Ucc Filing Oregon With Secretary Of State Texas

Description

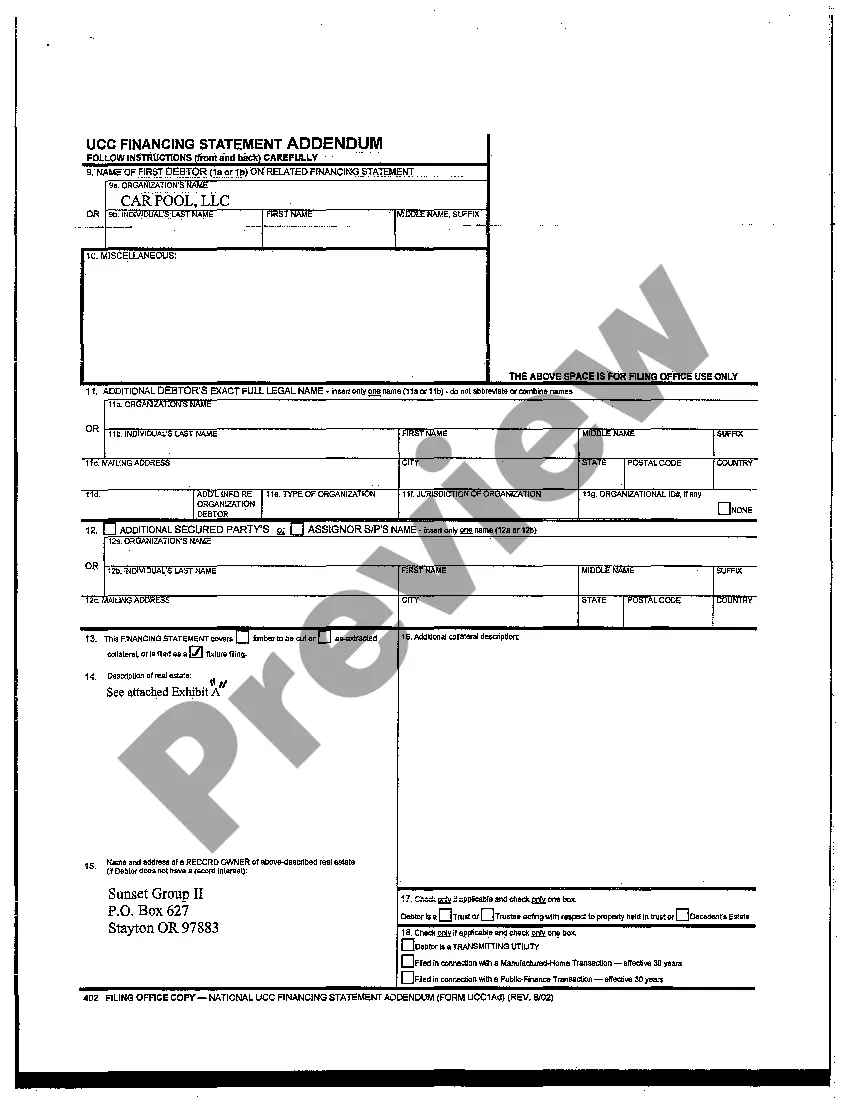

How to fill out Oregon UCC Financing Statement?

It's well known that you cannot instantly become a legal expert, nor can you easily learn how to swiftly prepare Ucc Filing Oregon With Secretary Of State Texas without a specific background.

Assembling legal documents is a lengthy undertaking that requires certain education and expertise. So, why not entrust the preparation of the Ucc Filing Oregon With Secretary Of State Texas to the professionals.

With US Legal Forms, which boasts one of the most extensive collections of legal documents, you can access everything from court filings to templates for internal business communication. We understand how vital compliance with federal and state regulations is.

Create a free account and select a subscription plan to purchase the form.

Click Buy now. Once the payment is completed, you can download the Ucc Filing Oregon With Secretary Of State Texas, fill it out, print it, and send or deliver it to the relevant individuals or organizations.

- That's why all forms on our website are tailored to your location and are current.

- Begin by visiting our site and obtain the document you need in just minutes.

- Find the document you require utilizing the search bar at the top of the page.

- Preview it (if this option is available) and review the supporting description to determine if Ucc Filing Oregon With Secretary Of State Texas is what you need.

- If you require a different form, start your search again.

Form popularity

FAQ

The state in which you file a UCC Financing Statement depends on certain factors, typically the location of the debtor or the collateral involved. For UCC filing in Oregon with the Secretary of State Texas, aligning your filing with the correct jurisdiction is essential for enforcing your lien rights. Platforms like USLegalForms can simplify your filing process, ensuring that you meet all the regulatory requirements.

When dealing with a foreign entity, you generally file a UCC Financing Statement in the state where the entity is registered. If you are considering UCC filing in Oregon with the Secretary of State Texas, you should confirm the filing requirements to guarantee compliance. USLegalForms provides helpful resources to guide you through this process, making it straightforward to file correctly.

LA LLC in 5 Steps Step 1: Name your Louisiana LLC. Begin by giving your LLC a name. ... Step 2: Appoint a registered agent in Louisiana. You must select a Louisiana registered agent for your LLC. ... Step 3: File Louisiana Articles of Organization. ... Step 4: Create an operating agreement. ... Step 5: Apply for an EIN.

Starting an LLC in Louisiana will include the following steps: #1: Name Your Louisiana LLC. #2: Get an EIN. #3: Choose a Louisiana Registered Agent. #4: Prepare and File Articles of Organization. #5: Draft an Operating Agreement.

LLCs must list (in the initial report) the name and address of a registered agent with a physical address (no post office boxes) in Louisiana. The registered agent must be available during normal business hours to accept important legal and tax documents for the business.

Starting an LLC costs $100 in Louisiana. This is the state filing fee for a document called the Louisiana Articles of Organization. The Articles of Organization are filed with the Louisiana Secretary of State, and you can file your LLC online.. And once approved, this is what creates your LLC.

You can get an LLC in Louisiana in 3-5 business days if you file online (or 2-3 weeks if you file by mail). If you need your Louisiana LLC faster, you can pay for expedited processing.

Starting an LLC in Louisiana will include the following steps: #1: Name Your Louisiana LLC. #2: Get an EIN. #3: Choose a Louisiana Registered Agent. #4: Prepare and File Articles of Organization. #5: Draft an Operating Agreement.

How Much Does It Cost To Get an LLC in Louisiana? You need to pay the following filing fees to start your LLC in Louisiana: Domestic LLCs: $100. Foreign or out-of-state LLCs: $150.