Pa Attorney Estate Withholding

Description

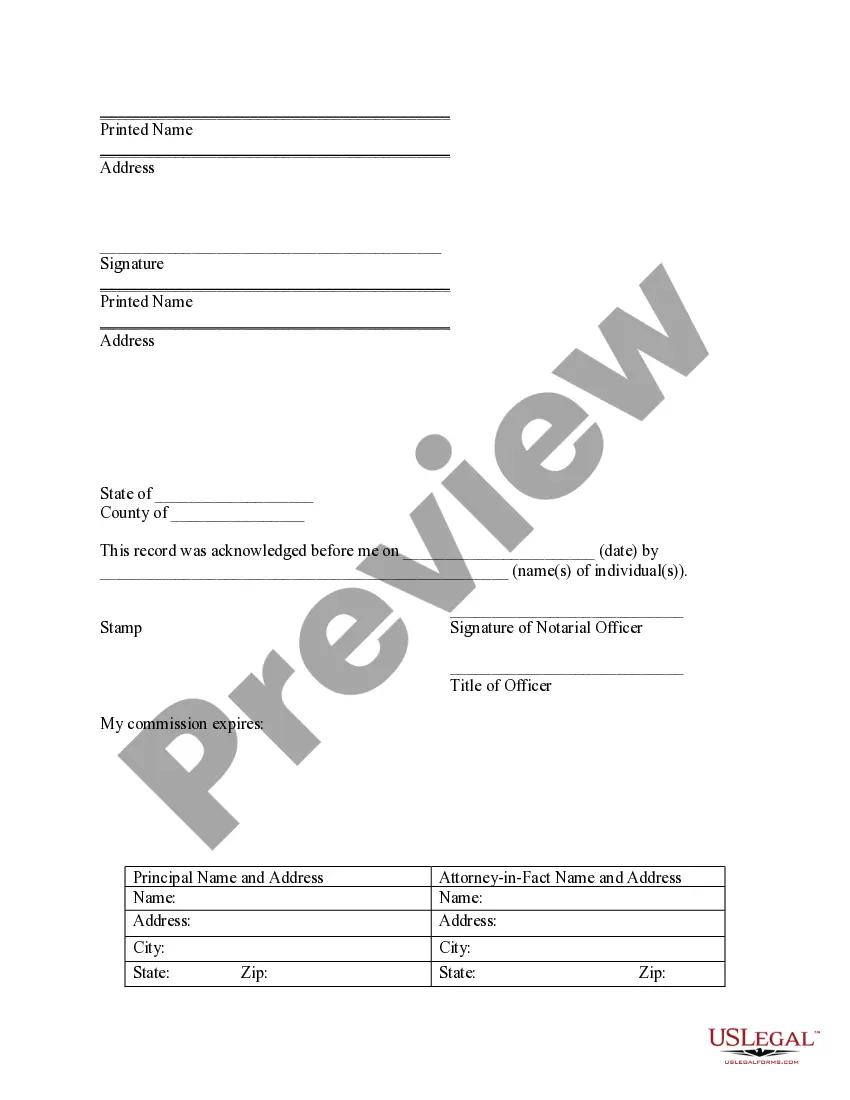

How to fill out Pennsylvania Special Or Limited Power Of Attorney For Real Estate Purchase Transaction By Purchaser?

Legal managing may be overwhelming, even for the most experienced specialists. When you are searching for a Pa Attorney Estate Withholding and do not get the time to spend trying to find the appropriate and updated version, the operations can be stress filled. A strong web form catalogue can be a gamechanger for everyone who wants to manage these situations efficiently. US Legal Forms is a market leader in web legal forms, with over 85,000 state-specific legal forms available to you at any time.

With US Legal Forms, you are able to:

- Access state- or county-specific legal and organization forms. US Legal Forms covers any demands you may have, from personal to business papers, all in one place.

- Utilize innovative resources to complete and handle your Pa Attorney Estate Withholding

- Access a useful resource base of articles, instructions and handbooks and resources highly relevant to your situation and requirements

Save effort and time trying to find the papers you will need, and use US Legal Forms’ advanced search and Preview tool to find Pa Attorney Estate Withholding and download it. In case you have a subscription, log in in your US Legal Forms profile, search for the form, and download it. Review your My Forms tab to find out the papers you previously saved as well as to handle your folders as you can see fit.

Should it be your first time with US Legal Forms, create an account and get limitless usage of all advantages of the platform. Listed below are the steps for taking after getting the form you want:

- Verify this is the proper form by previewing it and looking at its description.

- Ensure that the sample is approved in your state or county.

- Pick Buy Now when you are ready.

- Select a monthly subscription plan.

- Find the formatting you want, and Download, complete, sign, print and send your papers.

Benefit from the US Legal Forms web catalogue, backed with 25 years of expertise and stability. Change your daily papers managing in a easy and user-friendly process today.

Form popularity

FAQ

Pennsylvania Individual Tax The Pennsylvania individual income tax withholding rate remains at 3.07% for 2021.

Pennsylvania Withholding Tax Account Number and Filing Frequency. If you are a new business, register online with the PA Department of Revenue to retrieve your account number and filing frequency. You can also contact the agency at 1-888-PATAXES (1-888-728-2937).

Purpose. Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial sit- uation changes. Photocopies of this form are acceptable.

Inheritances aren't considered income for federal tax purposes, but subsequent earnings on the inherited assets, including interest income and dividends, are taxable (unless it comes from a tax-free source).

Register for Employer Withholding online by visiting mypath.pa.gov. Registering online allows business owners to withhold employer taxes with the Pennsylvania Department of Revenue and open Unemployment Compensation accounts administered by the Pennsylvania Department of Labor & Industry.