Rhode Island Trust Formation

Description

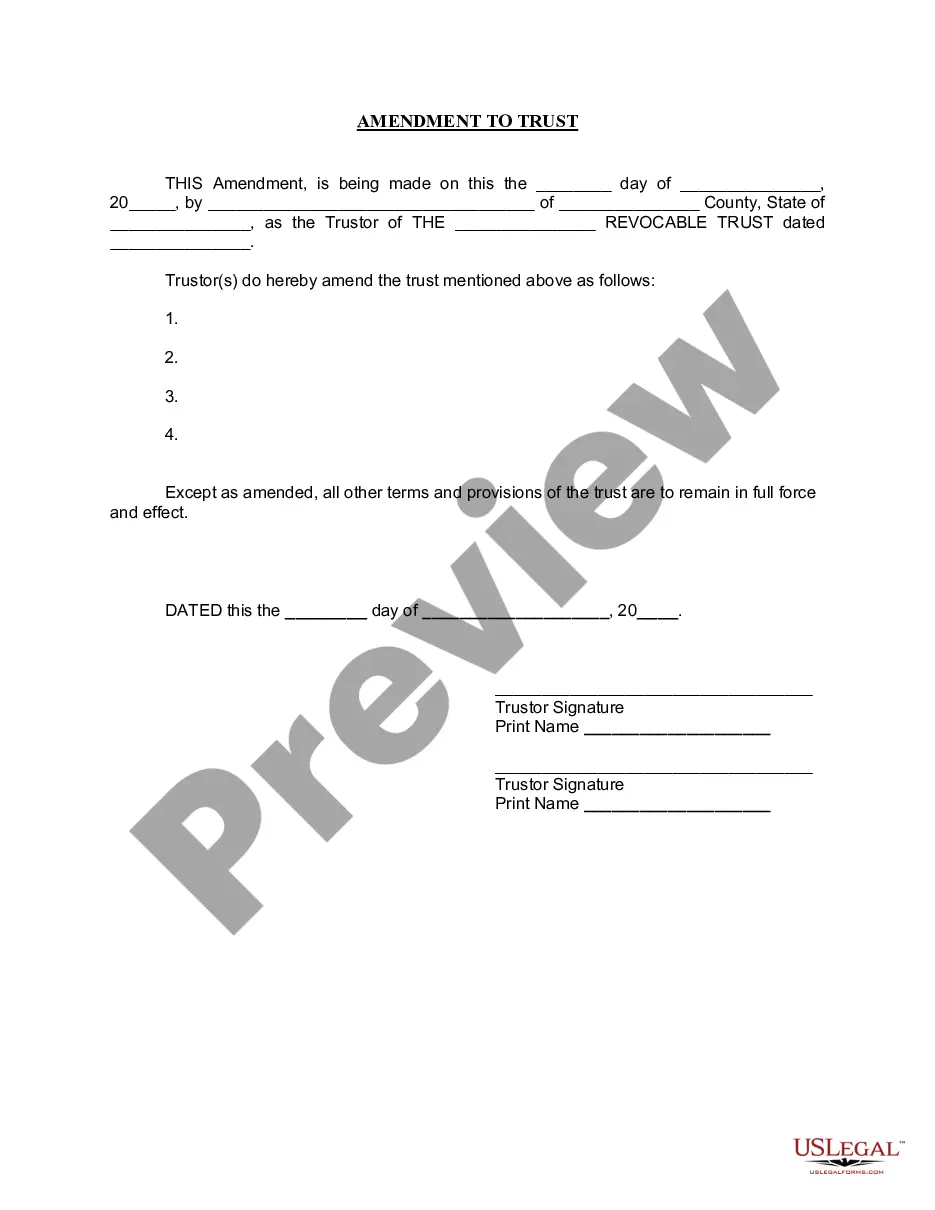

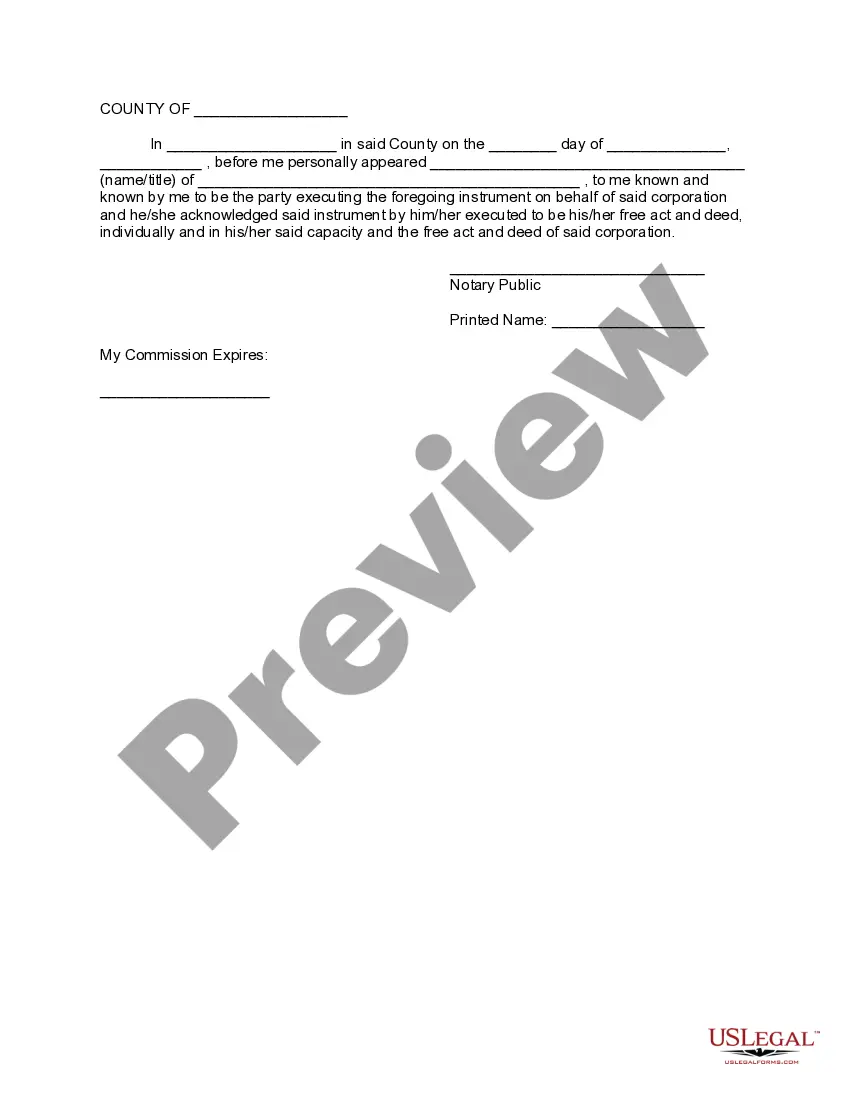

How to fill out Rhode Island Amendment To Living Trust?

It’s no secret that you can’t become a law professional overnight, nor can you grasp how to quickly draft Rhode Island Trust Formation without the need of a specialized background. Putting together legal documents is a long process requiring a certain training and skills. So why not leave the creation of the Rhode Island Trust Formation to the specialists?

