Pennsylvania Quitclaim Deed With A Mortgage

Description

How to fill out Pennsylvania Quitclaim Deed With A Mortgage?

How to locate professional legal documents that adhere to your state's regulations and draft the Pennsylvania Quitclaim Deed With A Mortgage without consulting an attorney.

Numerous online services provide templates for various legal situations and formalities. However, it might take some time to determine which of the accessible samples meet both your usage needs and legal standards.

US Legal Forms is a reliable platform that assists you in locating official documents formulated in line with the latest updates in state laws, helping you save on legal costs.

If you do not have an account with US Legal Forms, then follow the steps below.

- US Legal Forms is not a typical online directory.

- It features a collection of over 85,000 verified templates for assorted business and life situations.

- All documents are categorized by area and state to streamline your search process.

- It additionally incorporates robust tools for PDF editing and e-signatures, allowing users with a Premium subscription to swiftly finalize their paperwork online.

- Obtaining the required documents requires minimal effort and time.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Pennsylvania Quitclaim Deed With A Mortgage using the corresponding button next to the file name.

Form popularity

FAQ

In Pennsylvania, a deed can be prepared by various parties including attorneys, title companies, or individuals who understand property laws. While anyone can draft a deed, it is advisable to engage a professional to ensure compliance with legal requirements and local regulations. Using a service like US Legal Forms can help you find the right documents and assistance for creating a Pennsylvania quitclaim deed with a mortgage, providing peace of mind for your real estate transactions.

