Claimed Of Waivers

Description

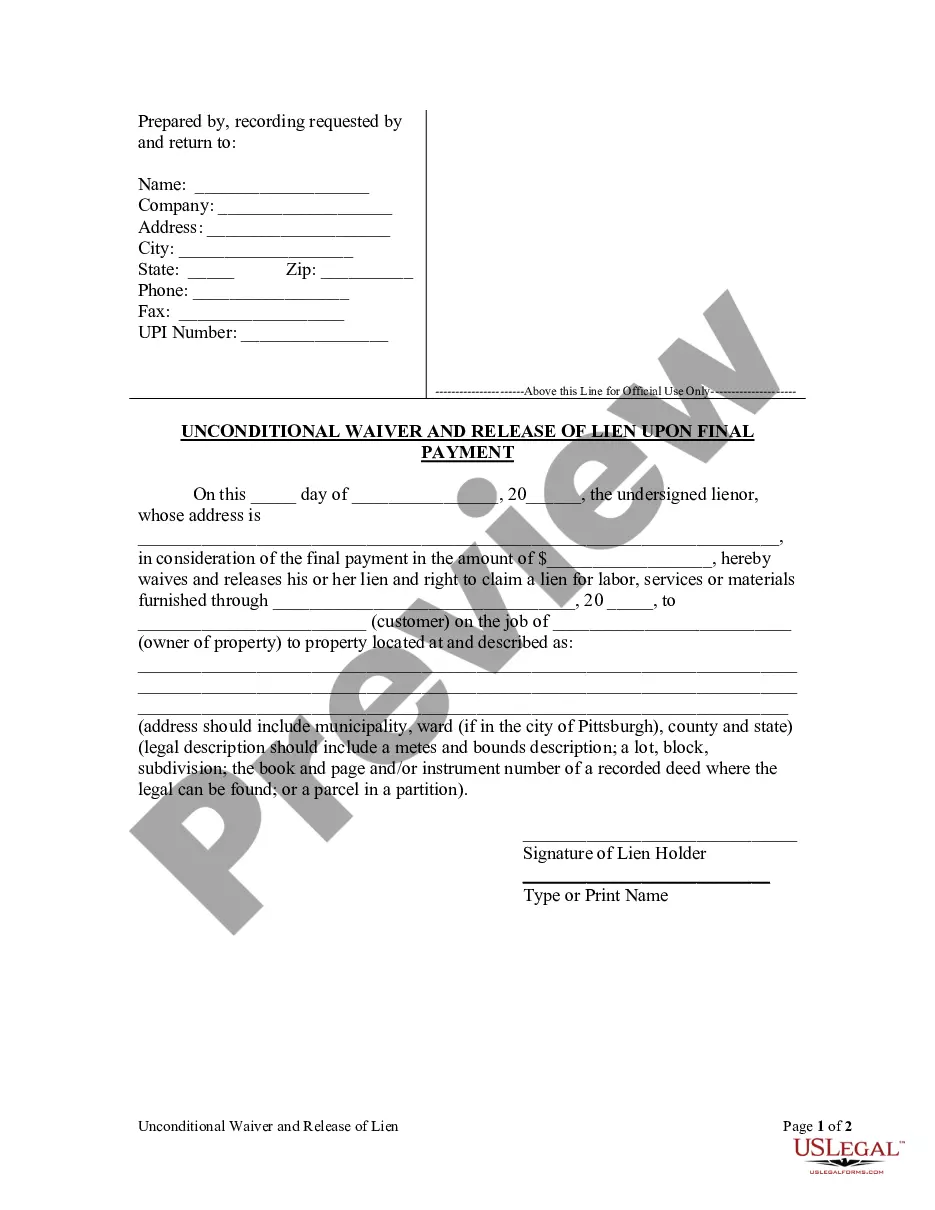

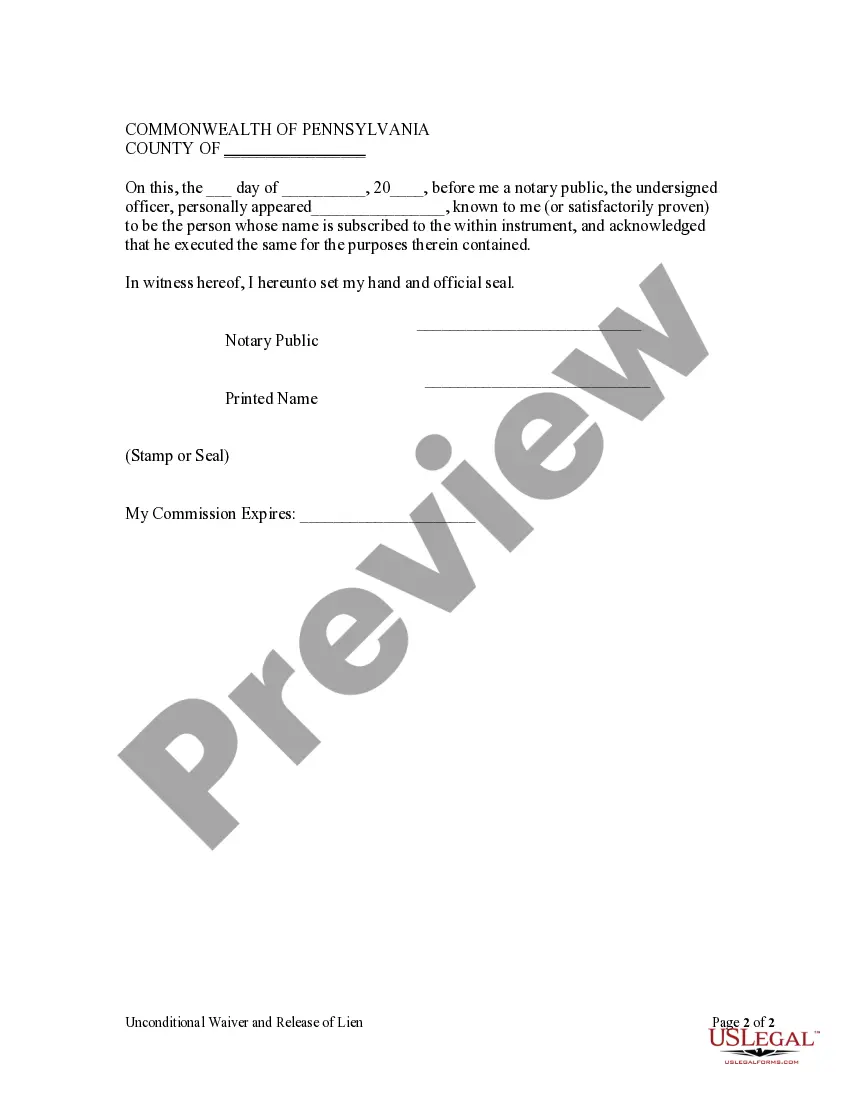

How to fill out Pennsylvania Unconditional Waiver And Release Of Claim Of Lien Upon Final Payment?

- If you're a returning user, log into your account and select the Download button to save the required form template to your device. Confirm that your subscription is active; otherwise, renew it according to your selected payment plan.

- For first-time users, start by previewing the form and reading its description to ensure it matches your local requirements.

- Should you need a different template, utilize the Search tab to find the correct documentation that suits your needs.

- Once the required form is located, click the Buy Now button and select your preferred subscription plan to proceed.

- Complete your purchase by entering your credit card information or using your PayPal account for a secure payment process.

- After payment, download the form to your device and access it anytime via the My Forms section of your profile.

US Legal Forms offers a robust library of over 85,000 easily fillable and editable legal forms, empowering both individuals and attorneys to swiftly execute legal documents. With more forms available than many competitors at similar costs, you can rest assured that you will find what you need.

Experience the convenience of US Legal Forms today. Start your journey towards efficient legal document management now!

Form popularity

FAQ

A waived claim signifies that an individual or entity has voluntarily chosen not to pursue a specific claim or legal action. This decision can be a strategic move based on various factors, including risk assessment and potential costs. By waiving a claim, the party accepts the consequences and relinquishes any legal recourse. Understanding this concept is essential for making informed decisions in legal contexts.

Waiver claims refer to requests made by individuals or entities to relinquish their rights regarding certain claims or liabilities. In various contexts, such as legal agreements or insurance policies, these claims enable parties to manage relationships and responsibilities effectively. When a waiver claim is executed, it signifies a mutual agreement to bypass potential legal actions on specific issues. It's essential to approach waiver claims with caution and clarity.

A waived claim on insurance indicates that the policyholder has given up their right to claim certain benefits or coverage under their policy. This might occur due to specific provisions in the policy or a mutual agreement. Essentially, when a claim is waived, the insurance company is no longer liable for that particular loss. Understanding this term is vital, as it can impact your financial recovery in challenging situations.

