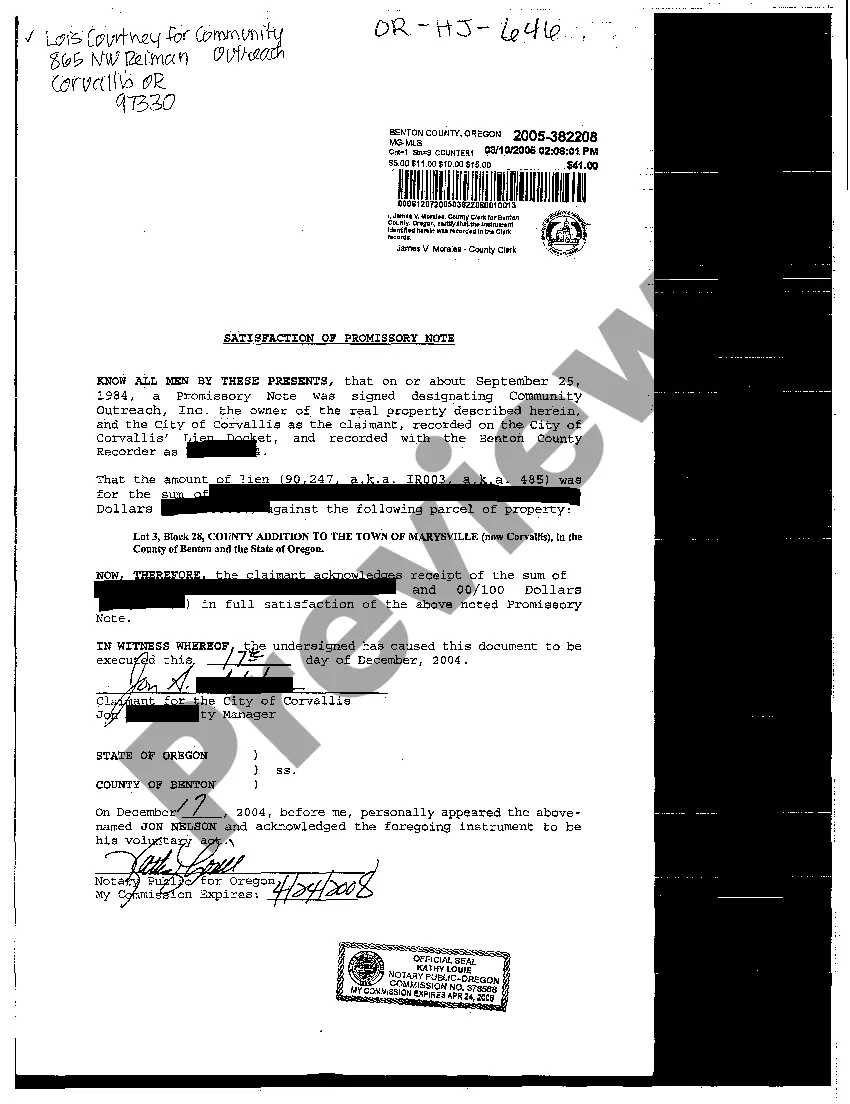

Satisfaction Of Promissory Note Without Recourse

Description

How to fill out Oregon Satisfaction Of Promissory Note?

Navigating through the red tape of standard documents and templates can be challenging, especially when one does not engage in that professionally.

Even selecting the appropriate template for the Satisfaction of Promissory Note Without Recourse will be labor-intensive, as it must be valid and accurate to the very last numeral.

However, you will need to invest significantly less time locating an appropriate template from a trustworthy source.

Obtain the correct document in a few straightforward steps: Enter the name of the document in the search field. Identify the correct Satisfaction of Promissory Note Without Recourse from the list of results. Review the outline of the sample or view its preview. When the template meets your criteria, click Buy Now. Proceed to select your subscription plan. Utilize your email and set a password to register an account at US Legal Forms. Choose a credit card or PayPal payment method. Store the template document on your device in the format you prefer. US Legal Forms will save you time and effort in verifying whether the form you discovered online meets your requirements. Create an account and gain unlimited access to all the templates you need.

- US Legal Forms is a platform that streamlines the process of searching for the correct documents online.

- US Legal Forms is a singular destination you require to find the latest examples of documents, examine their use, and download these examples to complete them.

- It is a compilation with over 85K documents that pertain to various sectors.

- When searching for a Satisfaction of Promissory Note Without Recourse, you will not need to doubt its relevance as all documents are verified.

- A membership at US Legal Forms will guarantee you have all the essential examples at your fingertips.

- Store them in your history or add those to the My documents catalog.

- You can retrieve your saved documents from any device by simply clicking Log In at the library website.

- If you have yet to create an account, you can always search anew for the template you need.

Form popularity

FAQ

If your lender requires you to sign the promissory note in your own name, you are personally liable for paying the note. However, you can avoid personal liability by including a provision in the note that states it is "non-recourse."

In a general sense, without recourse pertains to when the buyer of a promissory note or other negotiable instrument assumes the risk of default. No recourse means that the person cannot obtain a judgment against, or reimbursement from, a defaulting or opposing party.

One form of transaction is "assignment without recourse," which means that once the loan is sold or transferred, neither the borrower nor the new loan holder can hold the original loan-maker liable for anything.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark paid in full on the promissory note.Place a signature beside the paid in full notation.Mail the original promissory note to the borrower.