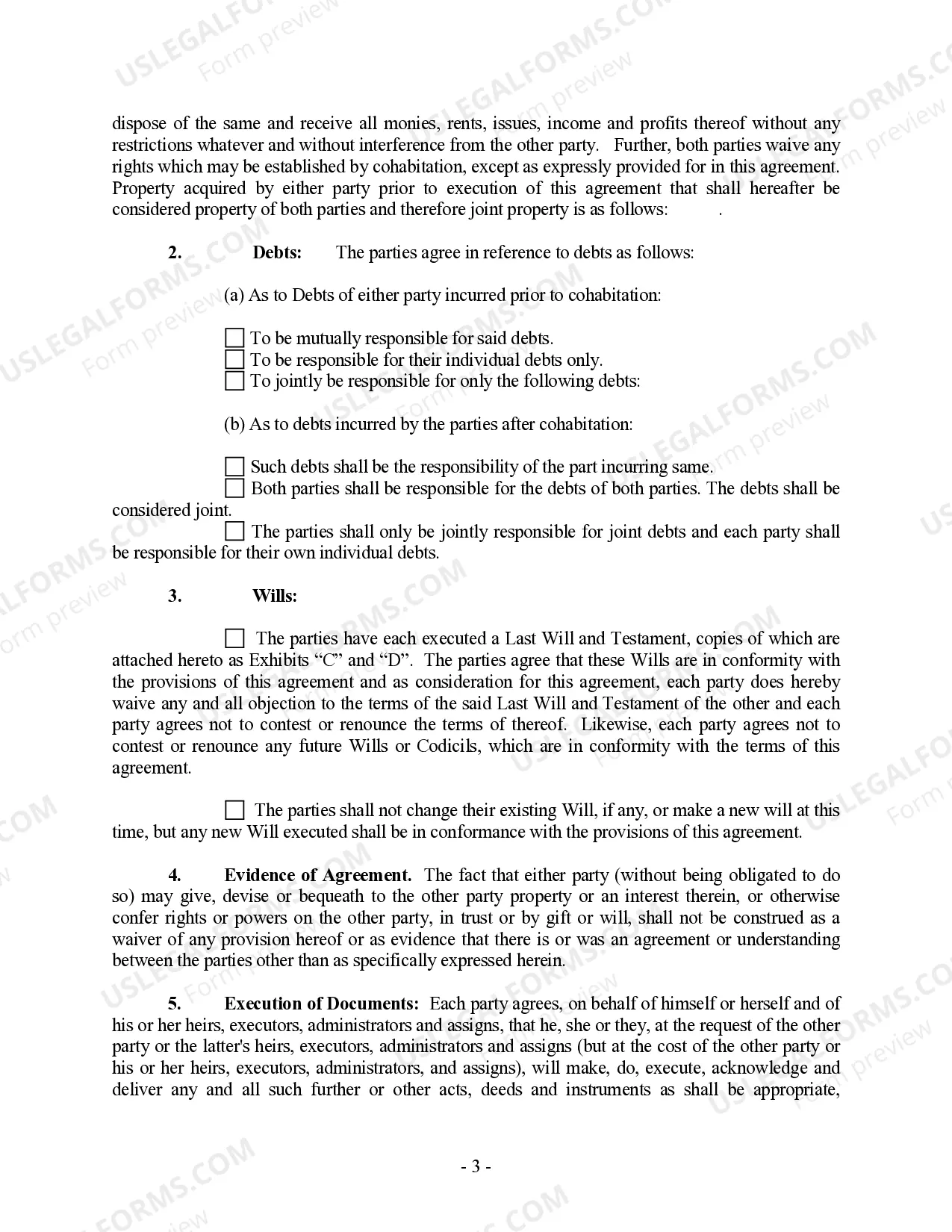

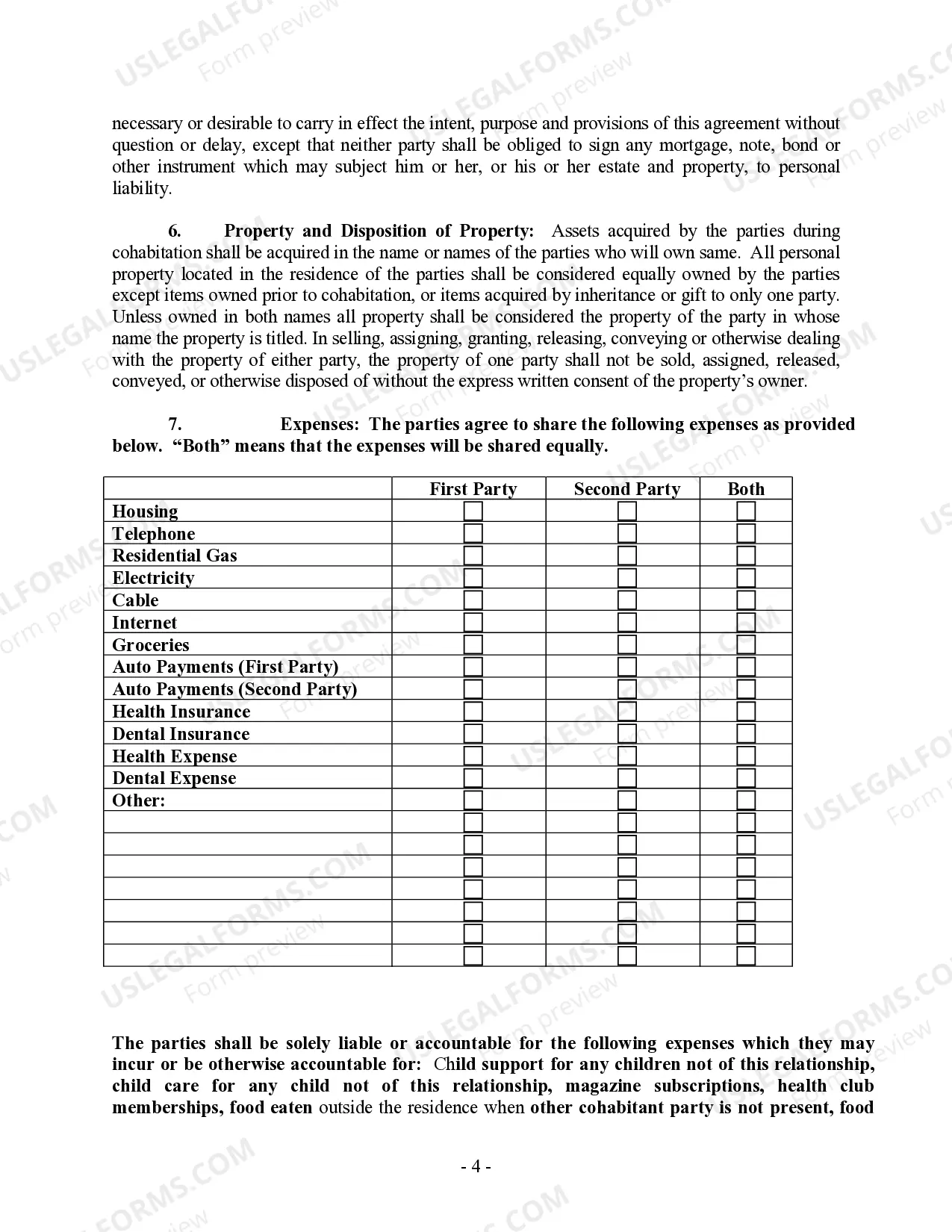

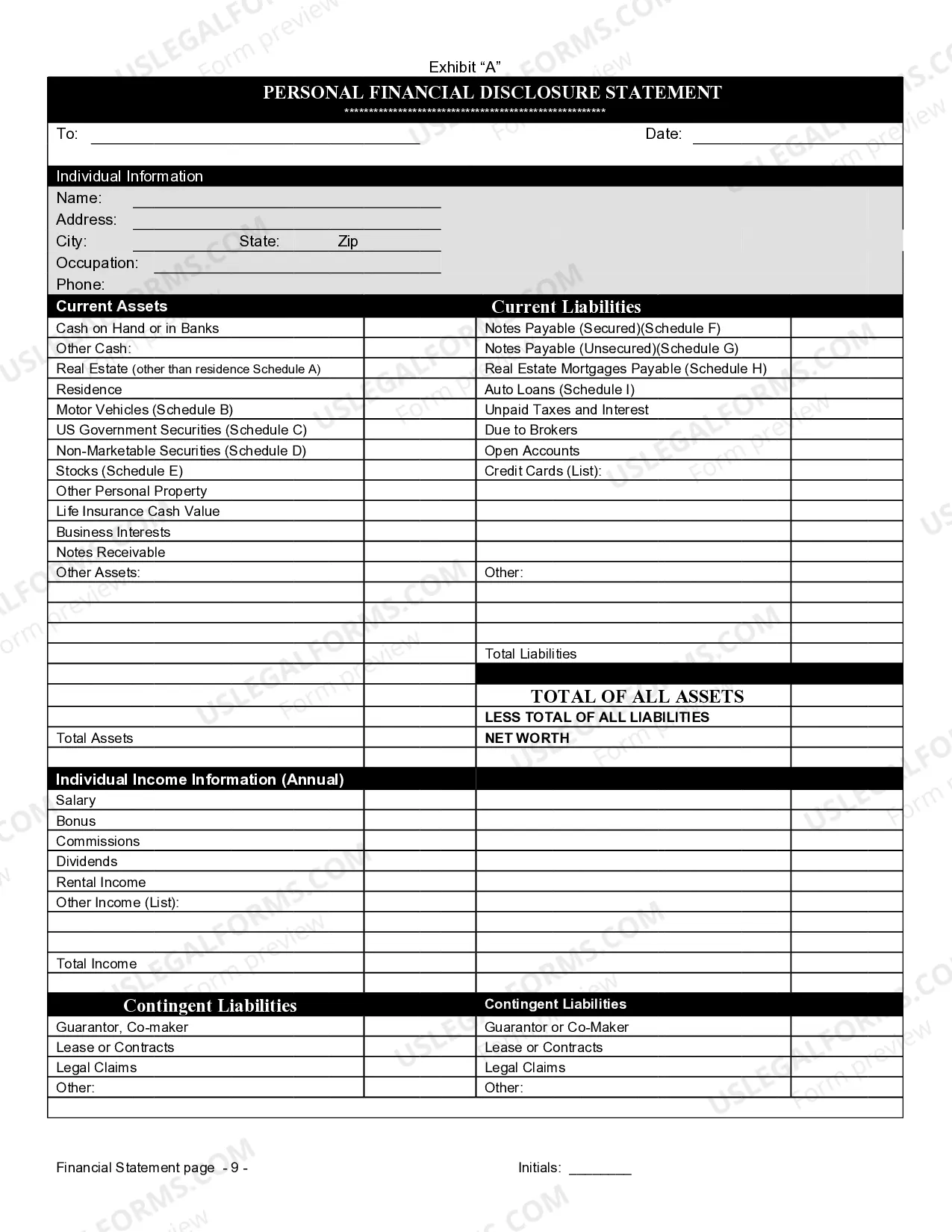

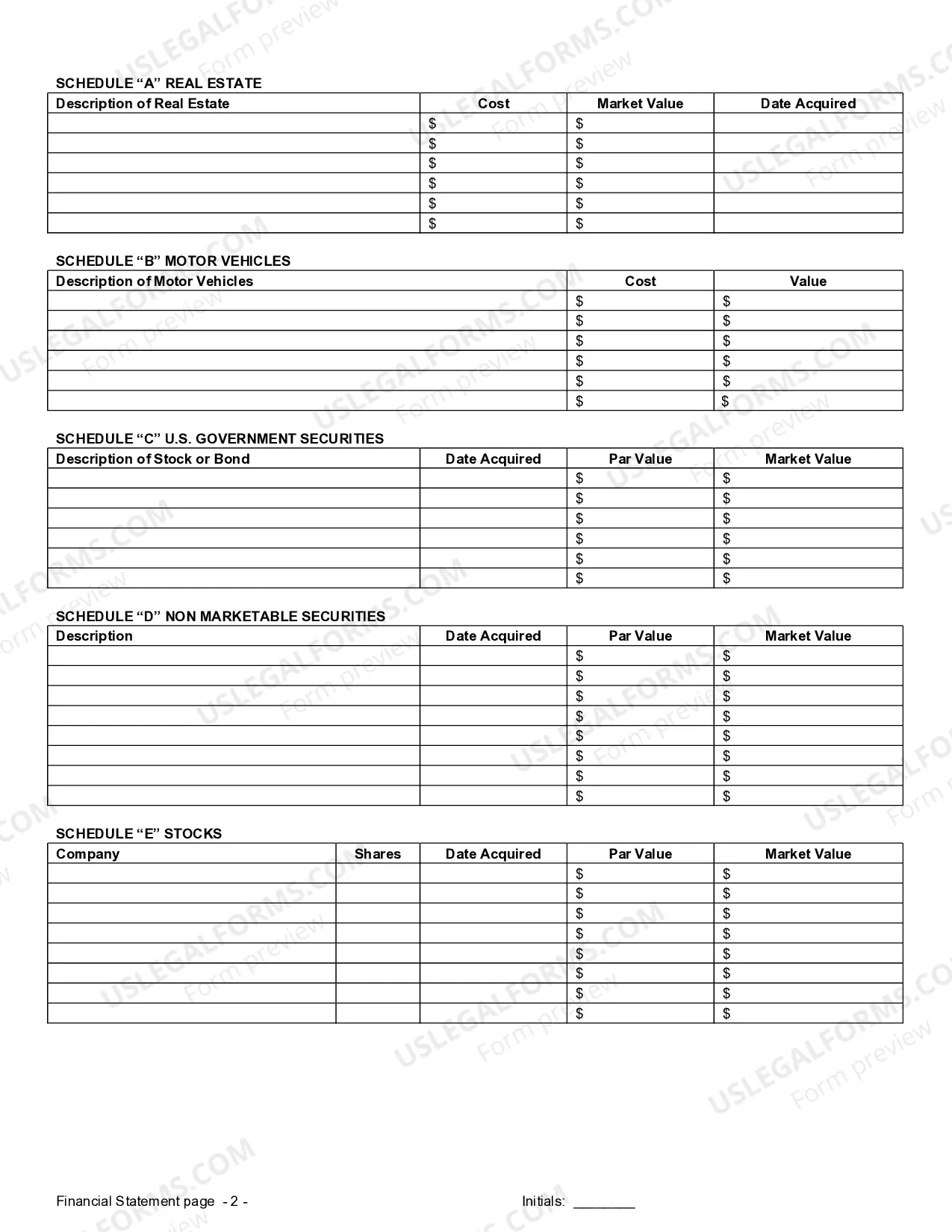

The Non-Marital Cohabitation Agreement helps clarify what is expected of each party. It contains provisions relating to expenses, assets and what happens if the parties discontinue the living arrangement, including ownership and division of property acquired during the course of the relationship.

South Carolina Cohabitation Withholding Form 2023

Description

How to fill out South Carolina Non-Marital Cohabitation Living Together Agreement?

Dealing with legal paperwork and procedures might be a time-consuming addition to the day. South Carolina Cohabitation Withholding Form 2023 and forms like it typically require you to search for them and understand how you can complete them appropriately. As a result, if you are taking care of economic, legal, or individual matters, having a thorough and convenient online catalogue of forms on hand will significantly help.

