Pa Estate Tax Rate

Description

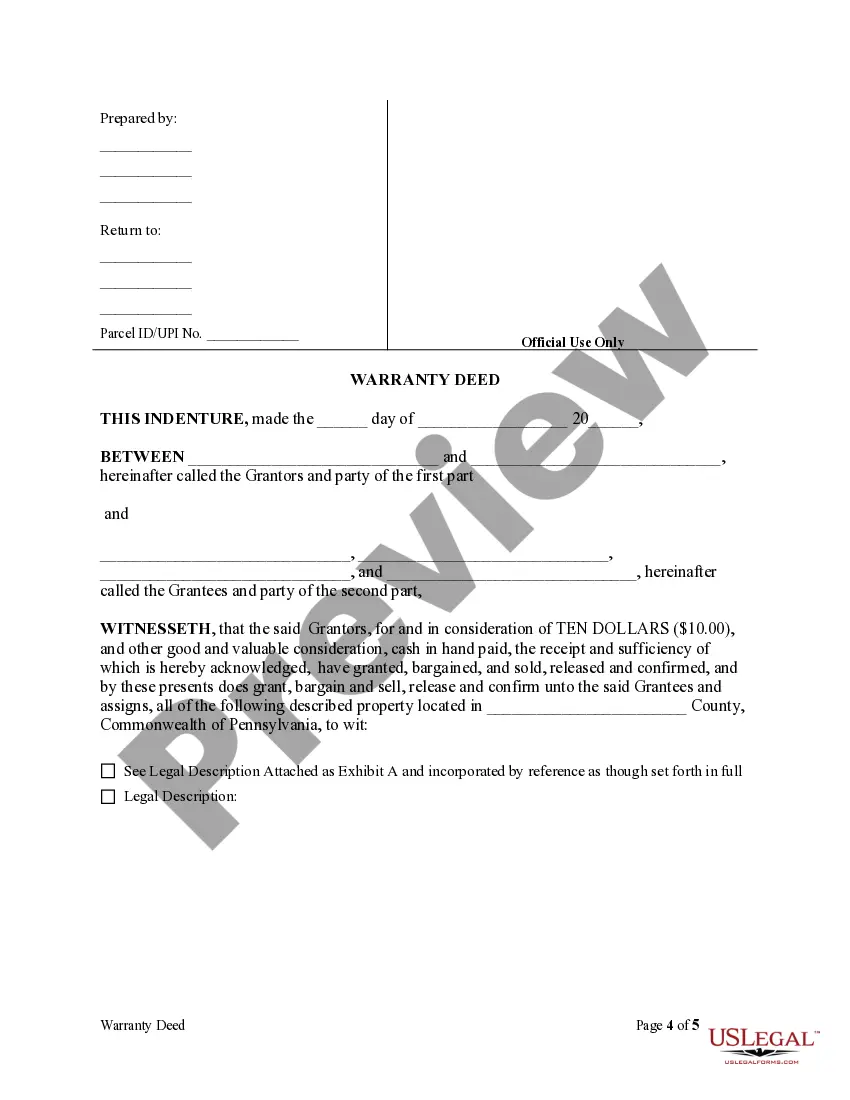

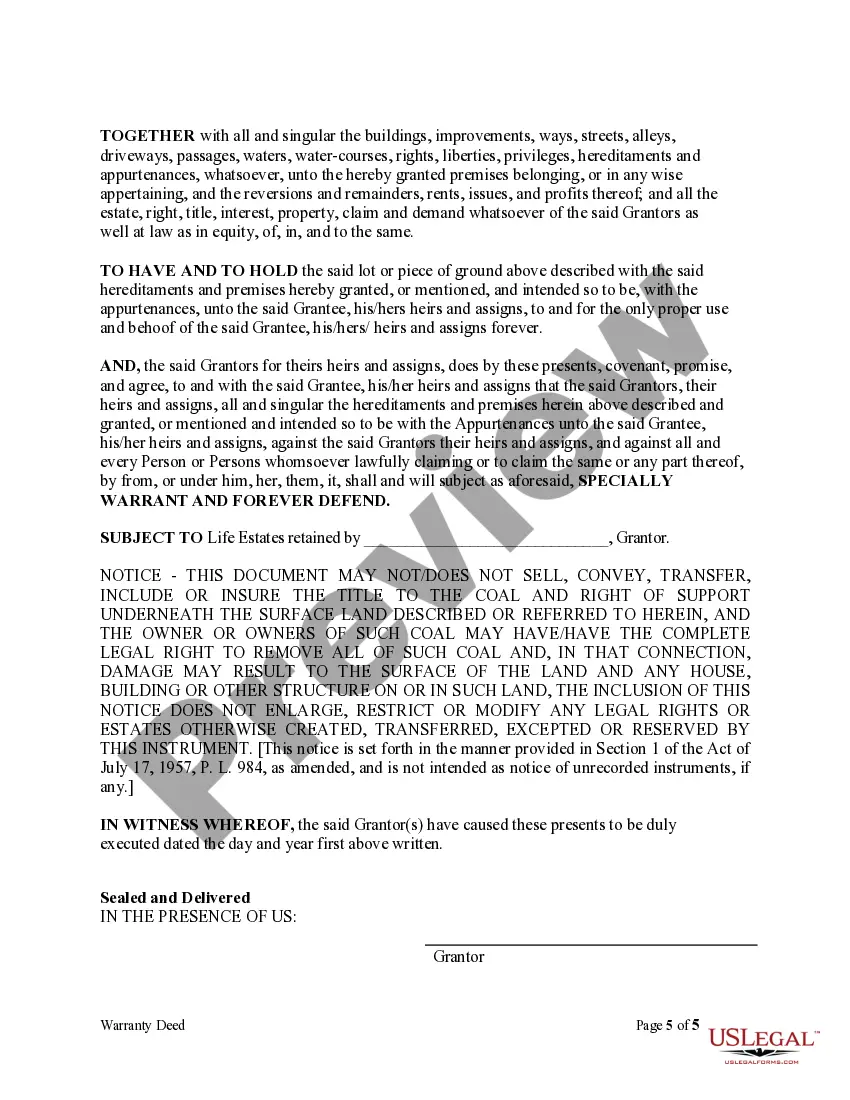

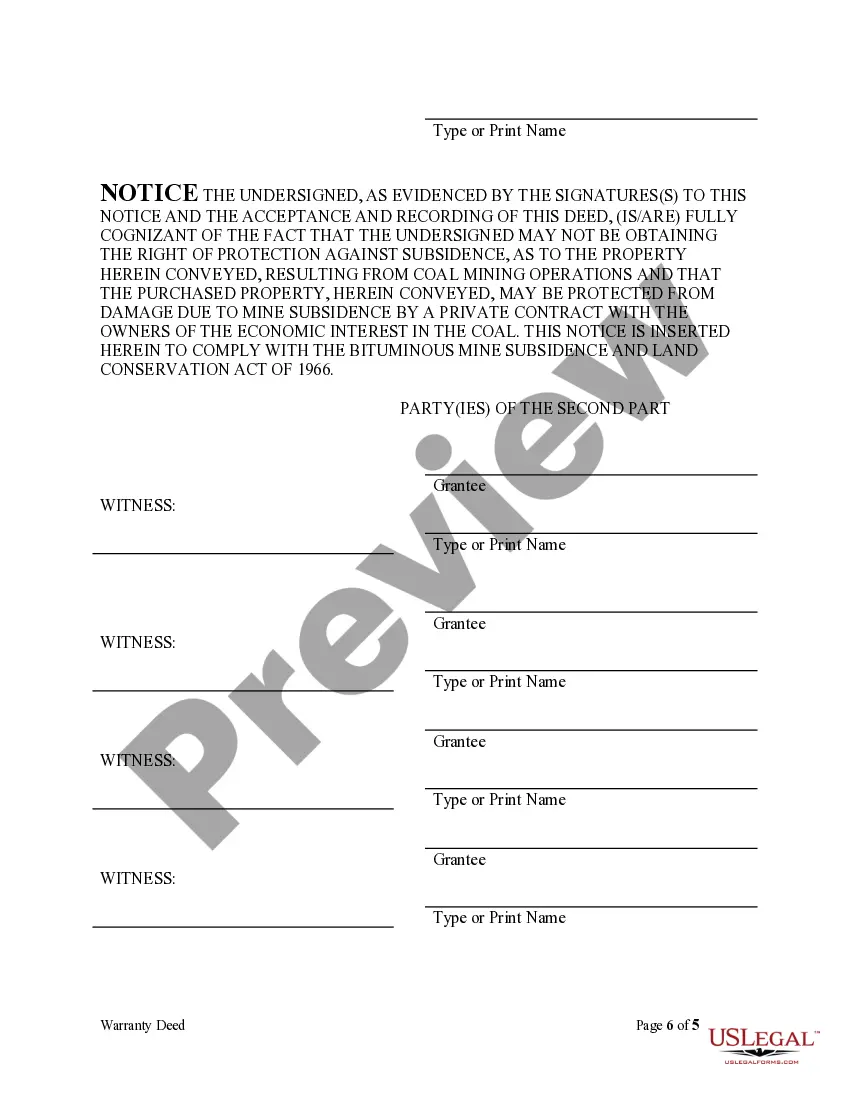

How to fill out Pennsylvania Warranty Deed From Individual To Four Individuals As Tenants In Common With Reserved Life Estate?

It’s obvious that you can’t become a law professional overnight, nor can you figure out how to quickly draft Pa Estate Tax Rate without having a specialized background. Creating legal documents is a long process requiring a specific training and skills. So why not leave the creation of the Pa Estate Tax Rate to the professionals?

With US Legal Forms, one of the most comprehensive legal document libraries, you can find anything from court paperwork to templates for internal corporate communication. We know how important compliance and adherence to federal and state laws and regulations are. That’s why, on our website, all templates are location specific and up to date.

Here’s how you can get started with our website and obtain the form you require in mere minutes:

