Company Employment Policies With Cash Value

Description

How to fill out Pennsylvania Company Employment Policies And Procedures Package?

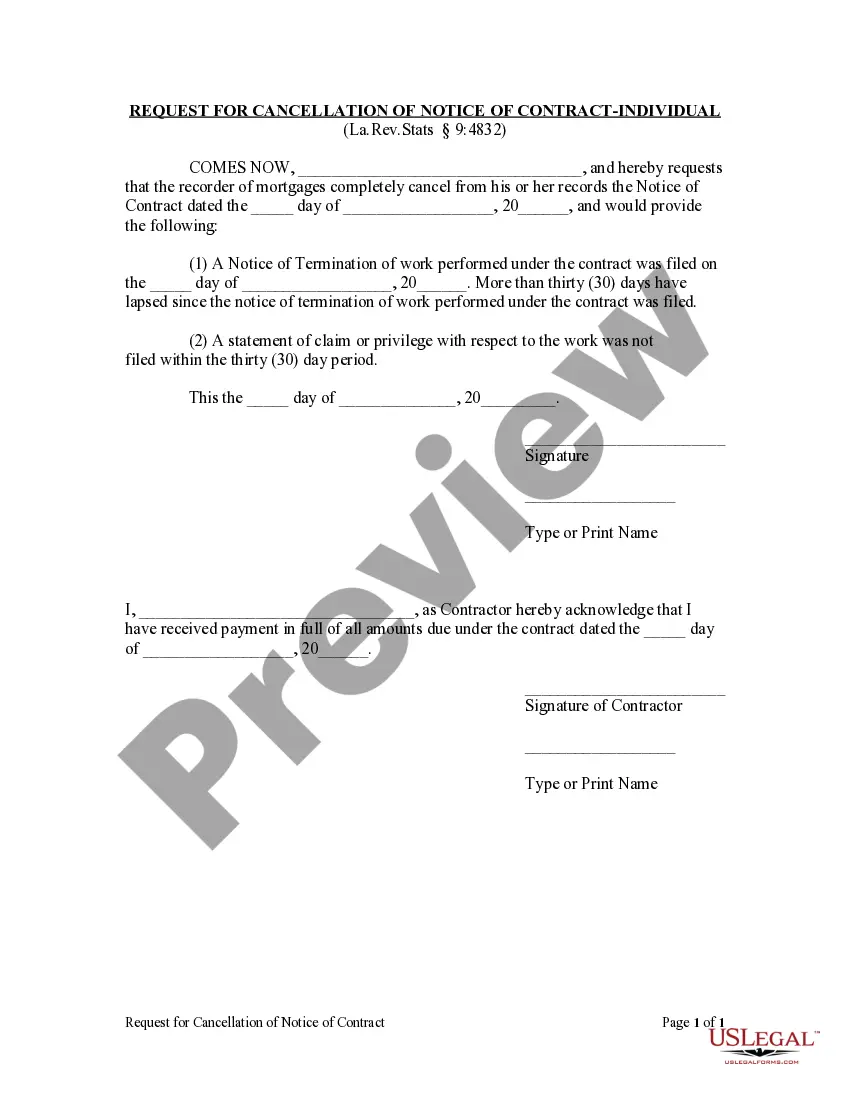

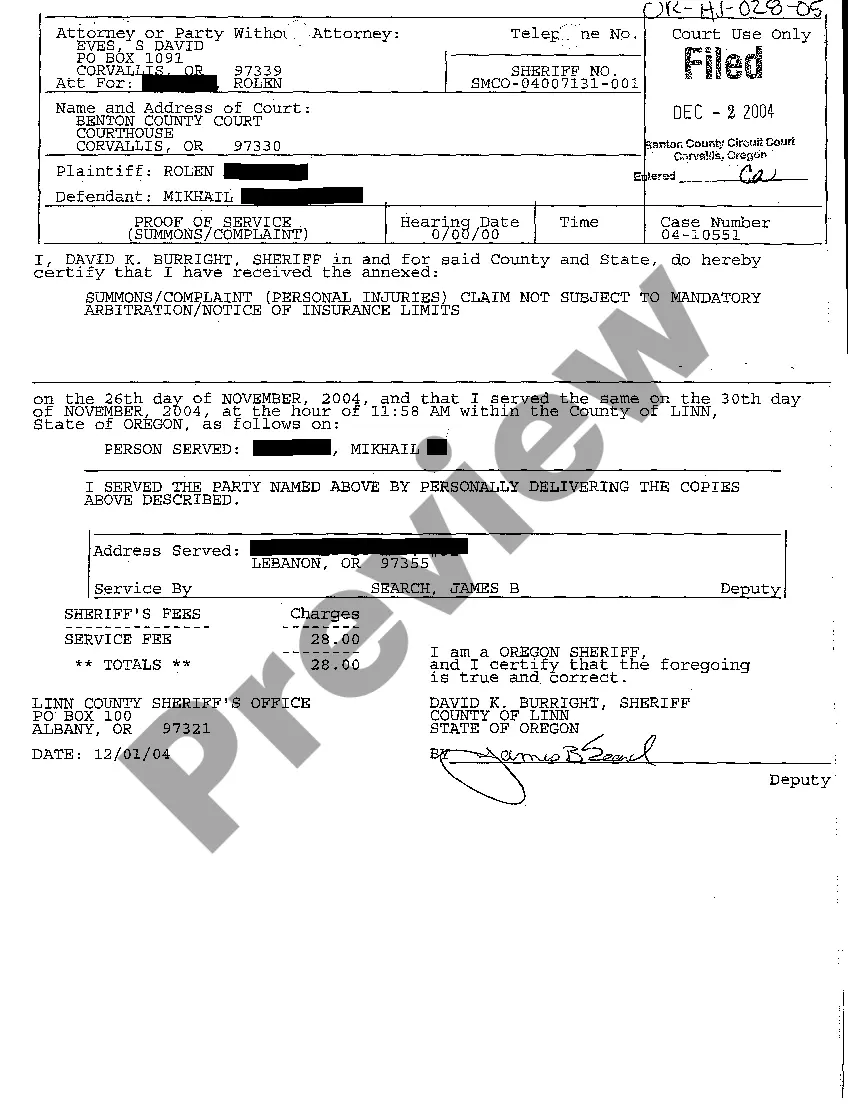

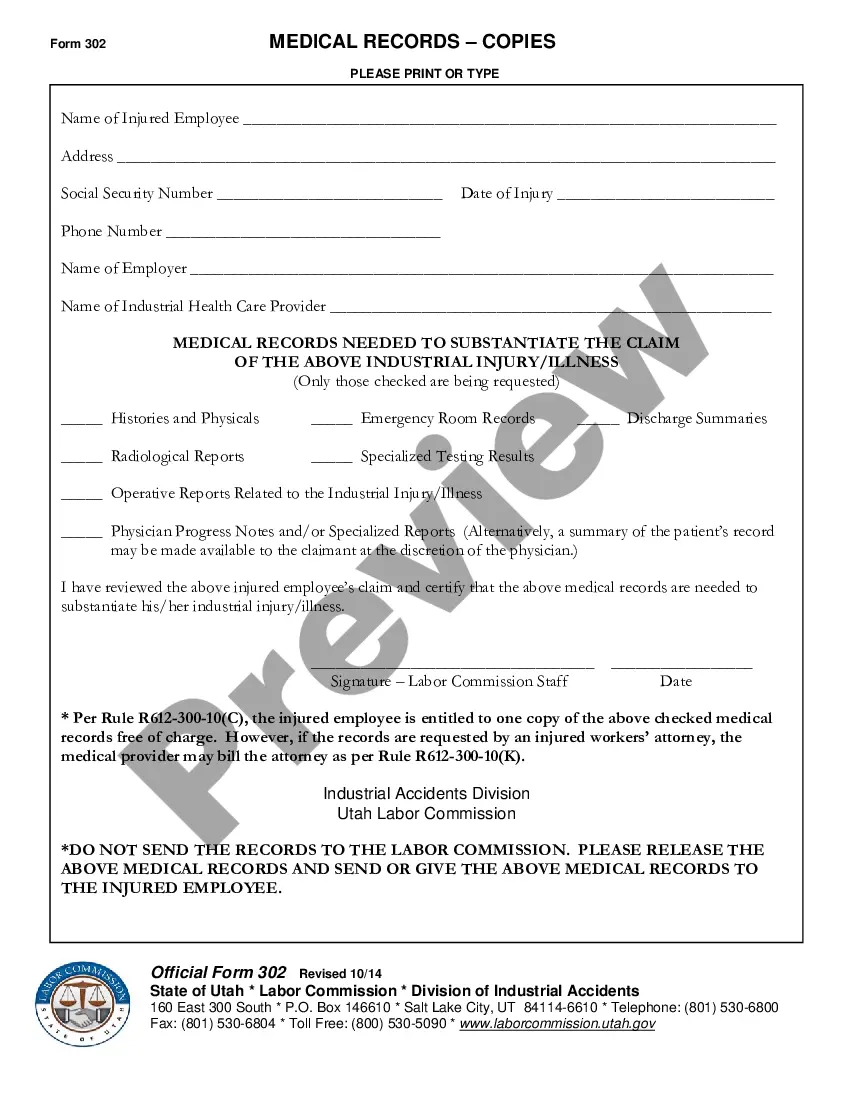

Whether for business purposes or for personal matters, everybody has to deal with legal situations sooner or later in their life. Completing legal papers requires careful attention, starting with selecting the correct form template. For instance, if you pick a wrong edition of a Company Employment Policies With Cash Value, it will be turned down once you send it. It is therefore essential to have a dependable source of legal documents like US Legal Forms.

If you need to get a Company Employment Policies With Cash Value template, stick to these simple steps:

- Find the template you need by using the search field or catalog navigation.

- Examine the form’s description to make sure it matches your case, state, and region.

- Click on the form’s preview to see it.

- If it is the wrong document, return to the search function to find the Company Employment Policies With Cash Value sample you require.

