Rhode Island Application For Default Withdrawal

Description

How to fill out Rhode Island Application For Default Withdrawal?

Individuals often link legal documentation with something complex that only an expert can handle.

In a way, this is accurate, as creating the Rhode Island Application For Default Withdrawal requires significant knowledge of subject requirements, comprising state and local policies.

Nonetheless, with US Legal Forms, these processes have become more straightforward: ready-to-use legal templates for various life and business scenarios tailored to state statutes are gathered in a singular online repository and are now accessible to everyone.

Choose the file format and click Download. Print your document or import it into an online editor for quicker completion. All templates in our repository are reusable: once obtained, they remain saved in your profile. You can access them anytime as needed through the My documents tab. Explore all advantages of utilizing the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85,000 current documents categorized by state and area of application, enabling quick searches for the Rhode Island Application For Default Withdrawal or any specific template in just a few minutes.

- Existing users with an active subscription must Log In to their account and click Download to get the form.

- New users on the platform should first register for an account and subscribe before downloading any documentation.

- Below are the sequential instructions on how to acquire the Rhode Island Application For Default Withdrawal.

- Carefully review the page content to ensure it meets your requirements.

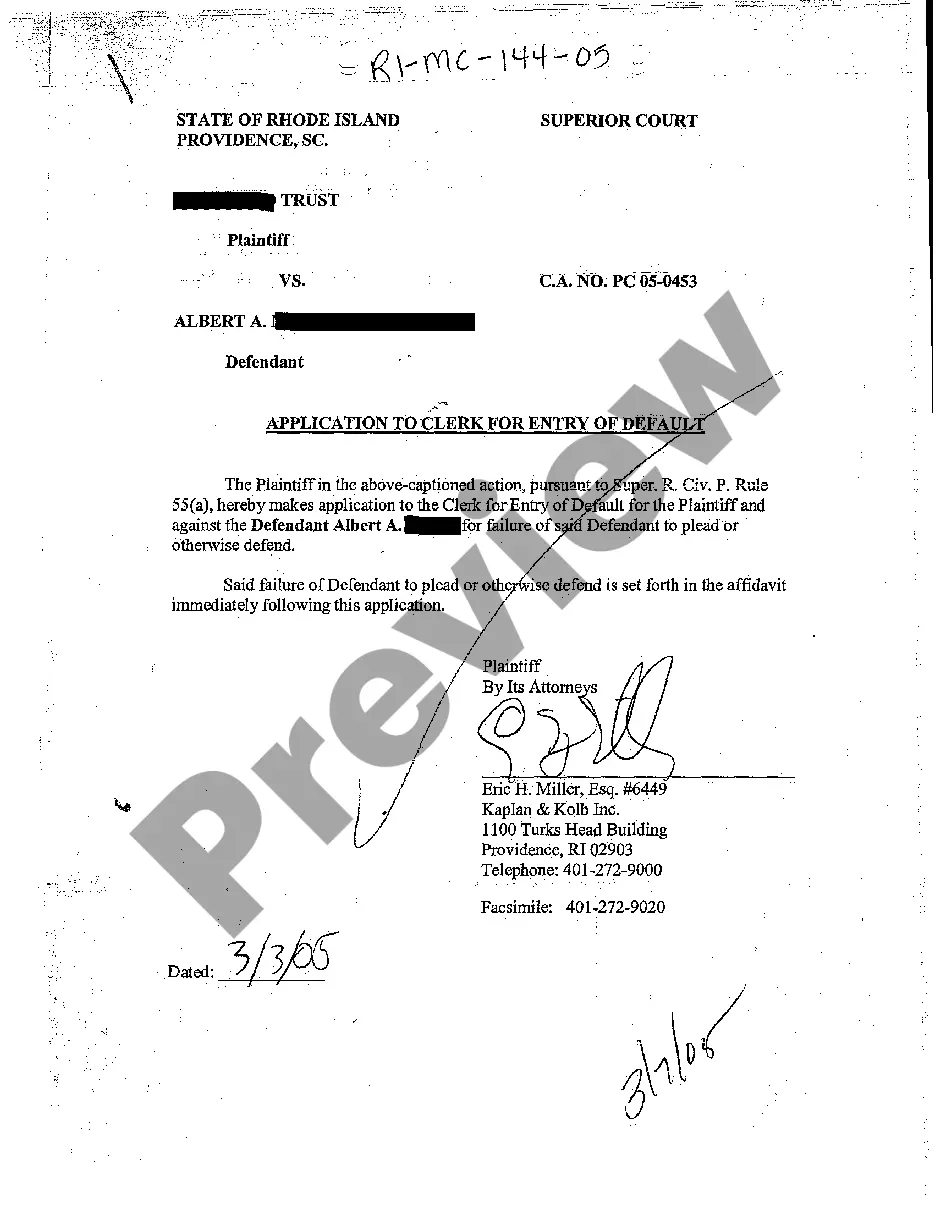

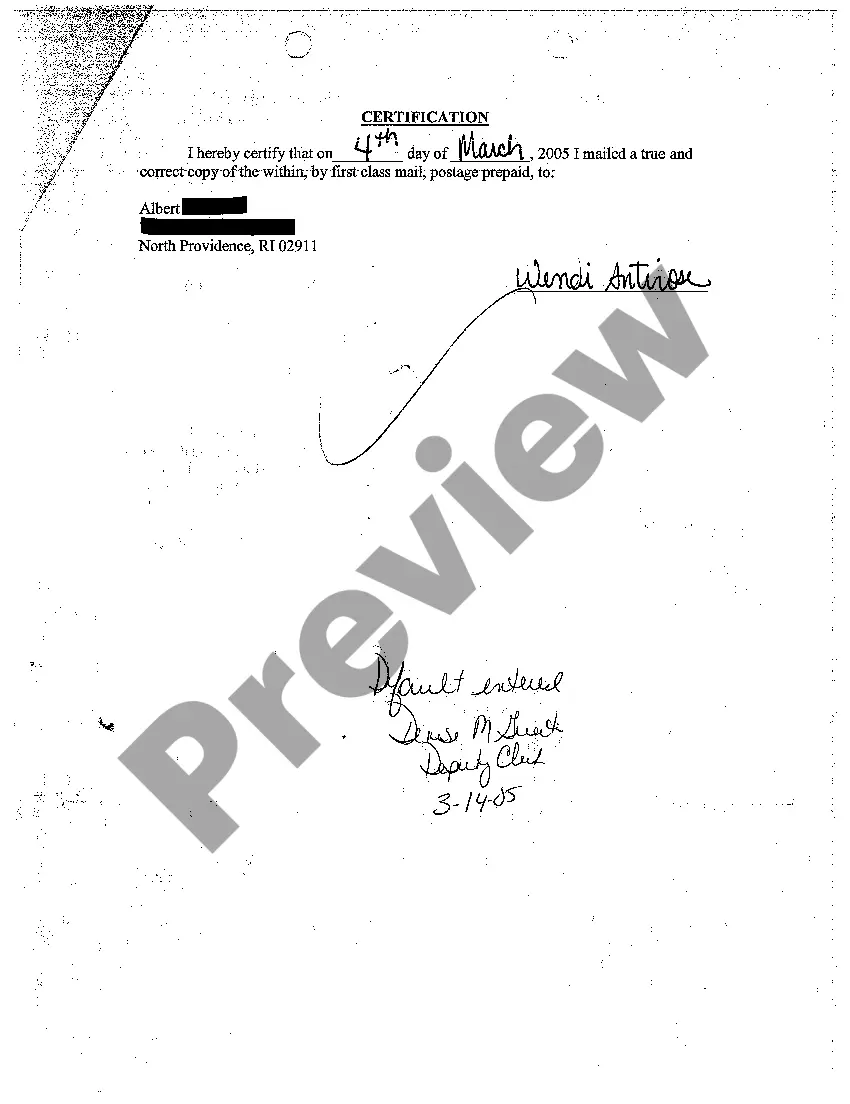

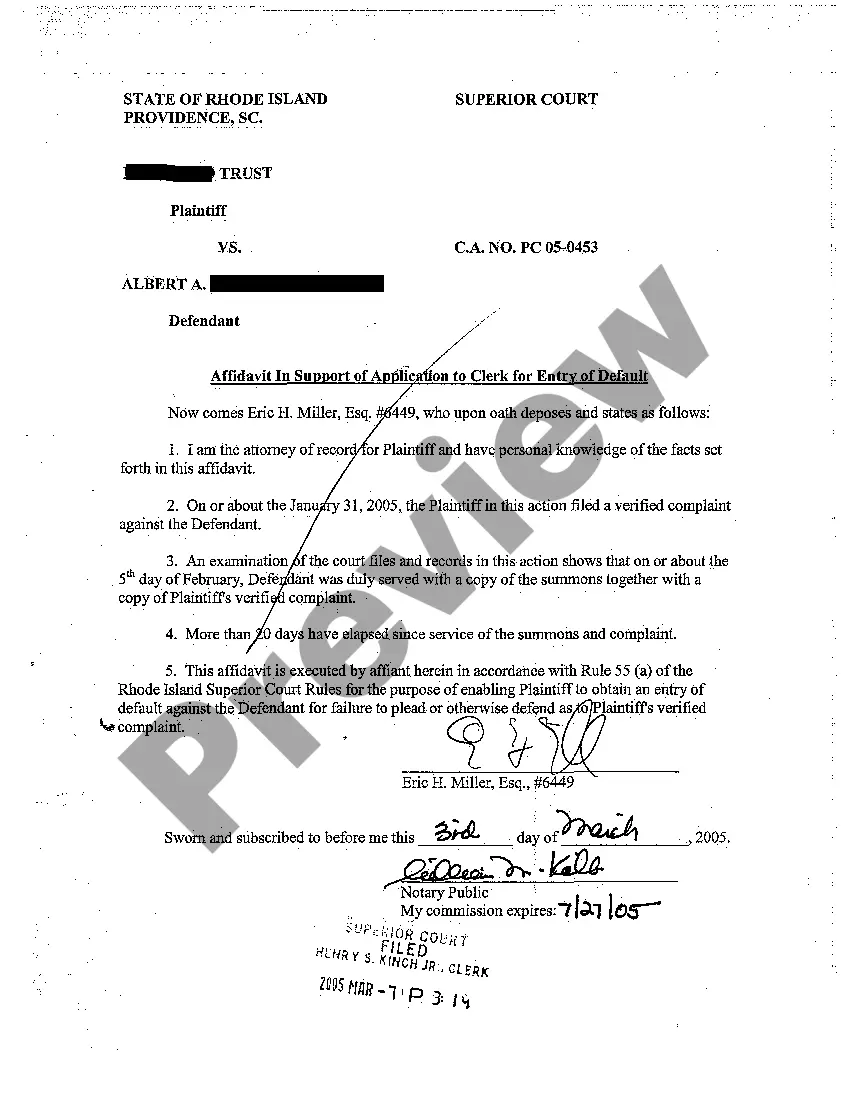

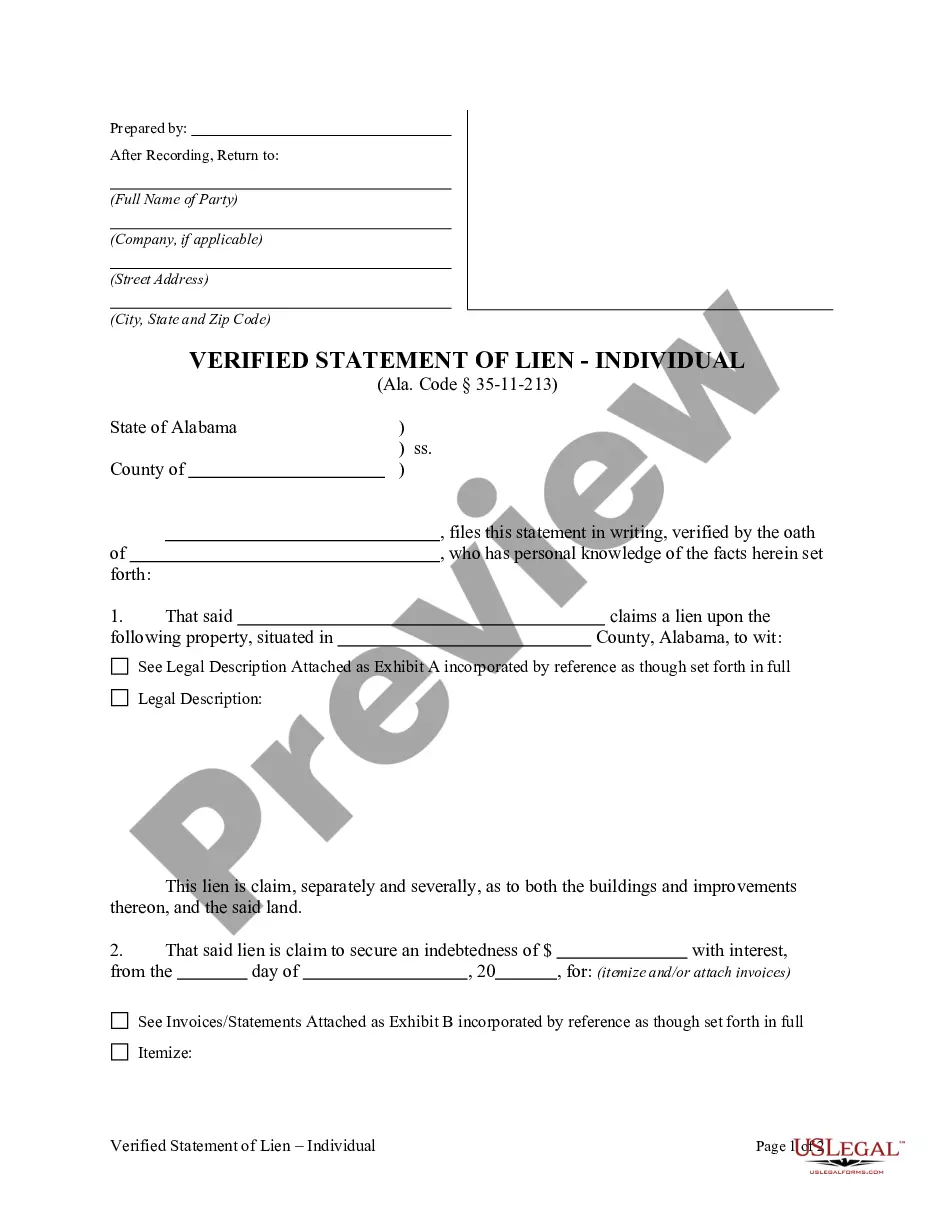

- Examine the form description or confirm it using the Preview option.

- If the previous sample isn't suitable, locate another one through the Search field above.

- Once you find the appropriate Rhode Island Application For Default Withdrawal, click Buy Now.

- Select a pricing plan that aligns with your needs and financial plan.

- Log In or create an account to move to the payment section.

- Complete your subscription payment through PayPal or with your credit card.

Form popularity

FAQ

Yes, Rhode Island imposes a state withholding tax on income earned by residents and non-residents working within the state. This tax helps fund state services and infrastructure. Understanding how this tax works is vital for managing your finances. Tools like the Rhode island application for default withdrawal can help clarify your withholding obligations.

Yes, Rhode Island maintains a state withholding tax form for employers to manage tax deductions from employees' wages. This form is important for ensuring compliance with state tax regulations. Payroll departments should update their records regularly to reflect any changes in personal exemption status. The Rhode island application for default withdrawal can provide guidance on filling out these forms correctly.

