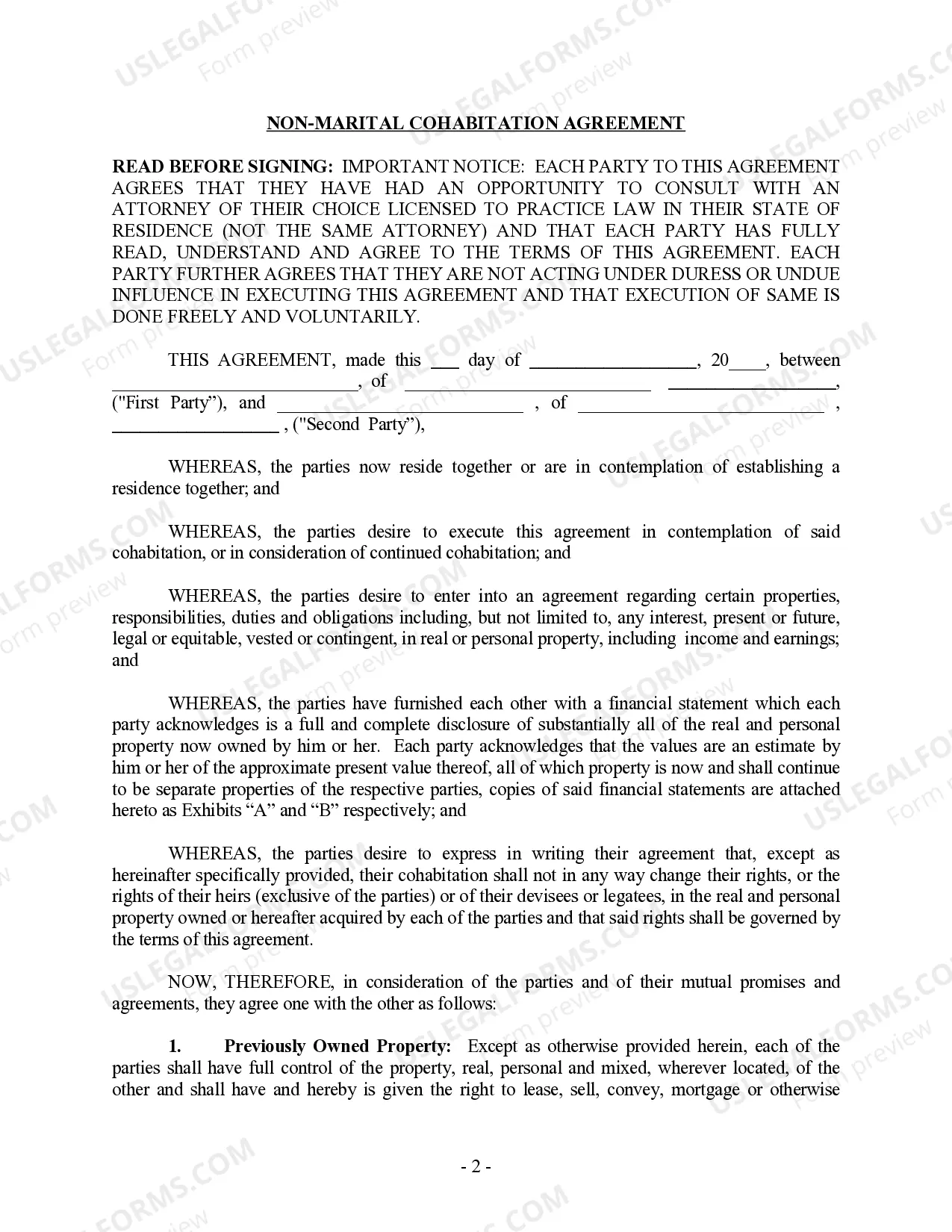

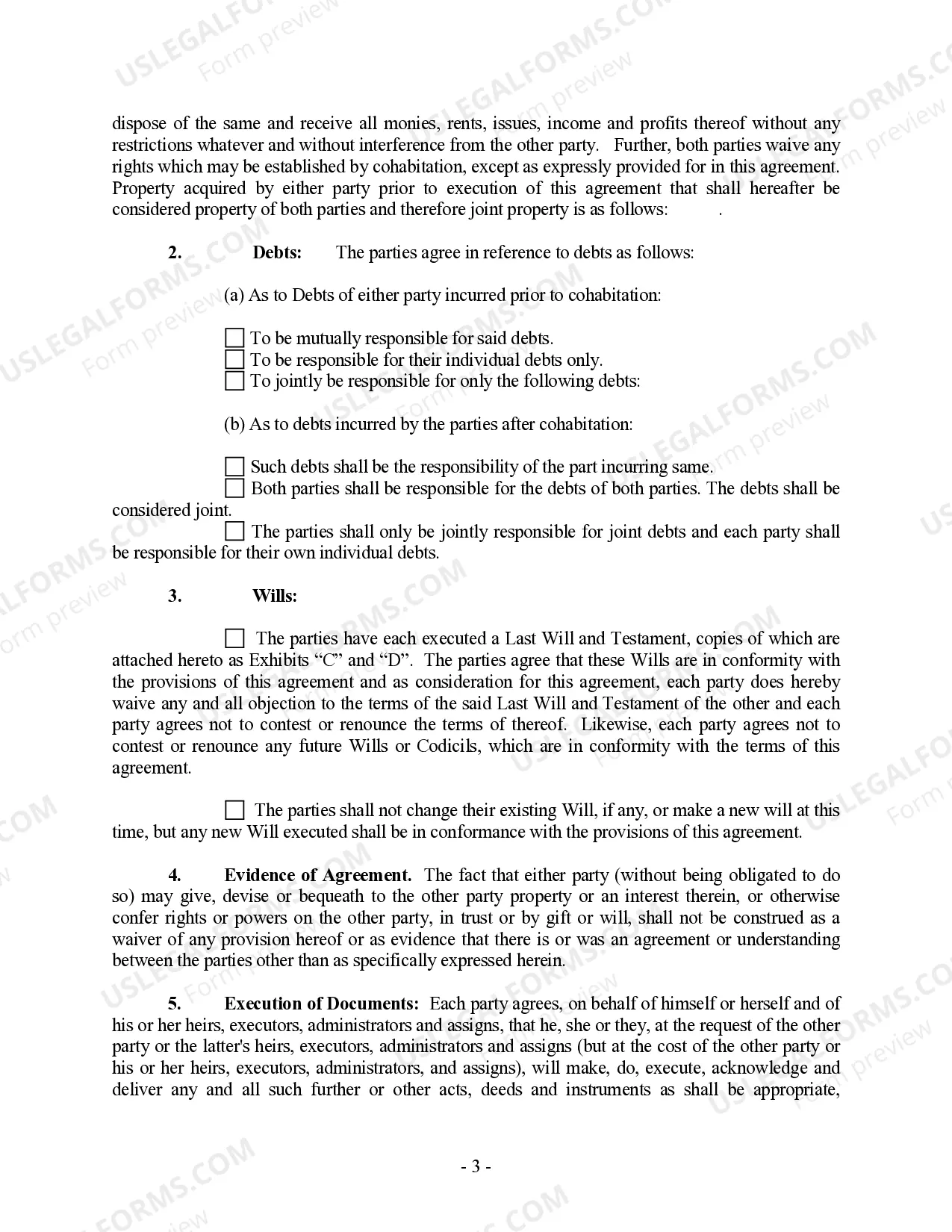

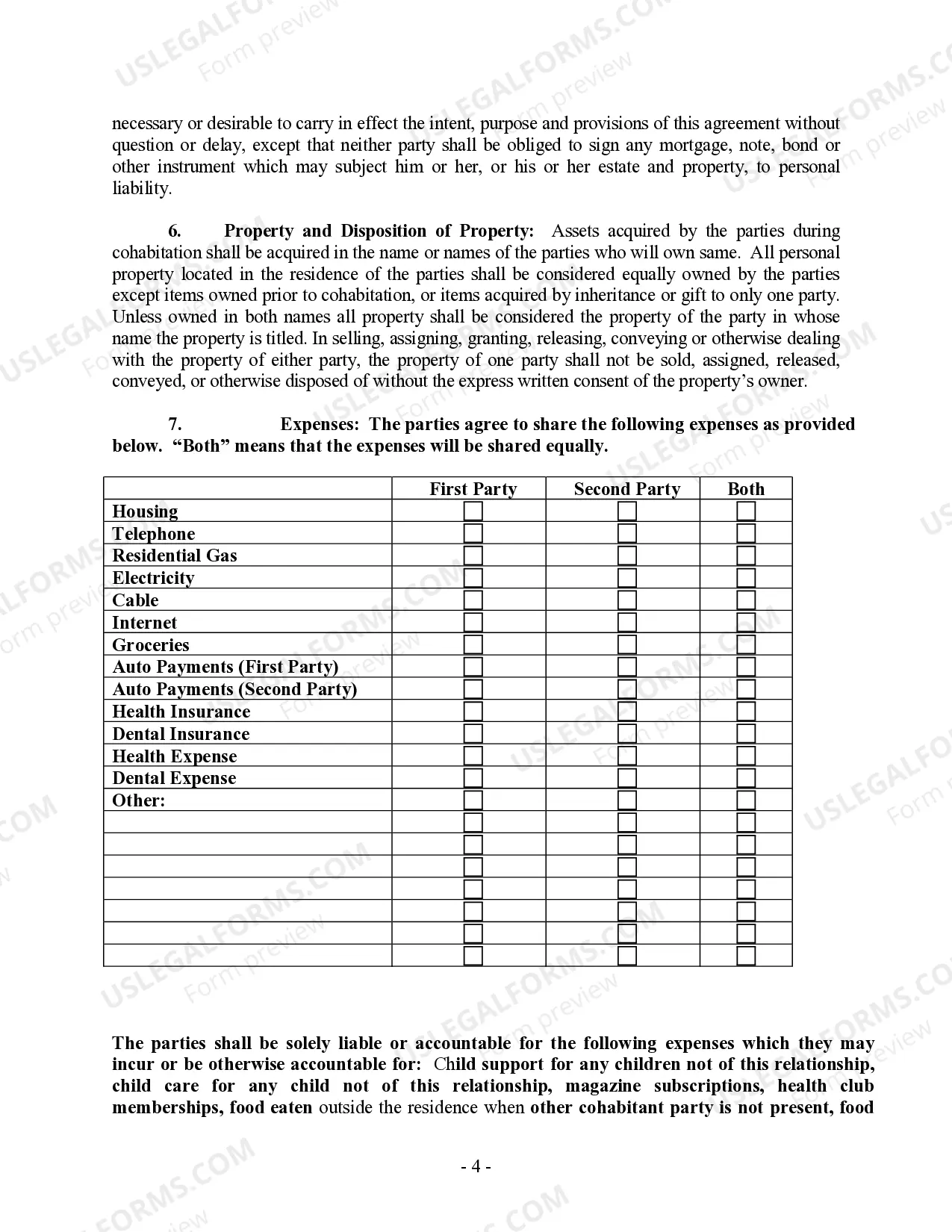

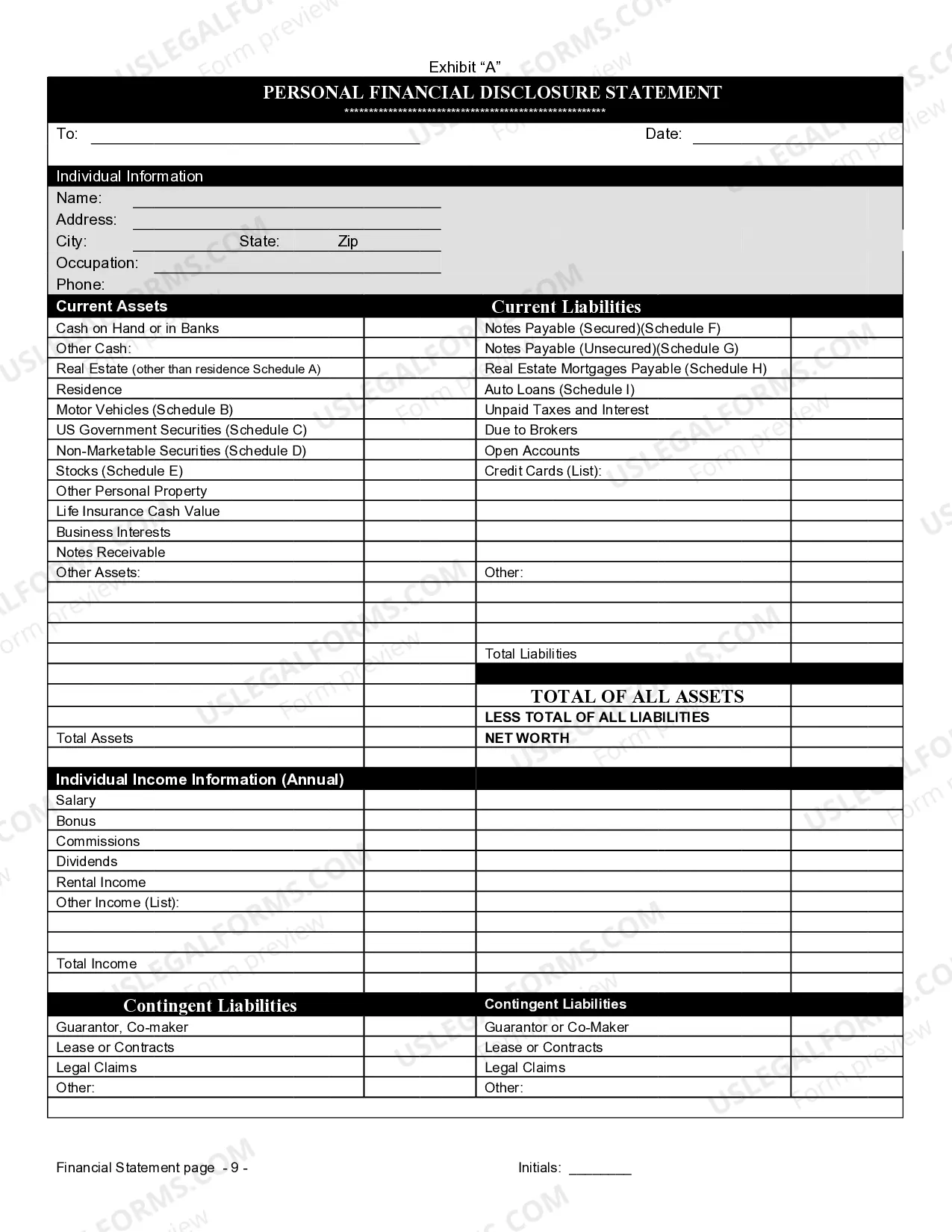

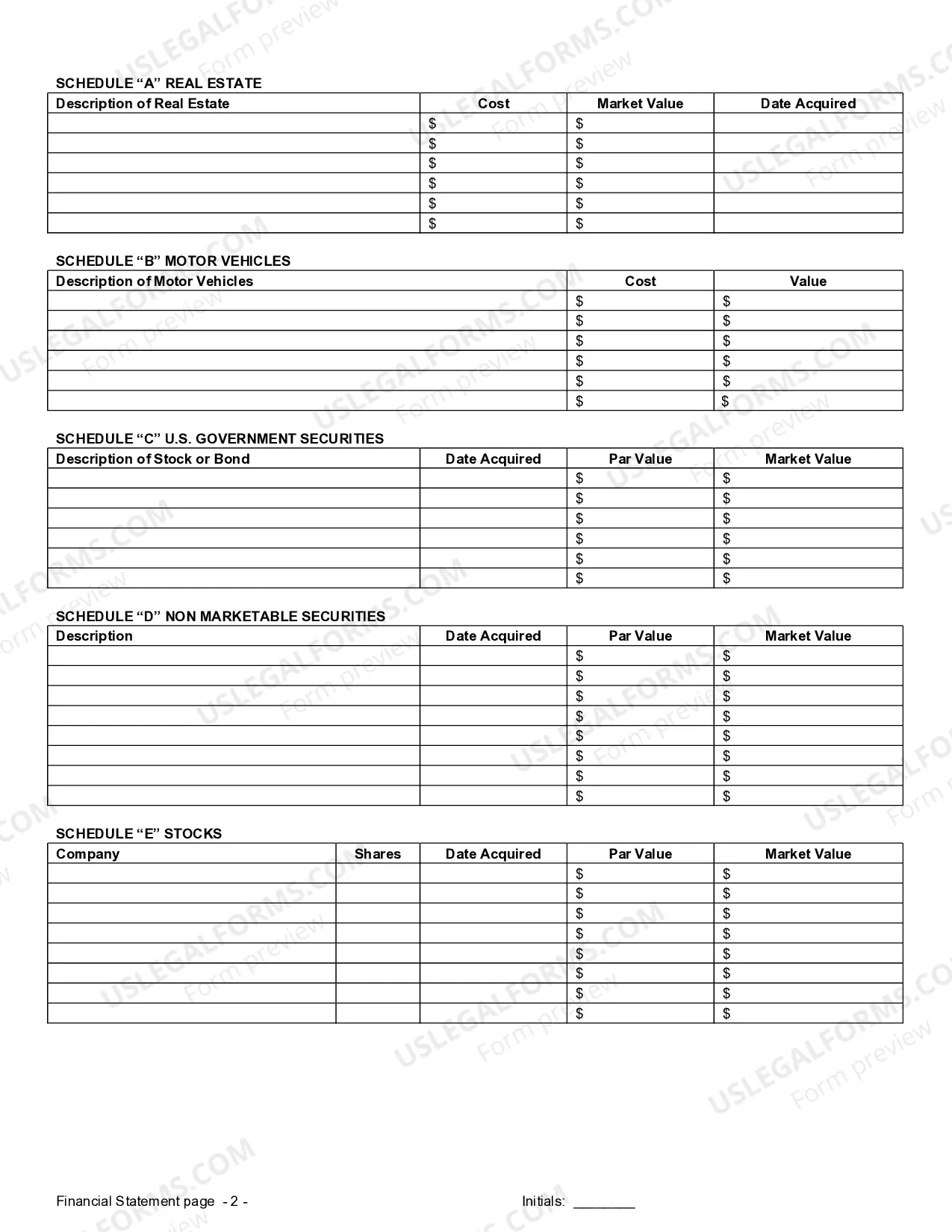

The Non-Marital Cohabitation Agreement helps clarify what is expected of each party. It contains provisions relating to expenses, assets and what happens if the parties discontinue the living arrangement, including ownership and division of property acquired during the course of the relationship.

South Carolina Cohabitation Withholding Registration

Description

How to fill out South Carolina Non-Marital Cohabitation Living Together Agreement?

