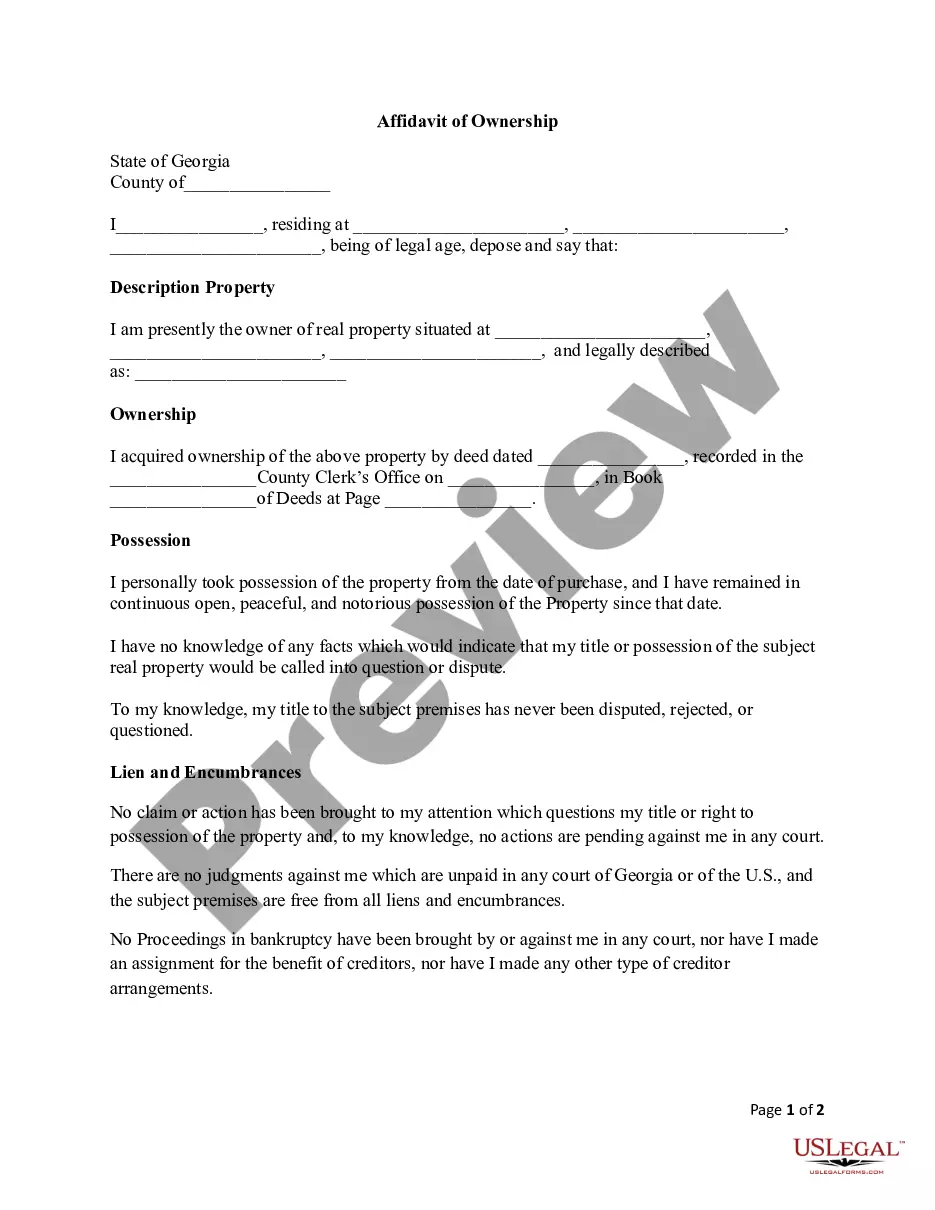

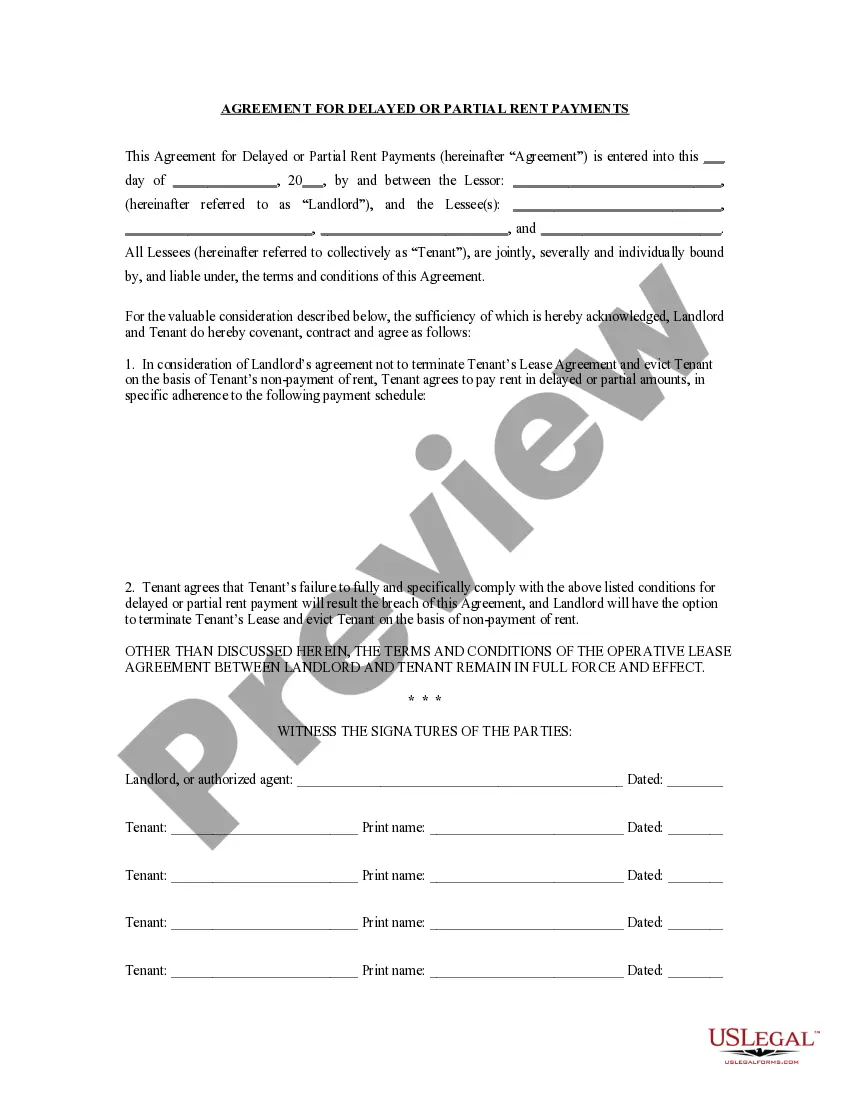

The Non-Marital Cohabitation Agreement helps clarify what is expected of each party. It contains provisions relating to expenses, assets and what happens if the parties discontinue the living arrangement, including ownership and division of property acquired during the course of the relationship.

