Quitclaim Deed For Property Template

Description

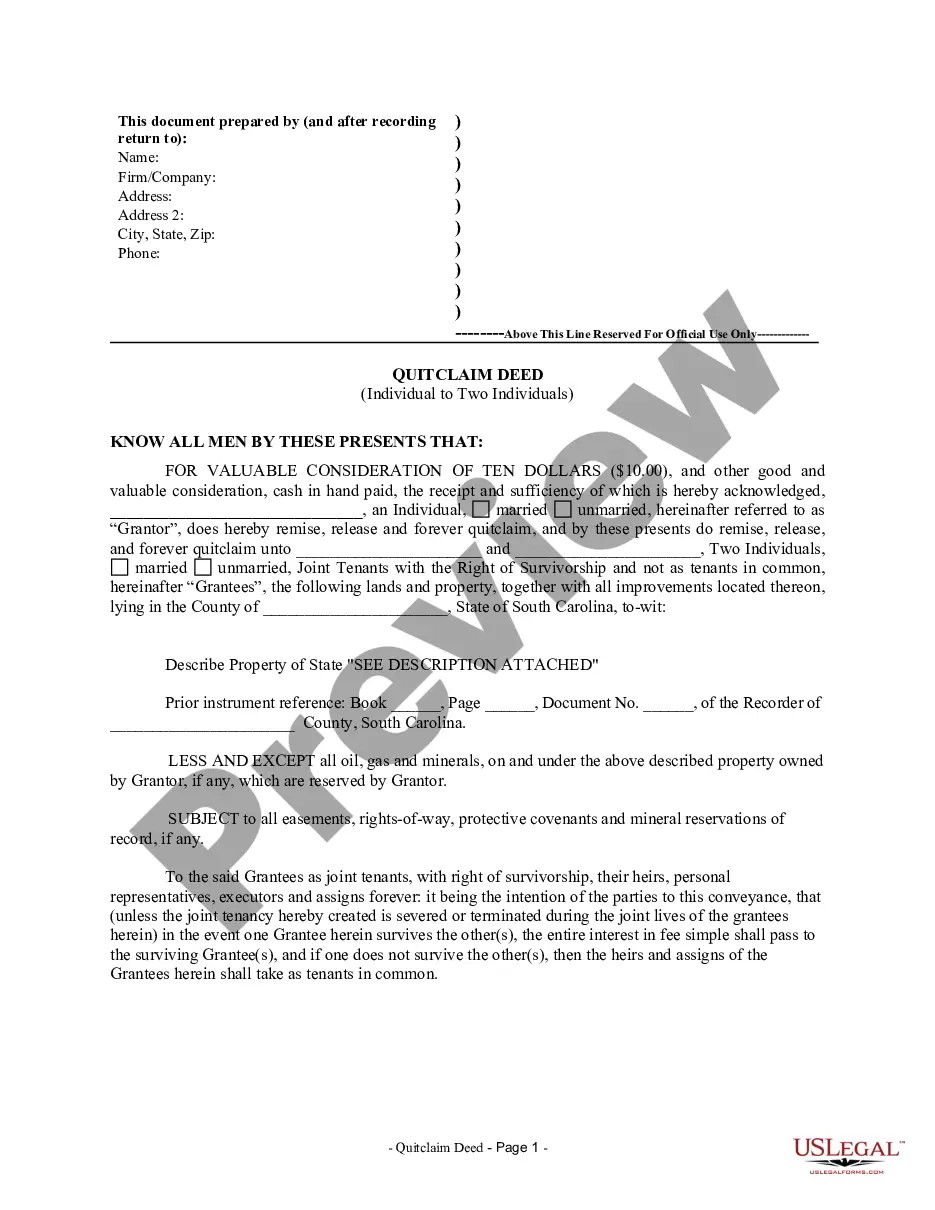

How to fill out South Carolina Quitclaim Deed From Individual To Two Individuals In Joint Tenancy?

- If you're an existing user, log in to your account and download the quitclaim deed template you need by clicking the Download button. Ensure your subscription is active.

- If you're new to our service, start by checking the Preview mode and description of the quitclaim deed template. Make sure it complies with your local jurisdiction.

- If necessary, use the Search bar to find an alternative template that fits your requirements.

