Pennsylvania Correction Pa Form Pa-100

Description

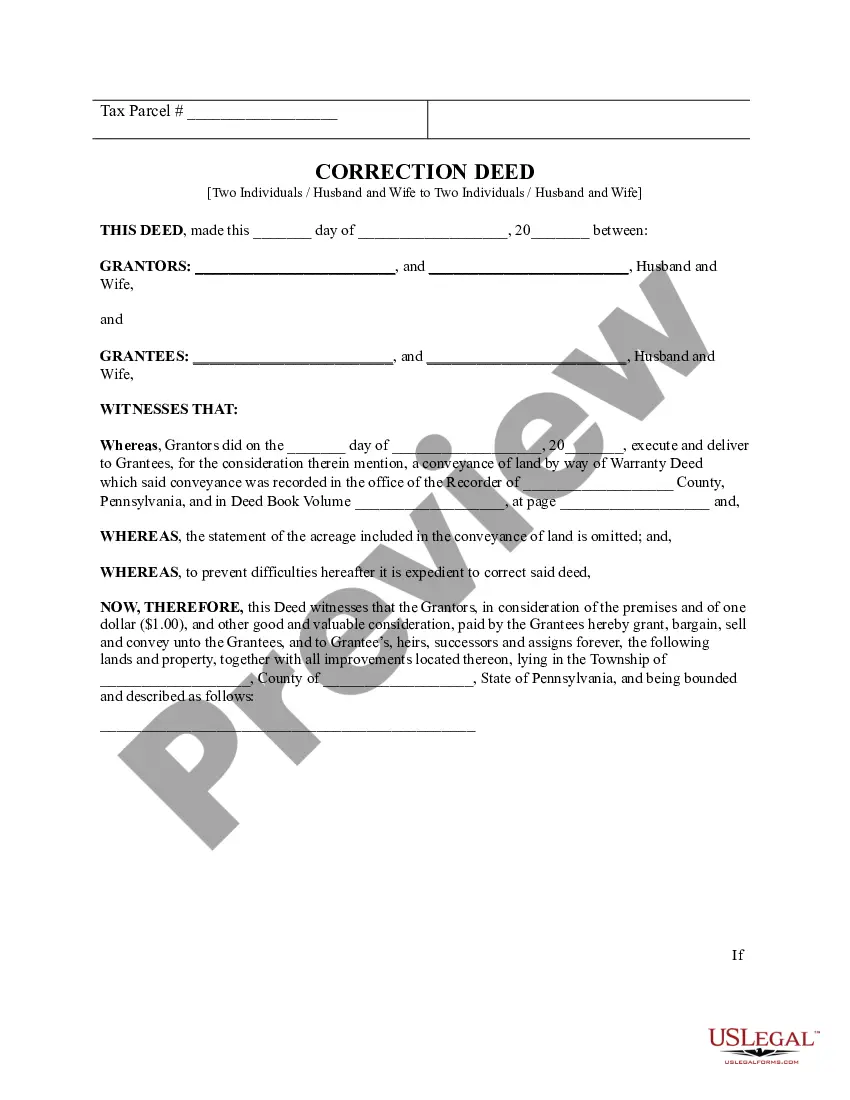

How to fill out Pennsylvania Correction Deed -?

Utilizing legal document examples that adhere to federal and state laws is crucial, and the internet provides numerous choices to consider.

However, what's the advantage of spending time searching for the accurately prepared Pennsylvania Correction Pa Form Pa-100 sample online when the US Legal Forms digital library already has such documents consolidated in one location.

US Legal Forms stands as the largest online legal repository featuring over 85,000 fillable templates created by attorneys for various business and personal matters.

If you are unfamiliar with our website, adhere to the following instructions.

- They are straightforward to navigate with all documents organized by state and intended use.

- Our experts keep pace with legislative changes, ensuring your form is always current and compliant when obtaining a Pennsylvania Correction Pa Form Pa-100 from our platform.

- Acquiring a Pennsylvania Correction Pa Form Pa-100 is simple and swift for both existing and new users.

- If you possess an account with an active subscription, Log In and retrieve the document sample you need in the appropriate format.

Form popularity

FAQ

Check or Money Order Carefully enter the amount of the payment. Make the check or money order payable to the PA DEPARTMENT OF REVENUE. Please write on the check or money order: The last four digits of the primary taxpayer's SSN; ? "2022 PA-40 V"; and ? Daytime telephone number of the taxpayer(s).

If you do not feel secure sending this information via the Internet, contact the Customer Experience Center at 717-787-8201. 3. Mail your change of address information to the address below. Be sure to include your first and last name, Social Security Number, new address and your telephone number.

New businesses file PA-100 to set up state tax accounts. Existing businesses file PA-100 to add or amend state tax accounts.

If you need to change or amend an accepted Pennsylvania State Income Tax Return for the current or previous tax year you need to complete Form PA-40 and Schedule PA-40X (explanation for amended return) for the appropriate Tax Year. Form PA-40 is used for the Tax Return and Tax Amendment.

How do I change my address on my personal income tax account? You may update your address through myPATH by creating a profile as a new user or logging into your existing myPATH account. Click on the "Submit a Question" tab above. ... Mail your change of address information to the address below.