US Legal Forms is the best online platform of legal templates, boasting more than 85,000 state-specific forms and a number of tools to assist you complete your paperwork easily. Discover the catalogue of relevant documents available with just a single click.

US Legal Forms provides you with state- and county-specific forms offered at any time for downloading. Protect your document managing processes by using a high quality services that lets you prepare any form within a few minutes without having additional or hidden cost. Simply log in to your account, locate South Carolina Cohabitation Withholding Form 2023 and acquire it straight away in the My Forms tab. You may also gain access to formerly downloaded forms.

Is it your first time making use of US Legal Forms? Register and set up a free account in a few minutes and you will have access to the form catalogue and South Carolina Cohabitation Withholding Form 2023. Then, stick to the steps listed below to complete your form:

- Be sure you have discovered the correct form using the Preview feature and looking at the form information.

- Pick Buy Now when ready, and select the subscription plan that fits your needs.

- Press Download then complete, sign, and print the form.

US Legal Forms has twenty five years of expertise supporting consumers handle their legal paperwork. Get the form you need today and enhance any operation without breaking a sweat.

Form popularity

FAQ

The withholding amount is 7% of the amount realized on the sale by a nonresident individual, partnership, trust, or estate, or 5% of the amount realized on the sale by a nonresident corporation or any other nonresident entity, if the seller does not provide the buyer with a Seller's Affidavit stating the amount of gain ...

South Carolina employees only need to submit an SC W-4 if: They start a new job. They want to make changes to their current South Carolina Withholding. They meet the requirements and want to claim exempt from South Carolina Withholding.

File and pay online at MyDORWAY.dor.sc.gov. Do not mail when filing online. You must file a return even if no SC Income Tax has been withheld during the quarter. You must file a WH-1606 if the account was open for any portion of the calendar year.

Employee instructions Complete the SC W-4 so your employer can withhold the correct South Carolina Income Tax from your pay. If you have too much tax withheld, you will receive a refund when you file your tax return.

Most workers will see less state taxes withheld in their 2023 paychecks as a result of the Withholding Tax Tables update. The top Income Tax rate has been reduced from 7% ?to 6.5% and could be reduced again in the future if certain general fund growth tests are met.