Electrical Contractor Rhode Island Withholding

Description

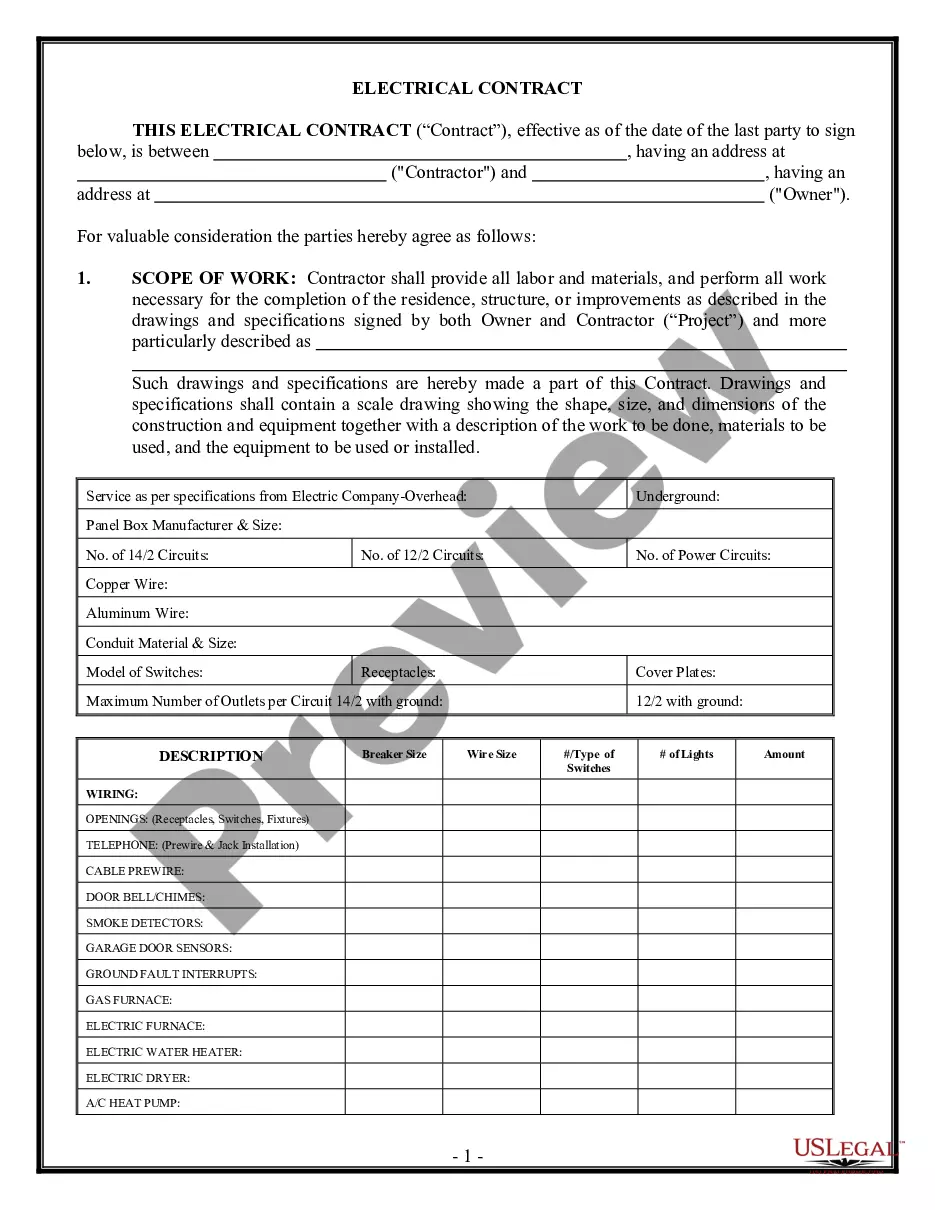

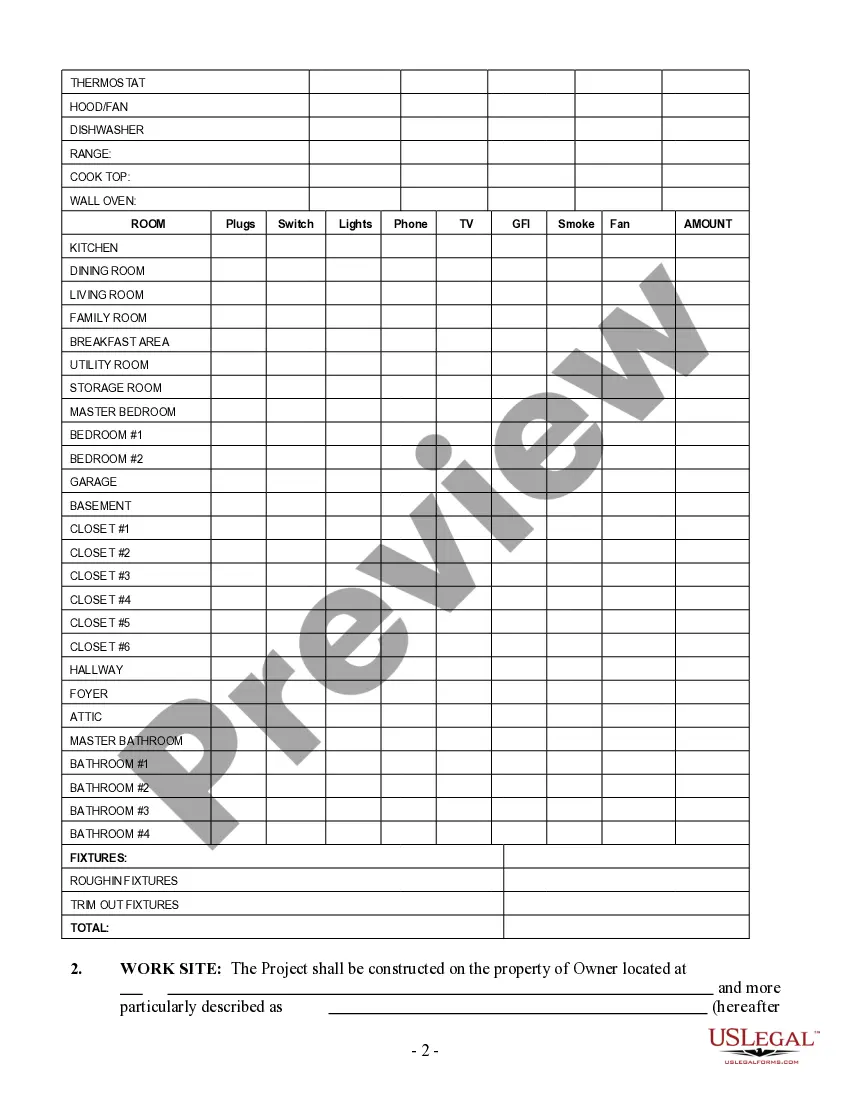

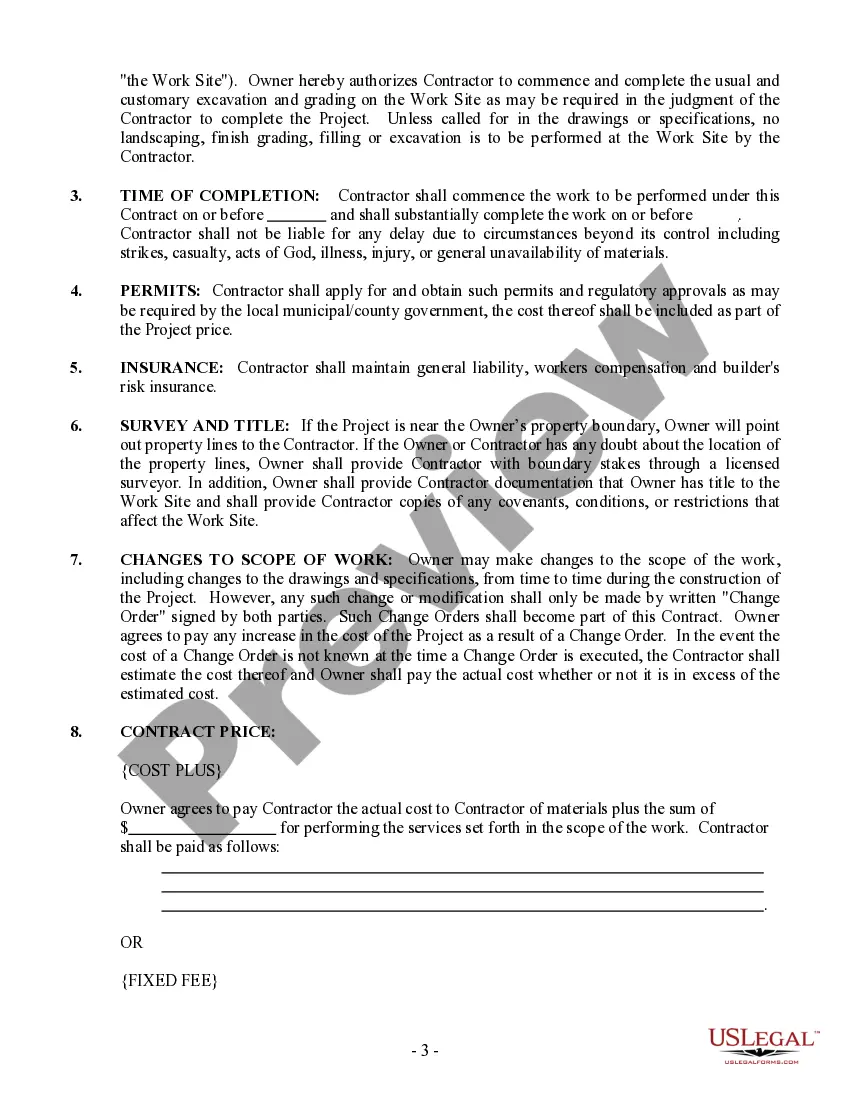

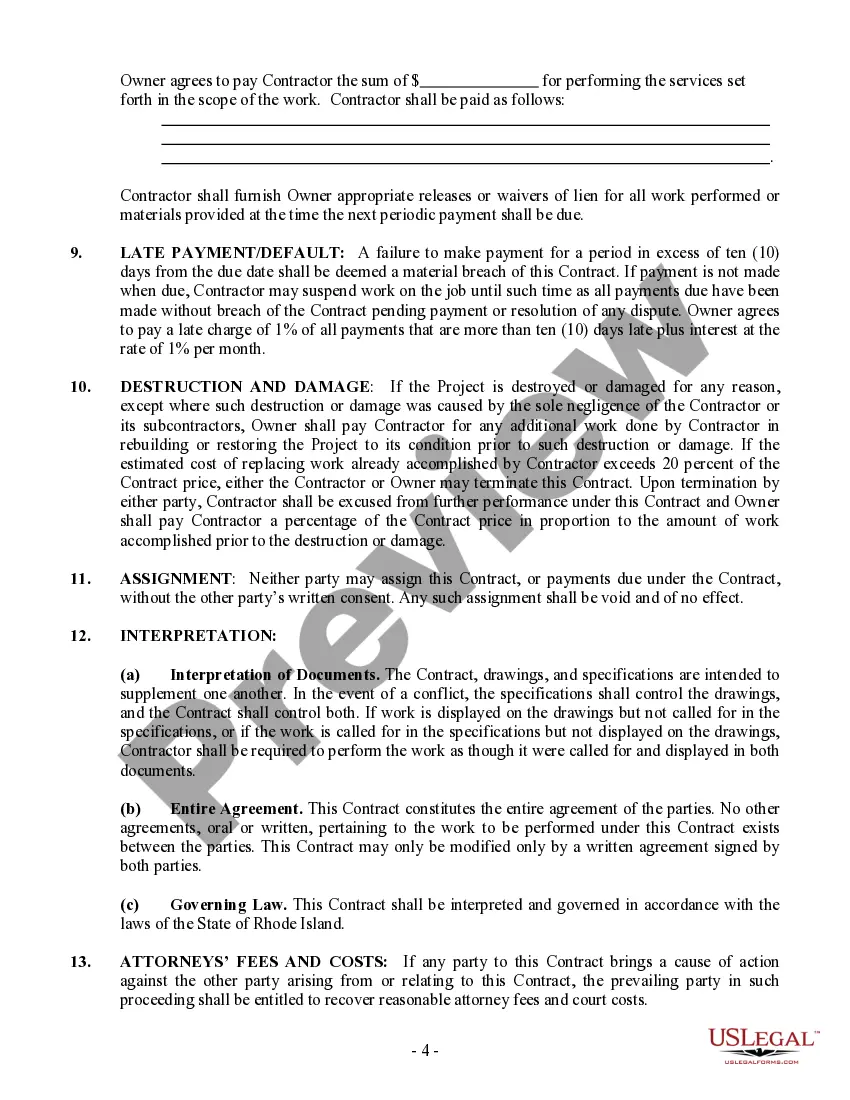

How to fill out Rhode Island Electrical Contract For Contractor?

What is the most reliable service to obtain the Electrical Contractor Rhode Island Withholding and other up-to-date versions of legal documents? US Legal Forms is the solution! It boasts the most comprehensive collection of legal forms for any purpose.

Each template is properly composed and validated for adherence to federal and local laws. They are categorized by region and state of use, making it simple to find the document you require.

US Legal Forms is an excellent choice for anyone needing assistance with legal documentation. Premium users can enjoy additional benefits, as they can fill out and authorize previously saved documents online at any time with the integrated PDF editing tool. Explore it today!

