Lien Letter Template For Car

Description

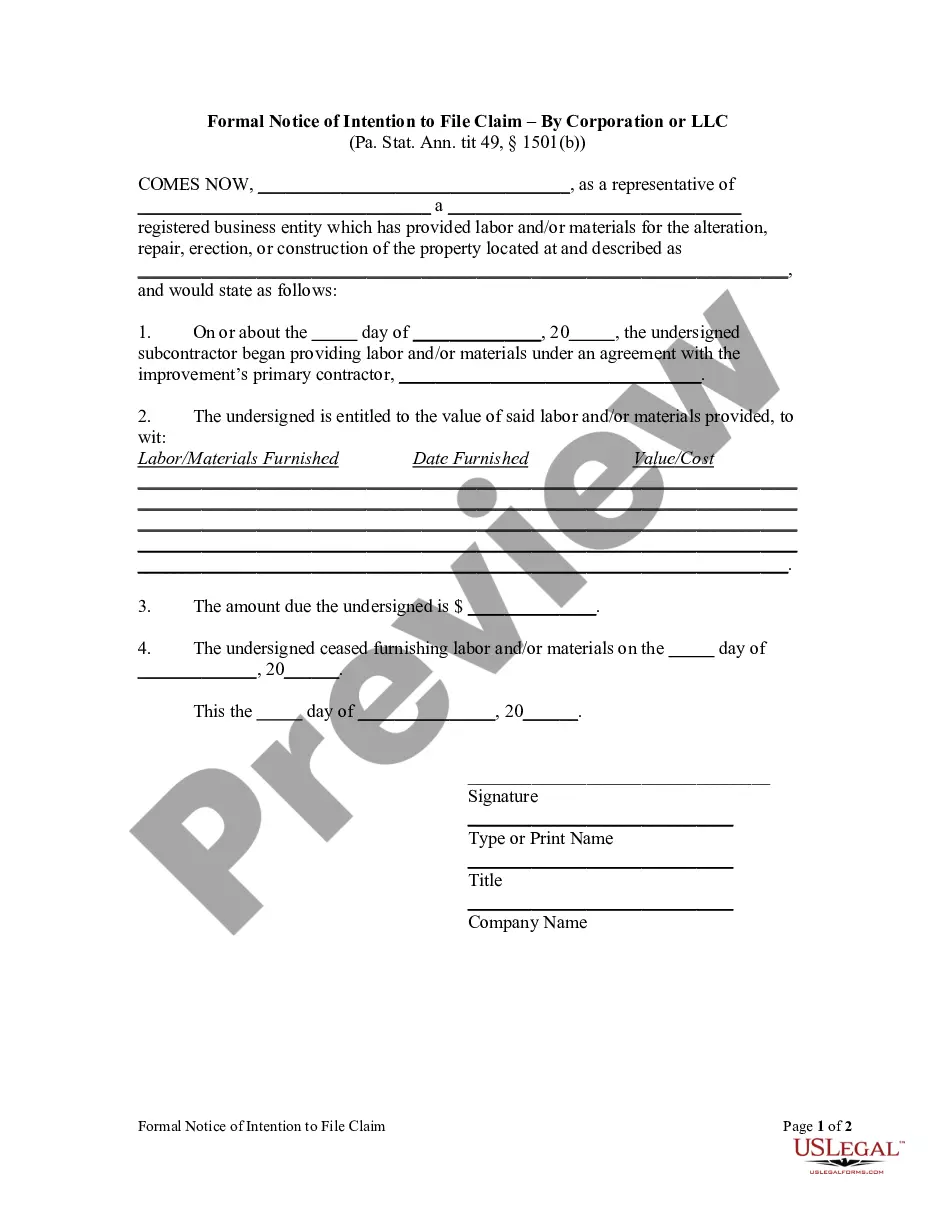

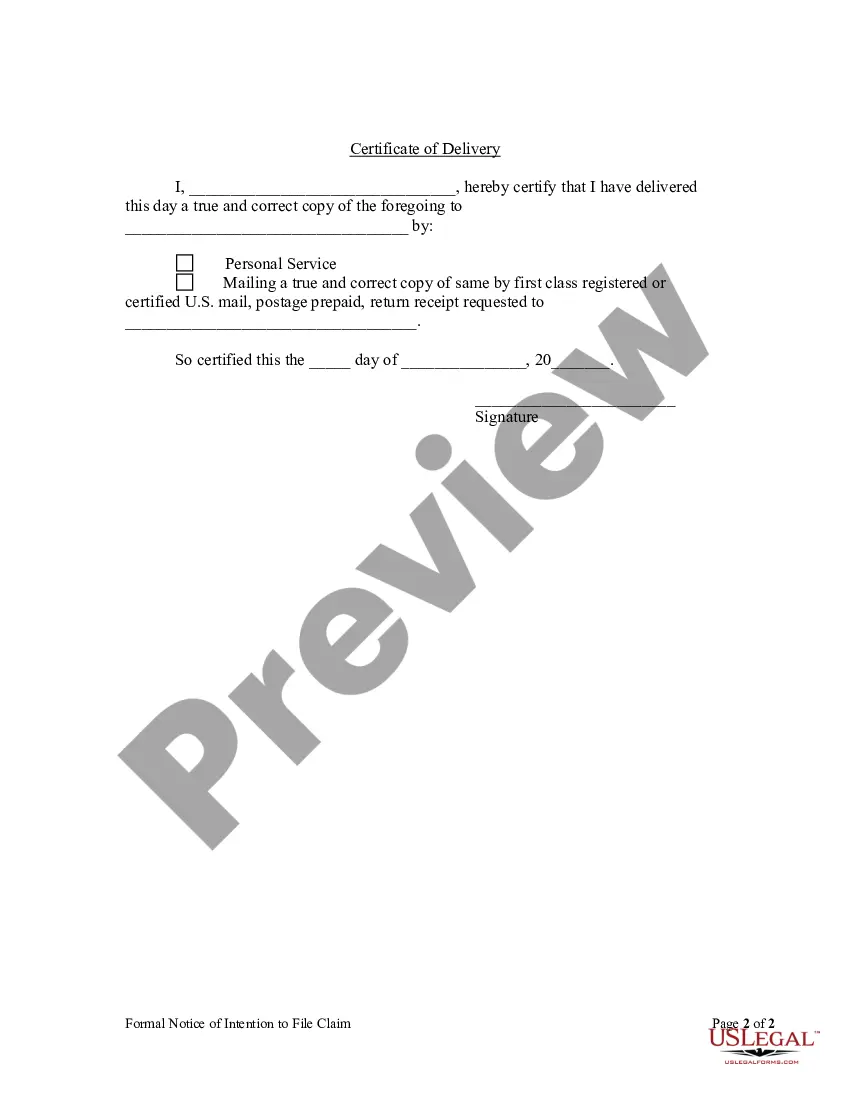

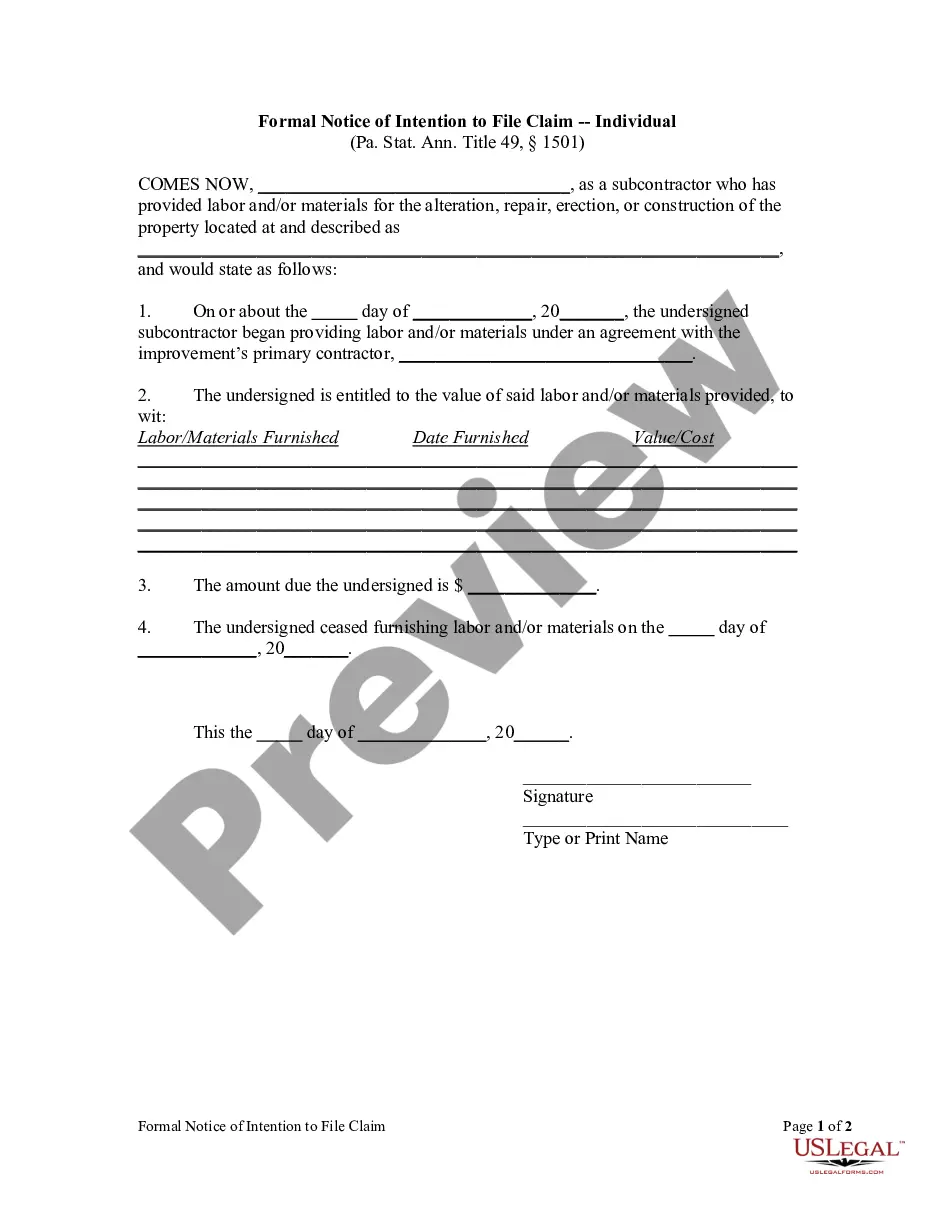

How to fill out Pennsylvania Formal Notice Of Intent To File Lien By Corporation?

It's clear that you cannot instantly become a legal expert, nor can you swiftly master how to create a Lien Letter Template For Car without possessing a specialized skill set.

Assembling legal documents is a lengthy process that requires particular education and abilities. So why not entrust the development of the Lien Letter Template For Car to the experts.

