Limited Partnership

Description

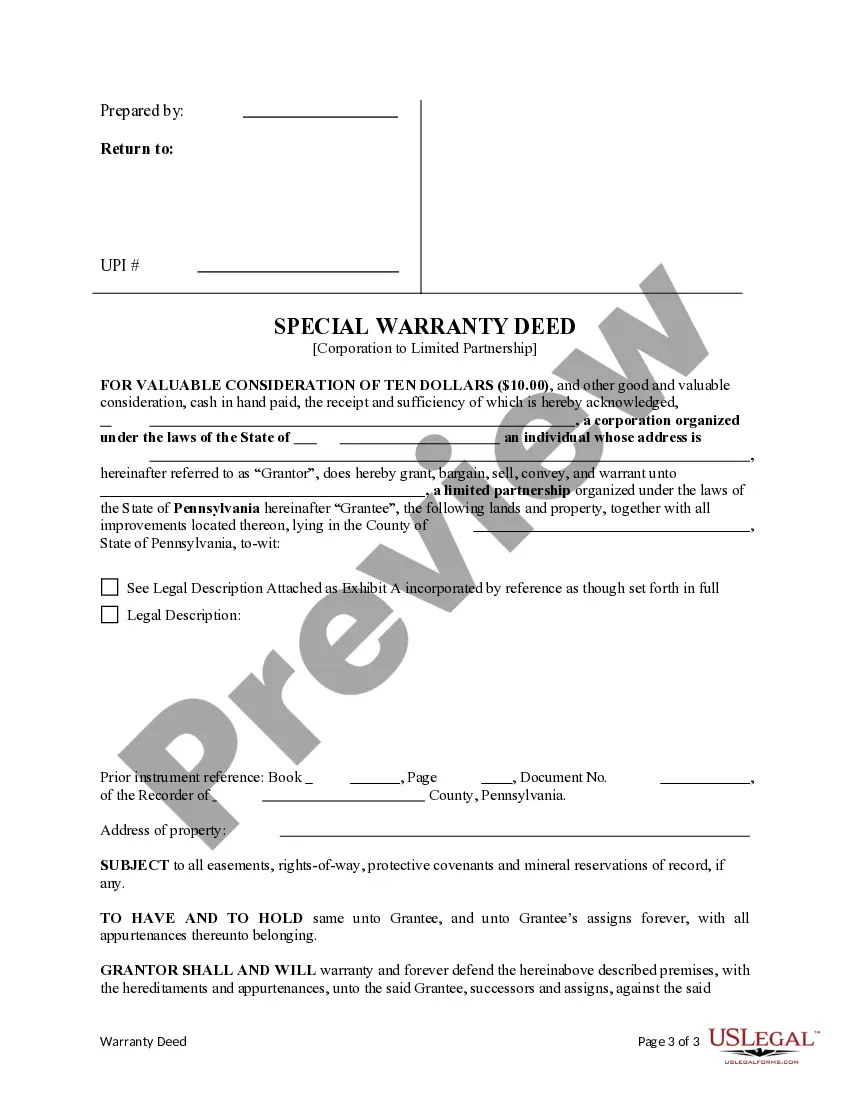

How to fill out Pennsylvania Special Warranty Deed From Corporation To Limited Partnership?

- Log in to your existing US Legal Forms account and ensure your subscription is active. If not, renew it according to your plan.

- Check the Preview mode to review the limited partnership form description, confirming it meets your jurisdictional needs.

- If you need additional templates, utilize the Search tab to locate the appropriate form. Once confirmed, proceed to the next step.

- Select the form by clicking the Buy Now button, then choose your preferred subscription plan and register for an account.

- Complete your purchase by entering your payment details via credit card or PayPal to finalize your subscription.

- Download your limited partnership form directly to your device for completion, and access it anytime via the My Forms section in your account.

In conclusion, US Legal Forms makes it easier to establish a limited partnership with its extensive library and expert support. Take a moment to explore their offerings and streamline your legal documentation process.

Get started today by visiting US Legal Forms!

Form popularity

FAQ

A limited partnership must have at least one general partner and one limited partner. The general partner assumes full control and liability for the business, while limited partners enjoy protection from personal liability. Additionally, it is essential to comply with state-specific regulations, which often include filing a written agreement and a certificate of limited partnership.

To form a limited partnership, you must file a certificate with the appropriate state authority, which typically includes the partnership's name, address, and details about general and limited partners. Additionally, you should draft a partnership agreement that states the rights and responsibilities of each partner. Meeting these requirements creates a legal framework that supports your limited partnership's operations.

The three essential elements of a partnership are: the mutual agreement among partners, the sharing of profits and losses, and the intention to operate a business. In a limited partnership, these elements apply differently based on the roles of general and limited partners. Understanding these elements is crucial for successfully establishing and managing a limited partnership.

To fill out a partnership agreement for a limited partnership, start by identifying all partners involved and their roles. Clearly outline the contribution of each partner, both financial and operational, along with profit-sharing arrangements. Additionally, ensure to specify procedures for dissolving the partnership and handling disputes, making it beneficial for all parties involved.

A limited partnership features at least one general partner who has unlimited liability and one or more limited partners whose liability is confined to their investment. This type of partnership provides flexibility in management and protects the limited partners from operational risks. Furthermore, it allows the limited partners to invest without having to take active roles in the business.

A limited partnership involves two types of partners: general partners and limited partners. For instance, if you start a restaurant, you might be the general partner managing daily operations, while an investor can be a limited partner who provides funds without participating in management. This structure allows for both investment and management control while protecting limited partners from personal liability.

The key difference between a limited partnership and an LLC lies in the roles and liabilities of the members. In a limited partnership, there are both general and limited partners, while an LLC protects all members from personal liability. Additionally, LLCs offer more flexibility in management and tax treatment. If you are considering a business structure, understanding these distinctions will help you select the option that best aligns with your operational and financial goals.

An LP, or Limited Partnership, consists of general and limited partners with distinct roles and liability protections. An LLP, or Limited Liability Partnership, involves partners who share equal management responsibilities and limited personal liability. While LPs limit liabilities of some partners, LLPs protect all partners from personal risk. Choosing between these structures depends on your business goals and how you want to distribute responsibilities and risks among partners.

A limited partnership is a legal business entity that provides a framework for collaboration between general and limited partners. Generally, general partners handle day-to-day operations, while limited partners offer capital and support without being involved in management. This structure can facilitate tailored investment arrangements that benefit all parties. By utilizing the limited partnership structure, you can protect your personal assets while maximizing business opportunities.

The term limited partnership refers to a business arrangement that consists of at least one general partner and one limited partner. General partners manage the business and assume personal liability, while limited partners contribute capital and enjoy liability protection against business debts. This structure allows you to leverage the expertise of general partners while attracting financial backing from limited partners. Essentially, it balances risk and responsibility effectively.