Pennsylvania Corporation Pa Withholding

Description

How to fill out Pennsylvania Bylaws For Corporation?

It’s clear that you cannot become a legal expert right away, nor can you comprehend how to swiftly create Pennsylvania Corporation Pa Withholding without a specialized array of expertise.

Drafting legal documents is an extensive undertaking that necessitates specific training and abilities. So why not entrust the creation of the Pennsylvania Corporation Pa Withholding to the experts.

With US Legal Forms, one of the most comprehensive legal template libraries, you can locate everything from court documents to templates for internal communication.

You can regain access to your documents from the My documents tab at any time. If you’re a current client, you can simply Log In and find and download the template from the same tab.

Regardless of the intent of your documents—financial, legal, or personal—our website has you covered. Try US Legal Forms today!

- Search for the document you require using the search bar located at the top of the page.

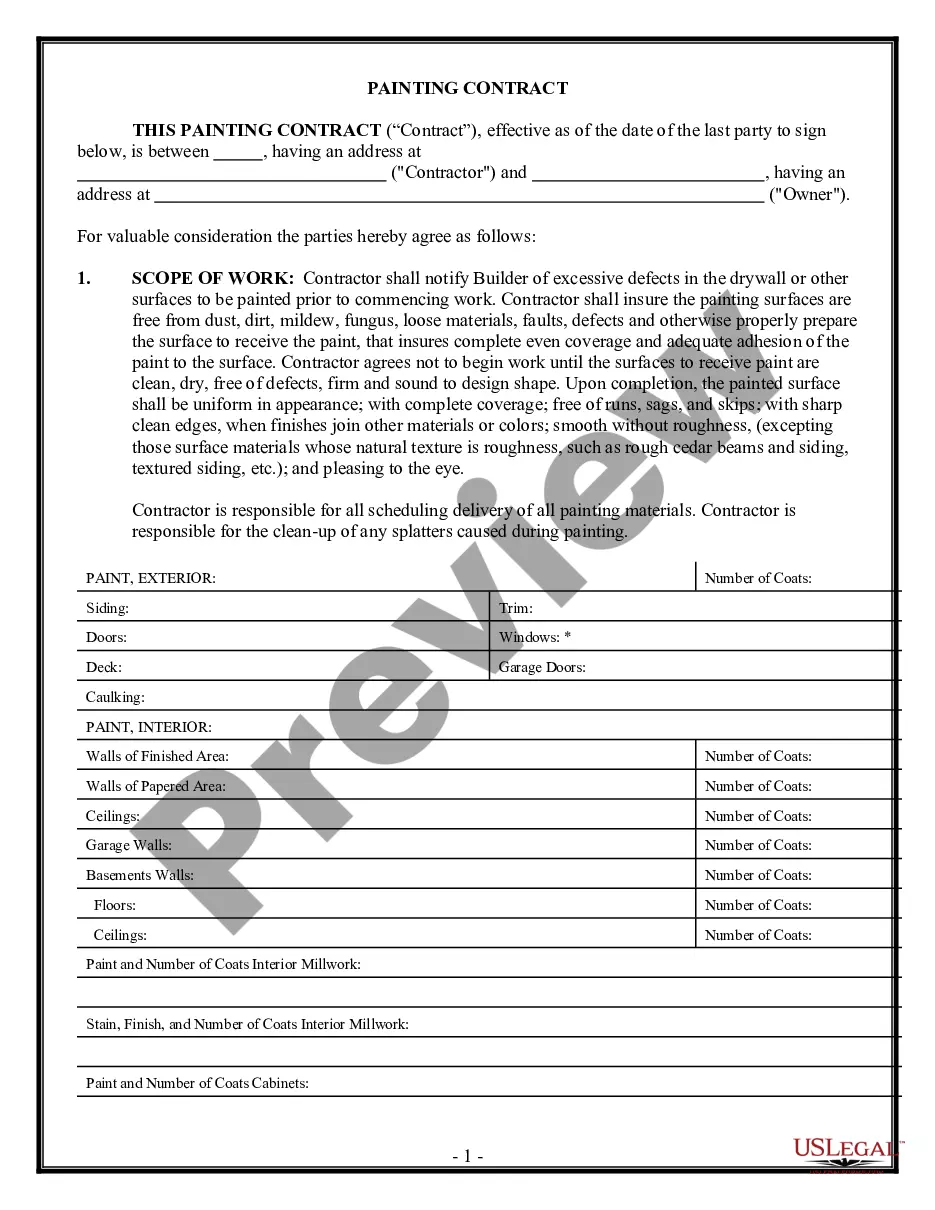

- Preview it (if this option is available) and read the supporting description to determine if Pennsylvania Corporation Pa Withholding is what you need.

- Restart your search if you require a different template.

- Create a free account and choose a subscription plan to acquire the template.

- Click Buy now. Once the payment is processed, you can obtain the Pennsylvania Corporation Pa Withholding, complete it, print it, and send or mail it to the appropriate recipients or organizations.

Form popularity

FAQ

For non-residents working in Pennsylvania, the state withholding rate remains the same at 3.07%. However, it is important for employers to ensure that they correctly withhold this amount from non-resident wages. Proper compliance with Pennsylvania corporation PA withholding laws helps avoid penalties and ensures that all tax obligations are met.

Pennsylvania Individual Tax The Pennsylvania individual income tax withholding rate remains at 3.07% for 2021.

REV-419 Employee's No withholding Application Certificate (Pennsylvania) ? The REV- 419 form helps the employer withhold the correct state income tax from the employee's pay, should the employee wish to withhold a different amount for state taxes.

If you intend to make your payment by check, please make the check payable to the PA Department of Revenue. Note on the check your PA Employer Account Identification Number, your Federal Employer Identification Number or Revenue ID, and the tax period begin and end dates.

Definition of an Employer Employers are required to withhold PA personal income tax at a flat rate of 3.07 percent of compensation from resident and nonresident employees earning income in Pennsylvania. This rate remains in effect unless you receive notice of a change from the Department of Revenue.

Register for Employer Withholding online by visiting mypath.pa.gov. Registering online allows business owners to withhold employer taxes with the Pennsylvania Department of Revenue and open Unemployment Compensation accounts administered by the Pennsylvania Department of Labor & Industry.