Rhode Island Eua

Description

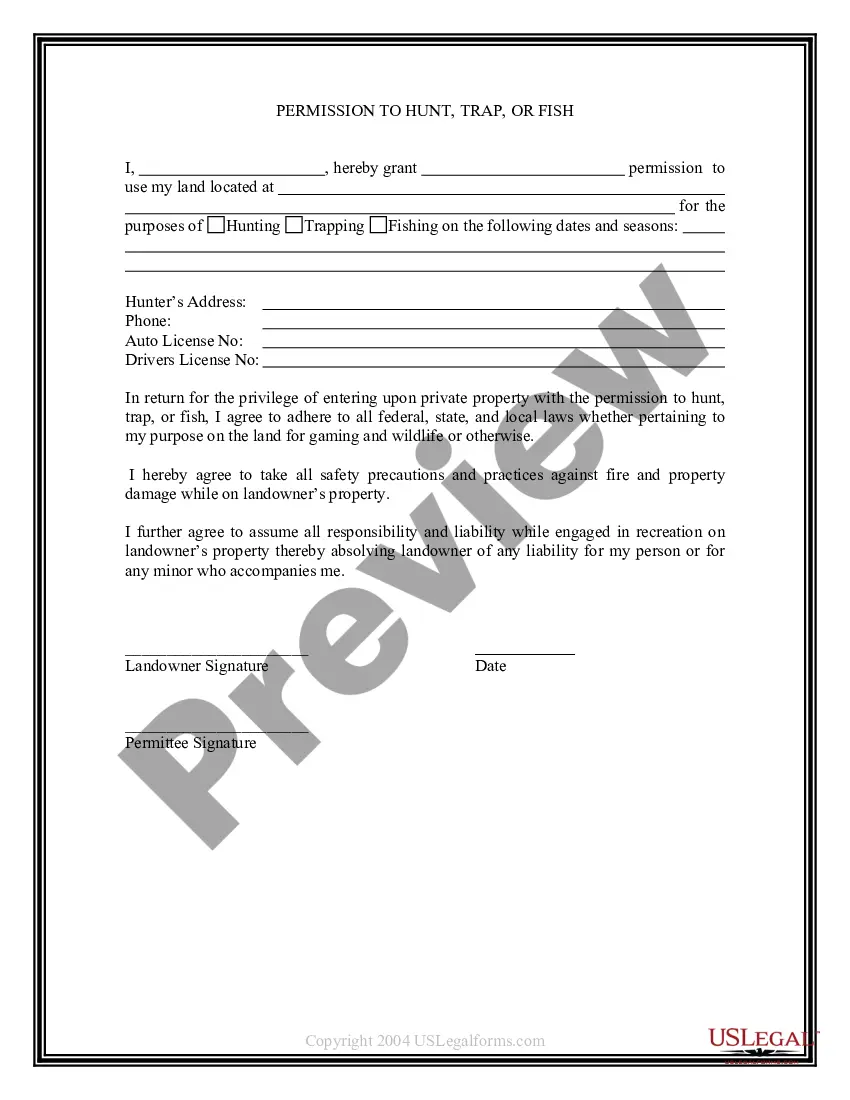

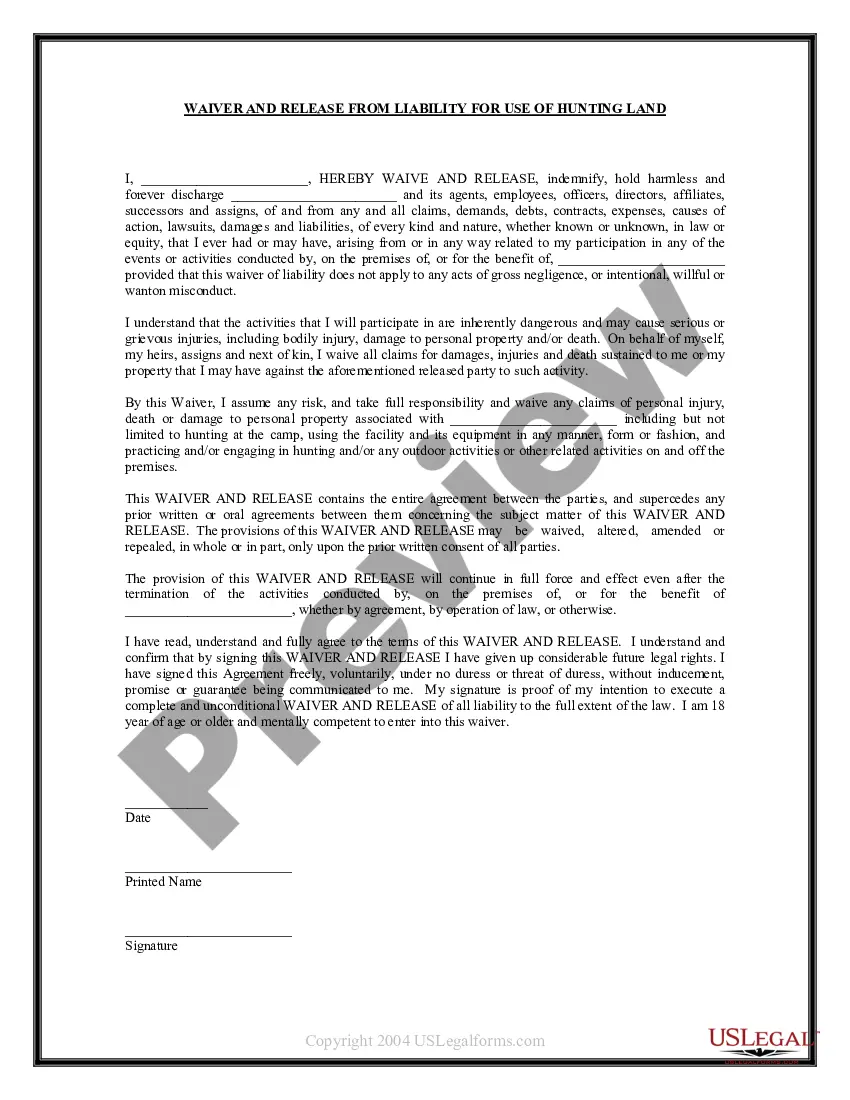

How to fill out Rhode Island Hunting Forms Package?

- Log in to your US Legal Forms account if you're already a member, or create a new account if it’s your first time.

- Explore the Preview mode to inspect form descriptions, ensuring that the selected document aligns with your specific jurisdictional criteria.

- Utilize the Search feature to locate alternative templates if the initial one doesn’t meet your requirements.

- Proceed to purchase your chosen document by clicking the Buy Now button and select a suitable subscription plan.

- Complete your transaction by entering your payment information, either via credit card or PayPal.

- Download the legal form and save it to your device, making it accessible anytime through the My Forms menu in your account.

By following these straightforward steps, you can effectively utilize the rich resources offered by US Legal Forms.

Ready to simplify your legal document process? Start using US Legal Forms today and ensure your documents are precise and compliant.

Form popularity

FAQ

While a domestic partnership in Rhode Island offers benefits similar to marriage, there are some disadvantages to consider. For instance, domestic partners may not have the same federal benefits and protections that married couples enjoy. Additionally, the rights to inheritance and other legal standings can differ significantly. It's crucial to weigh these factors carefully, and the US Legal Forms platform can provide valuable insights and documents to help you understand your options.

Yes, a Rhode Island extension can be filed electronically. The Rhode Island Division of Taxation allows taxpayers to submit extension requests online through their official website. This method is not only quick but also efficient. For more detailed instructions on filing electronically, US Legal Forms offers helpful resources to ensure your submission goes smoothly.

To apply for a domestic partnership in Rhode Island, you need to complete a domestic partnership declaration form. You can typically find this form online or at your local municipal office. After filling out the form, submit it to the appropriate office along with any required fees. For further assistance, consider utilizing the resources available on the US Legal Forms platform, which can guide you through the process step by step.