- Find the document you need with the search bar at the top of the page.

- Preview it (if this option available) and read the supporting description to figure out whether Pa Estate Tax Rate is what you’re looking for.

- Start your search again if you need any other form.

- Set up a free account and choose a subscription option to buy the template.

- Pick Buy now. Once the payment is through, you can download the Pa Estate Tax Rate, complete it, print it, and send or mail it to the necessary individuals or entities.

You can re-gain access to your forms from the My Forms tab at any time. If you’re an existing client, you can simply log in, and locate and download the template from the same tab.

Regardless of the purpose of your documents-whether it’s financial and legal, or personal-our website has you covered. Try US Legal Forms now!

Form popularity

FAQ

An inheritance tax return must be filed for every decedent (or person who died) with property that may be subject to PA inheritance tax. The tax is due within nine months of the decedent's death. After nine months, the tax due accrues interest and penalties.

There are practical ways to minimize or avoid PA inheritance tax without needing to move to a state without estate tax or inheritance tax. #1 - Gifting. Either to individuals, charities, or irrevocable trusts. #2 - Buying real property in a state without estate or inheritance tax.

4.5 percent on transfers to direct descendants and lineal heirs; 12 percent on transfers to siblings; and. 15 percent on transfers to other heirs, except charitable organizations, exempt institutions and government entities exempt from tax.

No estate will have to pay estate tax from Pennsylvania. There is still a federal estate tax. The federal estate tax exemption is $12.06 million in 2022 and $12.92 million in 2023. This exemption is portable.

Inheritance tax forms, schedules and instructions are available at .revenue.pa.gov. You may also order any Pennsylvania tax form or schedule by calling, toll-free 1-800-362-2050. Schedules A through G are used to report assets of the estate. Schedules H and I are used to report debts and deductions of the estate.