Rhode Island Trust Code

Description

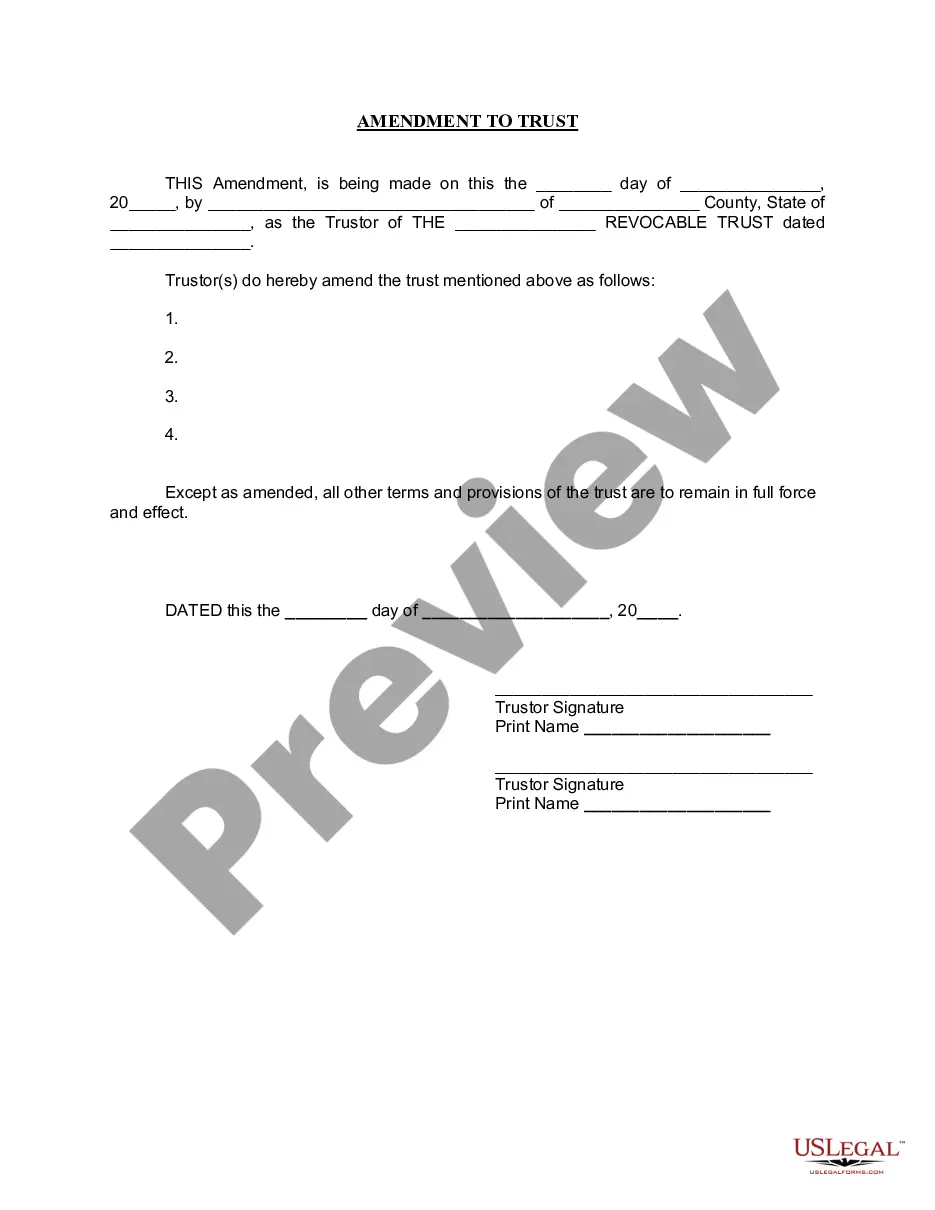

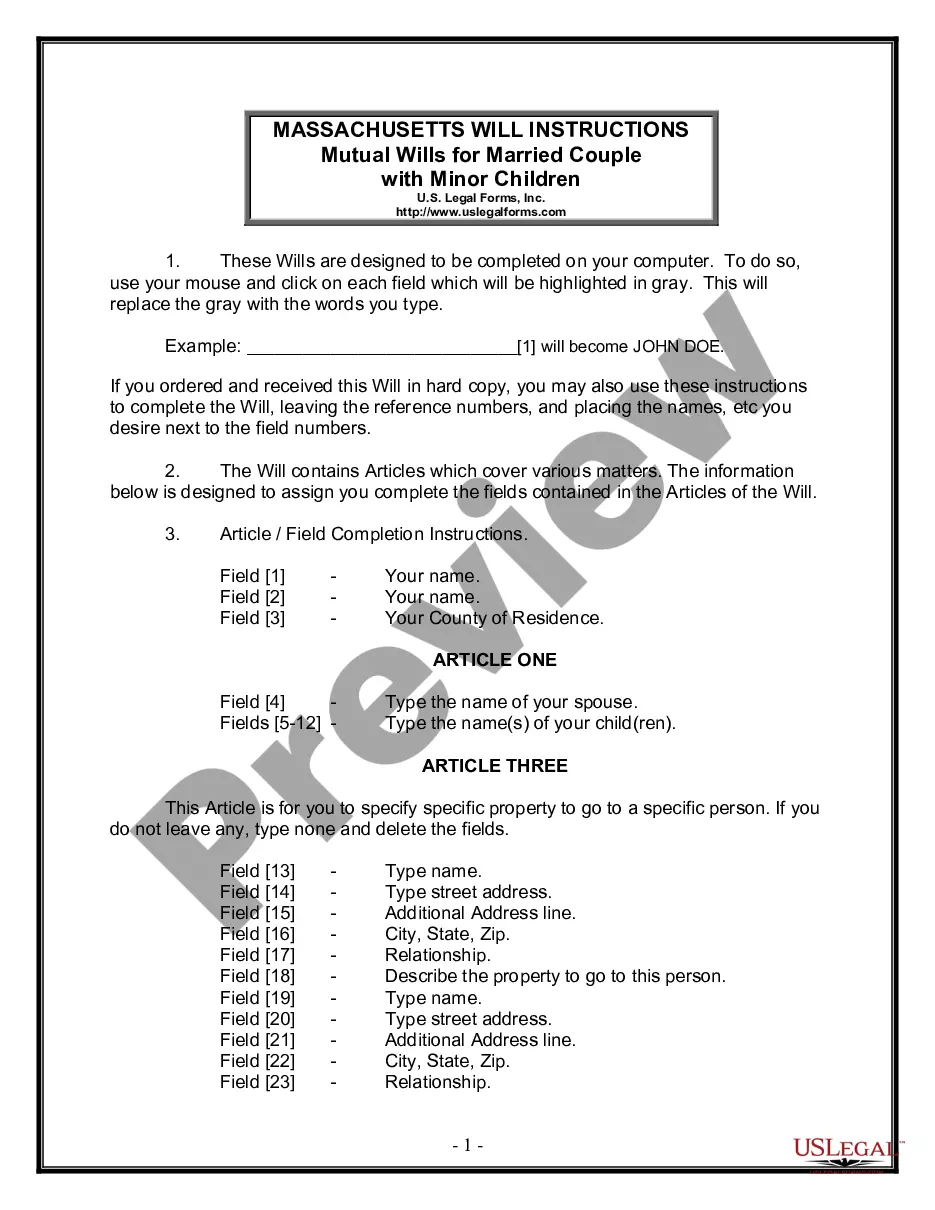

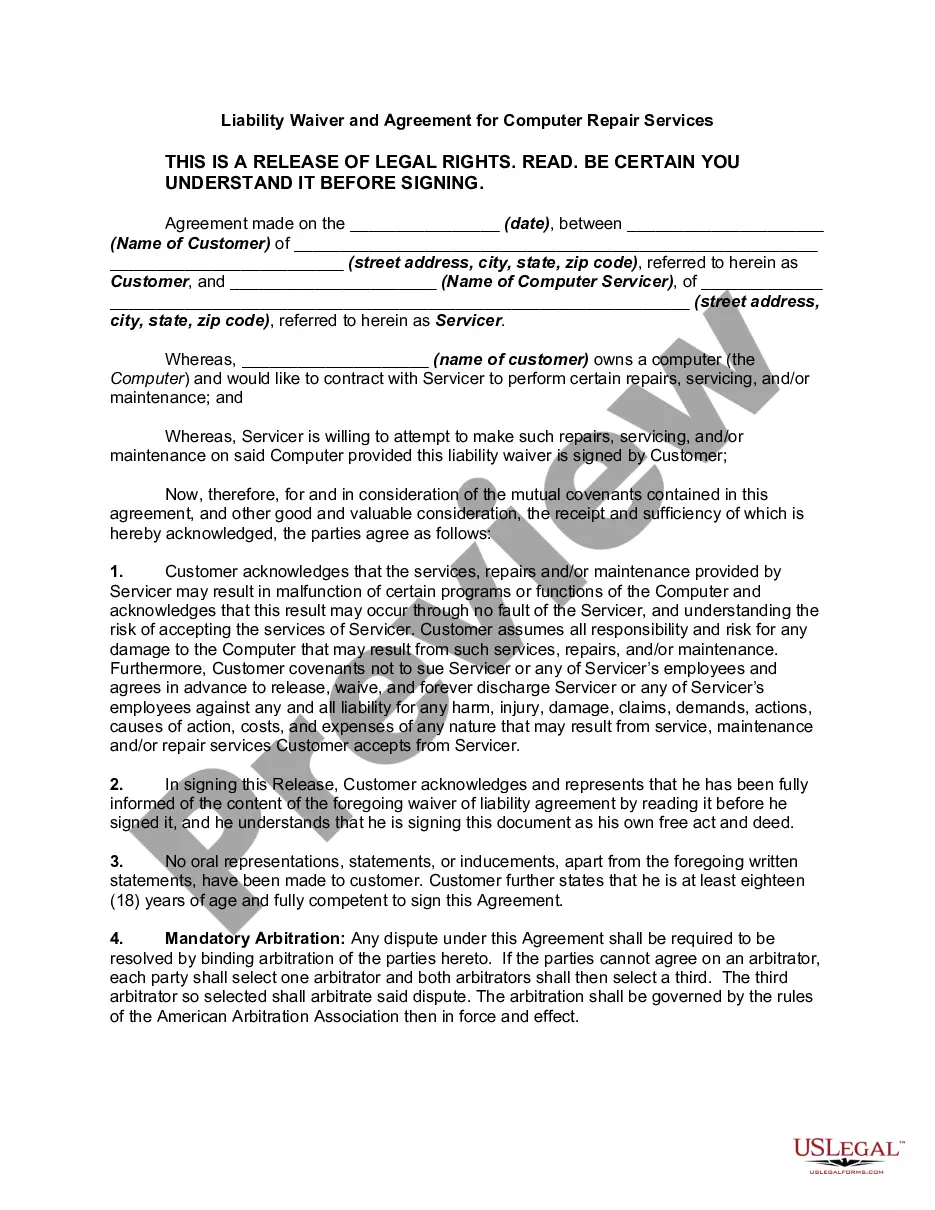

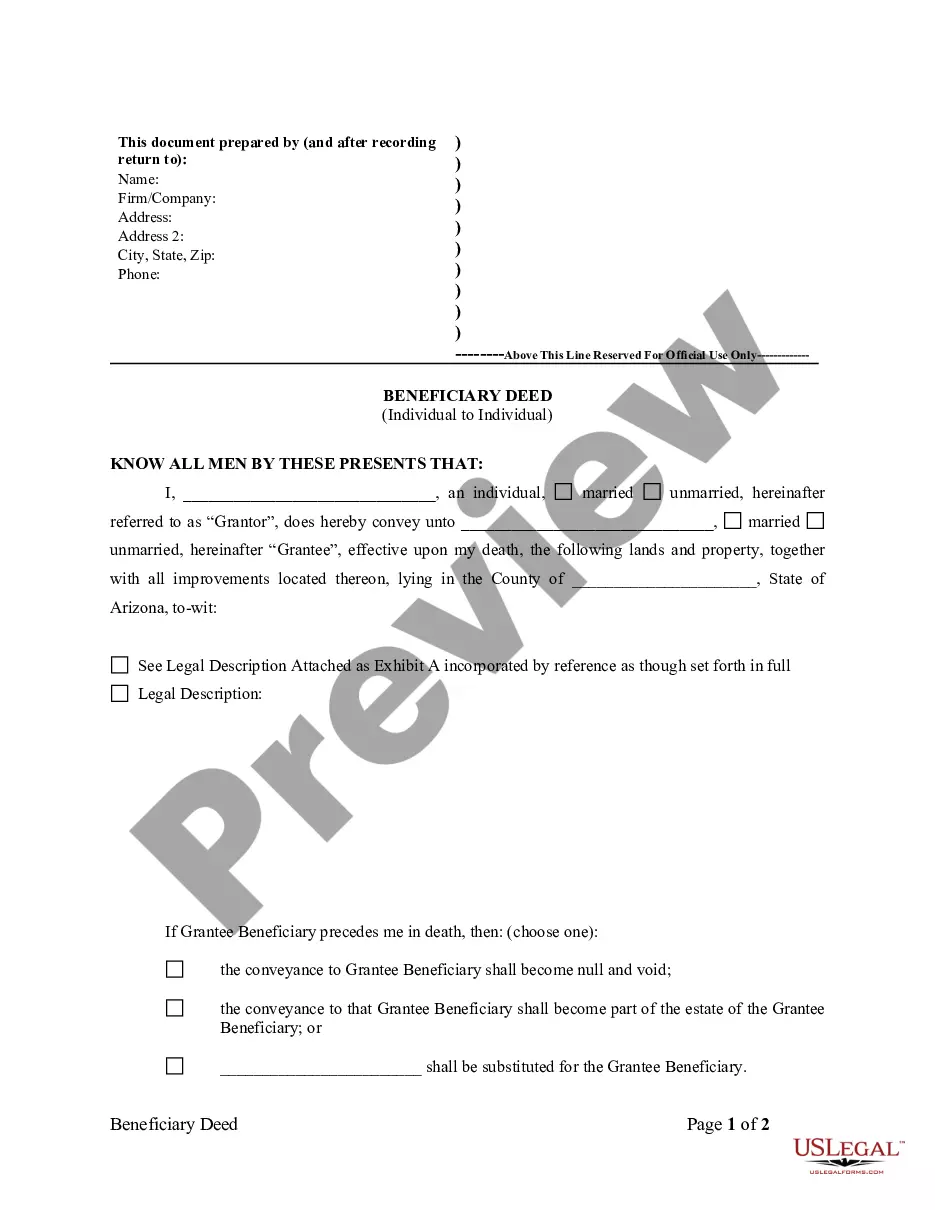

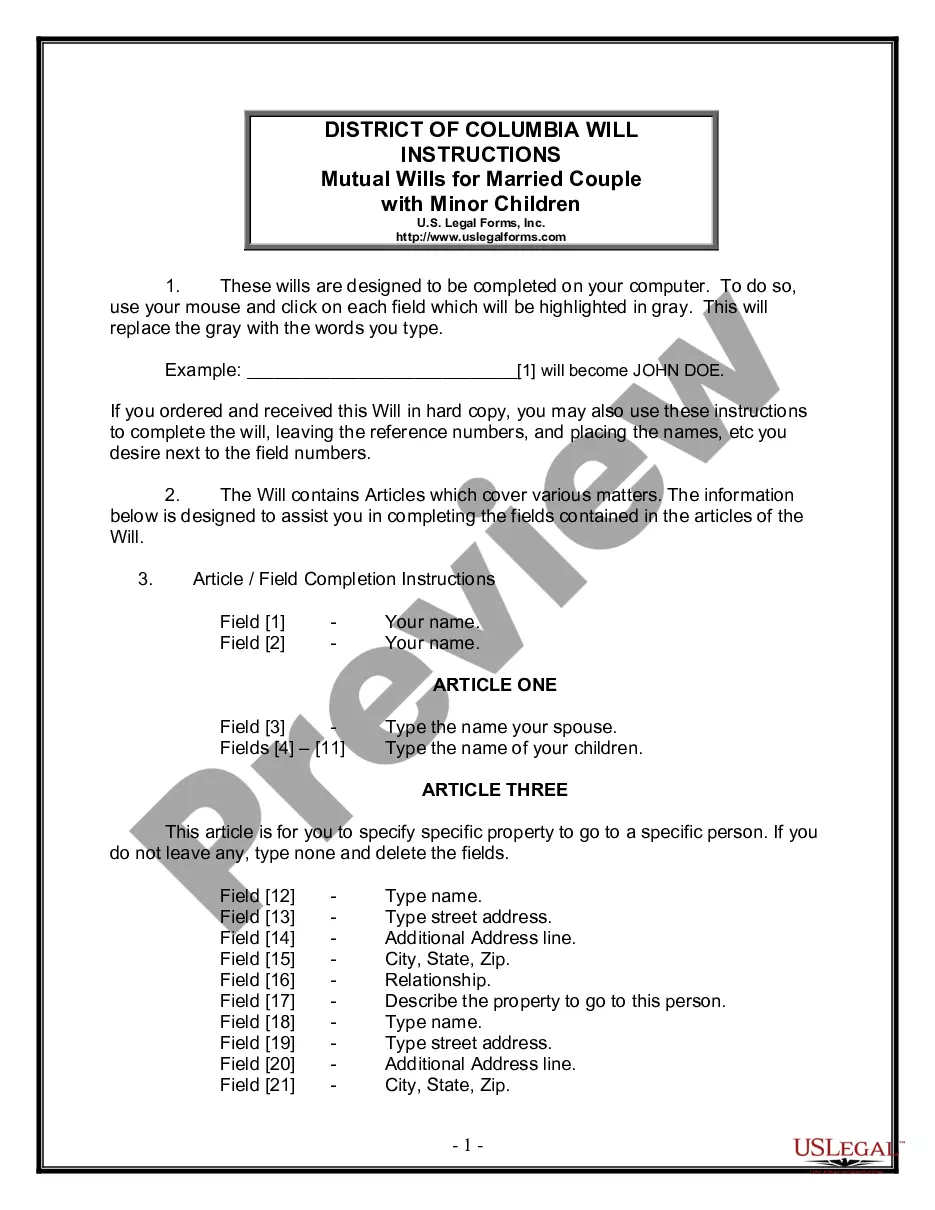

How to fill out Rhode Island Amendment To Living Trust?

Drafting legal paperwork from scratch can often be a little overwhelming. Certain scenarios might involve hours of research and hundreds of dollars spent. If you’re looking for a a more straightforward and more affordable way of preparing Rhode Island Trust Code or any other documents without the need of jumping through hoops, US Legal Forms is always at your fingertips.