When a team claims a player off waivers, it means they have submitted a request to acquire the player from another team that no longer wants them. This process involves the player being temporarily placed on waivers, allowing other teams the opportunity to claim them. If a claim is successful, the claiming team assumes the player's contract and responsibilities. This system allows teams to manage their rosters effectively while providing opportunities for players.

In insurance, waived refers to the act of relinquishing a right to recover certain claims or losses. For example, if a policyholder waives their rights, they cannot file a claim for coverage on a specific incident. This often happens in specific circumstances outlined in the policy documents. It's essential to thoroughly read your insurance agreements to understand when and how claims might be waived.

To waive a claim means that a person or party voluntarily relinquishes their right to pursue a legal claim. This often occurs in legal contracts or agreements, where one party agrees not to hold the other liable for potential losses. By waiving a claim, you are essentially giving up your chance to seek remedies for any breaches or damages. Understanding the implications of waiving a claim is crucial, especially in legal matters.

Yes, you can write your own waiver if you cover all necessary elements, such as the intent, parties involved, and any risks. It’s essential to ensure that the language is clear and legally sound to avoid future disputes. However, consider using a professional service like uslegalforms for guidance, especially when dealing with claimed of waivers, to ensure you meet all legal standards.

To fill out a waiver form, start by entering your personal information accurately. Next, specify the event or activity you are waiving rights for, and read any disclaimers provided. After filling in all required sections, you should sign and date the form at the bottom. By using the claimed of waivers, you confirm your acknowledgment of potential risks involved.

A waiver statement typically includes a declaration that the signee accepts responsibility for risks associated with an activity. For instance, a statement may read, 'I, Name, hereby waive any claims against Organization for injuries incurred during Activity.' This serves as a legal acknowledgment that you understand the risks involved, illustrating the purpose of claimed of waivers.

Filling out a waiver form requires you to provide basic information, such as your name and contact details. Next, outline the activity or event related to the waiver, and clearly articulate any assumed risks. Ensure you read the entire document before signing, as this will clarify what you agree to. Using the claimed of waivers provides reassurance that you understand your obligations.