South Carolina Corporation Withholding Form 2022

Description

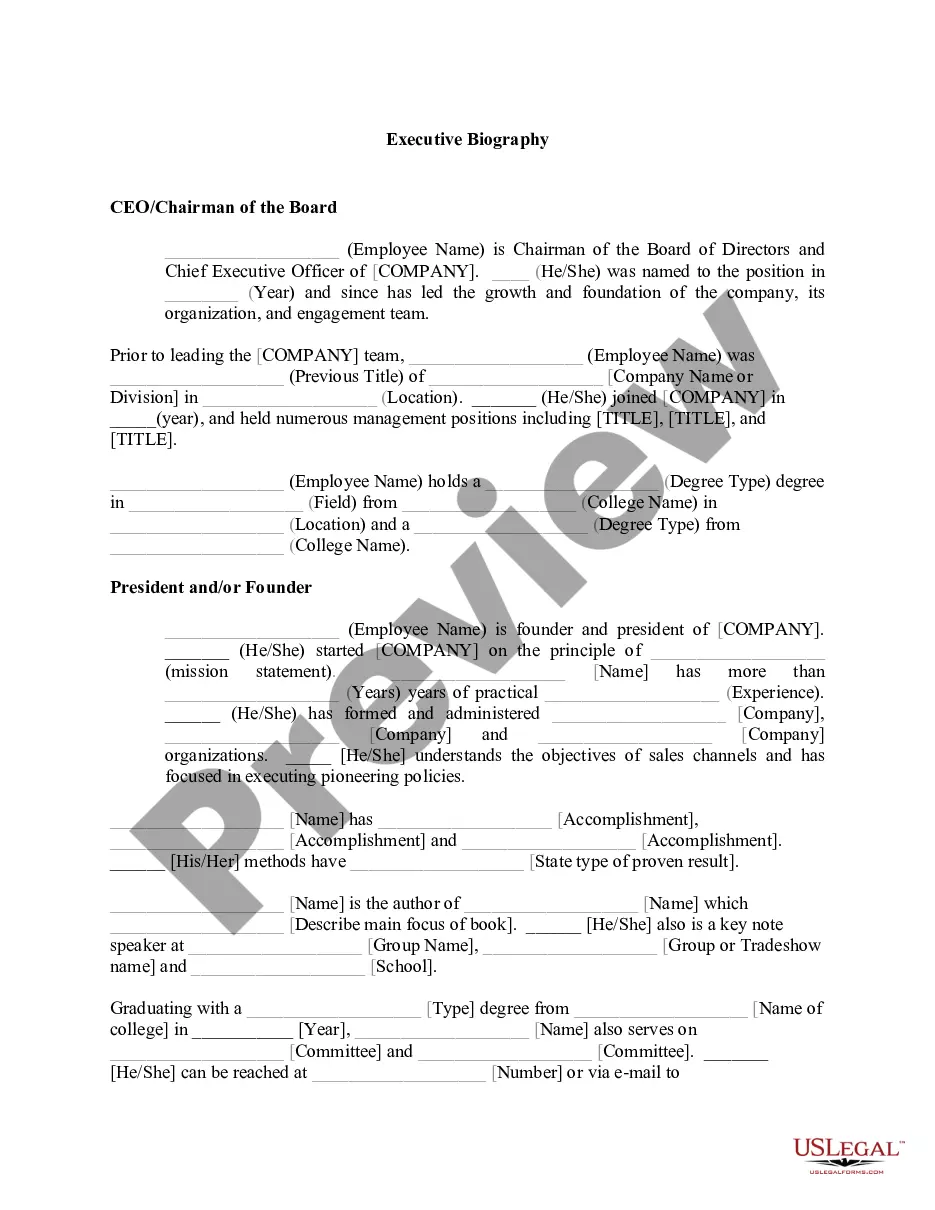

How to fill out South Carolina Bylaws For Corporation?

