South Carolina Corporation Withholding Form 2023

Description

How to fill out South Carolina Bylaws For Corporation?

Getting a go-to place to take the most current and relevant legal templates is half the struggle of handling bureaucracy. Choosing the right legal documents needs accuracy and attention to detail, which is the reason it is important to take samples of South Carolina Corporation Withholding Form 2023 only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have very little to worry about. You can access and check all the information regarding the document’s use and relevance for the situation and in your state or county.

Take the listed steps to complete your South Carolina Corporation Withholding Form 2023:

- Utilize the library navigation or search field to find your sample.

- Open the form’s information to see if it matches the requirements of your state and region.

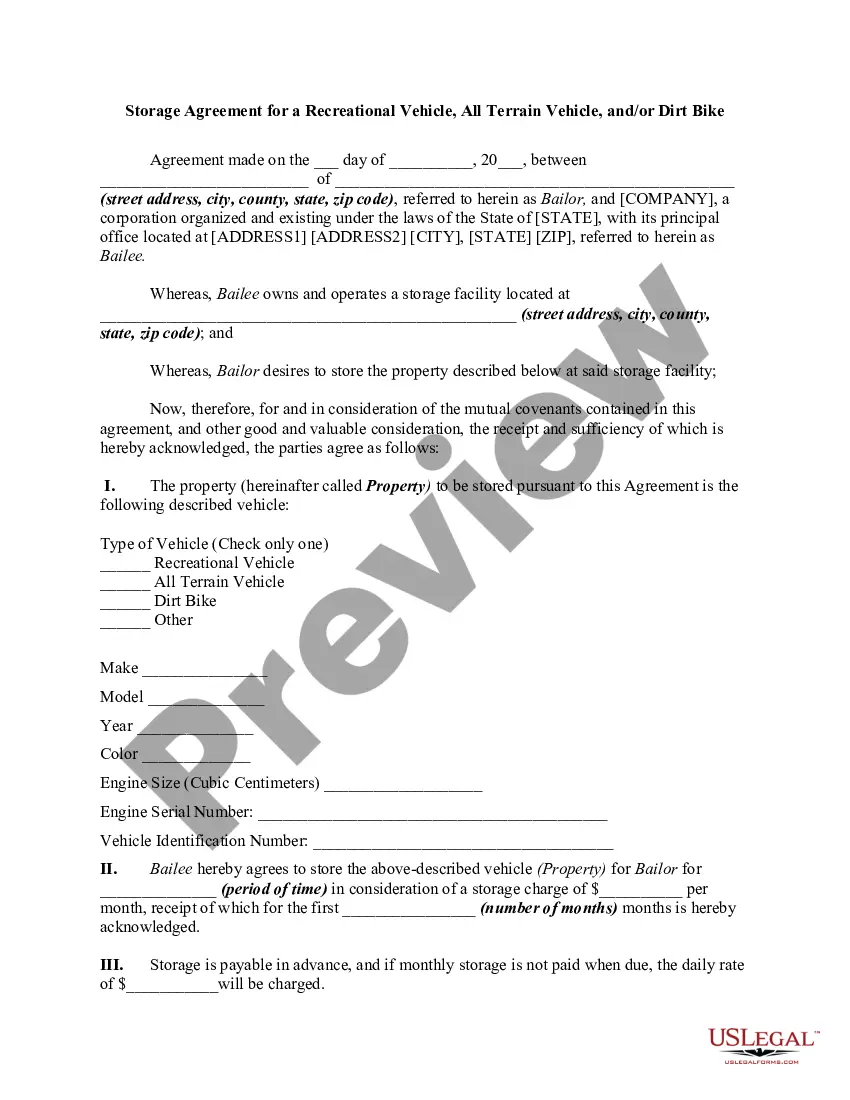

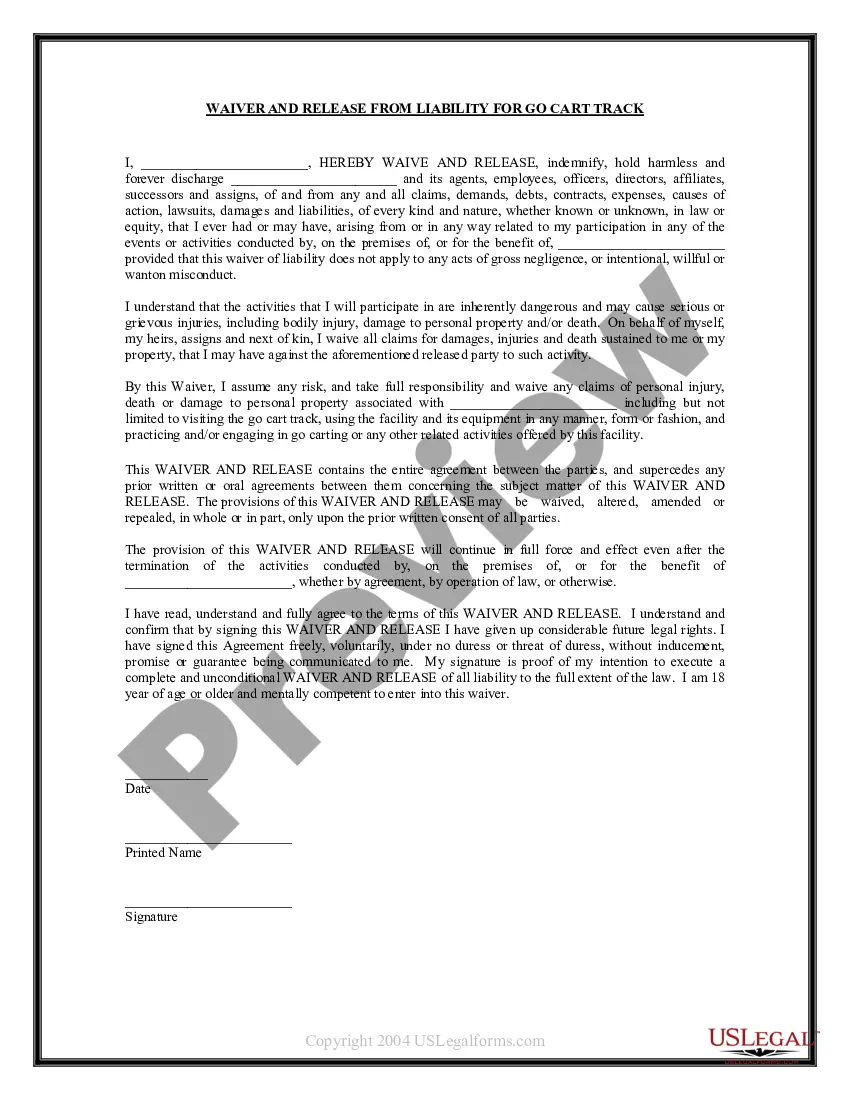

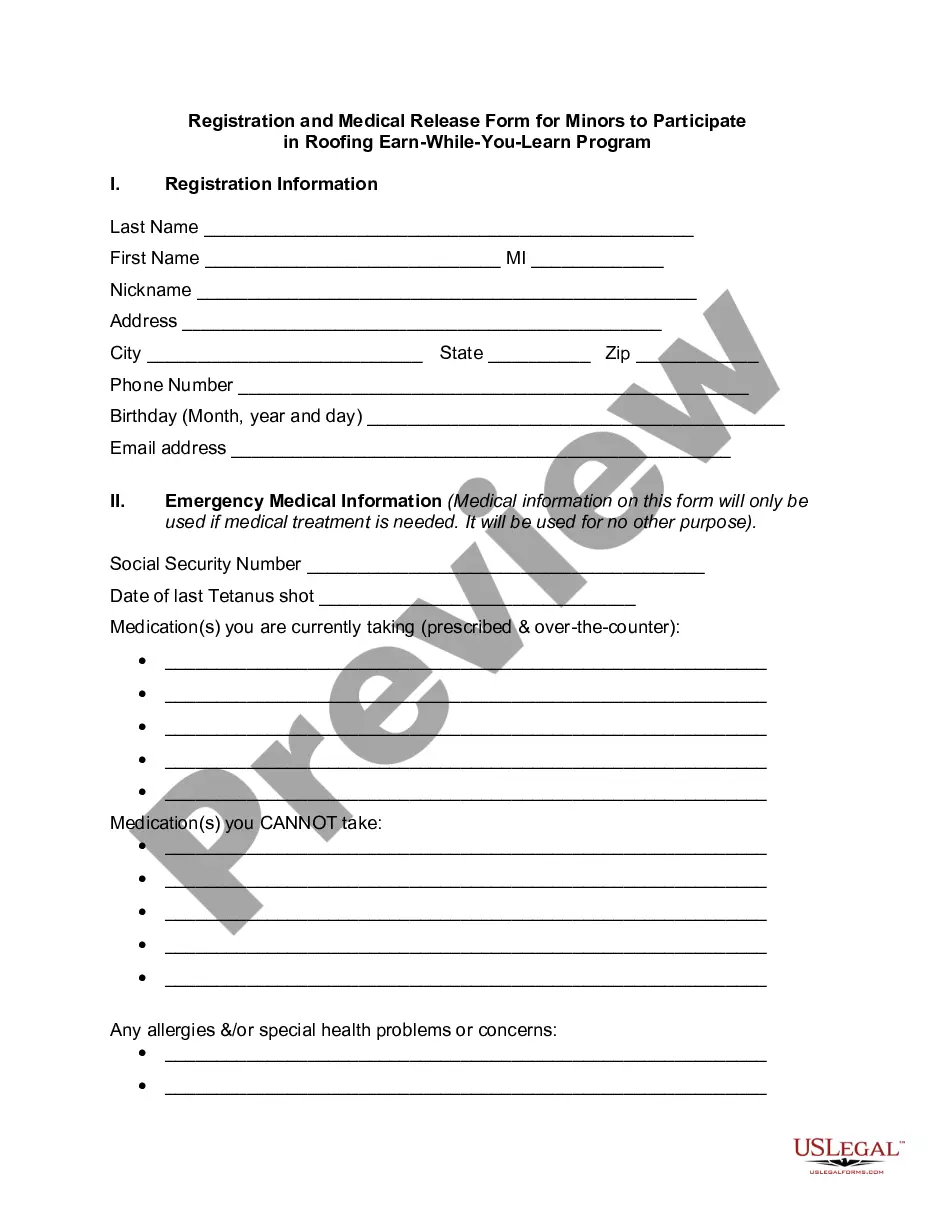

- Open the form preview, if there is one, to make sure the form is definitely the one you are interested in.

