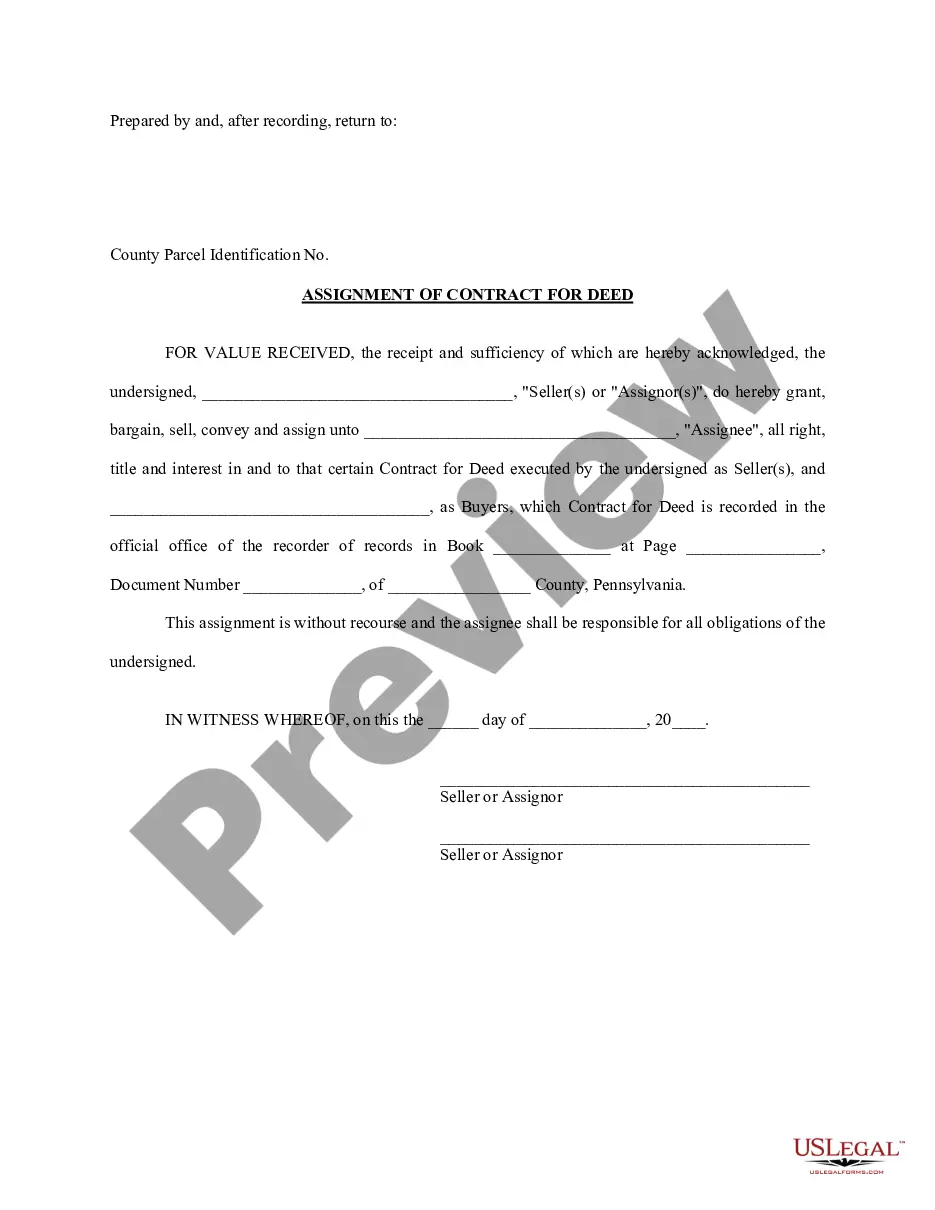

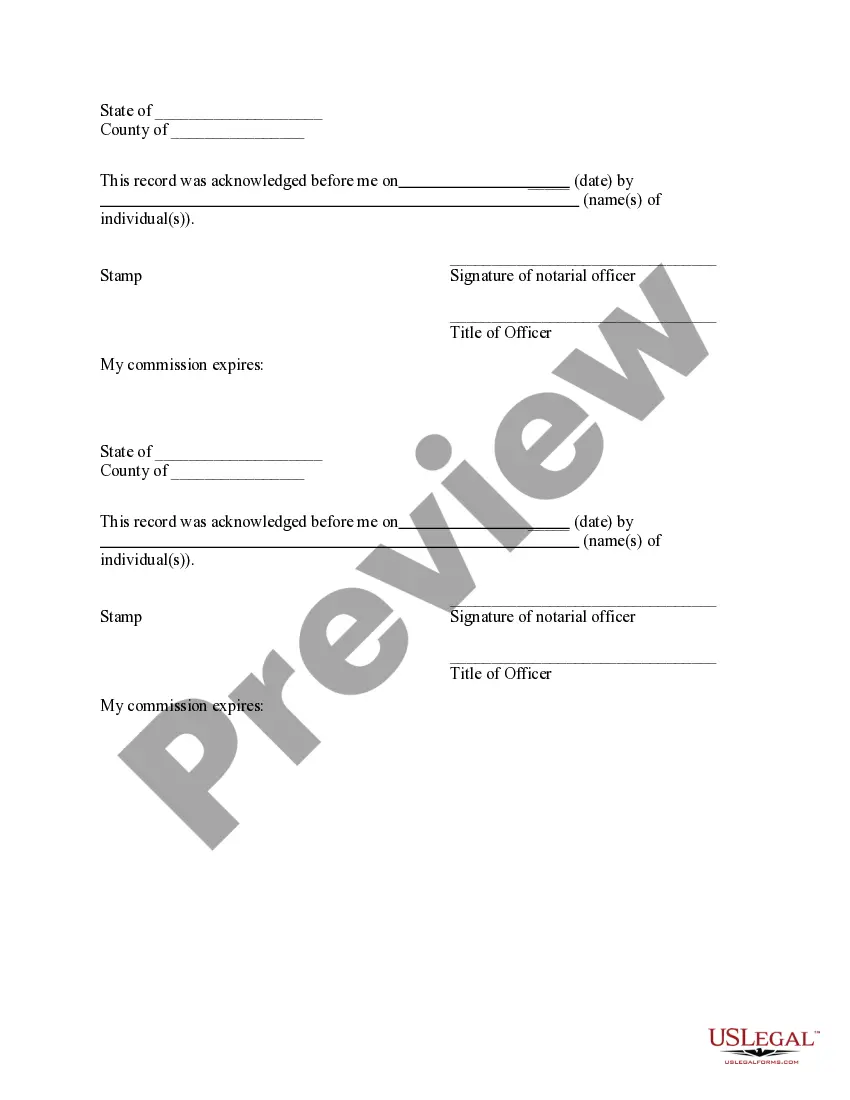

Assignment Of Contract Pennsylvania Withholding Form

Description

How to fill out Pennsylvania Assignment Of Contract For Deed By Seller?

What is the most dependable service to obtain the Assignment Of Contract Pennsylvania Withholding Form and other up-to-date versions of legal documents.

US Legal Forms is the solution! It features the largest assortment of legal templates for any purpose.

If you yet do not have an account with our library, here are the steps you need to follow to create one: Verify form compliance. Prior to acquiring any template, ensure that it aligns with your case requirements and your state or county regulations. Review the form description and use the Preview option if provided. Search for alternatives. If there are discrepancies, use the search bar at the page header to locate a different template. Click Buy Now to select the correct one. Registering and acquiring a subscription. Choose the best pricing plan, Log In or create an account, and pay for your subscription through PayPal or credit card. Obtaining the document. Select the format in which you wish to save the Assignment Of Contract Pennsylvania Withholding Form (PDF or DOCX) and click Download to acquire it. US Legal Forms is an ideal resource for anyone needing to handle legal documentation. Premium users gain even more advantages as they can fill out and electronically sign previously saved documents anytime using the built-in PDF editing tool. Check it out now!

- Each template is expertly crafted and verified for adherence to federal and local laws.

