Pennsylvania Property Values

Description

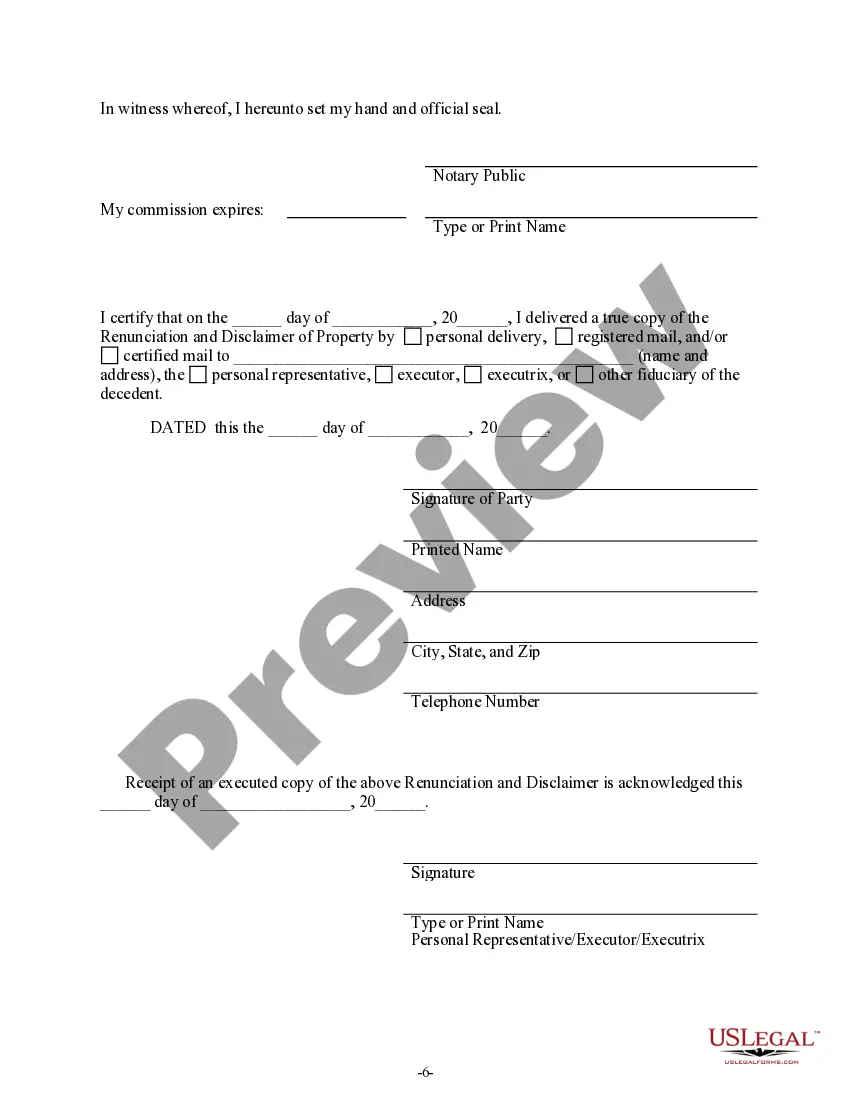

How to fill out Pennsylvania Renunciation And Disclaimer Of Property From Will By Testate?

Whether for commercial reasons or personal matters, everyone must confront legal issues at some stage in their existence.

Filling out legal documents necessitates meticulous focus, beginning with selecting the correct template.

Once downloaded, you can fill out the form using editing software or print it and complete it by hand. With a vast US Legal Forms collection at your disposal, you never need to waste time searching for the right template online. Utilize the library’s straightforward navigation to find the correct form for any scenario.

- Locate the template you require using the search bar or catalog browsing.

- Review the form’s details to confirm it aligns with your circumstances, state, and locality.

- Click on the form’s preview to view it.

- If it's the incorrect form, revert to the search feature to find the Pennsylvania Property Values template you require.

- Download the document when it fulfills your requirements.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously saved documents in My documents.

- If you don’t yet have an account, you can acquire the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the file format you desire and download the Pennsylvania Property Values.

Form popularity

FAQ

Online property value estimates can provide a good starting point but may not always be accurate. These estimates typically use algorithms based on recent sales and property features, which can lead to discrepancies. For a more reliable assessment, consider consulting real estate professionals who can provide insights tailored to your specific property. Utilizing tools to understand Pennsylvania property values will help you make informed decisions.

Yes, property records are public in Pennsylvania, allowing anyone to access information about property ownership and transactions. You can obtain these records through local government offices or online databases. By reviewing these public records, you can evaluate Pennsylvania property values and better understand the real estate landscape in your area.

To find the present value of your property, you can start by searching for recent sales of similar homes in your area. Online property valuation tools can also offer estimates based on current market conditions and property features. Additionally, consulting a real estate agent can provide a professional assessment. Understanding your property's value is crucial, especially when considering Pennsylvania property values in today's market.

Property records in Pennsylvania are indeed public. This means anyone can request to see these records, which include details about property ownership, sales history, and tax assessments. You can easily access this information through county offices or various online platforms. By reviewing these records, you can gain insights into Pennsylvania property values and market trends.

Yes, you can find out who bought a house in Pennsylvania by looking at public property records. These records include information about past transactions, including the names of buyers and sellers. To access these records, you may visit your local county's office or use online resources. Understanding Pennsylvania property values can also help you see trends based on these transactions.

Pennsylvania assesses property value through a systematic approach that includes evaluating property income, sales comparisons, and replacement costs. Each county may have specific methods and standards to determine values, making it vital to understand local processes. Utilizing resources like USLegalForms can guide you through the assessment appeals process if you disagree with your property valuation.

The assessed value in Pennsylvania may not always reflect current market value. Often, assessed values lag behind real-time market changes due to infrequent updates. Therefore, it is wise to regularly review Pennsylvania property values and engage with local assessors if you believe your assessment does not align with current market conditions.

To estimate your Pennsylvania property taxes, you can start by determining the assessed value of your property. Multiply this assessed value by your local tax rate, which is typically expressed as a percentage or a millage rate. Keep in mind that Pennsylvania property values directly affect these calculations, so staying updated on any changes is essential.

Property value in Pennsylvania is assessed based on the fair market value of the property. Local assessors evaluate properties using comparable sales data, property characteristics, and current market trends. Understanding Pennsylvania property values can help homeowners prepare for assessments and appeals if necessary.

In Pennsylvania, seniors may qualify for property tax exemptions or deductions once they reach the age of 65. However, they do not completely stop paying property taxes unless they meet certain criteria, such as being eligible for programs like the Property Tax/Rent Rebate Program. It's important for seniors to stay informed about these programs, as Pennsylvania property values can influence their tax responsibilities.