- Proceed to purchase the document by clicking the Buy Now button. Select your preferred subscription plan and create an account to access our extensive library.

- Complete your purchase by entering your payment information via credit card or PayPal.

- Once purchased, download your quitclaim deed template and save it on your device. You can also access it later in the My Forms section of your profile.

By utilizing US Legal Forms, you gain access to one of the largest libraries of legal templates, making document preparation straightforward and tailored to legal requirements.

Start your journey today by visiting US Legal Forms to access your quitclaim deed for property template and ensure a smooth transfer of ownership!

Form popularity

FAQ

Yes, you can prepare a quit claim deed yourself, especially if you utilize a quitclaim deed for property template. This template provides a straightforward structure that simplifies your task. However, it's advisable to ensure that you understand your local laws and requirements to avoid potential issues later. If you have any doubts, consider consulting a legal professional for peace of mind.

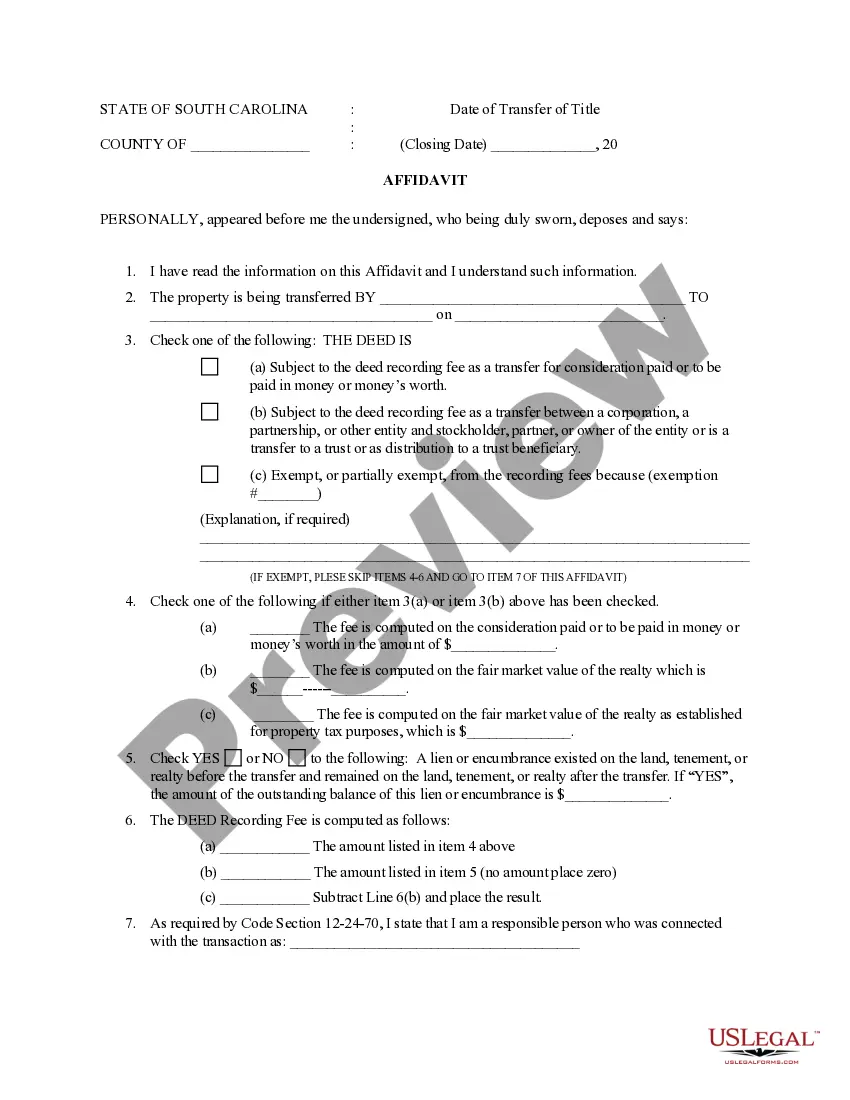

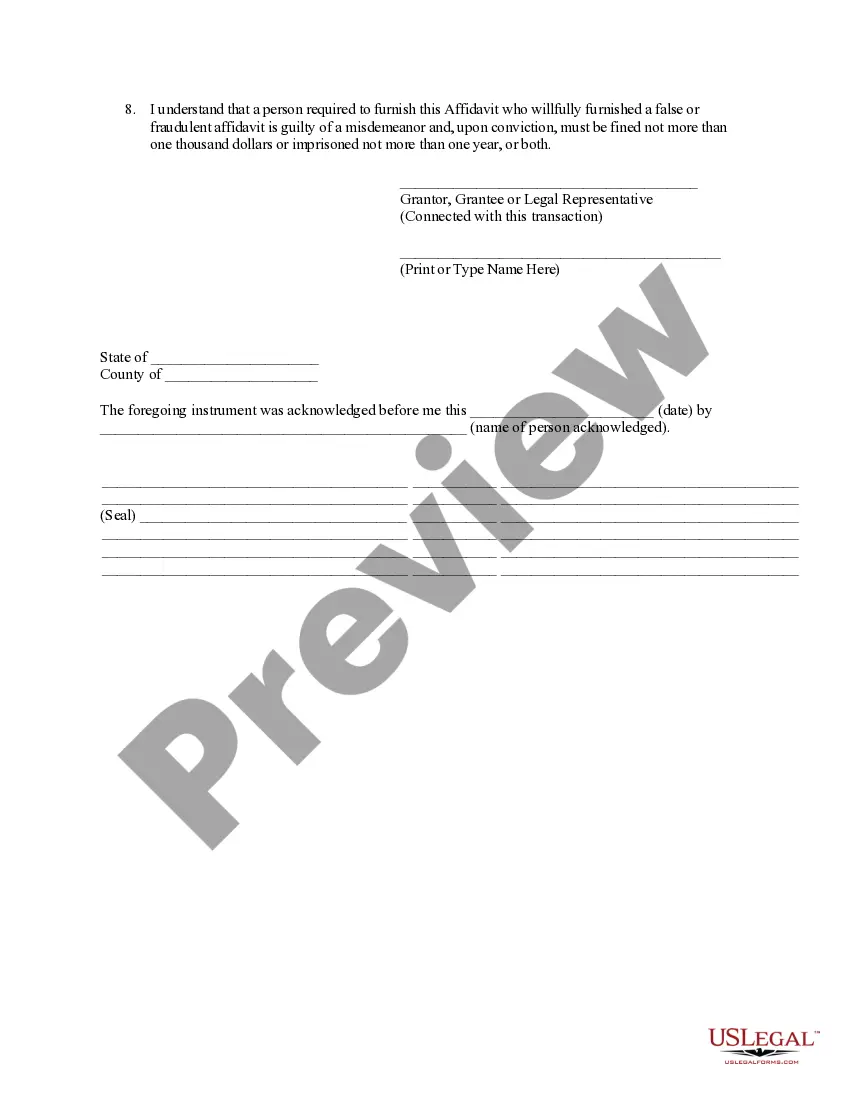

A quitclaim deed can become invalid due to several reasons. First, if the document lacks the necessary signatures or proper notarization, it may not hold up in court. Additionally, if the property description is unclear or incorrect, it can lead to disputes over ownership. To ensure validity, it’s crucial to use a reliable quitclaim deed for property template that guides you through the correct process.

An example of a quitclaim deed for property template may involve a father transferring property to his child. In this scenario, the father, as the grantor, would complete the quitclaim deed, indicating the handover of his interest in the property. It is crucial to also present the legal description of the property involved. This straightforward approach simplifies the property transfer process, ensuring clarity and official acknowledgment.