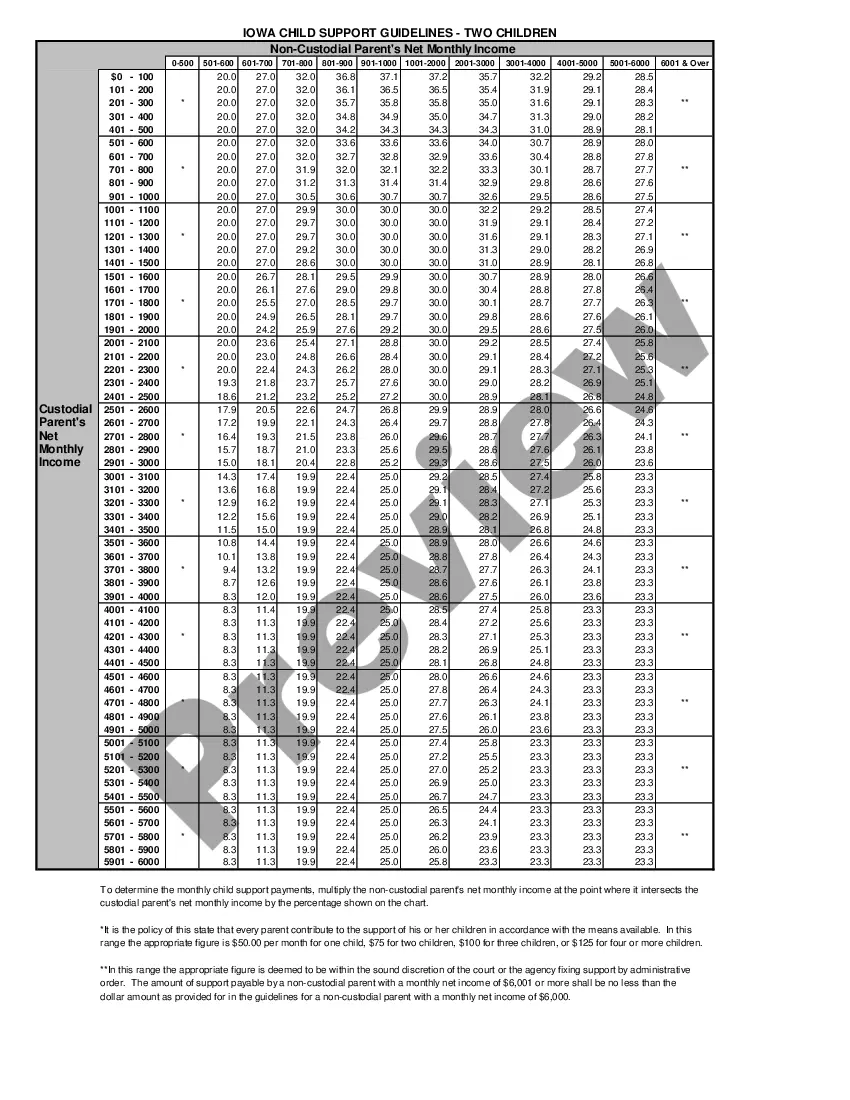

South Carolina Cohabitation Withholding Tables 2023

Description

How to fill out South Carolina Non-Marital Cohabitation Living Together Agreement?

Obtaining legal document samples that meet the federal and local laws is essential, and the internet offers a lot of options to pick from. But what’s the point in wasting time looking for the right South Carolina Cohabitation Withholding Tables 2023 sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the biggest online legal library with over 85,000 fillable templates drafted by lawyers for any professional and life scenario. They are easy to browse with all papers arranged by state and purpose of use. Our experts stay up with legislative changes, so you can always be sure your form is up to date and compliant when obtaining a South Carolina Cohabitation Withholding Tables 2023 from our website.

Getting a South Carolina Cohabitation Withholding Tables 2023 is easy and quick for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, adhere to the steps below:

- Take a look at the template using the Preview option or via the text outline to ensure it fits your needs.

- Locate another sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your South Carolina Cohabitation Withholding Tables 2023 and download it.

All templates you locate through US Legal Forms are multi-usable. To re-download and complete previously obtained forms, open the My Forms tab in your profile. Take advantage of the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

The withholding rate is California's highest tax rate for each partner's entity type. The current withholding rates are: Noncorporate partners - 12.3 percent. Corporate partners - 8.84 percent.

Tax brackets 2023 (taxes due 2024) Tax RateSingleMarried filing jointly12%$11,001 to $44,725.$22,001 to $89,450.22%$44,726 to $95,375.$89,451 to $190,750.24%$95,376 to $182,100.$190,751 to $364,200.32%$182,101 to $231,250.$364,201 to $462,500.2 more rows ?

Updates to the Income Tax Withholding Tables and What You Need to Know. Like past years, the IRS changed the income tax withholding tables for 2023. Use these updated tables to calculate federal income tax on employee wages in 2023.