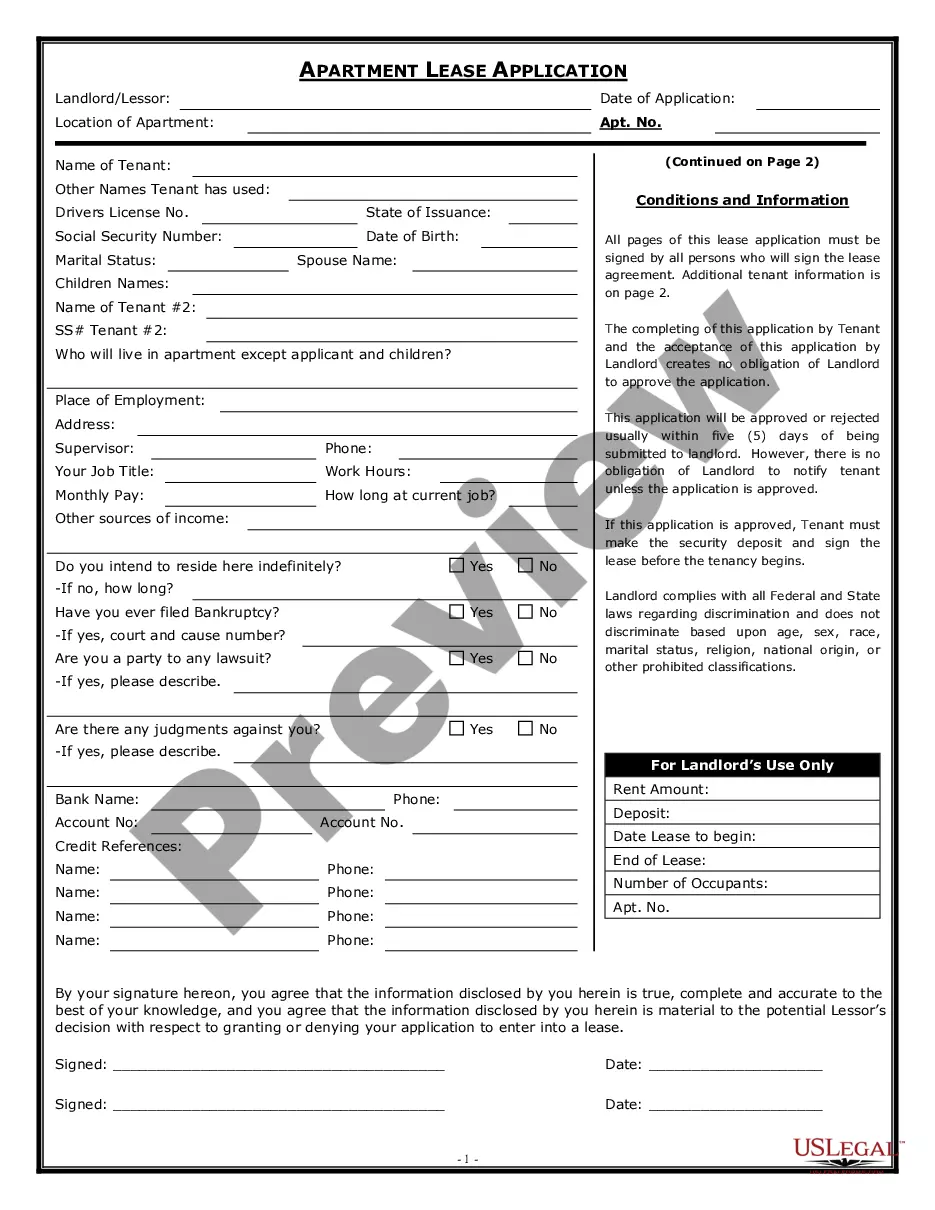

With US Legal Forms, one of the most extensive legal document repositories, you can locate anything from court filings to templates for internal communication.

If you need a different form, start your search again.

Create a free account and select a subscription plan to buy the form. Click Buy now. After completing the payment, you can access the Lien Letter Template For Car, fill it out, print it, and send or mail it to the relevant parties or organizations.

- We understand the significance of compliance and adherence to federal and state laws and regulations.

- That’s why all templates on our site are location-specific and current.

- Start by visiting our website and obtain the document you require in just a few minutes.

- Find the document you need using the search bar at the top of the page.

- Preview it (if this option is available) and review the accompanying description to determine if the Lien Letter Template For Car meets your needs.

Form popularity

FAQ

The time it takes to receive a lien release letter can vary depending on several factors. Generally, once you submit the necessary documents and payment, you can expect to receive the lien release letter within a few days to a couple of weeks. If you want to simplify the process, consider using a lien letter template for car from UsLegalForms. This template can help ensure that you provide all required information, potentially speeding up the processing time.

In Virginia, you typically have a period of five years to file a lien against a vehicle. This timeframe begins from the date the debt becomes due. If you require assistance, US Legal Forms provides a lien letter template for car that you can customize to meet your needs. Be proactive in filing the lien to protect your interests and avoid complications.

To obtain a lien release letter for your car, you should contact the entity that holds the lien. If you used a lien letter template for car to secure the lien, this document can also guide you through the release process. Once the debt is settled, request a formal lien release letter from the lender, and ensure it is filed with your local DMV. This step is crucial to clear the title and prove that you own the vehicle outright.

