Pa Wills And Probate Records

Description

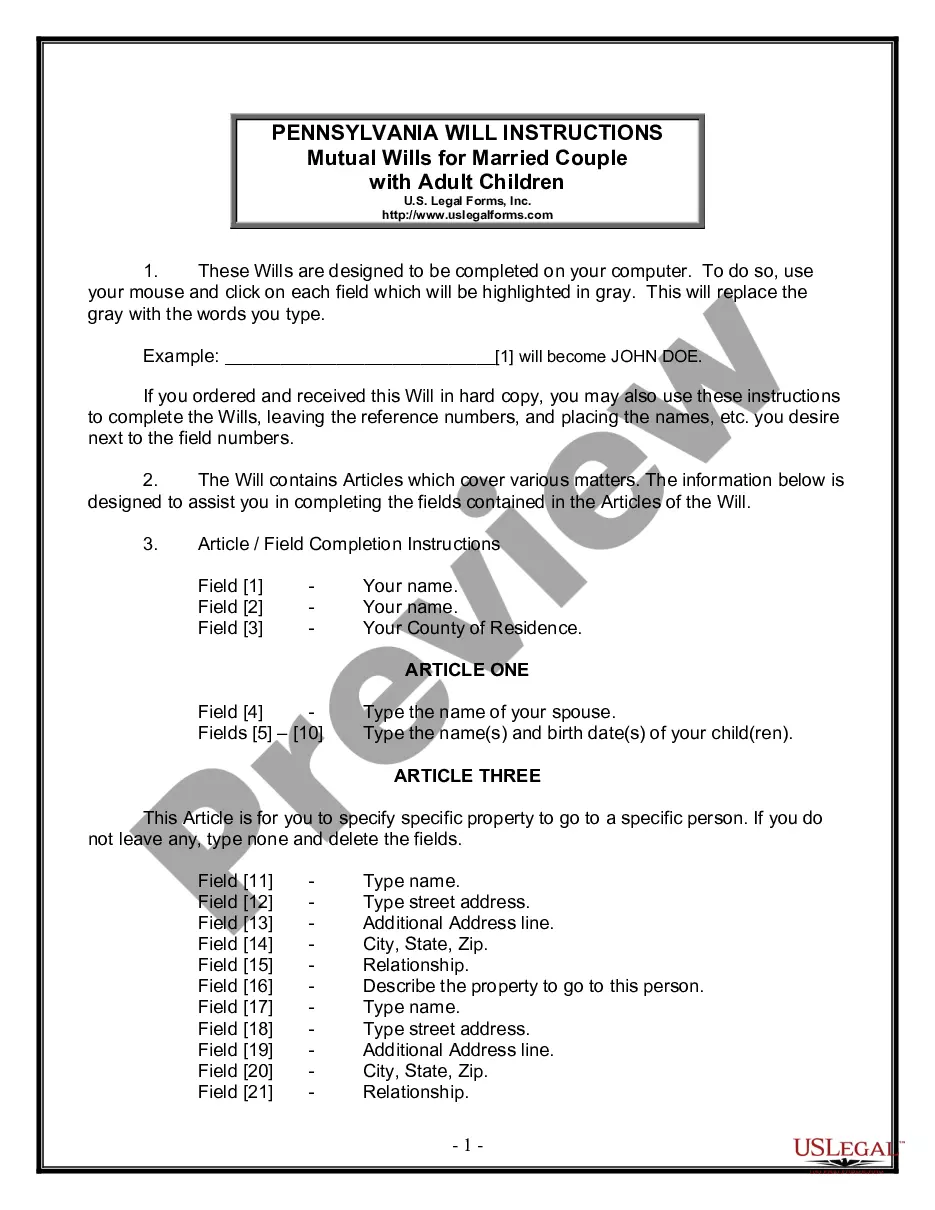

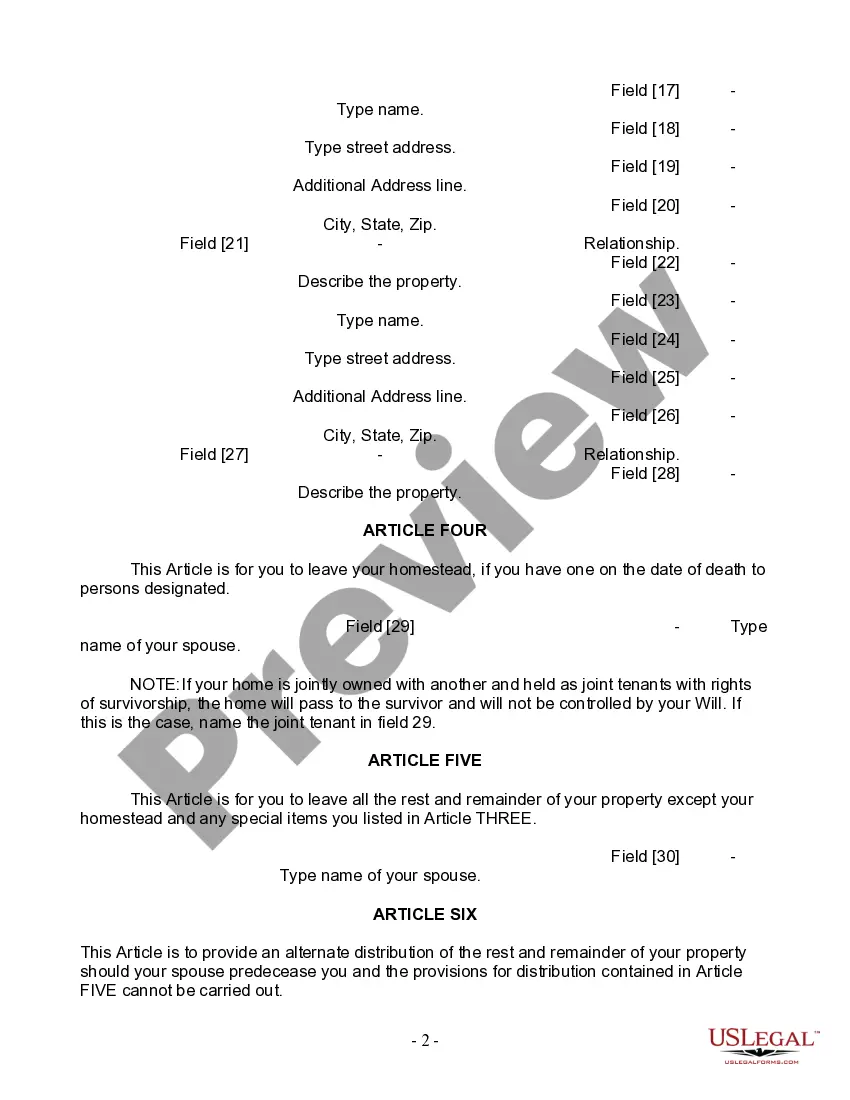

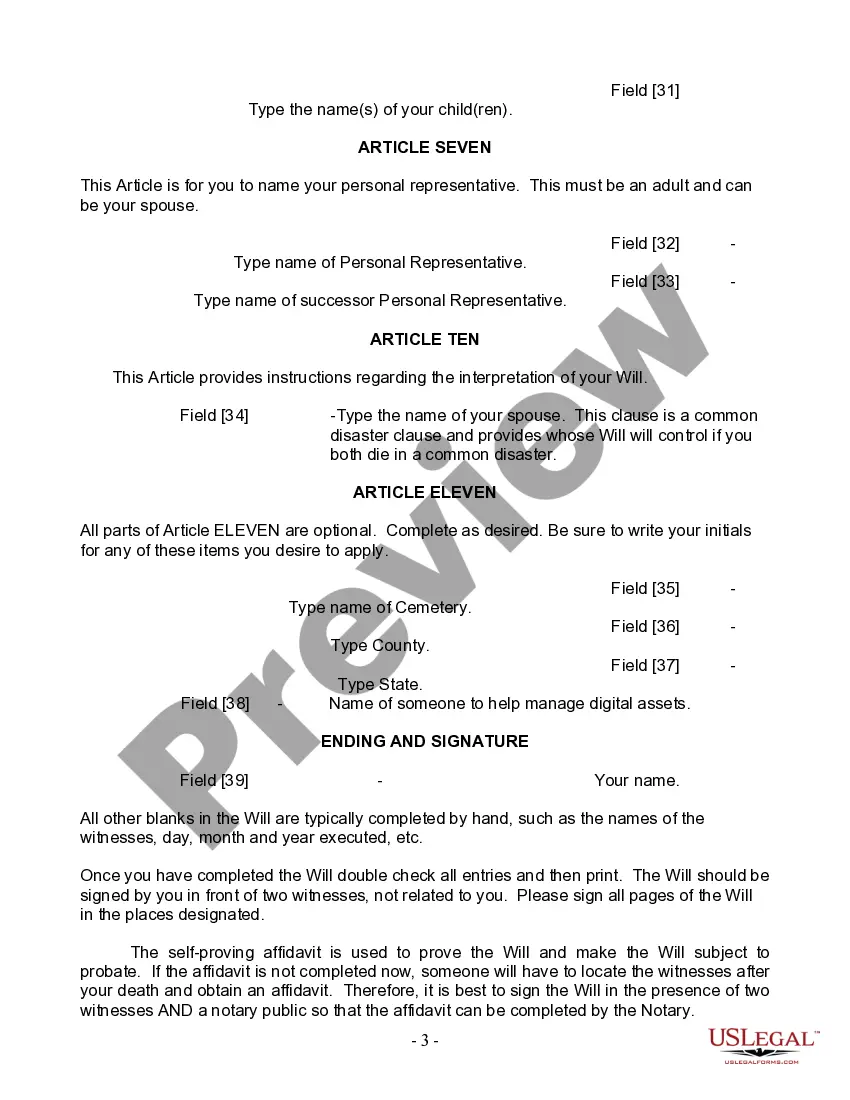

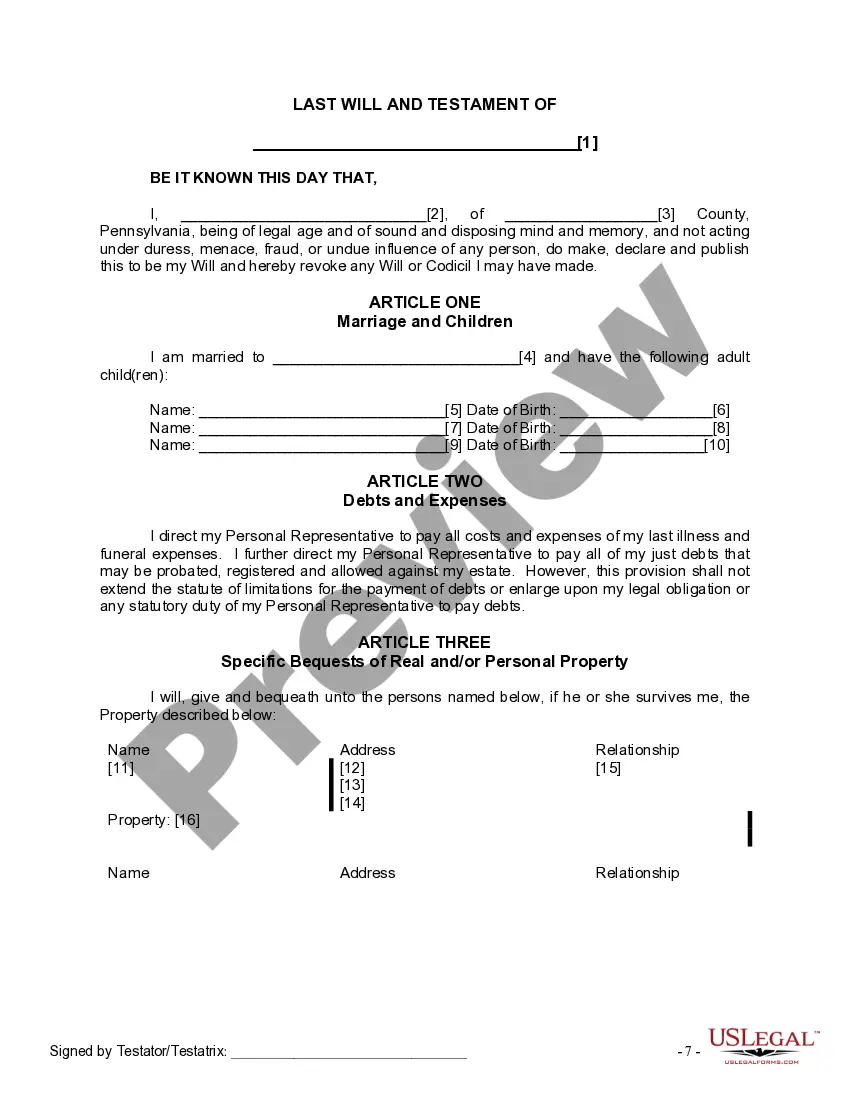

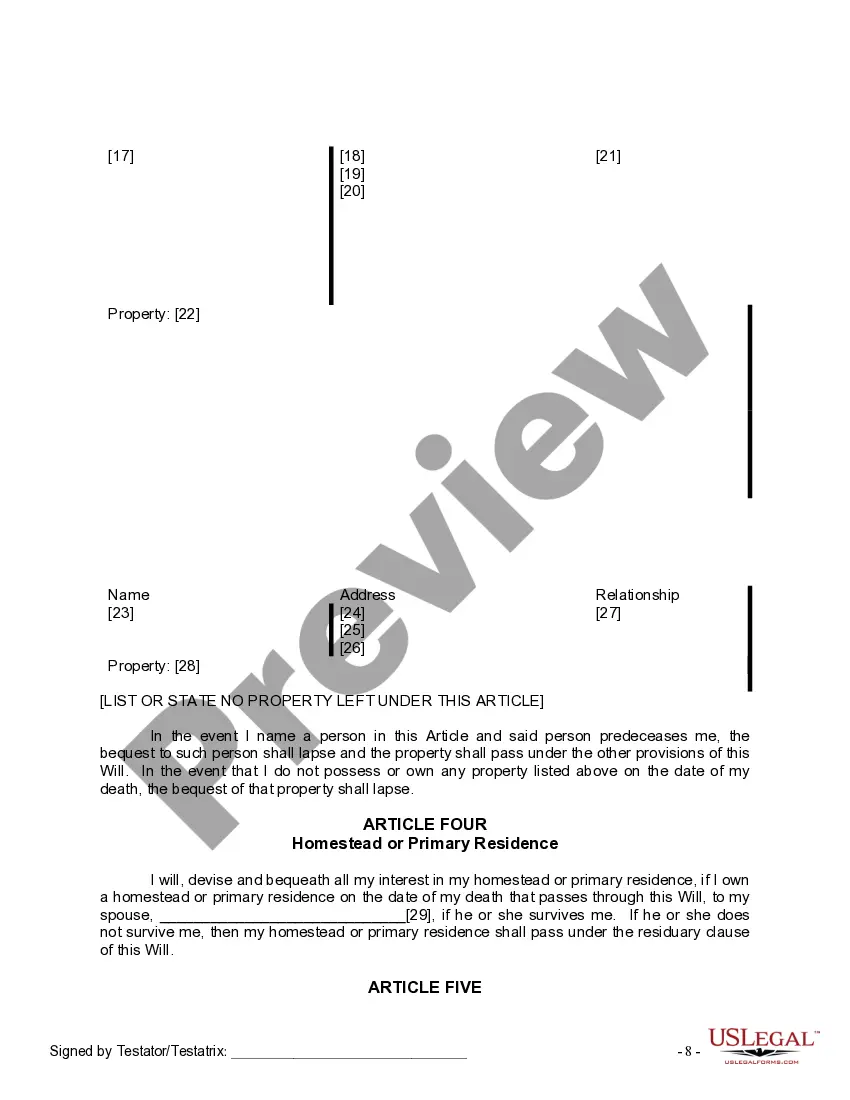

