Title To Real Estate With Integrity

Description

How to fill out South Carolina Title To Real Estate?

Creating legal documents from the ground up can at times be daunting.

Certain instances may require extensive investigation and significant sums of money invested.

If you’re in search of a more straightforward and cost-effective approach to preparing Title To Real Estate With Integrity or any other documentation without the hassle, US Legal Forms is always accessible to you.

Our digital repository of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal matters. With just a few clicks, you can effortlessly obtain state- and county-specific forms meticulously assembled for you by our legal professionals.

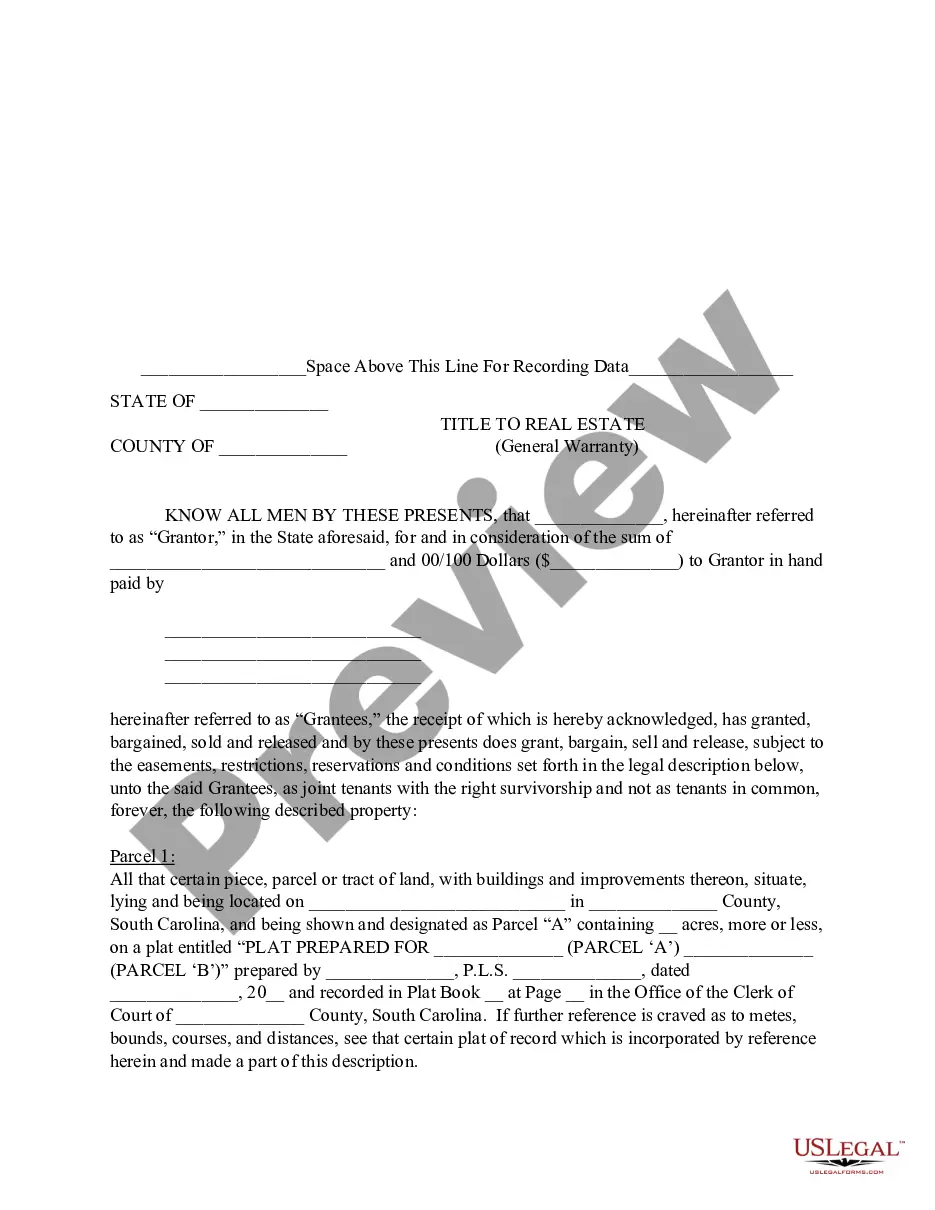

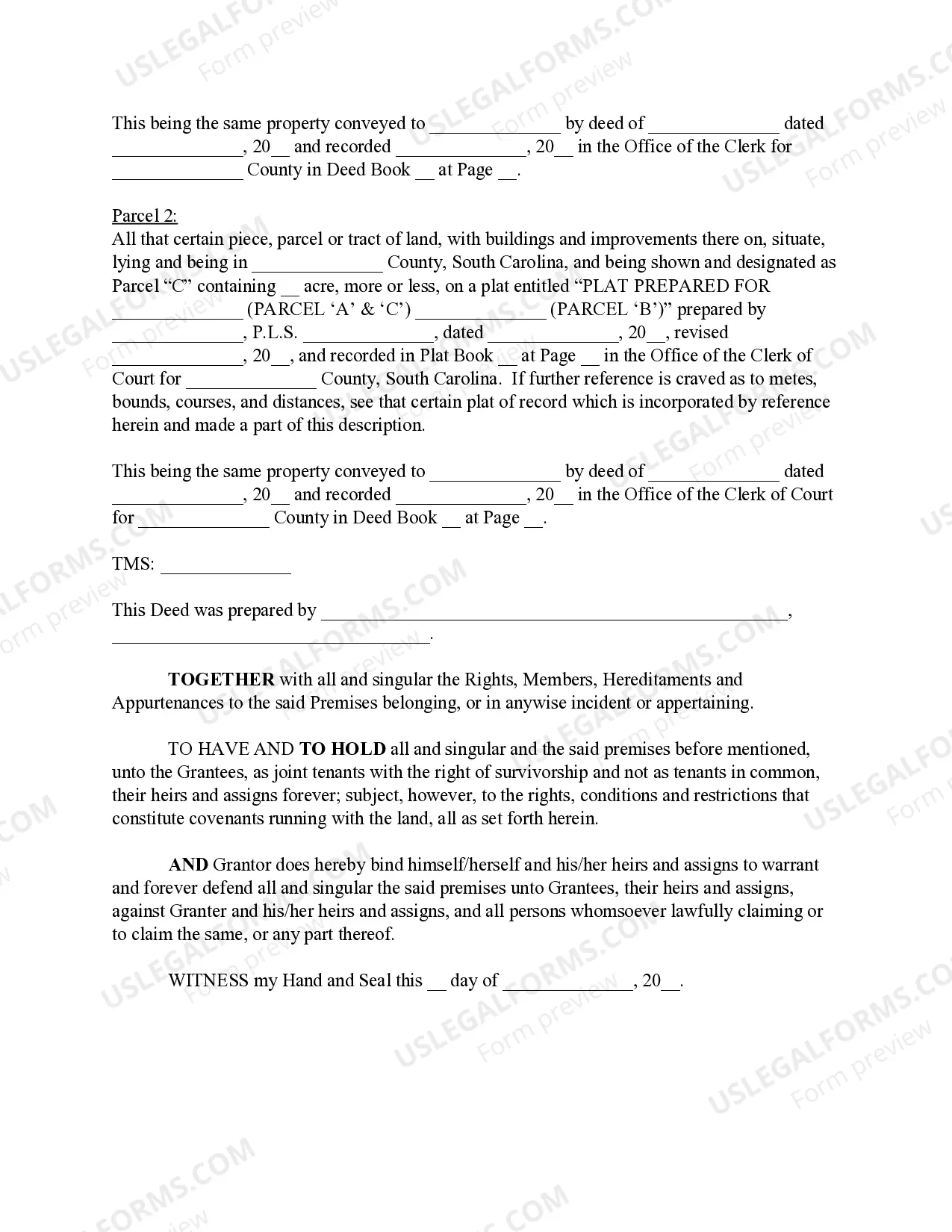

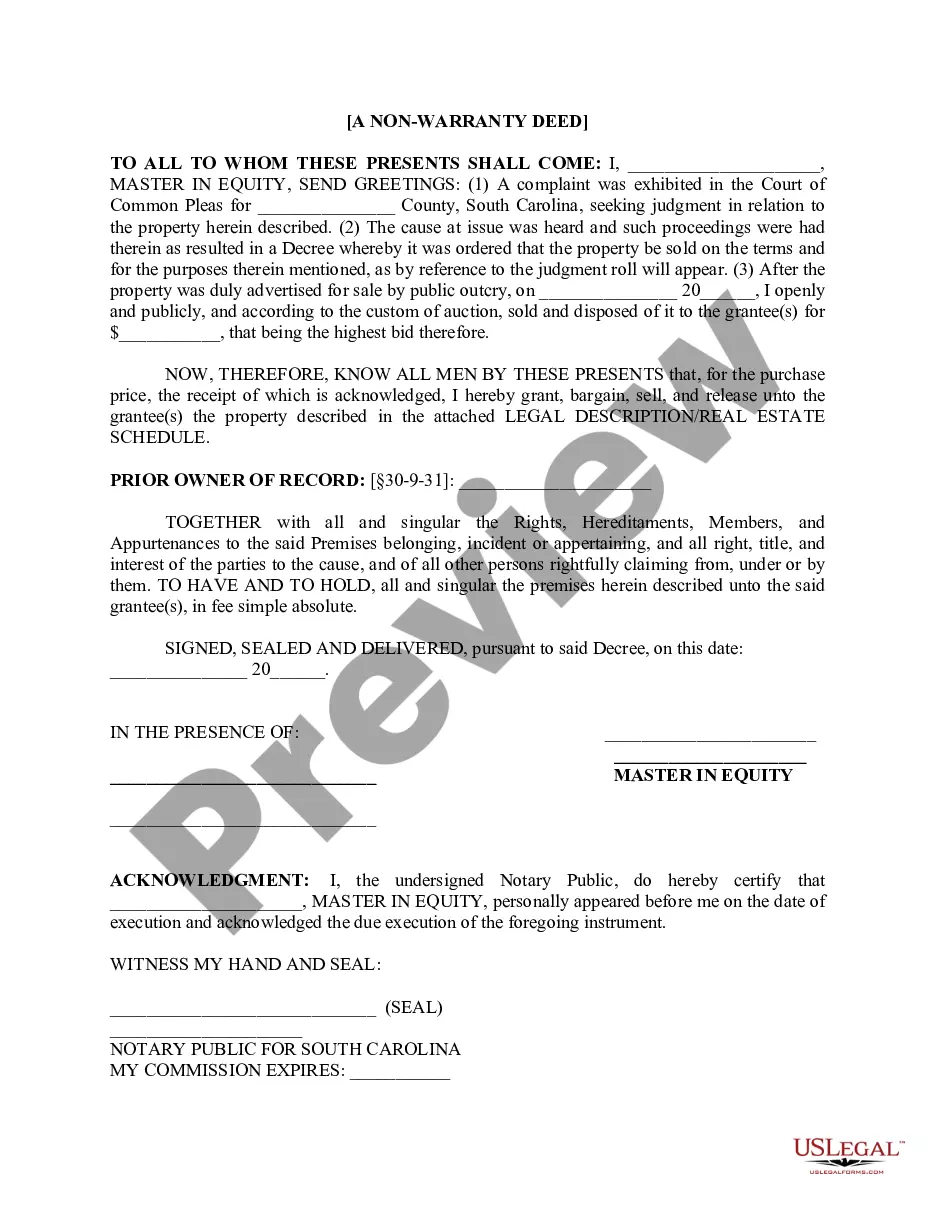

Examine the form preview and descriptions to ensure you have located the document you seek. Confirm that the template you select meets the standards of your state and county. Choose the most appropriate subscription plan to acquire the Title To Real Estate With Integrity. Download the form. Next, complete, sign, and print it out. US Legal Forms takes pride in its solid reputation and over 25 years of experience. Join us today and transform form completion into a simple and efficient process!

