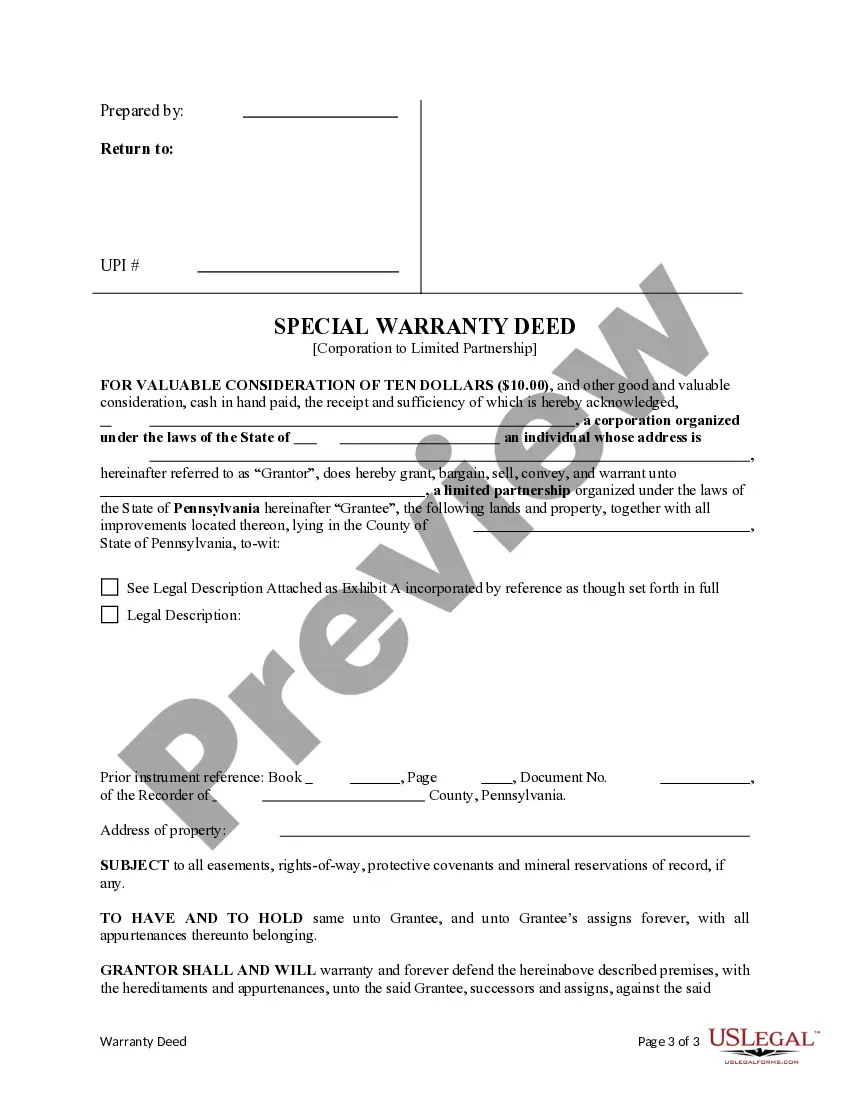

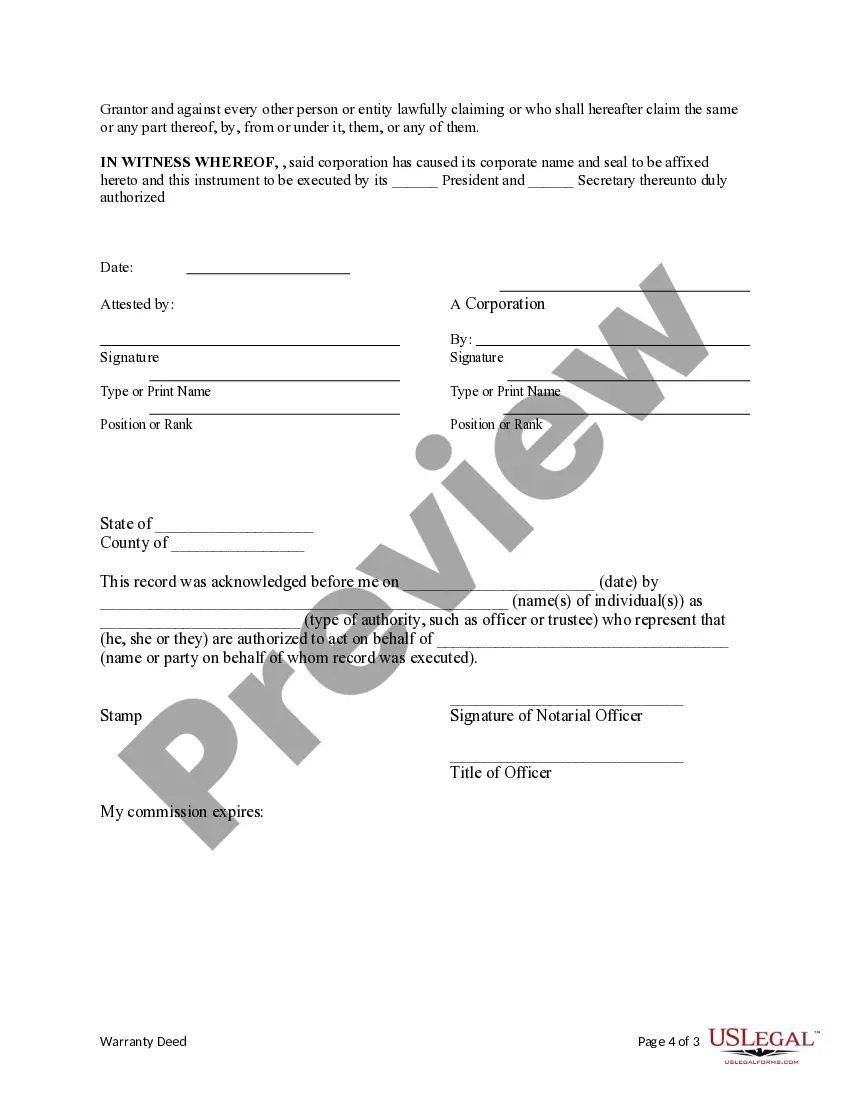

This form is a Special Warranty Deed where the Grantor is a corporation and the Grantee is a limited partnership. Grantor conveys and specially warrants the described property to the Grantee. The Grantor only warrants and will defend the property only as to claims of persons claiming by, through or under Grantor, but not otherwise. This deed complies with all state statutory laws.

Limited Partnership Agreement

Description

How to fill out Pennsylvania Special Warranty Deed From Corporation To Limited Partnership?

- Log in to your US Legal Forms account if you're a returning user. Check your subscription validity and refresh it if necessary.

- Preview the form to confirm it meets your requirements, ensuring compliance with your local jurisdiction.

- If you need a different form, utilize the search function to locate the correct template.

- Select the document by clicking the 'Buy Now' button and choose your preferred subscription plan. Create an account for full access.

- Complete your purchase using your credit card or PayPal for swift access to premium resources.

- Download the form to your device, enabling you to fill it out, and find it anytime in the 'My Forms' section of your profile.

By following these steps, you can easily navigate the process of obtaining a limited partnership agreement while benefiting from the extensive resources provided by US Legal Forms.

Don’t hesitate! Start streamlining your legal document preparations today by visiting US Legal Forms.

Form popularity

FAQ

The structure of a partnership agreement typically includes an introduction, definitions of key terms, roles of partners, profit distribution, and terms for dissolution. Each section should clearly outline the expectations and responsibilities of partners. By having a well-defined limited partnership agreement, all parties can operate with clarity and confidence.

A good example of a limited partnership is a business venture where one partner is the general partner, actively managing the business, while the others are limited partners, providing capital but not participating in daily operations. This structure allows for investment while limiting personal liability for the limited partners. Establishing a clear limited partnership agreement can help define these roles.

To fill out a partnership form, start by gathering the required information about your business and partners. Clearly indicate each partner's name, address, and contribution to the partnership. Finally, make sure to read through the completed limited partnership agreement for accuracy before submission, ensuring compliance with any local regulations.