Many states, including Rhode Island, require state tax withholding forms for income earners. These forms ensure that the appropriate amount of tax is deducted from your paycheck. Each state may have different requirements, so it's essential to check your specific state's laws. Utilizing tools like the Rhode island application for default withdrawal can provide clarity on this requirement.

Yes, Rhode Island offers several state tax forms, including the RI 1040 for individual income tax. These forms are crucial for reporting your income and calculating your tax obligations. If you are unsure which forms to use, the Rhode island application for default withdrawal can streamline this experience.

You should mail your Rhode Island 1040 form to the Division of Taxation in Providence. The specific mailing address depends on whether you are including a payment or not. Check the Rhode Island Division of Taxation website for the latest details on where to send your forms. This can simplify the process, making it easier as you consider the Rhode island application for default withdrawal.

Yes, Rhode Island has its own version of the W4 form used for state tax withholding. It helps employers determine how much state tax to withhold from employees' paychecks. You can easily access this form online to ensure your withholdings align with your tax obligations. Using the Rhode island application for default withdrawal can also aid in this process.

Yes, you must file a state tax return in Rhode Island if you have earned income that meets the filing threshold. This applies to residents and non-residents alike. Filing a return is essential to ensure you stay compliant with state tax laws. For assistance in navigating this process, consider utilizing the Rhode island application for default withdrawal.

To cancel an LLC in Rhode Island, you must file a formal application for default withdrawal with the Department of State. Begin by ensuring that you have settled all debts and obligations of your business. Once ready, complete and submit the appropriate form along with any necessary fees. This process will officially dissolve your LLC and remove it from state records, allowing you to move forward confidently.

There are several reasons you might choose to cancel your LLC. Business owners often cancel due to lack of profits, changes in personal circumstances, or the desire to pursue new ventures. Additionally, maintaining an inactive LLC can lead to unnecessary costs and compliance issues. Therefore, opting for a Rhode Island application for default withdrawal is a practical step to officially and effectively close your business.

To cancel your LLC in Rhode Island, you must file the appropriate paperwork with the Secretary of State. This typically involves submitting a certificate of cancellation along with any required fees. It's important to ensure that all debts and obligations of the LLC are settled before initiating the cancellation process. Using the Rhode Island application for default withdrawal can simplify this process for you.