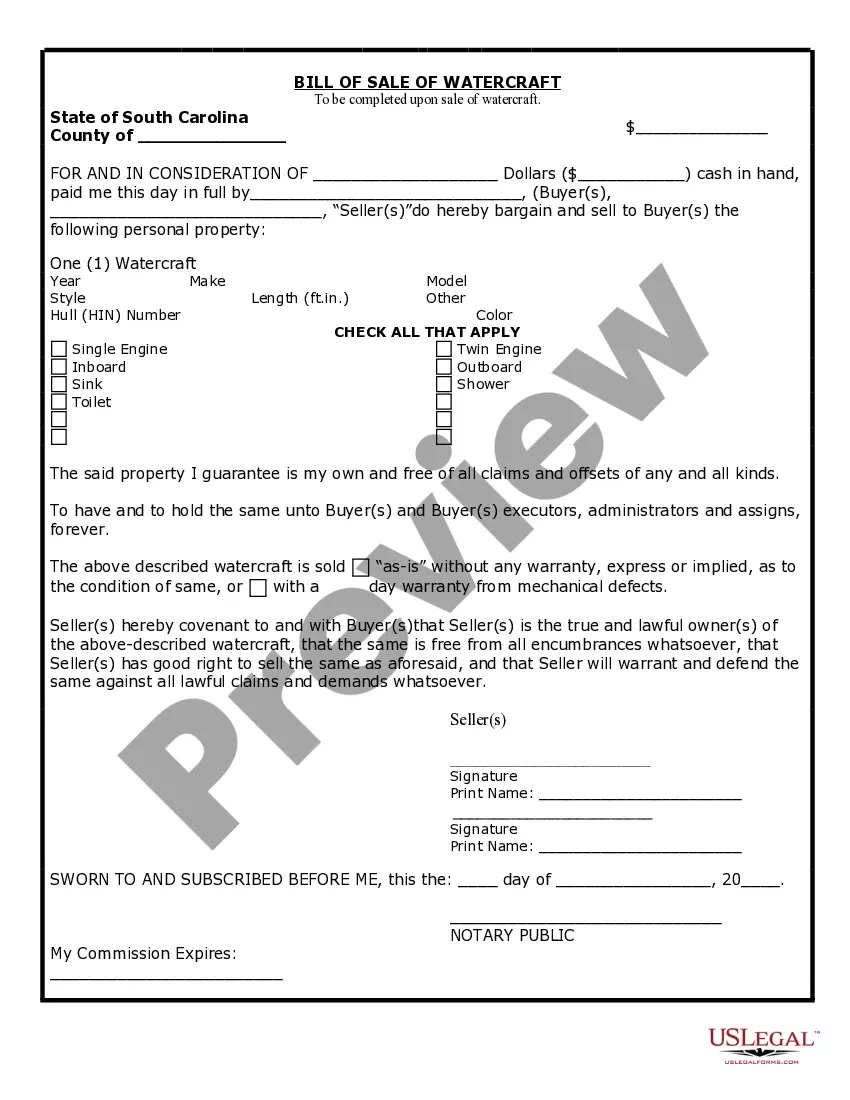

This is a bill of sale for the sale of a watercraft such as a boat. It includes information regarding the seller, buyer consideration paid and a detailed boat description.

Sc Boat Bill Of Sale Withholding Tax

Description

How to fill out South Carolina Bill Of Sale For WaterCraft Or Boat?

It’s obvious that you can’t become a law expert immediately, nor can you grasp how to quickly prepare Sc Boat Bill Of Sale Withholding Tax without the need of a specialized set of skills. Putting together legal documents is a time-consuming process requiring a particular education and skills. So why not leave the preparation of the Sc Boat Bill Of Sale Withholding Tax to the specialists?

With US Legal Forms, one of the most comprehensive legal template libraries, you can access anything from court documents to templates for in-office communication. We understand how important compliance and adherence to federal and state laws are. That’s why, on our platform, all forms are location specific and up to date.

Here’s start off with our platform and get the document you require in mere minutes:

- Discover the form you need by using the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to determine whether Sc Boat Bill Of Sale Withholding Tax is what you’re looking for.

- Begin your search over if you need a different template.

- Set up a free account and select a subscription plan to buy the form.

- Pick Buy now. Once the transaction is complete, you can get the Sc Boat Bill Of Sale Withholding Tax, complete it, print it, and send or send it by post to the necessary individuals or organizations.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and locate and download the template from the same tab.

No matter the purpose of your forms-whether it’s financial and legal, or personal-our platform has you covered. Try US Legal Forms now!

Form popularity

FAQ

A boat bill of sale includes information on the buyer, the seller, and the vessel. It also includes the transaction date, purchase price, and signatures of both the buyer and the seller. Boat owners in South Carolina must register their vessels with the South Carolina Department of Natural Resources.

?Casual Excise Tax on sales of boats, motors, or airplanes may not exceed the $500 Maximum Tax. ?Any item subject to the $500 Maximum Tax is taxed at a state rate of 5% and is not subject to any local tax administered by the SCDOR.

?All you have to do is register the boat outside of California and no tax is due,? one dealer told me. ?If you register it anywhere outside of California the tax is avoided. That's the long and the short of it,? another said.

It is part of the state registration process and is required to obtain the decals needed to operate boat in the state. The bill of sale will contain information about the buyer and the seller, a description of the boat, and the terms of the transaction.

If you purchase a boat from an individual, you will need to visit your County Auditor's Office to get a bill created and pay it in the Treasurer's office prior to going to SCDNR to get your stickers.