To put a lien on a vehicle, you need to complete specific legal steps. First, you should create a lien letter template for car that includes essential details such as the owner's information, the vehicle identification number, and the reason for the lien. After you prepare the document, file it with your local Department of Motor Vehicles, or DMV, to officially register the lien. This process ensures your legal claim on the vehicle is recognized.

To place a lien, you need specific information, including the lien letter template for car, vehicle identification details, and proof of the debt owed. You will also need to comply with state laws regarding lien registration. This ensures that your claim is legally recognized and enforceable.

Putting a lien on a vehicle title involves submitting a lien application to the appropriate state authority, usually the DMV. You will need to include the lien letter template for car, which provides essential details of your claim. It is vital to ensure that all documentation is complete to avoid delays in processing.

To add a lien to a vehicle title, you will need to complete a lien application through your local Department of Motor Vehicles. Accompany this application with the lien letter template for car, which details your claim. Once submitted, the DMV will process your request and update the title accordingly.

Yes, someone can put a lien on your car without your knowledge, especially if they have a valid reason, such as unpaid debts. This is why it is essential to monitor your vehicle’s title regularly. Utilizing tools or services that help you track your vehicle's title status can prevent unexpected surprises.

Yes, you can file a lien without a lawyer. By using a lien letter template for car, you can create the necessary documents yourself. However, it is wise to understand your state's requirements to ensure that your filing is valid and legally binding.

If someone puts a lien on your vehicle, it means they have a legal claim to it until their debt is satisfied. This can affect your ability to sell or transfer the vehicle, as the lien must be cleared first. Furthermore, it may impact your credit score, so addressing any liens promptly is advisable.