Using legal document samples that meet the federal and regional regulations is a matter of necessity, and the internet offers numerous options to choose from. But what’s the point in wasting time looking for the correctly drafted South Carolina Cohabitation Withholding Registration sample on the web if the US Legal Forms online library already has such templates accumulated in one place?

US Legal Forms is the largest online legal catalog with over 85,000 fillable templates drafted by lawyers for any business and personal situation. They are easy to browse with all documents organized by state and purpose of use. Our specialists stay up with legislative updates, so you can always be sure your form is up to date and compliant when getting a South Carolina Cohabitation Withholding Registration from our website.

Obtaining a South Carolina Cohabitation Withholding Registration is fast and simple for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, follow the steps below:

- Examine the template using the Preview feature or via the text description to make certain it meets your needs.

- Locate a different sample using the search tool at the top of the page if needed.

- Click Buy Now when you’ve located the correct form and opt for a subscription plan.

- Create an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your South Carolina Cohabitation Withholding Registration and download it.

All documents you find through US Legal Forms are reusable. To re-download and complete previously purchased forms, open the My Forms tab in your profile. Benefit from the most extensive and simple-to-use legal paperwork service!

Form popularity

FAQ

Taxable income (loss) of a partnership flows through and is taxable to the partners in the same manner as for federal partnership income. South Carolina income taxable to nonresident partners is subject to withholding by the partnership at a 5% rate.

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

You must apply for a South Carolina Withholding file number to deposit your withholding payments. The fastest, easiest way to apply is online at MyDORWAY.dor.sc.gov. You can also apply by completing and submitting an SCDOR-111, Business Tax Application. The number makes you a withholding agent.

The withholding amount is 7% of the amount realized on the sale by a nonresident individual, partnership, trust, or estate, or 5% of the amount realized on the sale by a nonresident corporation or any other nonresident entity, if the seller does not provide the buyer with a Seller's Affidavit stating the amount of gain ...

The fastest, easiest way to apply is online at MyDORWAY.dor.sc.gov. You can also apply by completing and submitting an SCDOR-111, Business Tax Application. The number makes you a withholding agent.