Limited Partnerships

Description

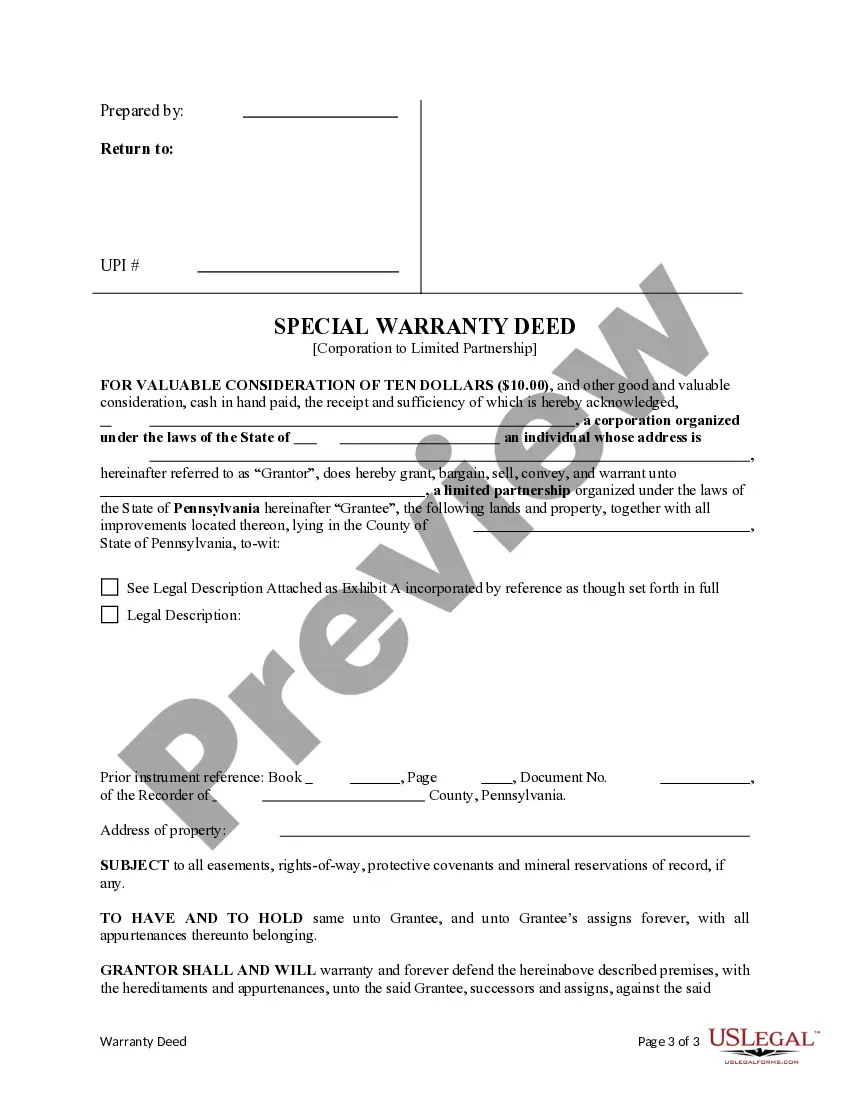

How to fill out Pennsylvania Special Warranty Deed From Corporation To Limited Partnership?

- If you're an existing user, simply log in to your account and ensure your subscription is current. Click the Download button to save your required form template.

- For first-time users, start by reviewing the available templates in the Preview mode and read the form descriptions carefully to select the correct document for your needs.

- If you can’t find what you need, use the Search tab to locate additional templates that might meet your jurisdiction’s requirements.

- Once you've selected the right document, click on the Buy Now button, choose your preferred subscription plan, and create an account for access to the extensive library.

- Complete your purchase by entering your payment information, whether it’s a credit card or PayPal account.

- Finally, download your form directly to your device. You can access it anytime via the My Forms menu in your profile.

Using US Legal Forms empowers you and your legal representatives to efficiently generate legal documents tailored to your specific needs.

Start your journey towards successful limited partnerships today by registering with US Legal Forms for access to their vast library.

Form popularity

FAQ

One clear example of a limited partnership is a large law firm. In this case, the senior partners often act as general partners, assuming responsibility for managing the firm’s operations and client relations. Meanwhile, junior partners or associates who invest in the firm can enjoy the advantages of limited partnerships, sharing in the profits without full managerial duties, illustrating the effective use of this business structure.

To form a limited partnership, start by choosing a unique name that complies with your state’s naming rules. Next, file a Certificate of Limited Partnership with your state’s business filing office, providing details about the partners and the nature of the business. After successfully registering, it is wise to create a partnership agreement outlining the roles, responsibilities, and profit-sharing arrangements of each partner to avoid future conflicts.

An example of a limited partnership can be found in many real estate ventures. In such a scenario, a general partner manages the property, making daily decisions and handling expenses, while limited partners invest capital without engaging in management. This structure helps attract more funding, as investors can see limited partnerships as a way to reduce personal risk while still gaining returns.

A limited partnership consists of at least one general partner and one limited partner. The general partner manages the business and assumes personal liability, while limited partners contribute capital and receive a share of the profits but do not take part in management. This structure allows for greater investment while protecting limited partners from liability, making limited partnerships an appealing option for many investors.

Filling out a partnership form is straightforward. First, gather all the required information about the partners, including names, addresses, and roles. Next, ensure you understand the type of partnership you are forming, such as limited partnerships, and fill in the necessary details accurately. Consider using platforms like US Legal Forms for guidance and templates to simplify the process.

A limited partnership refers to a business structure that includes at least one general partner and one limited partner. The general partner manages the business and bears full liability, while the limited partner enjoys limited liability and does not engage in day-to-day operations. This setup allows investors to contribute capital without risking more than their investment, making limited partnerships an appealing choice for many.

Examples of limited partnerships include real estate investment companies and private equity firms. These firms often feature general partners who manage the investments and limited partners who contribute capital but do not manage operations. By consolidating resources in limited partnerships, these business structures can take advantage of various investment opportunities while offering some safety to investors.

The key difference between a Limited Partnership (LP) and a Limited Liability Company (LLC) lies in their management and liability structures. In an LP, there are both general partners who manage the business and assume full liability, while limited partners have restricted involvement and liability. Conversely, an LLC offers a more universal protection model where all members enjoy limited liability, regardless of their level of involvement.

Someone may choose a limited partnership for several reasons, including the ability to raise capital while limiting personal liability. This structure allows general partners to actively manage the business, while limited partners can invest without being involved in daily operations. This balance between control and liability makes limited partnerships an attractive option for many investors.

A typical example of a Limited Liability Partnership (LLP) is a law firm where partners wish to limit their liabilities while maintaining flexibility in management. In this structure, individual partners are not personally responsible for another partner's negligence or misconduct. Limited partnerships can incorporate this LLP model to offer protection and clear operational guidelines.