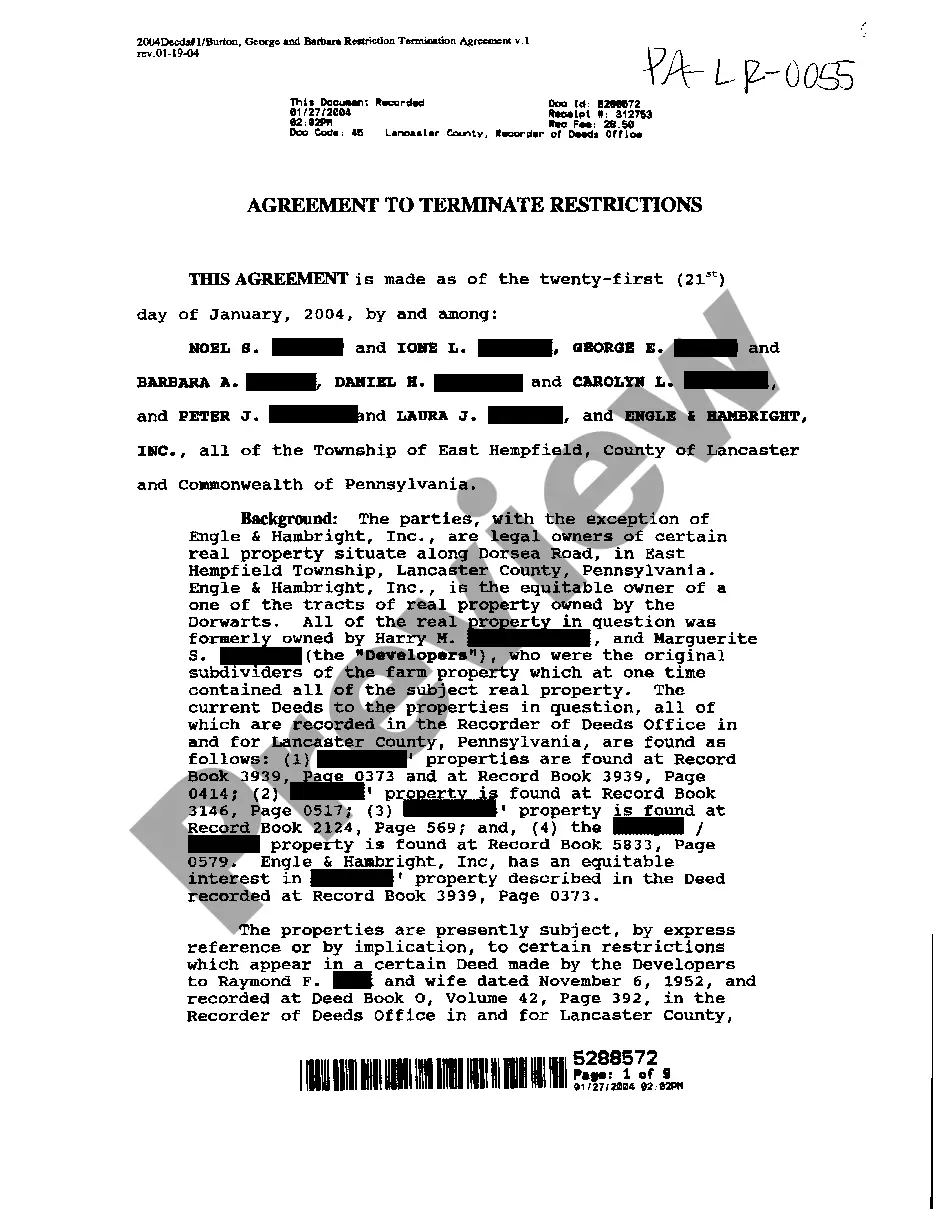

Restriction Release Form For Lender

Description

How to fill out Pennsylvania Agreement To Terminate Restrictions That Were In Original Deed By Developer?

It’s evident that you cannot become a legal expert instantly, nor can you comprehend how to swiftly prepare a Restriction Release Form For Lender without possessing a specialized skill set.

Compiling legal documents is a lengthy endeavor necessitating specific training and expertise. So why not entrust the development of the Restriction Release Form For Lender to the experts.

With US Legal Forms, one of the most extensive legal document repositories, you can gain access to a variety of materials, from court documents to in-office communication templates.

If you need a different form, initiate your search again.

Create a free account and choose a subscription plan to purchase the form. Select Buy now. Once the payment is finalized, you will be able to access the Restriction Release Form For Lender, fill it out, print it, and send or mail it to the relevant individuals or organizations.

- We understand how essential it is to comply with federal and local laws and regulations.

- That’s why, on our platform, all forms are tailored to specific locations and are up to date.

- Start by visiting our website and acquire the document you need in just a few minutes.

- Utilize the search bar located at the top of the page to find the form you require.

