Pa Attorney Real Estate Withholding

Description

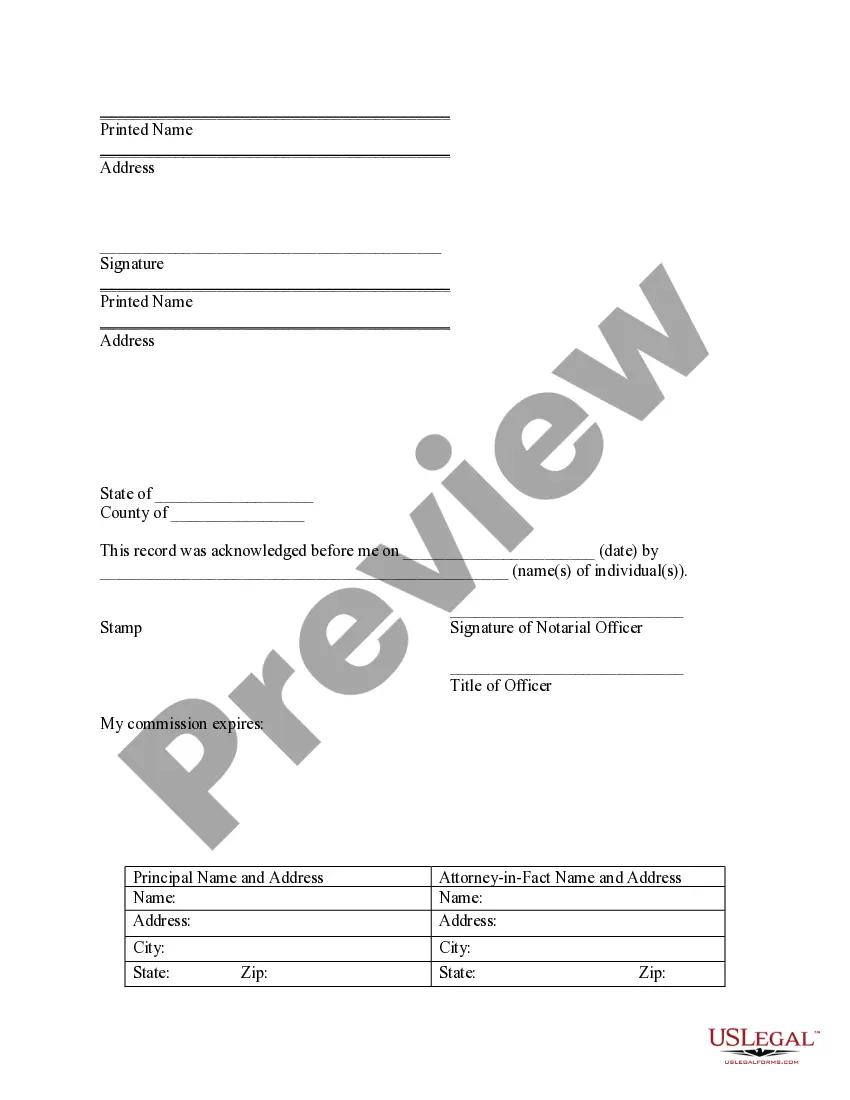

How to fill out Pennsylvania Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Utilizing legal documents that adhere to national and local regulations is crucial, and the web presents numerous choices to select from.

However, what’s the benefit of spending time searching for the properly constructed Pa Attorney Real Estate Withholding example online when the US Legal Forms online repository already has such documents compiled in one location.

US Legal Forms is the largest online legal directory with over 85,000 editable templates created by legal professionals for any work and personal situation. They are simple to navigate with all files categorized by state and intended use. Our specialists keep abreast of legislative changes, allowing you to feel secure that your documents are current and compliant when obtaining a Pa Attorney Real Estate Withholding from our site.

- Review the template using the Preview feature or through the text explanation to ensure it meets your requirements.

- Search for a different document using the search bar at the top of the page if needed.

- Click Buy Now once you’ve located the correct template and choose a subscription option.

- Create an account or sign in and make a payment via PayPal or a credit card.

- Select the format for your Pa Attorney Real Estate Withholding and download it.

Form popularity

FAQ

Lawyers in Pennsylvania typically take a portion of the settlement, usually around 5% to 10%, depending on the complexity of the case. Factors such as the size of the estate, the type of assets involved, and additional legal services required may influence this amount. It’s essential to have a clear conversation with your PA attorney regarding fees for real estate withholding to avoid surprises. Transparency in these discussions helps ensure all parties are on the same page regarding costs.

Act 542 is a Pennsylvania law that allows municipalities to sell properties at tax sales while preserving the rights of property owners. This law is significant for real estate transactions, as it provides a framework for redeeming properties before and after the sale. Knowing how Act 542 interacts with real estate withholding rates can be crucial for property owners. Consulting a knowledgeable PA attorney can clarify how this act may impact your real estate interests.

In Pennsylvania, hiring a PA attorney for real estate withholding can simplify the estate settlement process. While it is not legally required to have an attorney, their expertise can help navigate the complexities of estate laws and filings. An experienced attorney can ensure all legal documents are in order and that assets are distributed according to the deceased's wishes. Ultimately, having legal guidance can save time and prevent potential disputes.

You may consider filing a complaint against an attorney in PA if you experience malpractice, misconduct, or ethical violations in your real estate transactions. Reasons can include failure to keep clients informed, improper handling of funds, or violation of fiduciary duties. If issues arise, the Pennsylvania Bar Association provides resources to file a complaint and investigate concerns. Understanding these processes can protect your interests and ensure compliance with regulations like the PA attorney real estate withholding.

The PA state withholding form refers to the PA-100 form used for registering a withholding account, along with PA-501 or PA-40 for reporting. This documentation is essential for businesses and individuals to accurately report tax withholdings to the state. Ensure you use the correct form based on your business structure or employee payments involving PA attorney real estate withholding. It's important to keep records of all submitted forms for future references.

You should file your withholdings electronically through the Pennsylvania Department of Revenue’s e-TIDES system for a seamless process. Make sure to gather all necessary employee information and payment records to facilitate accurate filings. Alternatively, if you prefer traditional methods, you can print and submit forms by mail. Streamlining your filing process helps ensure compliance with PA attorney real estate withholding regulations.

To file PA withholding tax, complete the necessary forms like the PA-501 or PA-40, depending on whether you are a business or an individual filer. Then, submit these forms through the online e-TIDES platform or mail them to the appropriate Pennsylvania Revenue office. By following these steps carefully, you will stay on top of your PA attorney real estate withholding obligations.

The amount you should withhold for PA state taxes depends on the employee's wages and filing status. Generally, you can refer to the Pennsylvania withholding tables or use payroll software designed for PA attorney real estate withholding calculations. Additionally, make sure to factor in exemptions claimed by employees to accurately determine the withholding amount. Always consult the latest guidelines to ensure compliance.

You can submit withholding tax through electronic filing or by mailing paper forms. For electronic submissions, use the Pennsylvania Department of Revenue's e-TIDES system, which is convenient and efficient. If you opt for paper submissions, ensure you send the completed forms and payments to the designated state address. This process is crucial for compliance with the PA attorney real estate withholding.

Filing PA withholding tax involves reporting the amount withheld from employees’ wages or payments made to non-residents. You typically complete the PA-100 form, which allows you to register for a withholding tax account. After registering, you will submit your withholding tax returns alongside the appropriate payments through the Pennsylvania Department of Revenue's website. Remember to stay up to date with deadlines to avoid any potential penalties.