- Get the template if it meets your requirements.

- If you have a US Legal Forms profile, just click Log in to gain access to previously saved templates in My Forms.

- If you do not have an account yet, you may obtain the form by clicking Buy now.

- Pick the correct pricing option.

- Complete the profile registration form.

- Pick your payment method: use a credit card or PayPal account.

- Pick the document format you want and download the Company Employment Policies With Cash Value.

- After it is downloaded, you are able to fill out the form with the help of editing applications or print it and finish it manually.

With a vast US Legal Forms catalog at hand, you do not have to spend time seeking for the appropriate template across the web. Make use of the library’s simple navigation to get the correct form for any situation.

Form popularity

FAQ

However, most people receive around 20% of the face value on average, ing to LISA. So, if we're using that 20% average to calculate the cash value of a $100,000 life insurance policy, the cash value of the policy would be $20,000.

Cash value is the portion of your policy that accumulates1 over time and may be available for you to withdraw or borrow against for long-term savings needs such as retirement, paying down a mortgage, covering an unforeseen emergency, or a significant expense, like sending your child to college.

Cash value in a permanent life insurance policy accumulates over time and can be accessed while you're still alive. You can use this money to fund retirement, cover your life insurance premiums, or increase your policy's death benefit to pass on more money to children, for example.

The value of your life insurance refers to the death benefit paid to beneficiaries. To find the cash value of your life insurance, calculate your total payments and subtract surrender fees. Remember, the value for a sale will be lower than the death benefit to allow the buyer to profit.

The cash value of your settlement will depend on all the other factors mentioned above. A typical life settlement is worth around 20% of your policy value, but can range from 10-25%. So for a 100,000 dollar policy, you would be looking at anywhere from 10,000 to 25,000 dollars.