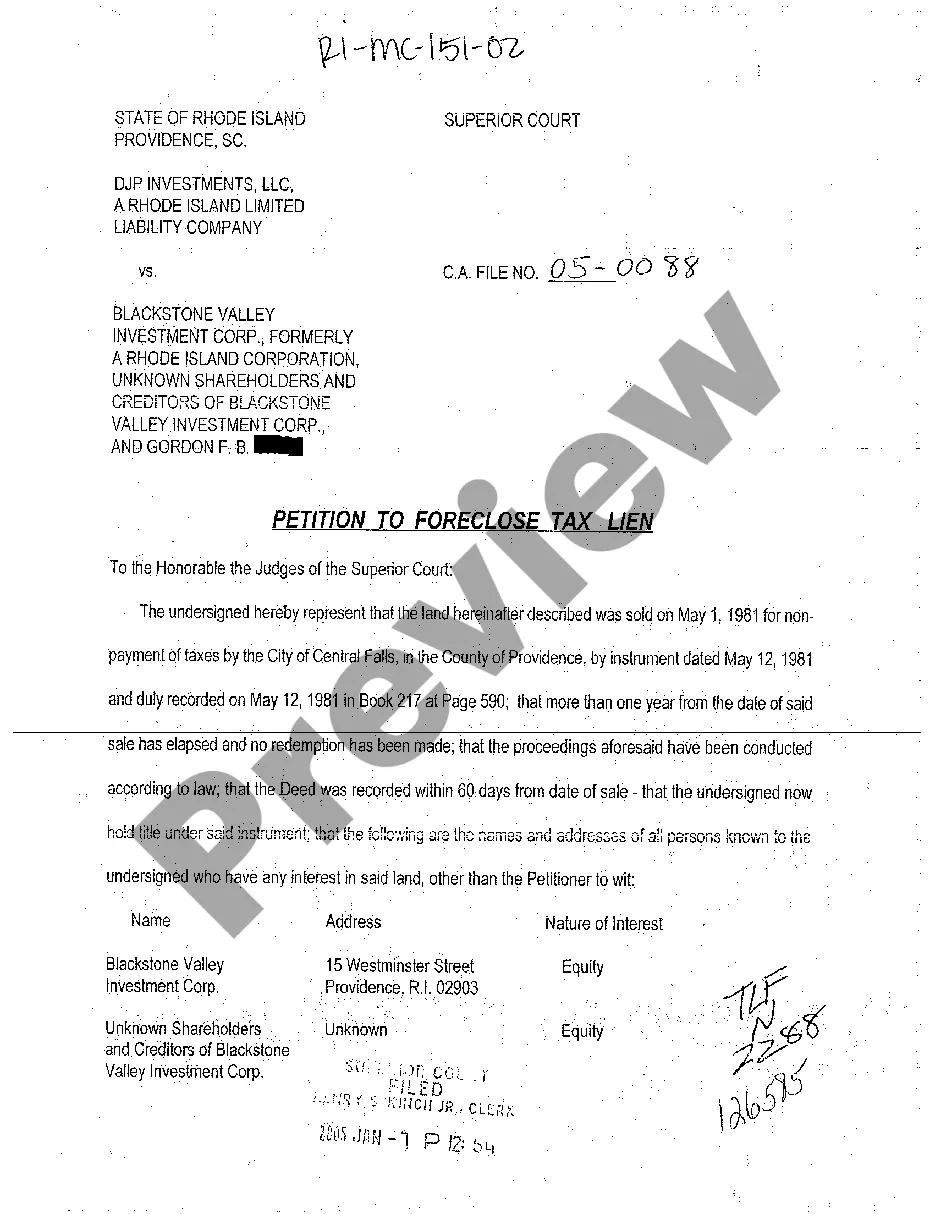

Rhode Island Citation Petition To Foreclose Tax Lien Withdrawal Form

Description

Form popularity

FAQ

You generally have one year to redeem a tax lien in Rhode Island. In some cases, this period can extend up to 18 months if certain criteria are met. It is important to act quickly within this timeframe to avoid losing your property. Completing the Rhode island citation petition to foreclose tax lien withdrawal form may help streamline the redemption process, ensuring you don't miss this critical opportunity.

The shortest redemption period for a tax lien in Rhode Island is typically one year. However, it can vary based on specific circumstances surrounding the lien. During this period, property owners should take proactive steps, including completing the Rhode island citation petition to foreclose tax lien withdrawal form, if necessary. This form serves as a crucial tool to address tax lien issues before further complications arise.

In Rhode Island, individuals aged 65 and older may qualify for property tax relief programs. These programs can significantly reduce or even eliminate property tax payments for eligible seniors. However, it is important for seniors to understand the requirements and apply through the appropriate channels. Utilizing the Rhode island citation petition to foreclose tax lien withdrawal form may assist seniors facing difficulties in managing tax obligations.

In Rhode Island, the redemption period allows property owners to reclaim their property after a tax lien has been placed. Typically, this period lasts for one year, but it can extend up to 18 months depending on the situation. During this time, owners can utilize the Rhode island citation petition to foreclose tax lien withdrawal form to prevent any further legal actions against their property. Understanding this period is crucial, as it provides the opportunity to settle outstanding taxes and protect home ownership.