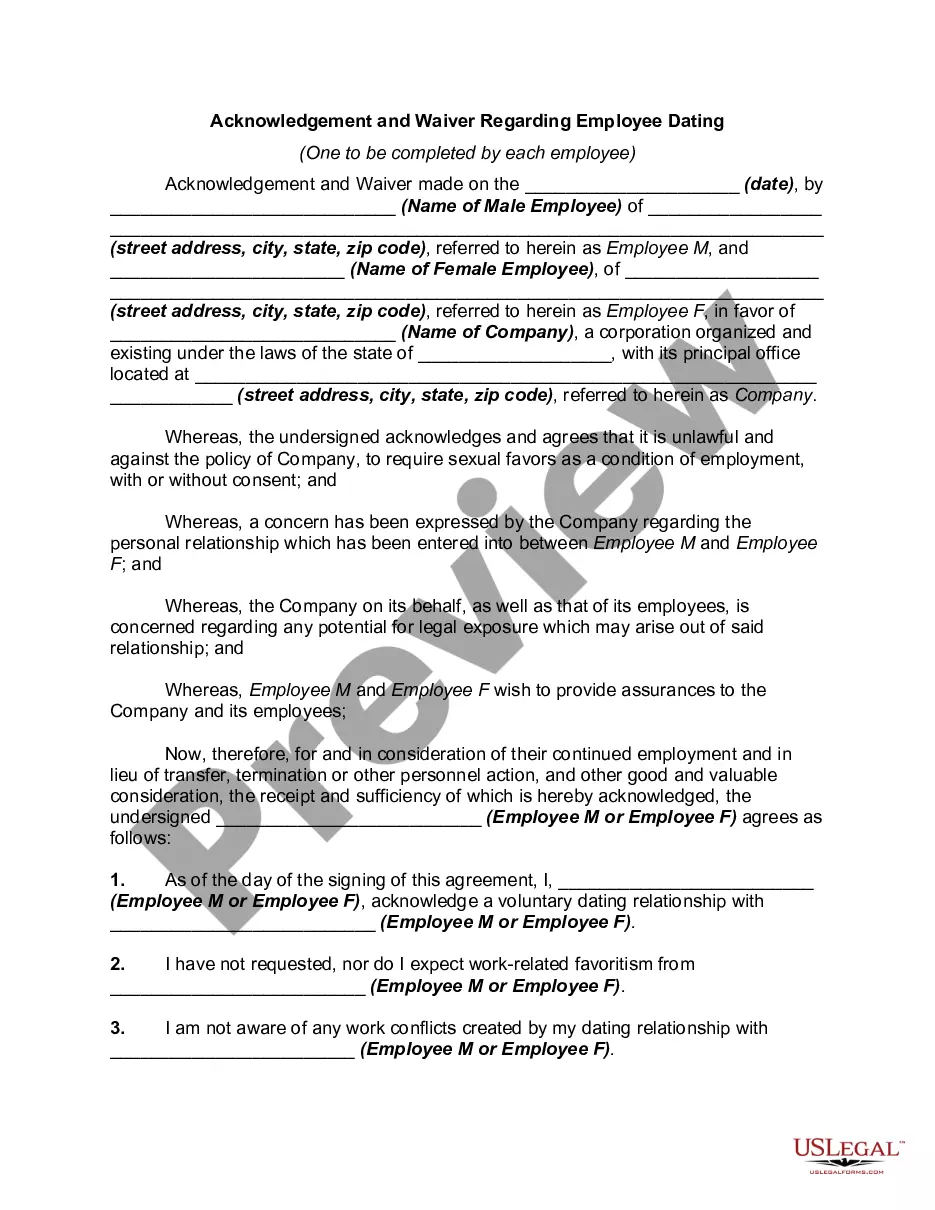

Legal management can be overpowering, even for skilled professionals. When you are interested in a South Carolina Corporation Withholding Form 2022 and don’t have the time to devote looking for the appropriate and updated version, the procedures could be demanding. A robust web form catalogue could be a gamechanger for anyone who wants to manage these situations effectively. US Legal Forms is a industry leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms covers any requirements you could have, from personal to enterprise paperwork, all in one spot.

- Use innovative tools to accomplish and control your South Carolina Corporation Withholding Form 2022

- Gain access to a useful resource base of articles, instructions and handbooks and resources related to your situation and requirements

Save time and effort looking for the paperwork you need, and use US Legal Forms’ advanced search and Review feature to get South Carolina Corporation Withholding Form 2022 and acquire it. For those who have a monthly subscription, log in in your US Legal Forms profile, look for the form, and acquire it. Take a look at My Forms tab to find out the paperwork you previously saved and also to control your folders as you can see fit.

Should it be your first time with US Legal Forms, create a free account and acquire unlimited usage of all benefits of the platform. Here are the steps for taking after downloading the form you need:

- Confirm this is the proper form by previewing it and looking at its description.

- Be sure that the sample is accepted in your state or county.

- Select Buy Now once you are all set.

- Select a monthly subscription plan.

- Find the formatting you need, and Download, complete, sign, print and send out your document.

Enjoy the US Legal Forms web catalogue, supported with 25 years of expertise and reliability. Change your everyday document administration in to a easy and intuitive process right now.

Form popularity

FAQ

S Corporations are required to withhold 5% of the South Carolina taxable income of shareholders who are nonresidents of South Carolina. To avoid penalty and interest, file the SC1120S-WH and submit your Withholding Tax payment by the 15th day of the third month following the S Corporation's taxable year end.

Withholding Formula (Effective Pay Period 04, 2022) If the Amount of Taxable Income Is:The Amount of Tax Withholding Should Be:Over $0 but not over $2,9800.2%Over $2,980 but not over $5,960$5.96 plus 3.0% of excess over $2,980Over $5,960 but not over $8,940$95.36 plus 4.0% of excess over $5,9603 more rows ?

An individual can claim two allowances if they are single and have more than one job, or are married and are filing taxes separately. Usually, those who are married and have either one child or more claim three allowances.

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

File and pay online at MyDORWAY.dor.sc.gov. Do not mail when filing online. You must file a return even if no SC Income Tax has been withheld during the quarter. You must file a WH-1606 if the account was open for any portion of the calendar year.