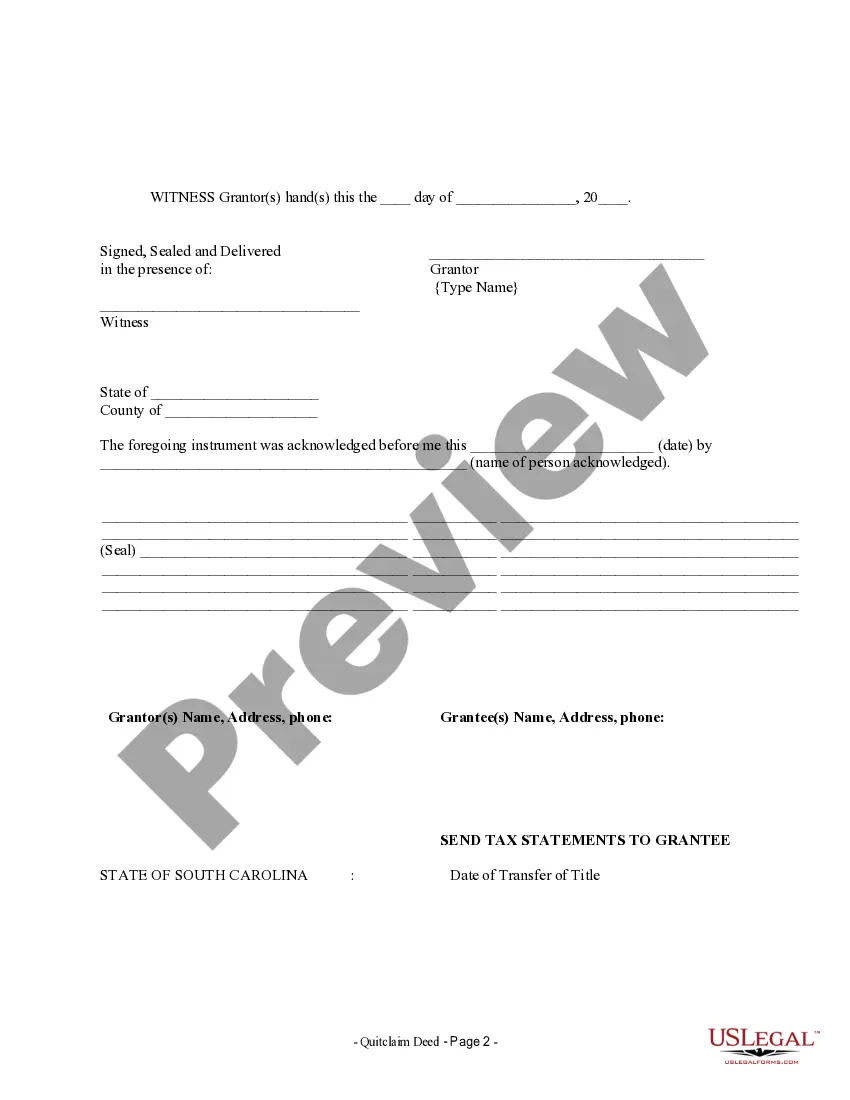

Properly filling out a quitclaim deed for property template requires careful attention to detail. Ensure you accurately input all relevant parties' names and addresses, along with the exact property description. Sign the form in the presence of a notary to validate the document. Finally, don't forget to submit the completed deed to your local office to make the transfer official.

To effectively fill out a quitclaim deed for property template, first gather essential information about the grantor and grantee. Include details such as their names, addresses, and the property's legal description. Clearly state the transfer of interest, and remember to sign the document in front of a notary. After completing the form, file it with the appropriate local government office for public record.

The disadvantages of a quit claim deed for property template revolve around security and assurance. Since this type of deed provides no warranties, the recipient may find they have limited recourse if issues arise after the transfer. Additionally, lack of formal appraisal can lead to misunderstandings about the property's actual value. For these reasons, it’s wise to consider alternative legal options or consult professionals if necessary.

People typically use a quitclaim deed for property template for its simplicity and efficiency in transferring property rights. This deed allows easy relocation of ownership between persons who know and trust each other, such as family members. Common reasons include conveying ownership after marriage, divorce, or in estate planning scenarios. Essentially, it streamlines the transfer process when formalities are less critical.

The primary negative of a quit claim deed for property template is the potential for unresolved issues regarding the title. A person receiving property might inherit hidden debts or liens that were not disclosed. Additionally, since this deed transfers ownership without any guarantees, the recipient assumes all risks post-transfer. This uncertainty can deter individuals from trusting quitclaim deeds outright.

Many people view quitclaim deeds with caution due to the lack of warranty on the title. When using a quitclaim deed for property template, the transferor does not guarantee that the title is clear of liens or other encumbrances. This means the recipient could face unexpected issues related to property ownership. As a result, some prefer more formal means of transfer that offer additional protections.

A quitclaim deed for property template primarily benefits individuals transferring property to family members or friends. This type of deed allows for a simple transfer without the need for extensive paperwork or legal procedures. It is convenient for those who trust the recipient, as it relinquishes any claim to the property. Therefore, it’s often used in situations like divorce settlements or family inheritances.