- They are categorized by area and state of application, making it simple to find what you need.

- Users who are experienced with the platform just need to Log In to the system, verify their subscription status, and click the Download button next to the Assignment Of Contract Pennsylvania Withholding Form to retrieve it.

- Once downloaded, the template is accessible for additional use within the My documents section of your profile.

Form popularity

FAQ

Types of Income Subject to Tax Withholding In addition, Pennsylvania law requires that non-wage Pennsylvania source income payments made to nonresidents have Pennsylvania personal income tax withheld.

A PSD code stands for political subdivision codes. These are six digit numbers that identity municipalities (cities, boroughs, townships) in Pennsylvania, and Pennsylvania alone. These codes help employers distribute the correct amount of local Earned Income Tax (EIT) to the corresponding tax jurisdictions.

A PSD code stands for political subdivision codes. These are six digit numbers that identity municipalities (cities, boroughs, townships) in Pennsylvania, and Pennsylvania alone. These codes help employers distribute the correct amount of local Earned Income Tax (EIT) to the corresponding tax jurisdictions.

Pennsylvania does not have a form exactly like the federal W-4 form, since Pennsylvania Personal Income Tax is based on a flat tax rate and everyone pays the same rate of 3.07 percent.

Complete Form REV-419 so that your employer can withhold the correct Pennsylvania personal income tax from your pay. Complete a new Form REV-419 every year or when your personal or financial situa- tion changes. Photocopies of this form are acceptable.