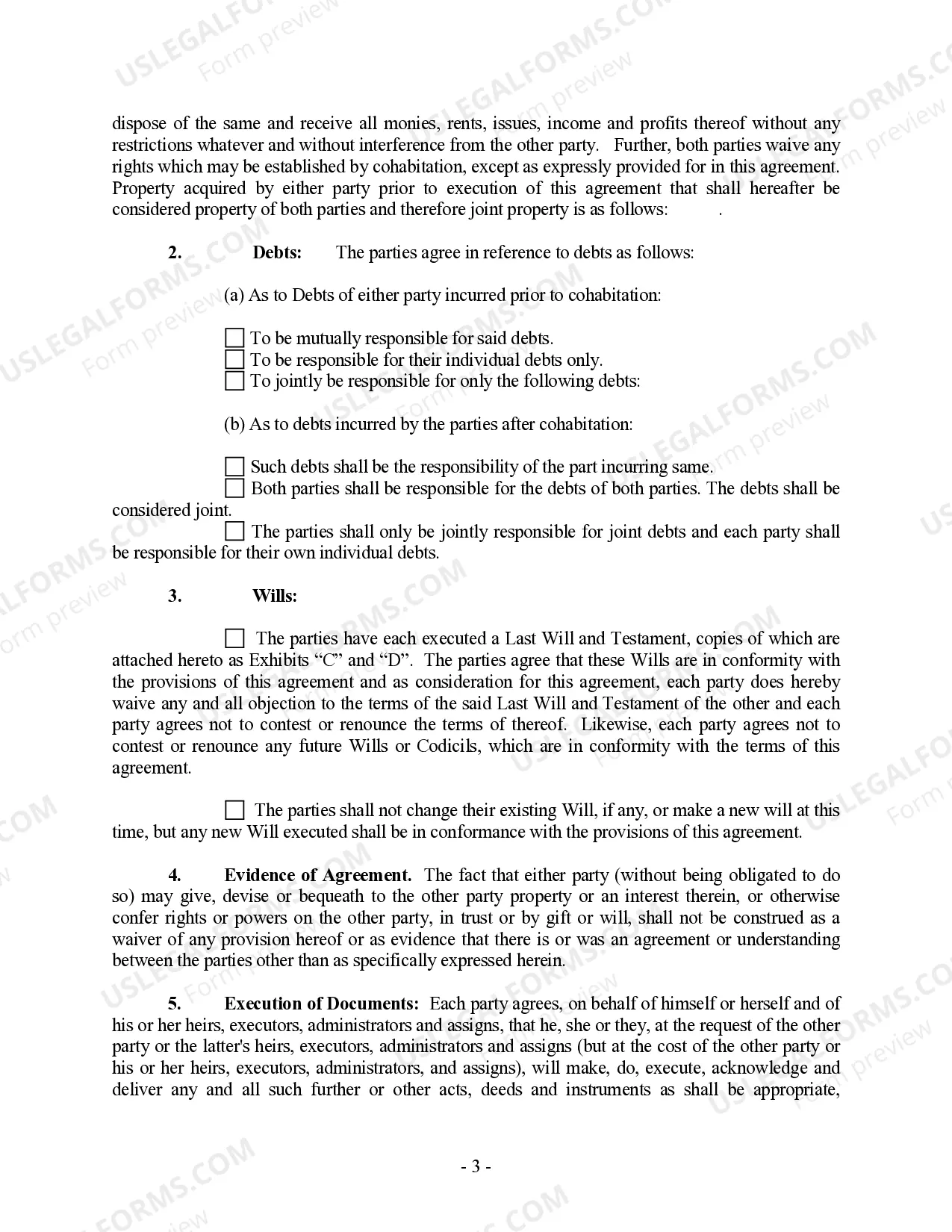

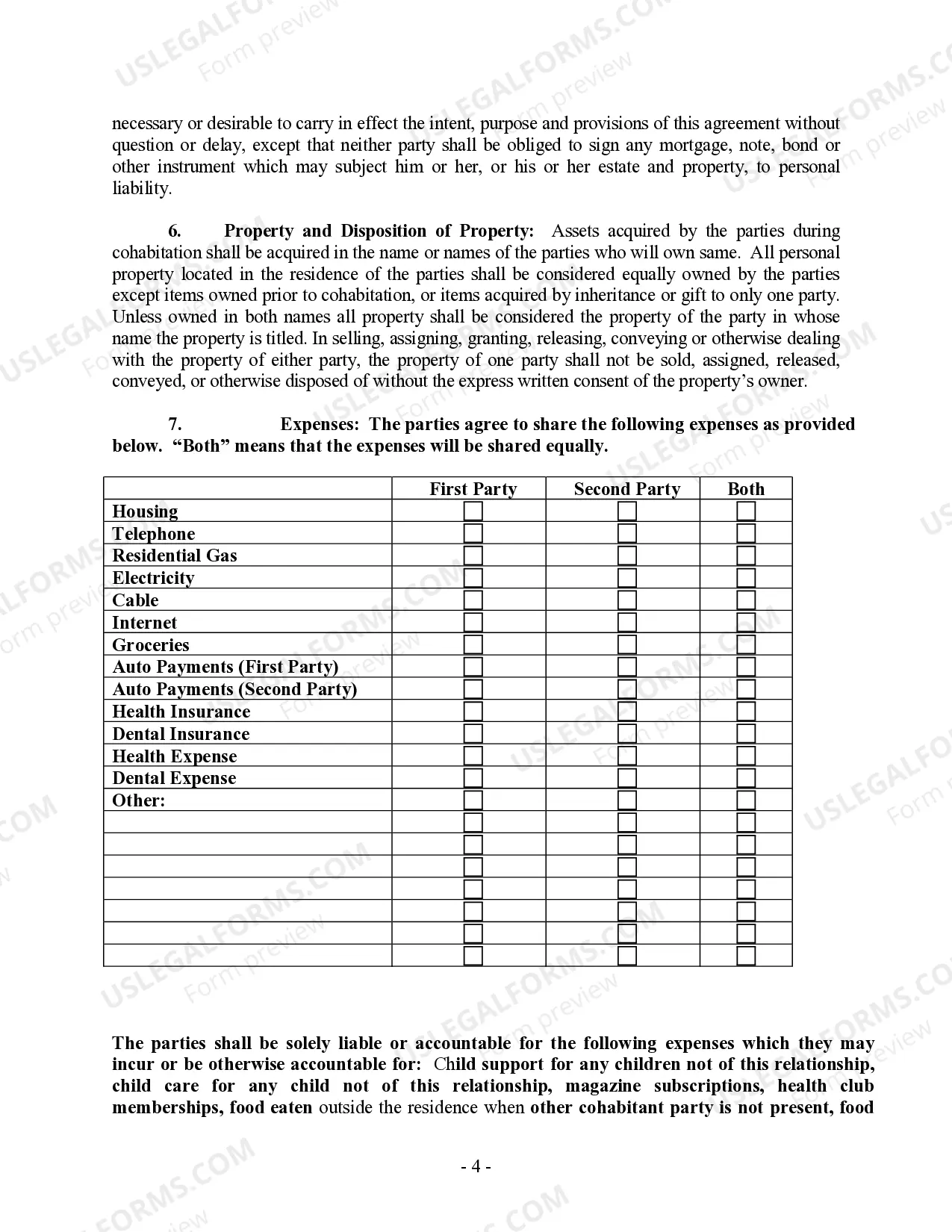

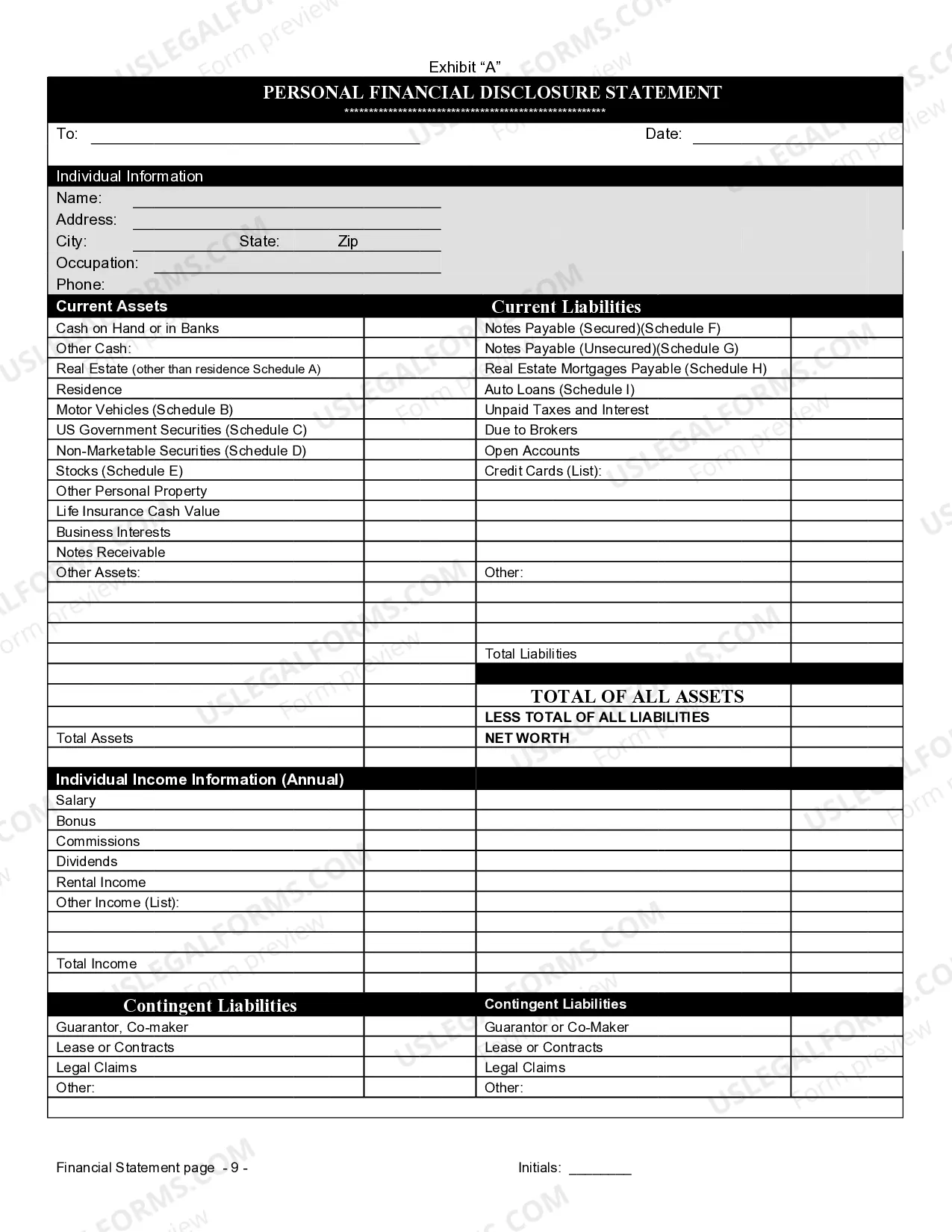

The Non-Marital Cohabitation Agreement helps clarify what is expected of each party. It contains provisions relating to expenses, assets and what happens if the parties discontinue the living arrangement, including ownership and division of property acquired during the course of the relationship.

South Carolina Cohabitation Withholding Form 2022

Description

How to fill out South Carolina Non-Marital Cohabitation Living Together Agreement?

It’s no secret that you can’t become a law professional immediately, nor can you figure out how to quickly prepare South Carolina Cohabitation Withholding Form 2022 without the need of a specialized background. Creating legal documents is a long venture requiring a specific education and skills. So why not leave the creation of the South Carolina Cohabitation Withholding Form 2022 to the specialists?

