Rhode Island Trust Without Power

Description

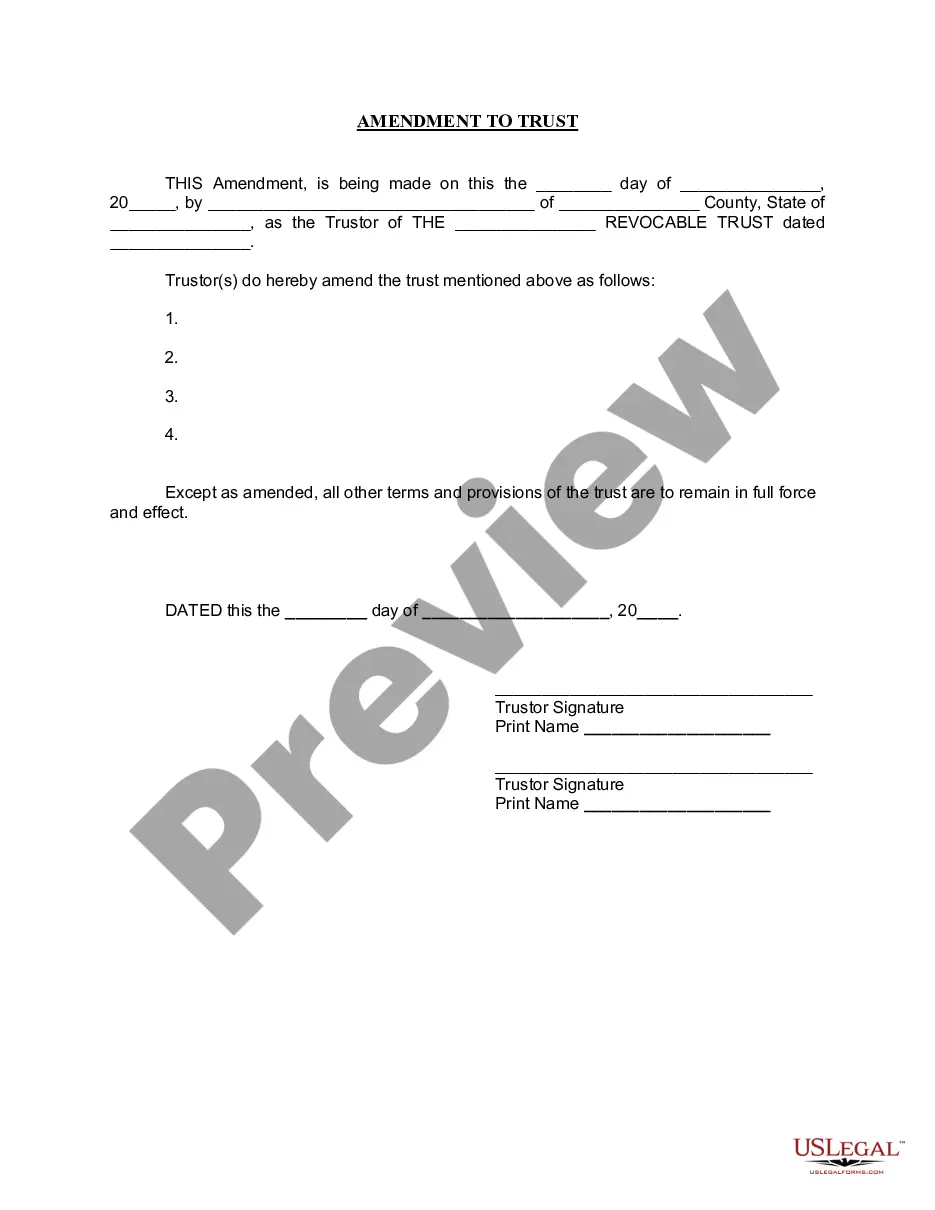

How to fill out Rhode Island Amendment To Living Trust?

There's no longer a need to spend hours searching for legal documents to fulfill your local state obligations. US Legal Forms has compiled all of them in one location and improved their accessibility.

Our platform offers over 85,000 templates for various business and personal legal situations, categorized by state and area of use. All forms are properly drafted and verified for validity, ensuring that you receive an up-to-date Rhode Island Trust Without Power.

If you are already acquainted with our platform and possess an account, you must verify that your subscription is active before you can access any templates. Log In to your account, select the document, and click Download. You can also revisit all acquired documents at any time by accessing the My documents tab in your profile.

Print out your document to fill it manually or upload the sample if you prefer to complete it within an online editor. Creating official paperwork under federal and state regulations is fast and easy with our library. Experience US Legal Forms today to maintain your documentation organized!

- If you are a new user, the process will involve a few more steps to complete.