Our virtual library of more than 85,000 up-to-date legal documents addresses almost every aspect of your financial, legal, and personal matters. With just a few clicks, you can instantly get state- and county-compliant templates diligently put together for you by our legal specialists.

Use our website whenever you need a trustworthy and reliable services through which you can quickly find and download the Rhode Island Trust Code. If you’re not new to our website and have previously created an account with us, simply log in to your account, locate the template and download it away or re-download it anytime later in the My Forms tab.

Don’t have an account? No worries. It takes minutes to register it and explore the catalog. But before jumping straight to downloading Rhode Island Trust Code, follow these tips:

- Check the form preview and descriptions to ensure that you have found the document you are searching for.

- Make sure the form you choose complies with the requirements of your state and county.

- Pick the best-suited subscription option to purchase the Rhode Island Trust Code.

- Download the form. Then complete, certify, and print it out.

US Legal Forms has a good reputation and over 25 years of expertise. Join us now and turn form execution into something simple and streamlined!

Form popularity

FAQ

Form 1041 is an Internal Revenue Service (IRS) income tax return filed by the trustee or representative of a decedent's estate or trust. The form consists of three pages, requiring basic information about the estate or trust and detailing its income and deductions.

Q: Do trusts have a requirement to file federal income tax returns? A: Trusts must file a Form 1041, U.S. Income Tax Return for Estates and Trusts, for each taxable year where the trust has $600 in income or the trust has a non-resident alien as a beneficiary.

A trust is not a separate taxable entity, but the trustee must lodge a tax return for the trust. Generally, the beneficiaries of the trust declare the amount of their entitlement to the trust's income in their own tax return. Then they pay tax on it, even if they didn't actually receive the income.

A trust needs to file a tax return if it has a gross income of $600 or more during the trust tax year or there is a nonresident alien beneficiary or if there is any taxable income.

INCOME TRUST DISTRIBUTIONS: RETURN OF CAPITAL Any portion of the distribution classified as return of capital is not taxable in the year of receipt. Taxation of this portion of the distribution is deferred until the units are ultimately sold.