- Get back to the search and locate the proper document if the South Carolina Corporation Withholding Form 2023 does not match your requirements.

- If you are positive regarding the form’s relevance, download it.

- If you are an authorized user, click Log in to authenticate and gain access to your selected forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Pick the pricing plan that fits your preferences.

- Proceed to the registration to complete your purchase.

- Complete your purchase by choosing a payment method (bank card or PayPal).

- Pick the file format for downloading South Carolina Corporation Withholding Form 2023.

- When you have the form on your gadget, you can change it with the editor or print it and complete it manually.

Eliminate the inconvenience that comes with your legal documentation. Check out the comprehensive US Legal Forms library to find legal templates, examine their relevance to your situation, and download them immediately.

Form popularity

FAQ

Most workers will see less state taxes withheld in their 2023 paychecks as a result of the Withholding Tax Tables update. The top Income Tax rate has been reduced from 7% ?to 6.5% and could be reduced again in the future if certain general fund growth tests are met.

Withholding Formula (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $2,9800.2%Over $2,980 but not over $5,960$5.96 plus 3.0% of excess over $2,980Over $5,960 but not over $8,940$95.36 plus 4.0% of excess over $5,9603 more rows ?

S Corporations are required to withhold 5% of the South Carolina taxable income of shareholders who are nonresidents of South Carolina. To avoid penalty and interest, file the SC1120S-WH and submit your Withholding Tax payment by the 15th day of the third month following the S Corporation's taxable year end.

Here's a step-by-step look at how to complete the form. Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

File and pay online at MyDORWAY.dor.sc.gov. Do not mail when filing online. You must file a return even if no SC Income Tax has been withheld during the quarter. You must file a WH-1606 if the account was open for any portion of the calendar year.