- If this option is available, preview it and review the accompanying description to see if the Restriction Release Form For Lender is what you seek.

Form popularity

FAQ

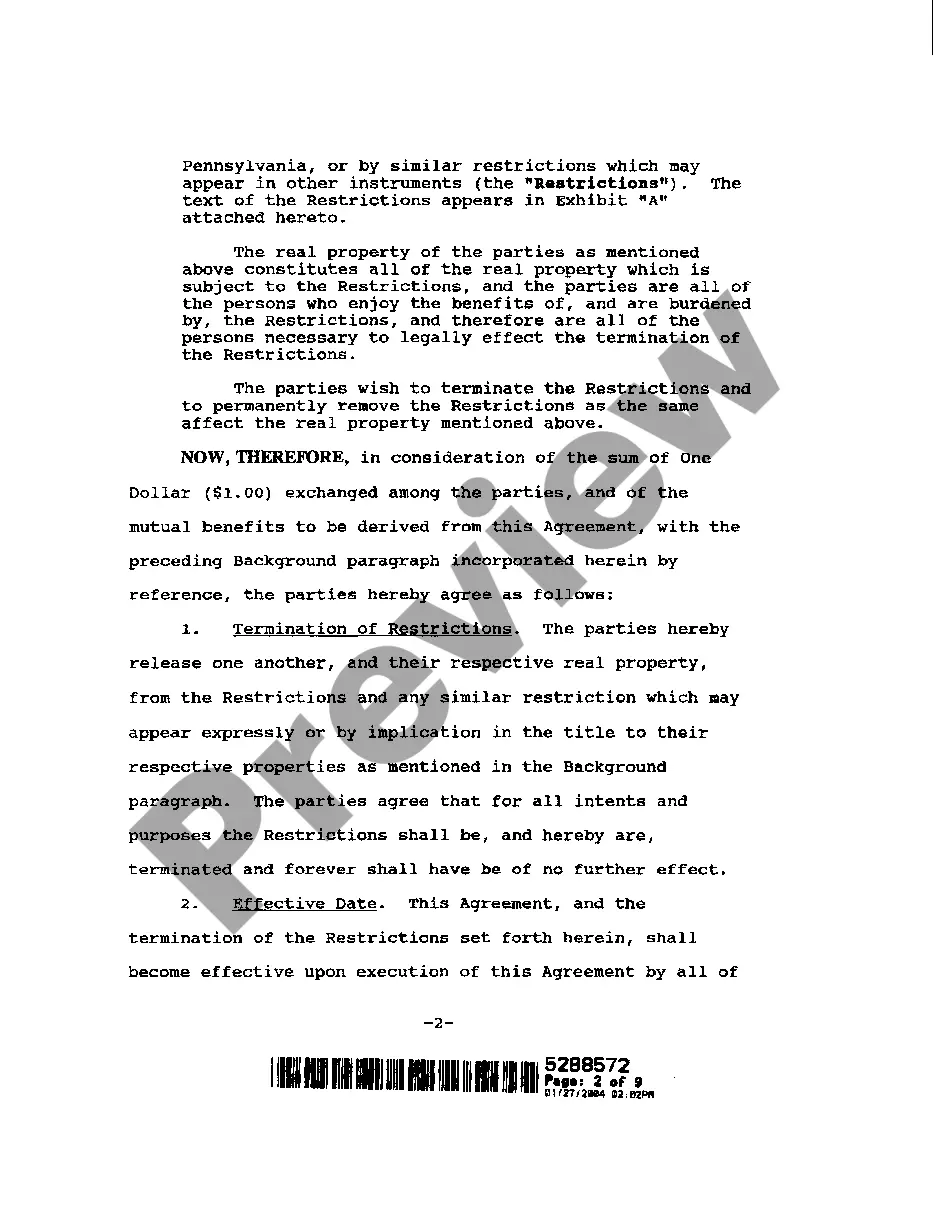

You'll need to get consent, either from the governing body that set them ? your city or HOA, for example ? or from the other parties involved in the restriction, like neighbors. Removing them may involve filing paperwork with the county clerk or even presenting it to a judge.

Deed restrictions are clauses on your home's deed that limit how you can use your property. A deed restriction might say you can't build a shed in your yard or own a certain breed of dog. Deed restrictions can come from an HOA, the builder of the home or a local governing body.

The purchase contract that Fannie Mae requires buyers to use when purchasing their properties contains a clause in which the buyer agrees to receive a deed containing deed restrictions.

A mortgage release, also referred to as ?deed in lieu of foreclosure? (DIL), is when a homeowner relinquishes the ownership of their property voluntarily to the owner of the mortgage, often a bank or lender, in exchange for a release from the mortgage and all future mortgage payments.

Removing deed restrictions is not easy, but it's possible. You'll need to get consent, either from the governing body that set them ? your city or HOA, for example ? or from the other parties involved in the restriction, like neighbors.