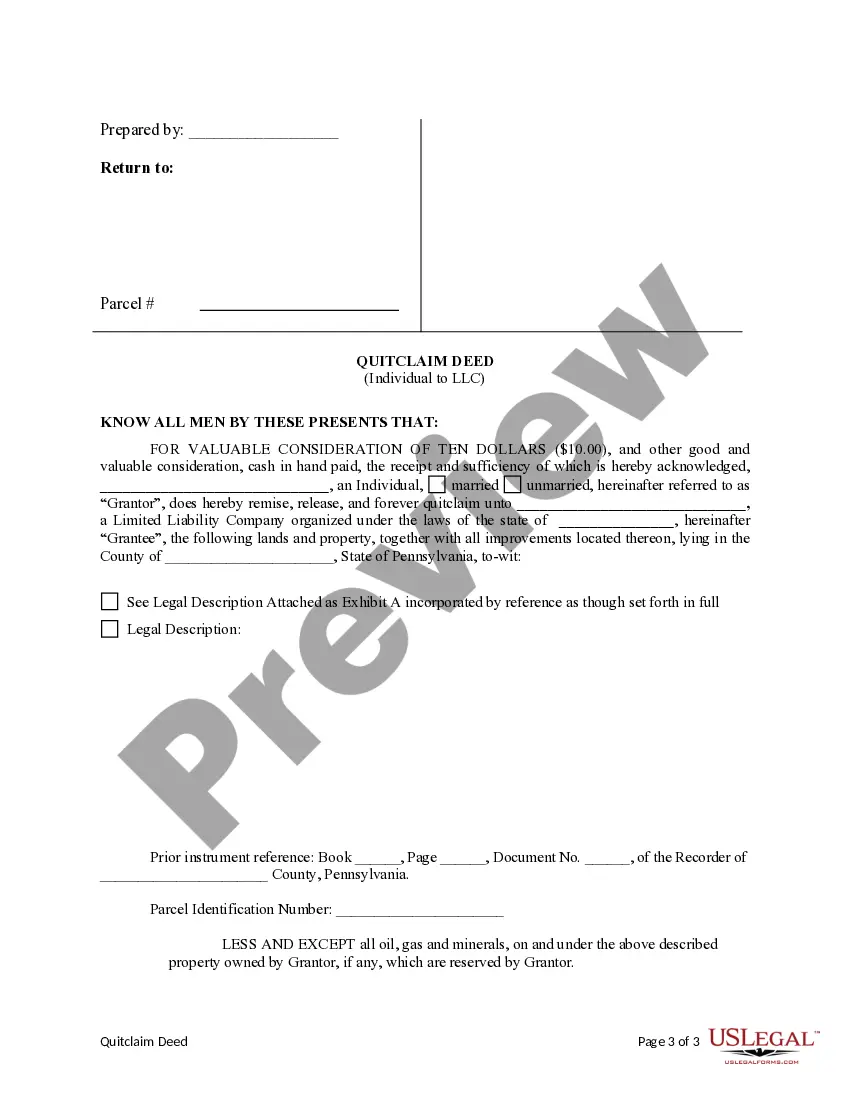

A quitclaim deed in Pennsylvania allows the granter to transfer their ownership interest in the property without guaranteeing that the title is clear. This type of deed is commonly used among family members or to correct a title issue. When you use a Pennsylvania quitclaim deed with a mortgage, it is essential to understand the implications for the mortgage liability. Always ensure that you consult with a legal expert when handling such transactions.

To create a valid deed in Pennsylvania, certain elements must be present. First, the deed must clearly identify the granter and grantee. Additionally, the legal description of the property must be accurate, and the deed must be signed by the granter. If you are transferring a property with a mortgage, you may want to consider a Pennsylvania quitclaim deed with a mortgage to ensure proper handling of the lien.

