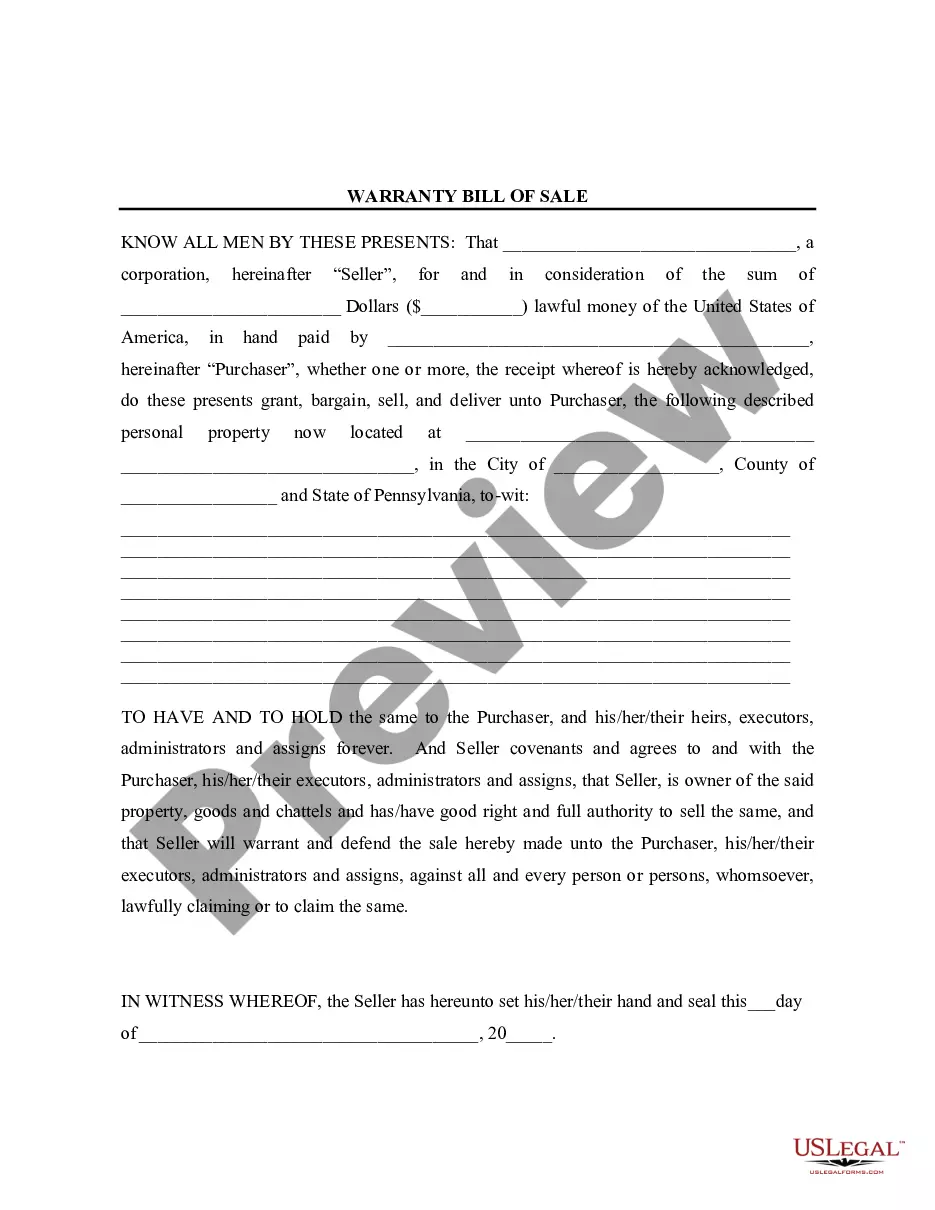

Bill Of Sale For Mobile Home In Pennsylvania

Description

How to fill out Pennsylvania Bill Of Sale With Warranty For Corporate Seller?

There is no longer any justification for spending hours looking for legal documents to meet your local state requirements.

US Legal Forms has gathered all of them in a single location and made their availability more efficient.

Our site provides over 85k templates for any business and personal legal needs categorized by state and area of application.

Employ the Search field above to look for another template if the previous one didn’t suit you.

- All forms are properly drafted and verified for correctness, allowing you to be confident in acquiring an up-to-date Bill Of Sale For Mobile Home In Pennsylvania.

