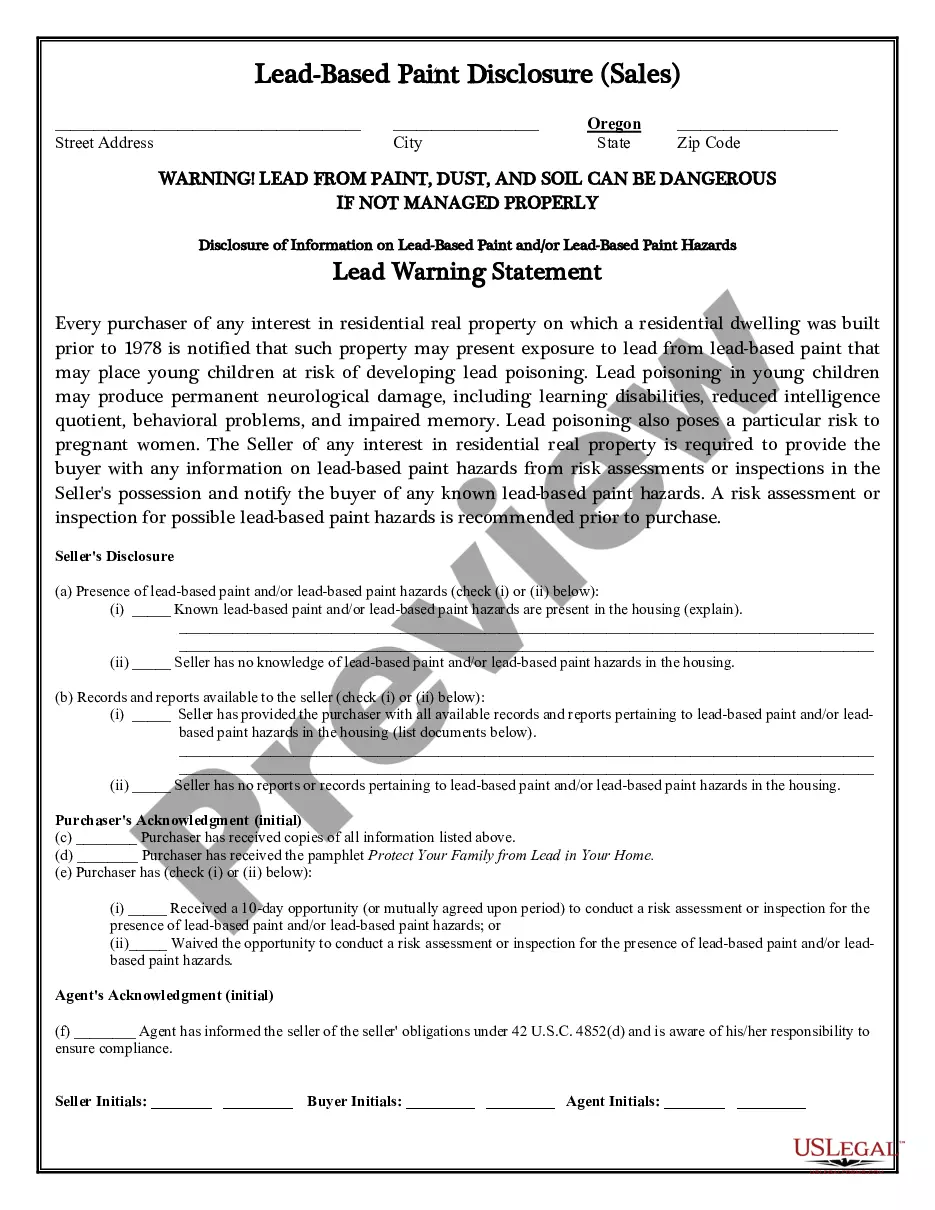

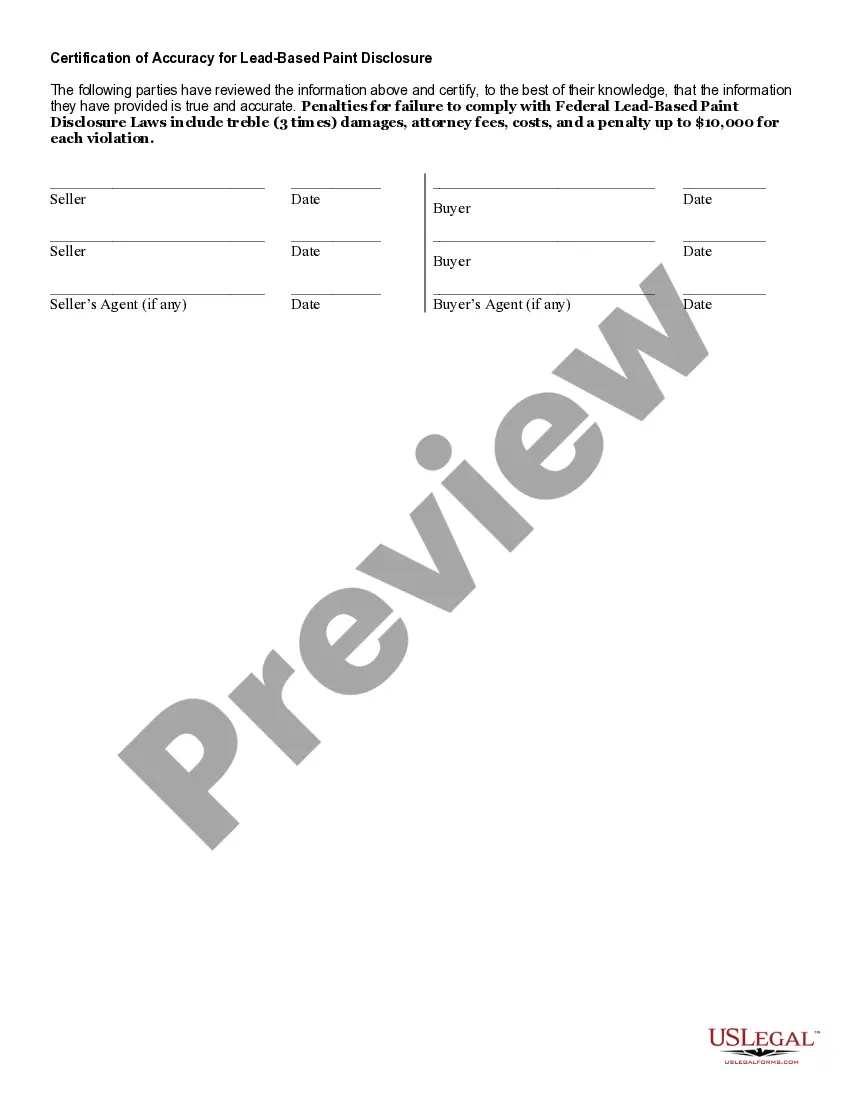

Lead Based Paint Disclosure Oregon Forest Fire Map

Description

How to fill out Oregon Lead Based Paint Disclosure For Sales Transaction?

The Lead Based Paint Disclosure Oregon Forest Fire Map you observe on this page is a reusable official template crafted by experienced attorneys in accordance with federal and local laws.

For over 25 years, US Legal Forms has supplied individuals, businesses, and lawyers with more than 85,000 authenticated, state-specific documents for any business and personal situation. It’s the fastest, easiest, and most reliable way to acquire the paperwork you require, as the service ensures bank-level data protection and anti-malware safeguards.

Subscribe to US Legal Forms to have authenticated legal templates for all of life’s circumstances at your disposal.

- Search for the document you require and examine it.

- Browse through the file you sought and preview it or check the form description to verify it meets your needs. If it doesn’t, utilize the search function to find the correct one. Click Buy Now once you have located the template you need.

- Choose a subscription and Log In.

- Pick the pricing plan that fits you and create an account. Use PayPal or a credit card for a swift transaction. If you already possess an account, Log In and review your subscription to proceed.

- Obtain the editable template.

- Select the format you want for your Lead Based Paint Disclosure Oregon Forest Fire Map (PDF, DOCX, RTF) and download the sample to your device.

- Complete and sign the documents.

- Print the template to finish it by hand. Alternatively, employ an online multifunctional PDF editor to quickly and accurately fill in and sign your form with an eSignature.

- Redownload your documents.

- Use the same document again whenever necessary. Access the My documents tab in your profile to redownload any previously acquired forms.

Form popularity

FAQ