A partnership agreement should include the details of each partner, profit-sharing ratios, and how decisions will be made. It is also important to outline procedures for adding or removing partners and addressing potential conflicts. A well-structured limited partnership agreement will support smooth business operations and clarify each partner's rights.

Yes, you can create your own partnership agreement. However, it's advisable to use templates or services that offer legal guidance to ensure your limited partnership agreement adheres to state laws. Taking the time to draft a thoughtful agreement can prevent misunderstandings and protect your interests in the long run.

Filling out a partnership agreement involves several steps. First, outline the names and addresses of the partners involved. Next, specify the roles and responsibilities each partner will have, as well as how profits and losses will be shared. It's essential to ensure that all necessary details are included to create a valid limited partnership agreement.

Starting a limited partnership can be quite simple with the right tools at your disposal. The key steps include drafting a limited partnership agreement and filing your formation documents with the state. Platforms such as US Legal Forms can make this process seamless, guiding you through each requirement and helping you avoid common pitfalls.

To establish a limited partnership, start by creating a comprehensive limited partnership agreement that defines contributions, profit sharing, and the powers of each partner. Next, register the partnership by filing the necessary documents with your state’s business office. Utilizing resources like US Legal Forms can streamline this process and help ensure compliance with state regulations.

The biggest disadvantage of limited partnerships is that general partners have unlimited personal liability for business debts. This means that if the partnership faces financial issues, general partners may risk personal assets. It’s crucial to weigh this risk against the benefits outlined in the limited partnership agreement before proceeding.

Yes, forming a limited partnership can be relatively straightforward, especially if you use a service like US Legal Forms. By drafting a clear limited partnership agreement and completing the required filings, you can establish your partnership with minimal hassle. However, it's essential to understand the legal and financial implications to ensure a smooth process.