- If you are familiar with our platform and already possess an account, ensure your subscription is active before obtaining any templates.

- Log In to your account, select the document, and click Download.

- You can also revisit all acquired documentation whenever needed by accessing the My documents tab in your profile.

- If you've never engaged with our platform before, the process will require a few additional steps to complete.

- Here’s how new users can acquire the Bill Of Sale For Mobile Home In Pennsylvania from our catalog.

- Carefully read the page content to confirm it contains the sample you need.

- Utilize the form description and preview options if available.

Form popularity

FAQ

All mobile homes or manufactured homes which are subject to taxation as real estate as provided in this chapter shall be assessed and taxed in the name of the owner.

PA considers mobile homes to be motor vehicles, so the only deduction for which you are eligible is the itemized deduction of the sales tax paid on the purchase.

You can: Sell your mobile home with the help of a real estate agent. Resort to for sale by owner option. Sell directly to a mobile home dealer....This is the list of paperwork necessary if you are selling your Pennsylvania mobile home yourself:Title(s)Clear tax certification from the county.Bill of sale.

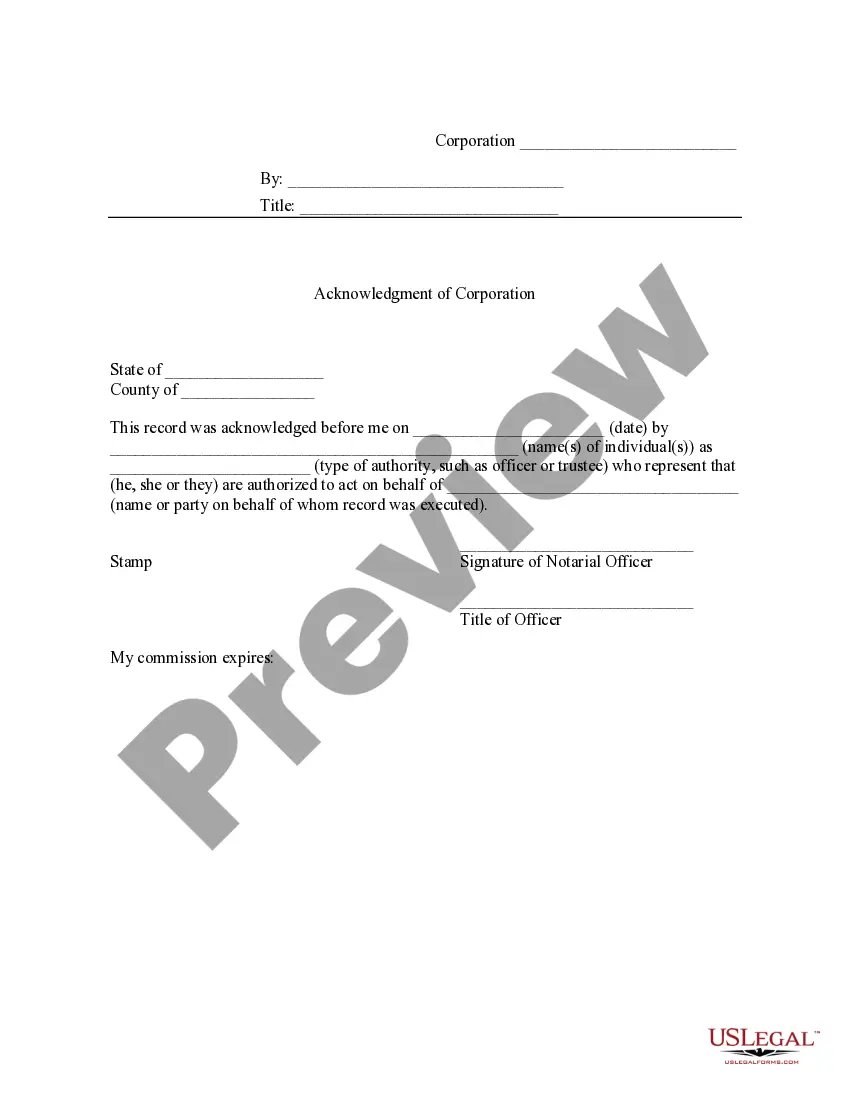

Doing it yourself: Bring signed title(s), Clear tax certification from county, and Bill of sale to your local DOT. Buyer(s) must be present at DOT to transfer title, however ideally buyer and seller go to DOT to transfer title to help expedite any last-minute issues that arise at the DOT.