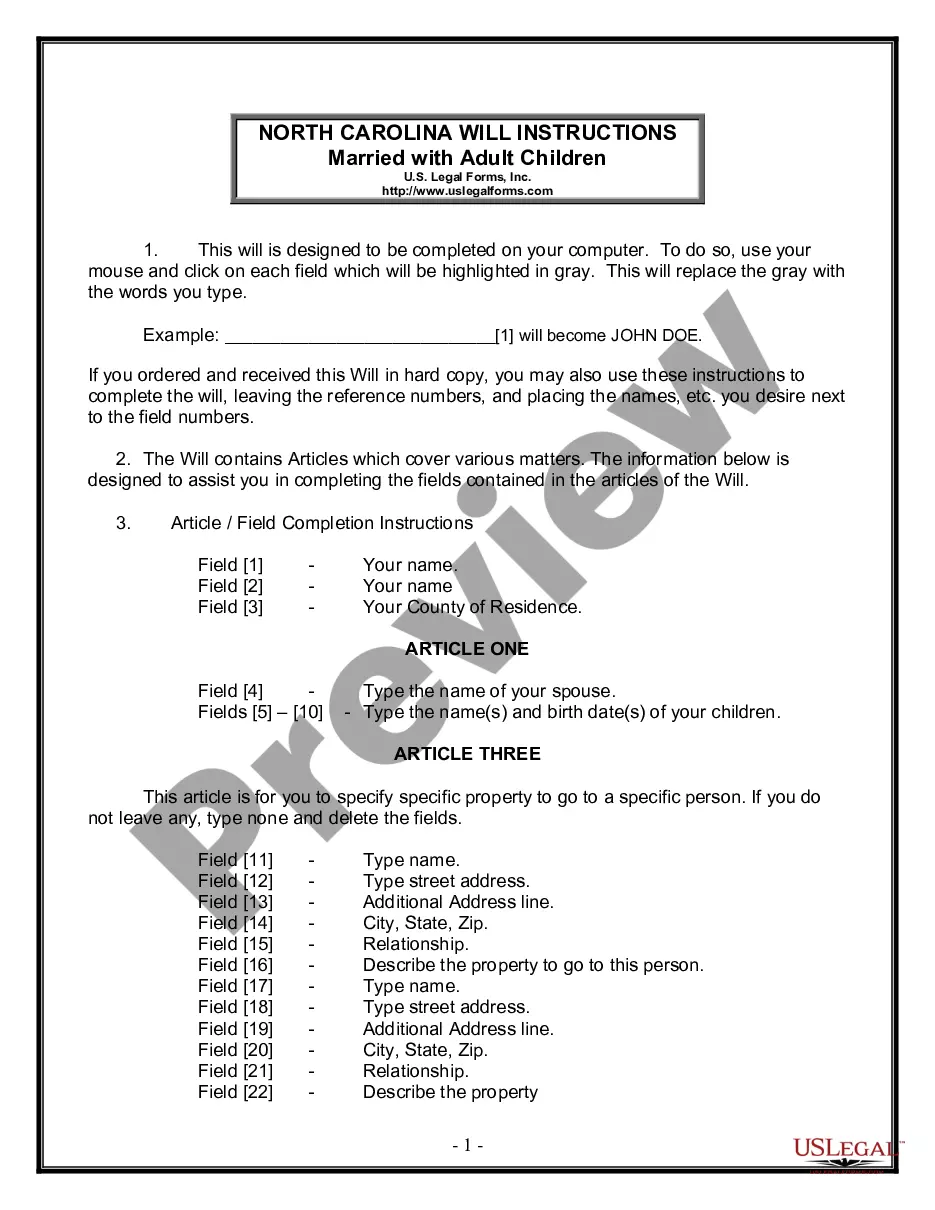

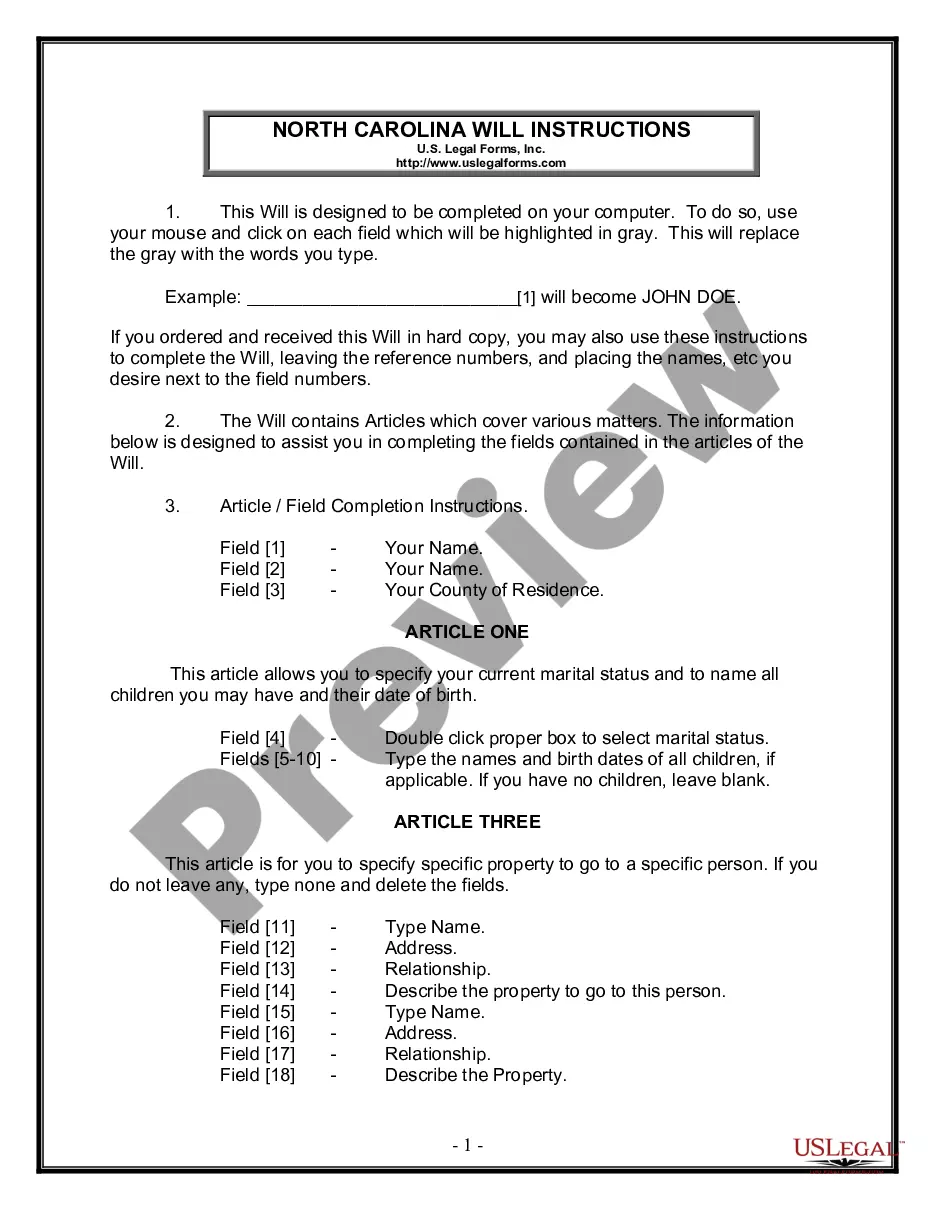

How to fill out Pennsylvania Mutual Wills Package With Last Wills And Testaments For Married Couple With Adult Children?

Using legal templates that meet the federal and local regulations is a matter of necessity, and the internet offers numerous options to choose from. But what’s the point in wasting time searching for the correctly drafted Pa Wills And Probate Records sample on the web if the US Legal Forms online library already has such templates gathered in one place?

US Legal Forms is the largest online legal library with over 85,000 fillable templates drafted by attorneys for any business and life scenario. They are simple to browse with all documents organized by state and purpose of use. Our specialists keep up with legislative updates, so you can always be sure your paperwork is up to date and compliant when obtaining a Pa Wills And Probate Records from our website.

Obtaining a Pa Wills And Probate Records is simple and fast for both current and new users. If you already have an account with a valid subscription, log in and save the document sample you need in the preferred format. If you are new to our website, adhere to the instructions below:

