Llp Agreement

Description

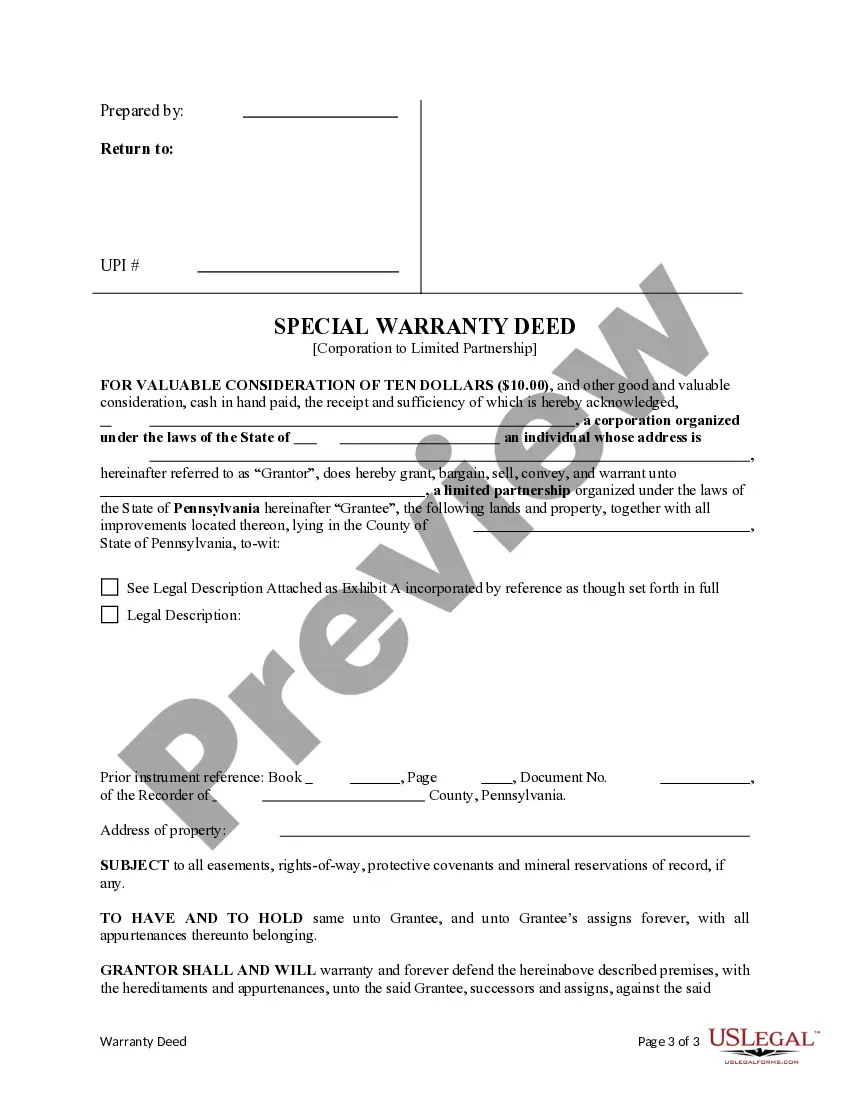

How to fill out Pennsylvania Special Warranty Deed From Corporation To Limited Partnership?

- Start by checking if you have an active account. If you're already a subscriber, simply log in and download the LLP agreement template you need.

- If you're new to US Legal Forms, begin by exploring the Preview mode and form descriptions to find a suitable LLP agreement that aligns with your specific requirements.

- Should you need a different document, utilize the Search tab at the top to find an appropriate template that matches your local jurisdiction.

- Once you select the desired form, click 'Buy Now' to choose a subscription plan that works for you. Account registration will be necessary to access our vast library.

- Proceed to make your payment using your credit card or PayPal account, completing your purchase effortlessly.

- Lastly, download the LLP agreement to your device. You can access it anytime through the My Forms section of your profile.

US Legal Forms empowers both individuals and attorneys to create workable legal documents with its extensive collection of forms. Enjoy the peace of mind knowing you're using a reliable resource for your legal needs.

Get started today and take advantage of our legal expertise to simplify your document creation process.

Form popularity

FAQ

To register an LLP in the USA, start by creating an LLP agreement that specifies the details of your partnership. Next, file the necessary paperwork with your state government, which may include registering your business name and paying applicable fees. Be aware of specific state requirements, as they can vary significantly. For efficient registration, uslegalforms provides comprehensive resources and templates to ensure your LLP agreement meets all criteria.

Yes, Limited Liability Partnerships (LLPs) exist in the USA. They offer flexibility and protection for business partners, allowing them to operate more comfortably while limiting personal liability. Each state has its own regulations regarding LLPs, so partners must familiarize themselves with these rules before forming one. By drafting a thorough LLP agreement, you can clearly define your responsibilities and guard against potential pitfalls.

To file an LLP, you need to prepare your LLP agreement, which outlines your business structure and the roles of each partner. Once your agreement is complete, you should submit it to the appropriate state agency, usually the Secretary of State. Ensure that you also meet any additional state requirements, such as obtaining a business license or permits. Using uslegalforms can streamline this process by providing you with easy-to-use templates tailored for your state.

The main difference between an LLC and an LLP lies in their structure and management flexibility. An LLC provides limited liability protection to all its members, similar to an LLP, but can also offer various management structures that might not be available in an LLP. Additionally, an LLC typically has fewer formalities and compliance requirements than an LLP. Understanding these distinctions can help you choose the right business structure, and a well-prepared LLP agreement can enhance operations in an LLP.

The primary difference between an LLP and a limited partnership is the liability protection offered to all partners in an LLP, while a limited partnership typically includes both general and limited partners. General partners in a limited partnership bear full personal liability for business obligations, whereas LLP partners enjoy limited liability. This structure supports a more favorable risk profile for all partners involved. Crafting a sound LLP agreement can clarify these roles and responsibilities.

A partnership might choose to form an LLP to gain limited liability protection, effectively shielding partners' personal assets from business debts. Additionally, forming an LLP allows for continuity in the business, even when a partner leaves or joins. The structure provides flexibility in management and tax benefits, making it an attractive option for many partnerships. The LLP agreement plays a vital role in ensuring these benefits are clearly defined and achieved.

An LLP agreement is a legal document that outlines the rights, responsibilities, and obligations of each partner in the limited liability partnership. It serves as a foundational framework that governs how the LLP operates, including profit sharing and partnership decision-making processes. Drafting a clear and detailed LLP agreement can prevent conflicts and misunderstandings among partners, creating a harmonious business environment. Platforms like uslegalforms can assist in drafting this essential agreement.

The main difference lies in the liability structure; LLPs offer limited liability to their partners, while partnerships usually entail shared personal liability. This means that in an LLP, even if the business incurs debts or legal issues, partners' personal assets are typically shielded. Understanding this distinction is fundamental when considering business structures. A comprehensive LLP agreement ensures that all partners are aware of their rights and limitations.

An LLP is a distinct legal entity separate from its partners, providing limited liability protection, unlike a traditional partnership. In a general partnership, partners share personal liability for business debts and obligations, whereas in an LLP, personal assets are generally protected. This protects individual partners from the actions of the business and offers a more secure environment for your investments. Therefore, the LLP agreement is crucial in outlining the responsibilities and liabilities of partners.

One key disadvantage of an LLP is the potential complexity of its formation and ongoing compliance requirements. Depending on the state, partners may need to file regular reports and maintain specific records, which can increase administrative burdens. This complexity can be a drawback for small business owners who seek simplicity in operations. However, a well-drafted LLP agreement can help manage these challenges effectively.