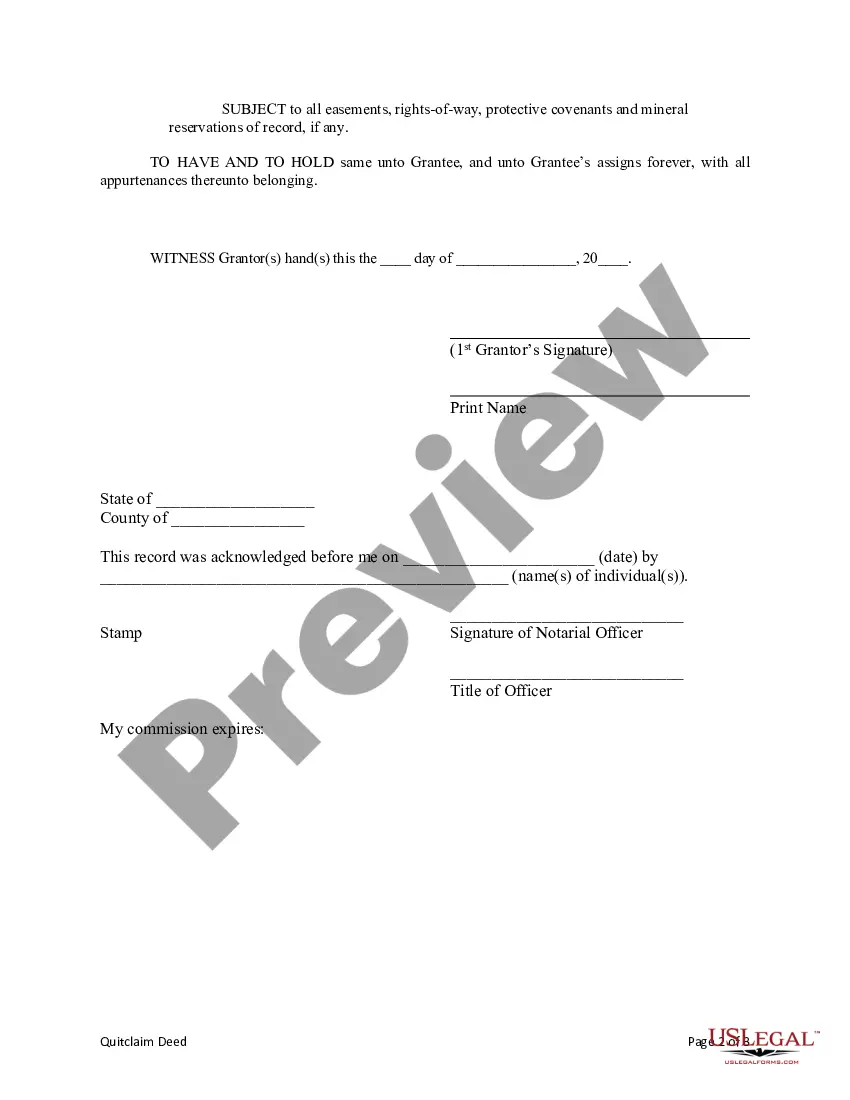

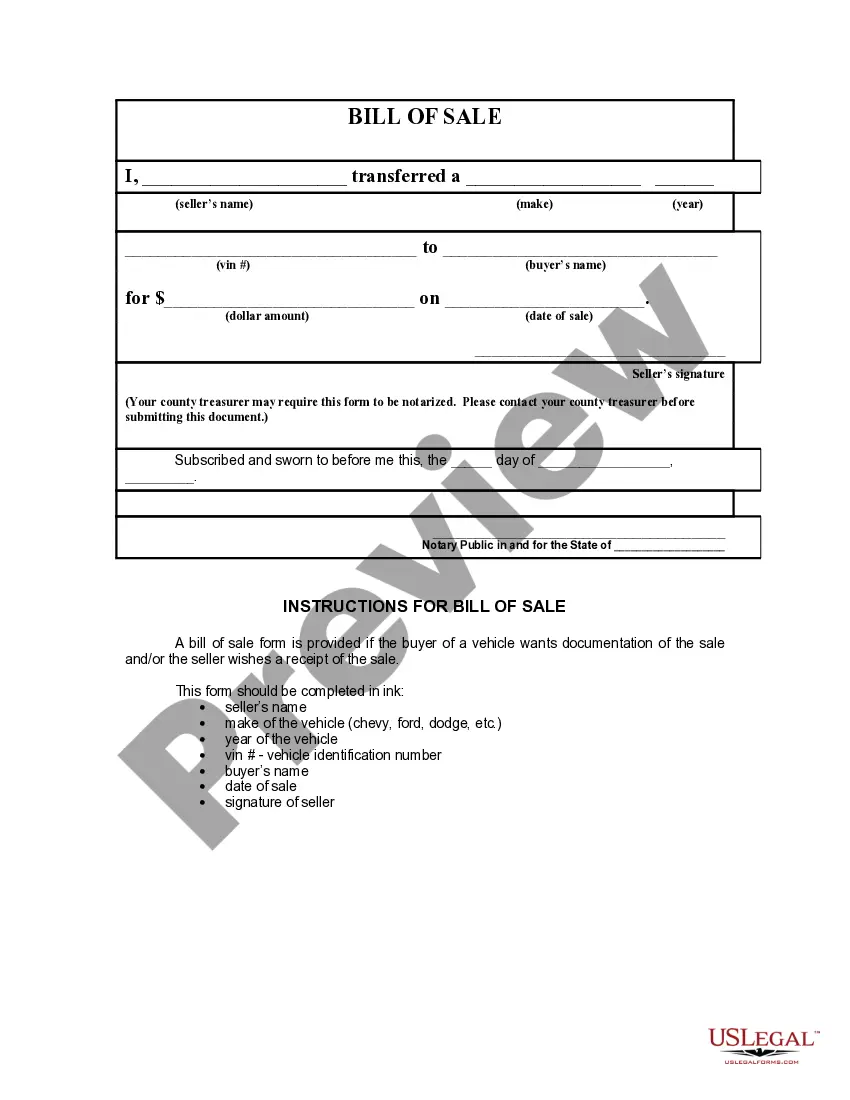

To execute a quitclaim deed in Luzerne County, PA, start by downloading or requesting the correct form for a Pennsylvania quitclaim deed. Fill it out with precise information, including the names of all parties and a clear property description. After signing the deed before a notary, file it with the Luzerne County recorder's office. If a mortgage is involved, it is wise to seek assistance from a legal service like USLegalForms to ensure compliance with local regulations.

Filing a quitclaim deed in Pennsylvania involves a few straightforward steps. First, complete the Pennsylvania quitclaim deed form accurately, ensuring all details are correct. Next, submit the completed deed to the appropriate county office where the property is located, along with any required fees. If a mortgage exists, consult with a professional to understand how it may impact the property transfer.

To fill out a Quit Claim Deed for adding someone to a home title, start by obtaining a Pennsylvania quitclaim deed form. Make sure to provide the names of the current owners and the new owner, along with the property's legal description. After filling out the necessary details, both parties should sign the document in front of a notary. Remember, this deed does not guarantee the title's quality, especially when it involves a mortgage.