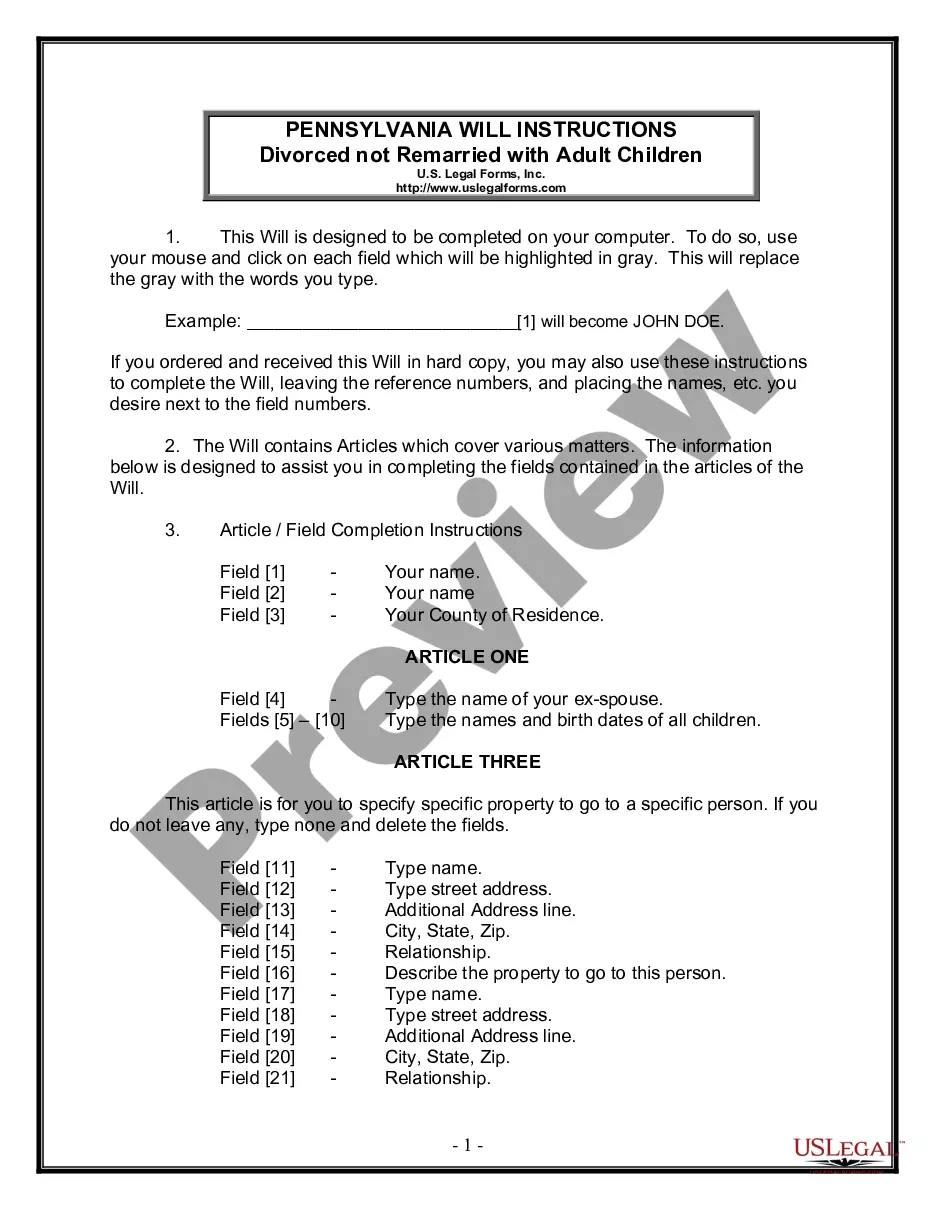

- Take a look at the template using the Preview feature or via the text outline to ensure it meets your requirements.

- Locate a different sample using the search function at the top of the page if necessary.

- Click Buy Now when you’ve found the suitable form and choose a subscription plan.

- Create an account or log in and make a payment with PayPal or a credit card.

- Select the best format for your Pa Wills And Probate Records and download it.

All templates you locate through US Legal Forms are reusable. To re-download and fill out earlier saved forms, open the My Forms tab in your profile. Enjoy the most extensive and easy-to-use legal paperwork service!

Form popularity

FAQ

Probating a Will in Pennsylvania Step 1: Appoint an Executor. ... Step 2: Authenticate the Will. ... Step 3: Notification of Beneficiaries, Heirs, and Creditors. ... Step 4: Inventory the Assets. ... Step 5: Calculation of Estate and Inheritance Taxes. ... Step 6: Payment of Debts. ... Step 6: Resolve Will Disputes.

Under Pennsylvania law, executors have a duty to provide an accounting to beneficiaries. An accounting is a detailed report that outlines the assets, liabilities, income, and expenses associated with the estate, as well as the executor's actions in managing and distributing the estate.

If all goes ingly, the will is first and quickly filed with the local, county, or municipal probate court in which the Testator died or last lived.

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated. Such assets are called probate assets, and in order to convey ownership of them it is necessary to probate.

The probate process in Pennsylvania begins with filing the deceased's will and a petition for probate with the county Register of Wills office where the deceased resided. If the will is deemed valid, the court will issue Letters Testamentary to the named executor, authorizing them to act on behalf of the estate.