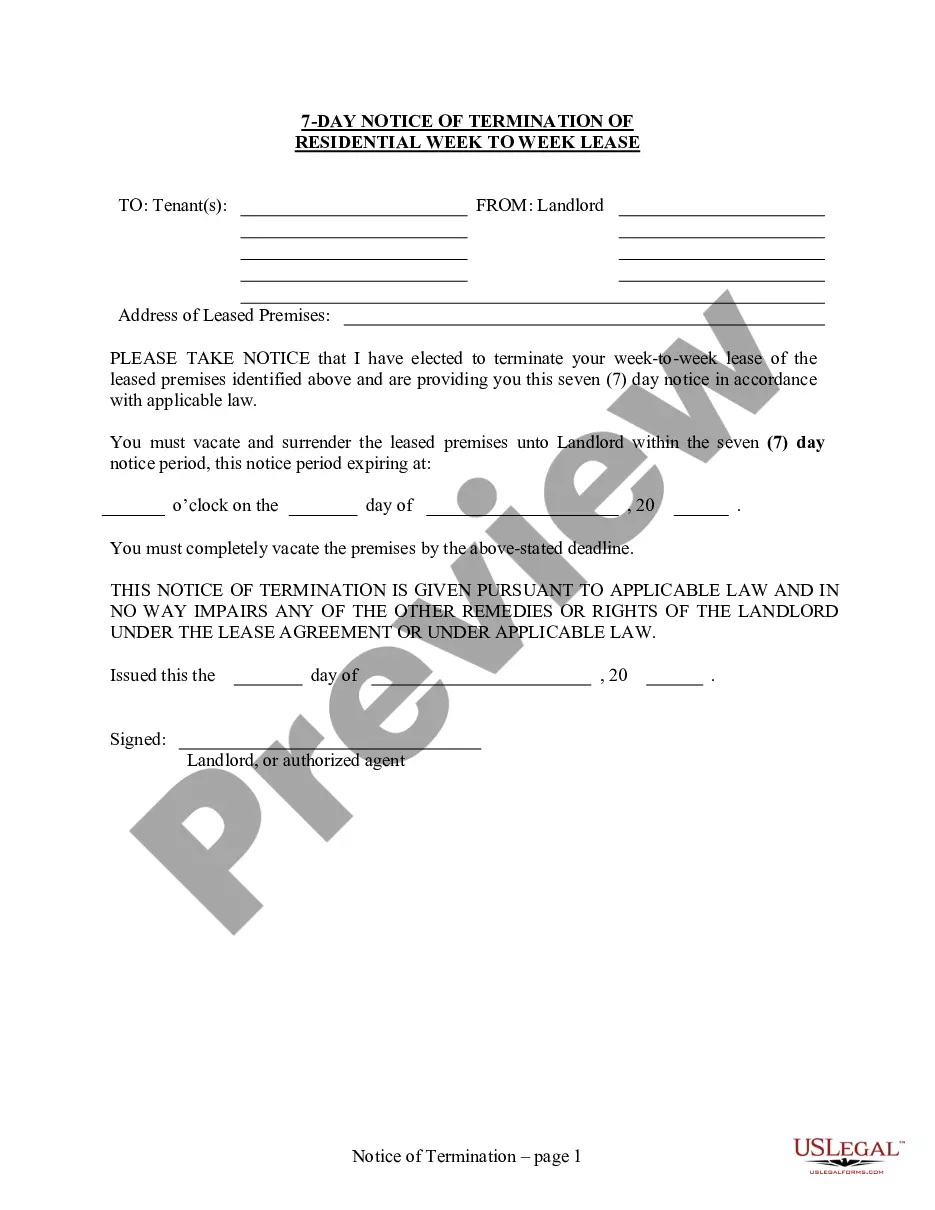

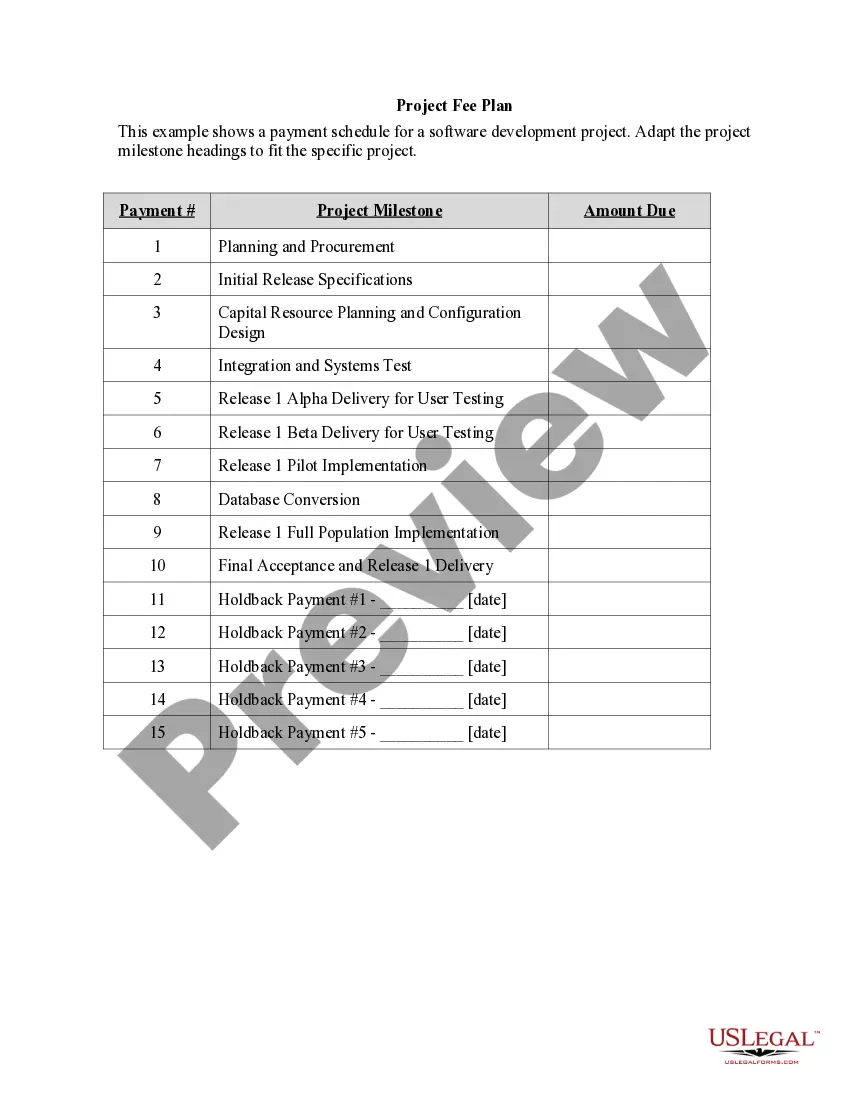

With US Legal Forms, one of the most comprehensive legal template libraries, you can find anything from court papers to templates for internal corporate communication. We understand how crucial compliance and adherence to federal and local laws and regulations are. That’s why, on our platform, all forms are location specific and up to date.

Here’s how you can get started with our website and get the document you need in mere minutes:

- Discover the document you need with the search bar at the top of the page.

- Preview it (if this option provided) and check the supporting description to figure out whether Rhode Island Trust Formation is what you’re looking for.

- Begin your search over if you need any other template.

- Register for a free account and choose a subscription option to buy the form.

- Choose Buy now. Once the transaction is complete, you can download the Rhode Island Trust Formation, fill it out, print it, and send or send it by post to the designated people or organizations.

You can re-gain access to your documents from the My Forms tab at any time. If you’re an existing customer, you can simply log in, and find and download the template from the same tab.

No matter the purpose of your forms-be it financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

Q: Do trusts have a requirement to file federal income tax returns? A: Trusts must file a Form 1041, U.S. Income Tax Return for Estates and Trusts, for each taxable year where the trust has $600 in income or the trust has a non-resident alien as a beneficiary.

Form 1041 is an Internal Revenue Service (IRS) income tax return filed by the trustee or representative of a decedent's estate or trust. The form consists of three pages, requiring basic information about the estate or trust and detailing its income and deductions.

The IRS requires the filing of an income tax return for trusts and estates on Form 1041?formerly known as the fiduciary income tax return. This is because trusts and estates must pay income tax on their income just like you report your own income on a personal tax return each year.

A trust is not a separate taxable entity, but the trustee must lodge a tax return for the trust. Generally, the beneficiaries of the trust declare the amount of their entitlement to the trust's income in their own tax return. Then they pay tax on it, even if they didn't actually receive the income.

A Resident is an individual that is domiciled in Rhode Island or an individual that maintains a place of abode in Rhodes Island spending at least 183 days in the state.