Non-resident tax withholding is the process where taxes are deducted from payments made to individuals who are not residents of Rhode Island. This applies to various forms of income, including wages, rents, and royalties. Understanding this process is essential to ensure proper tax management. The US Legal Forms platform provides detailed documents and instructions to help you navigate non-resident tax withholding.

Yes, if you earn income in Rhode Island, you must file a state tax return, regardless of your residency status. This includes income earned as a non-resident, which is subject to Rhode Island taxes. Filing your state tax return accurately ensures compliance and helps prevent potential issues with the tax authorities. US Legal Forms offers user-friendly forms and tips to simplify the filing process.

The threshold for non-resident withholding in Rhode Island is determined based on the amount of income earned by the non-resident. Generally, if you earn over a certain amount during the year, you may be subject to withholding. It is crucial to understand these thresholds to manage your tax obligations efficiently. Check out US Legal Forms to find detailed information that can guide you through these requirements.

The non-resident withholding requirement in Rhode Island mandates that employers withhold taxes from payments made to non-resident workers. This withholding applies to wages, commissions, and certain other payments. Employers must ensure compliance to avoid penalties. For further assistance on structuring your withholding correctly, the US Legal Forms platform can be a helpful resource.

Non-resident withholding in Rhode Island refers to the amount of state tax withheld from the earnings of individuals who do not reside in Rhode Island. Typically, this applies to individuals who earn income from work done in the state. The withholding rate may vary, so it is important to stay informed about current rates. For detailed information and guidance, you can check the resources available at US Legal Forms.

Filling out the RI W4 form is essential for determining state tax withholding from your income. Begin by providing your personal information, including your name and address. Next, indicate your filing status and allowances, which affect your tax liability. You can find helpful templates on US Legal Forms to guide you through filling out the RI W4 accurately and efficiently.

To claim residency in Rhode Island, you must establish a permanent home within the state. This typically means you live in Rhode Island for at least 183 days a year. Documents that prove your residency include your driver's license, voter registration, and other state-specific paperwork. If you need assistance with the process, consider visiting the US Legal Forms platform, which offers resources and forms to streamline your residency claim.