- Experienced users of the platform only need to Log In to the system, verify if their subscription is active, and click the Download button next to the Electrical Contractor Rhode Island Withholding to obtain it.

- Once saved, the document stays accessible for future use in the My documents section of your account.

- If you do not yet have an account with our library, follow these steps to create one.

- Form compliance assessment. Before acquiring any template, ensure it satisfies your requirements and complies with your state's or county's regulations. Review the form description and use the Preview feature if available.

Form popularity

FAQ

How to fill out a W-4: step by stepStep 1: Enter your personal information.Step 2: Account for all jobs you and your spouse have.Step 3: Claim your children and other dependents.Step 4: Make other adjustments.Step 5: Sign and date your form.

How to fill out a W-4: step by stepStep 1: Enter your personal information.Step 2: Account for all jobs you and your spouse have.Step 3: Claim your children and other dependents.Step 4: Make other adjustments.Step 5: Sign and date your form.

Rhode Island Withholding: What you need to know The Rhode Island withholding law requires employers in the state to withhold Rhode Island income tax from wages of residents for performing services both inside and outside the state and of nonresidents for service performed within the state.

If your small business has employees working in Rhode Island, you'll need to withhold and pay Rhode Island income tax on their salaries. This is in addition to having to withhold federal income tax for those same employees. Here are the basic rules on Rhode Island state income tax withholding for employees.

Are services subject to sales tax in Rhode Island? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Rhode Island, specified services are taxable.