Notice To Cure Letter Example For Auto Loan

Description

How to fill out South Carolina Notice Of Consumer's Right To Cure Default?

Accessing legal document samples that meet the federal and local regulations is a matter of necessity, and the internet offers numerous options to pick from. But what’s the point in wasting time searching for the right Notice To Cure Letter Example For Auto Loan sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the most extensive online legal catalog with over 85,000 fillable templates drafted by attorneys for any professional and personal situation. They are easy to browse with all files collected by state and purpose of use. Our professionals stay up with legislative changes, so you can always be confident your paperwork is up to date and compliant when getting a Notice To Cure Letter Example For Auto Loan from our website.

Obtaining a Notice To Cure Letter Example For Auto Loan is quick and easy for both current and new users. If you already have an account with a valid subscription, log in and download the document sample you need in the right format. If you are new to our website, adhere to the guidelines below:

- Take a look at the template using the Preview feature or through the text outline to ensure it fits your needs.

- Locate a different sample using the search function at the top of the page if needed.

- Click Buy Now when you’ve found the correct form and opt for a subscription plan.

- Register for an account or sign in and make a payment with PayPal or a credit card.

- Pick the format for your Notice To Cure Letter Example For Auto Loan and download it.

All templates you locate through US Legal Forms are reusable. To re-download and fill out earlier purchased forms, open the My Forms tab in your profile. Take advantage of the most extensive and straightforward-to-use legal paperwork service!

Form popularity

FAQ

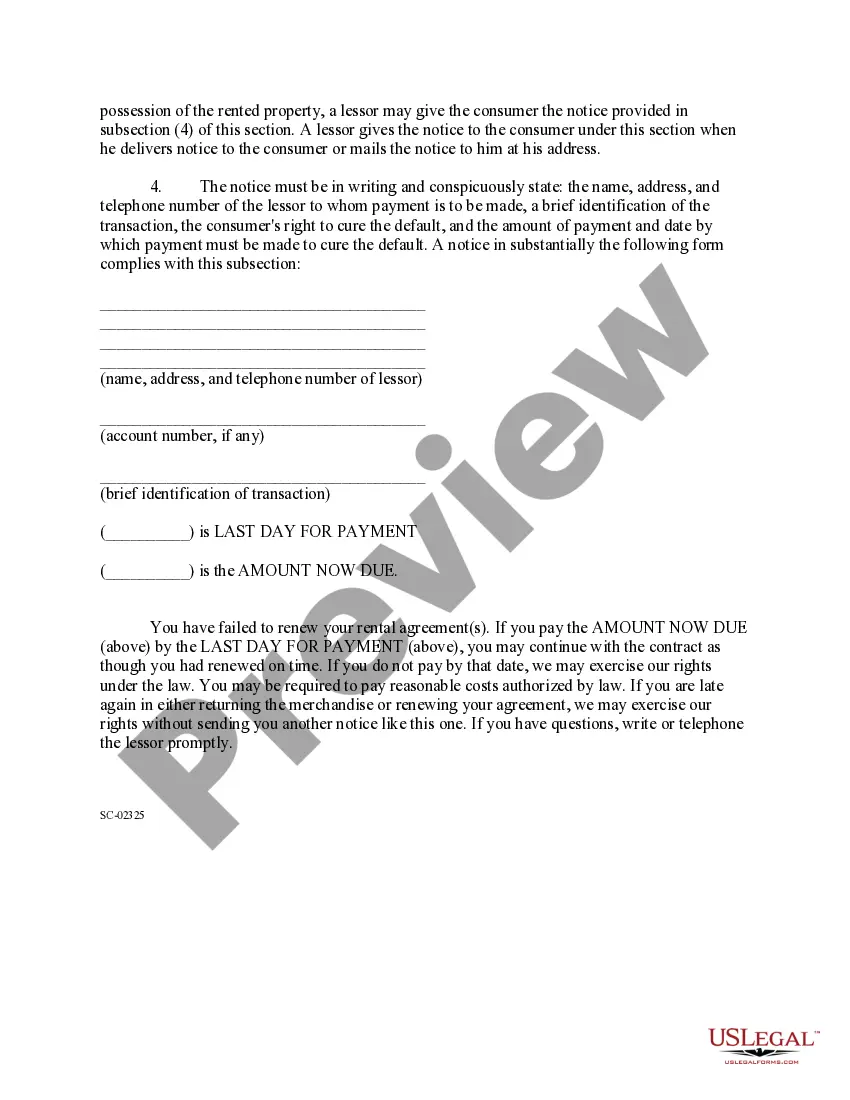

A cure or termination letter should begin where the problems began and tell the story chronologically. Bullet points work well to sum up this information. A contractor should be specific on the important dates, or if specific dates are not available, reference relevant time frames.

This document is a letter from a lender to a borrower stating that the borrower is in default of their car loan agreement and outlines the specific terms or conditions of the loan agreement that have been violated, the steps that the lender intends to take in response, and any options the borrower may have to avoid ...

How Notices of Default Work The name and address of the borrower. The name and address of the lender. The legal address of the property. Full details on the nature of the default. What action is required to cure the default. The deadline and the intentions of the lender if the deadline is passed without a cure.

A default occurs when a borrower stops making required payments on a debt. Defaults can occur on secured debt, such as a mortgage loan secured by a house, or on unsecured debt, such as credit cards or a student loan. Defaults expose borrowers to legal claims and may limit their future access to credit opportunities.

Sample Loan Default Letter I am writing to inform you that your loan is now in default. We must receive payment on the total past due amount of by to prevent legal action. If you have overlooked this payment, please pay it in full now. If you need to make an alternate payment arrangement, please call us.