- Utilize our site whenever you require a dependable and trustworthy service through which you can easily locate and download the Title To Real Estate With Integrity.

- If you’re already familiar with our services and have previously established an account with us, simply Log In to your account, choose the template and download it or re-download it any time later in the My documents section.

- Not registered yet? No worries. It requires minimal time to set it up and search the library.

- Before rushing to download Title To Real Estate With Integrity, adhere to these suggestions.

Form popularity

FAQ

U.S. Legal Forms provides a comprehensive platform that offers customizable legal documents and forms to help you address various title issues effectively. With access to real estate forms, you can ensure that all necessary paperwork is completed correctly, reducing the risk of title problems. This support is essential for maintaining a strong title to real estate with integrity, allowing you to navigate your real estate journey confidently.

A debt collection form is used by employers to get the contact information from debtors (people who owe you money).

If you ask a debt collector to stop all contact ? regardless of the communications channel ? the collector must stop. Keep in mind, though, that you may still owe the debt. If you don't want a debt collector to contact you again, write a letter to the debt collector saying so.

A debt collection letter reminds a debtor that they owe you money. You can use a debt collection letter to set up a repayment plan or warn of impending legal proceedings. A debt collection letter should include the total debt owed, the initial due date, and any necessary warnings of impending legal action.

You may stop a collector from contacting you by writing a letter to the agency telling them to stop. Once the agency receives your letter, they may not contact you again except to say there will be no further contact, or to notify you if the debt collector or the creditor intends to take some specific action.

Collecting a past-due debt is a legal way for creditors and debt collection agencies to get money that's owed to them. If you're late on payments ? or haven't made them at all ? you owe it to companies to pay that money back.

If you receive a notice from a debt collector, it's important to respond as soon as possible?even if you do not owe the debt?because otherwise the collector may continue trying to collect the debt, report negative information to credit reporting companies, and even sue you.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

If you have a bill that goes unpaid, the company that you owe can send your debt to collections. They may hire a debt collection agency to collect the outstanding balance, and in some cases, they can sell your debt to a debt collection company.