Mortgage companies may accept a quitclaim deed, but this decision often depends on the lender's policies and the specific circumstances around the property. If the deed transfers ownership, the lender may require additional documentation to assess the risk involved. For clarity on your options, consider utilizing services like USLegalForms to navigate the nuances of a Pennsylvania quitclaim deed with a mortgage.

One key disadvantage of a quitclaim deed is that it does not provide any warranties regarding the title. This means the grantee may inherit liens or other claims against the property. Additionally, if you are transferrin a Pennsylvania quitclaim deed with a mortgage, you should be aware of potential issues that may arise if the property has undisclosed debts.

Individuals who are transferring property within a family, such as between spouses or parents and children, often benefit from using a quitclaim deed. This type of deed allows for a quick transfer without costly legal fees or lengthy processes. However, keep in mind that when dealing with a Pennsylvania quitclaim deed with a mortgage, both parties should understand any existing debts tied to the property.

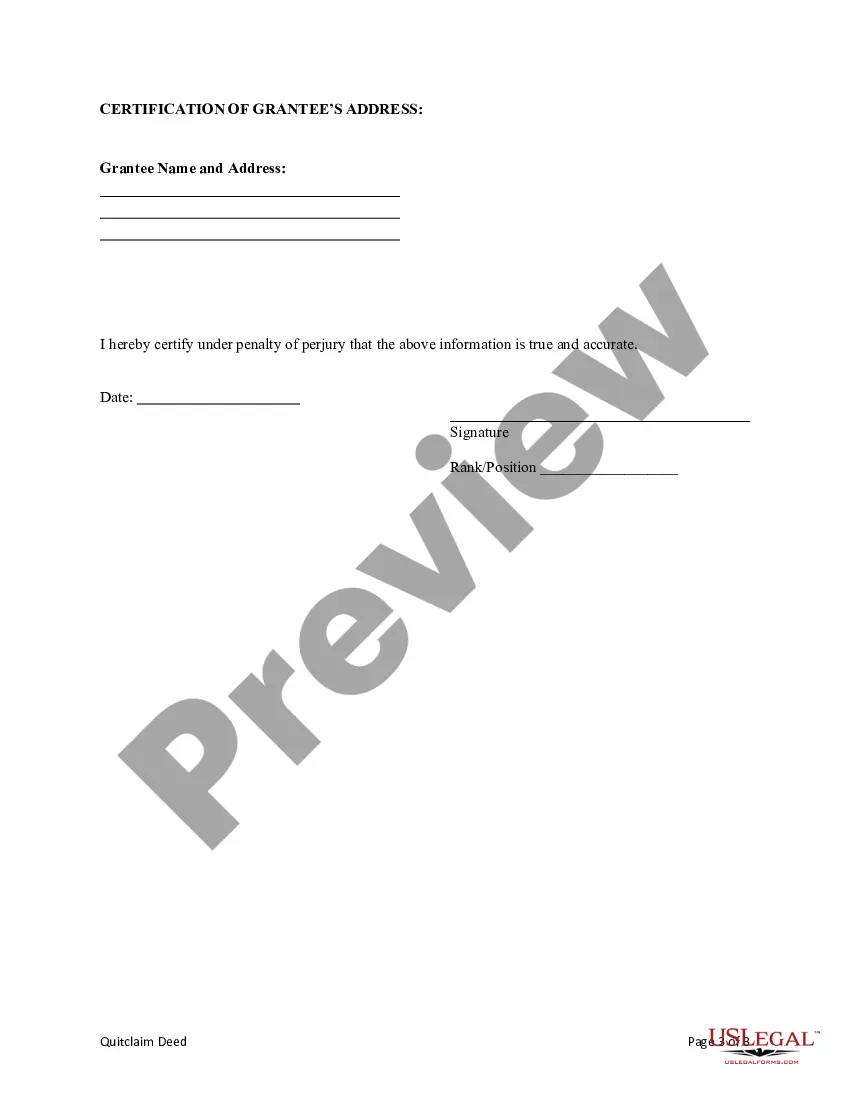

In Pennsylvania, a quitclaim deed must include the names of the grantor and grantee, a legal description of the property, and the signature of the grantor. It is also necessary for the deed to be notarized to ensure its legal validity. If you are working with a Pennsylvania quitclaim deed with a mortgage, additional documentation may be required, such as a mortgage release.