With US Legal Forms, one of the most extensive legal template libraries, you can find anything from court documents to templates for internal corporate communication. We know how crucial compliance and adherence to federal and state laws and regulations are. That’s why, on our platform, all templates are location specific and up to date.

Here’s start off with our website and obtain the document you require in mere minutes:

- Discover the document you need by using the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to determine whether South Carolina Cohabitation Withholding Form 2022 is what you’re looking for.

- Begin your search again if you need any other template.

- Set up a free account and choose a subscription option to buy the template.

- Pick Buy now. Once the transaction is through, you can download the South Carolina Cohabitation Withholding Form 2022, fill it out, print it, and send or send it by post to the designated people or entities.

You can re-access your documents from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Step 3 of the new W-4 form will ask you how many qualifying children you have under age 17, and how many other dependents you have. After you complete Step 3, your employer will know exactly how much to decrease withholding to allow for your children.

File and pay online at MyDORWAY.dor.sc.gov. Do not mail when filing online. You must file a return even if no SC Income Tax has been withheld during the quarter. You must file a WH-1606 if the account was open for any portion of the calendar year.

If you are single and have one job, or married and filing jointly then claiming one allowance makes the most sense. An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately.

Taxable income (loss) of a partnership flows through and is taxable to the partners in the same manner as for federal partnership income. South Carolina income taxable to nonresident partners is subject to withholding by the partnership at a 5% rate.