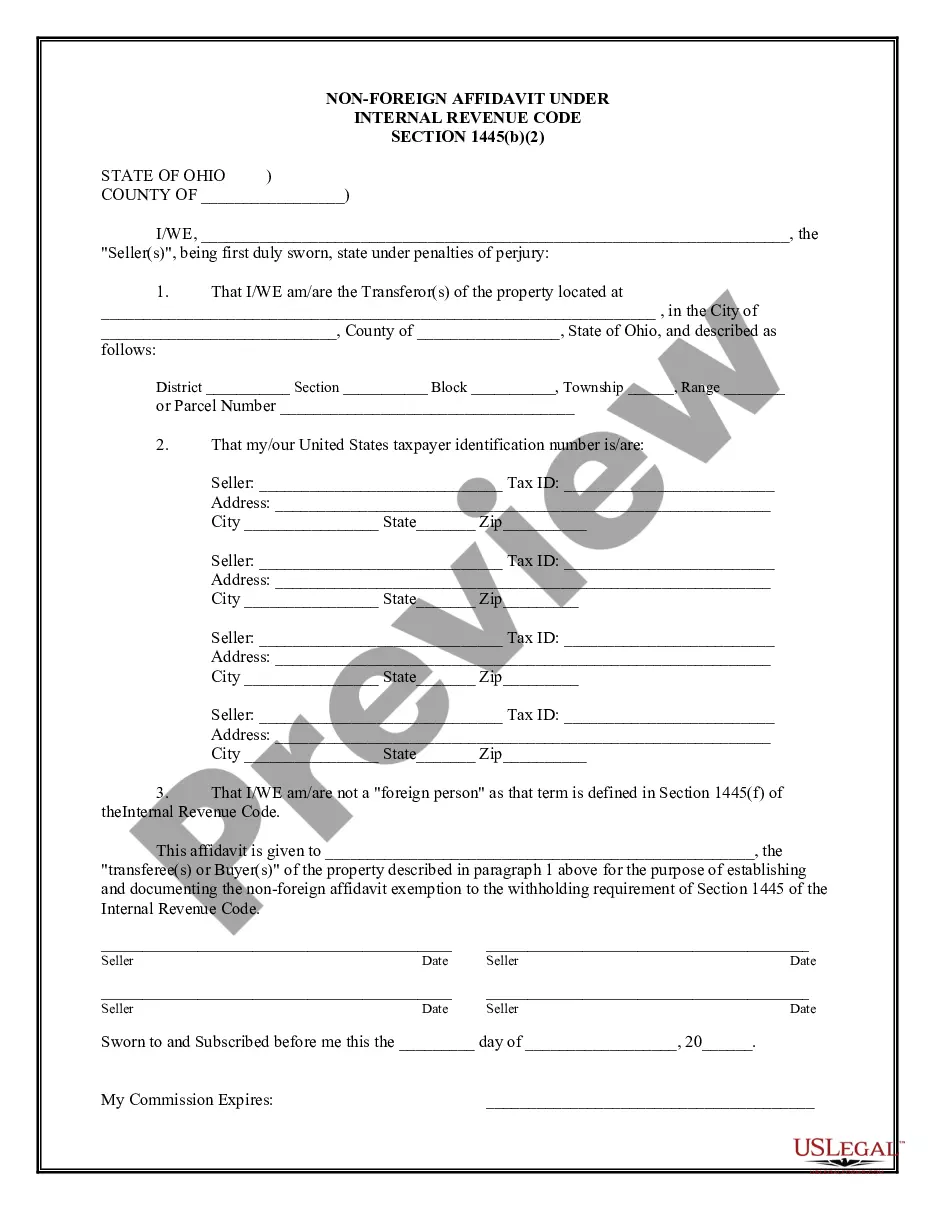

Taxable income (loss) of a partnership flows through and is taxable to the partners in the same manner as for federal partnership income. South Carolina income taxable to nonresident partners is subject to withholding by the partnership at a 5% rate.

Most workers will see less state taxes withheld in their 2023 paychecks as a result of the Withholding Tax Tables update. The top Income Tax rate has been reduced from 7% ?to 6.5% and could be reduced again in the future if certain general fund growth tests are met.