- Examine the page content thoroughly to ensure it includes the sample you need.

- To assist in this, utilize the form description and preview options if available.

- Use the Search bar above to find another sample if the earlier one did not meet your needs.

- Click Buy Now next to the template title once you identify the right one.

- Choose the most appropriate subscription plan and either register for an account or Log In.

- Process payment for your subscription using a credit card or via PayPal to proceed.

- Select the file format for your Rhode Island Trust Without Power and download it to your device.

Form popularity

FAQ

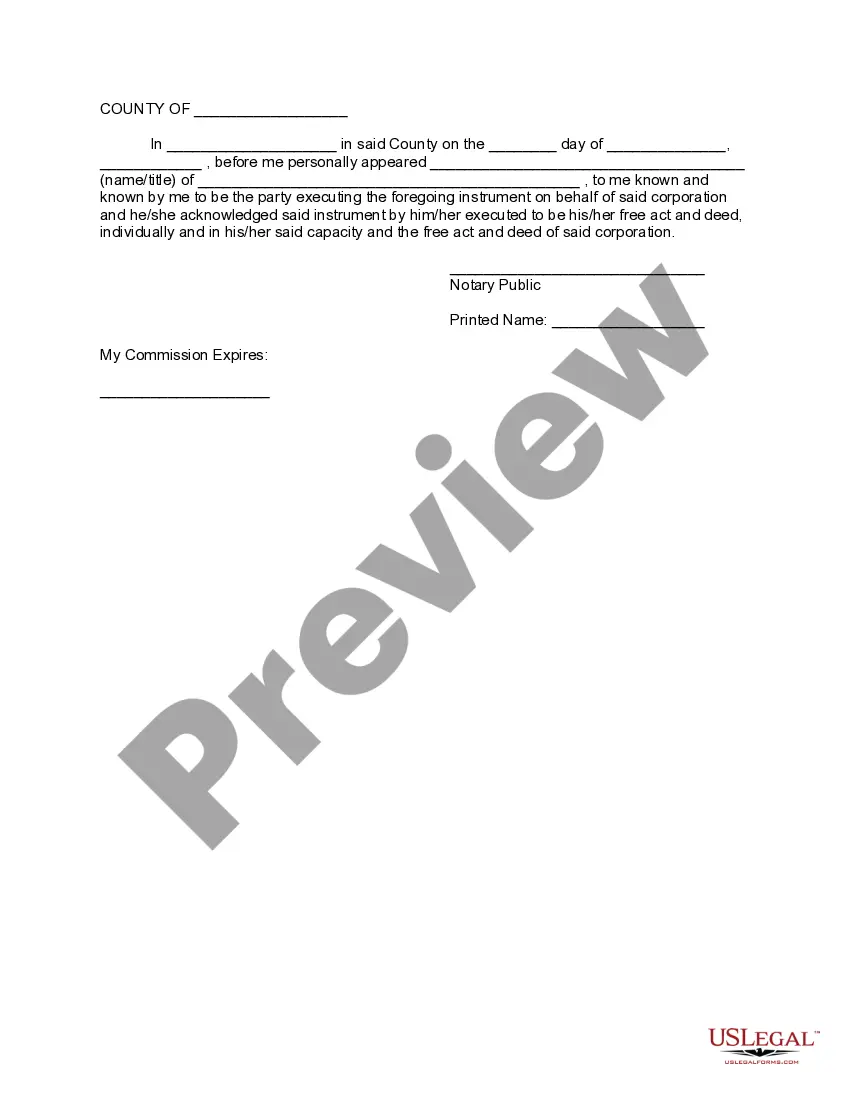

How to Create a Living Trust in Rhode IslandDecide on a single or joint trust.Take stock of your assets and property.Pick a trustee for your living trust.Create the living trust document.Sign your living trust in front of a notary public.Add your assets and property to your living trust.

A grantor trust can, in a given case, be either revocable or irrevocable, although most types of grantor trusts involve an irrevocable trust. Certain types of trusts (such, as for example, a revocable trust) are disregarded not only for income tax purposes but also for federal estate and gift tax purposes.

How Much Does a Trust Cost? If you hire an attorney to build your trust, you'll likely pay more than $1,000, and fees will be higher for couples. You can also use online software to create trust documents at a cheaper rate.

Under Section 663(b) of the Internal Revenue Code, any distribution by an estate or trust within the first 65 days of the tax year can be treated as having been made on the last day of the preceding tax year.

If you would like to create a living trust in Rhode Island, you must prepare a written trust document and sign it before a notary public. The trust is not functional until you take the final step of transferring ownership of assets into it. A living trust can be an important part of estate planning.