Pa Trust Withdrawal

Description

How to fill out Pennsylvania Amendment To Living Trust?

Creating legal documents from the beginning can occasionally be daunting.

Certain scenarios may necessitate hours of investigation and considerable financial investment.

If you’re looking for a simpler and more cost-effective method of preparing the Pa Trust Withdrawal or any other documents without needing to navigate obstacles, US Legal Forms is always available to assist you.

Our online collection of over 85,000 current legal forms covers nearly every element of your financial, legal, and personal matters. With just a few clicks, you can easily access state- and county-specific templates carefully assembled for you by our legal professionals.

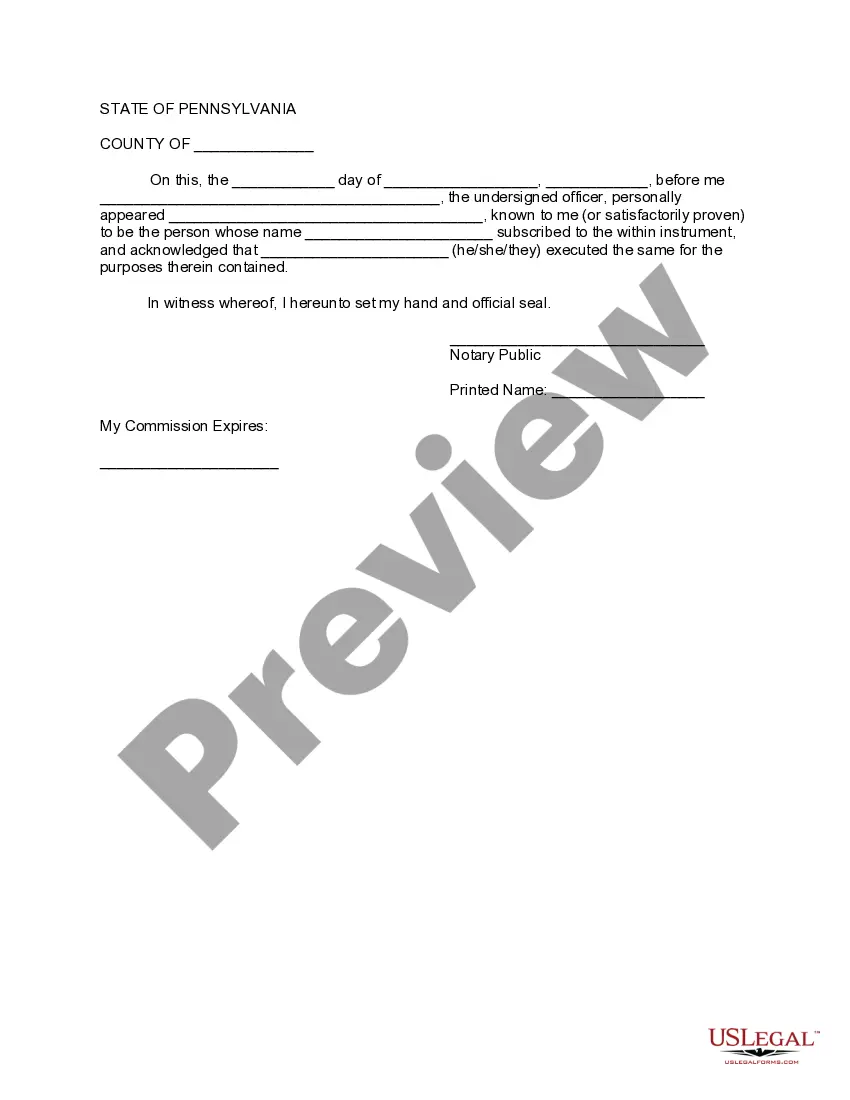

Examine the form preview and descriptions to confirm that you have located the document you seek.

- Utilize our website whenever you require dependable and trustworthy services through which you can conveniently find and download the Pa Trust Withdrawal.

- If you’re familiar with our website and have earlier established an account with us, simply Log In to your account, choose the form, and download it immediately or retrieve it at any time later from the My documents section.

- Not registered yet? No worries. Setting it up and browsing the catalog only takes a few minutes.

- However, before you proceed directly to downloading the Pa Trust Withdrawal, consider these suggestions.

Form popularity

FAQ

The amount you can withdraw from a trust is determined by the trust's provisions. Some trusts allow for specific withdrawals, while others may limit access to income generated by the trust assets. To find out the exact limits for your situation, refer to the trust document or seek advice from a professional. Knowing the guidelines for PA trust withdrawal can help you make informed financial decisions.

The withdrawal rights of a trust depend on the specific terms outlined in the trust document. Generally, beneficiaries can withdraw funds or assets based on the rules set by the trust’s creator. If you are unsure about your rights, consider reviewing the trust agreement or consulting with a legal expert. Understanding your rights regarding PA trust withdrawal is essential to ensure you access your entitled benefits.

Yes, a trust can be cashed out, but the process depends on the type of trust and its terms. Generally, beneficiaries may receive distributions as specified in the trust agreement, which may involve a PA trust withdrawal. If you are considering cashing out a trust, it’s wise to consult with a legal expert. Utilizing US Legal Forms can also provide you with the necessary documents and information to facilitate this process effectively.

Only the individuals designated as trustees or those granted specific authority within the trust document can initiate a PA trust withdrawal. Beneficiaries may not directly access funds unless the trust terms allow it. It is essential to review the trust agreement to understand who has the power to withdraw funds. If you need clarity, consider using US Legal Forms to find templates and resources to guide you through the process.

Withdrawing funds from a trust typically involves following the guidelines set forth in the trust agreement. You must identify the specific terms regarding distributions, and then you can initiate a PA trust withdrawal by submitting a request to the trustee. If you're unsure about the process, using platforms like US Legal Forms can provide you with the necessary documents and guidance to ensure a smooth withdrawal.

The PA 41 is filed by estates and trusts that generate income during the tax year. If you are managing a trust that has made a PA trust withdrawal, you may need to submit this form to report the income generated by the trust. It's essential to understand your responsibilities to avoid penalties, and using resources like US Legal Forms can simplify the filing process.

Withdrawals from a trust can be taxable, depending on several factors. Generally, if the trust generates income, that income might be subject to taxation at the beneficiary's tax rate. For specific situations related to a PA trust withdrawal, consulting with a tax professional can help clarify your obligations and ensure compliance with state and federal regulations.