PC-213. Affidavit of Closing of Decedent's Estate (Rev. 7/20) PC-234. Fiduciary's Notice to Creditors to Present Claims (Rev.

In the state of Connecticut, you have up to 30 days to file for probate. If you go beyond the 30-day limit then you can expect to receive fines. There are exceptions to the rule however it's not worth the risk of meeting any of the little-known exceptions.

Most states have different limits for different kinds of crimes, and Connecticut is no different. In Connecticut, there is a five-year time limit for the filing of crimes that carry a punishment of imprisonment for more than one year. Most other crimes, with some notable exceptions, have a one-year deadline.

1) A petitioner filing a PC-212, Affidavit in Lieu of Probate of Will/Administration, may use this form to request an order of distribution if (a) assets exceed expenses and claims or (b) a person who paid expenses or claims waives reimbursement for payment of the expense or claim.

Probate or administration is not granted after ten years from the decedent's death unless either: ? On a petition to the court, the court allows it. of limitations may be extended to allow one year after the minor reaches majority to begin a probate or an administration.

If no will exists, the property is divided ing to Connecticut law. The Probate Courts ensure that any debt owed by the deceased person, funeral expenses and taxes are paid before the remaining assets are distributed. Often a family member or friend is responsible for settling the affairs of the estate.

Full "probate" is ONLY required by law if the person who dies, with or without a will, (1) owned real estate (not just a life use) that does not pass by the deed to the "surviving" joint owner, OR (2) owned $40,000 or more of other assets that also don't pass by beneficiary or joint ownership to another person.

Rule 5 - Self-representation; Representation by Attorney and Appearance Section 5.1 Representation before court (a) A party who is an individual may represent himself or herself without an attorney.