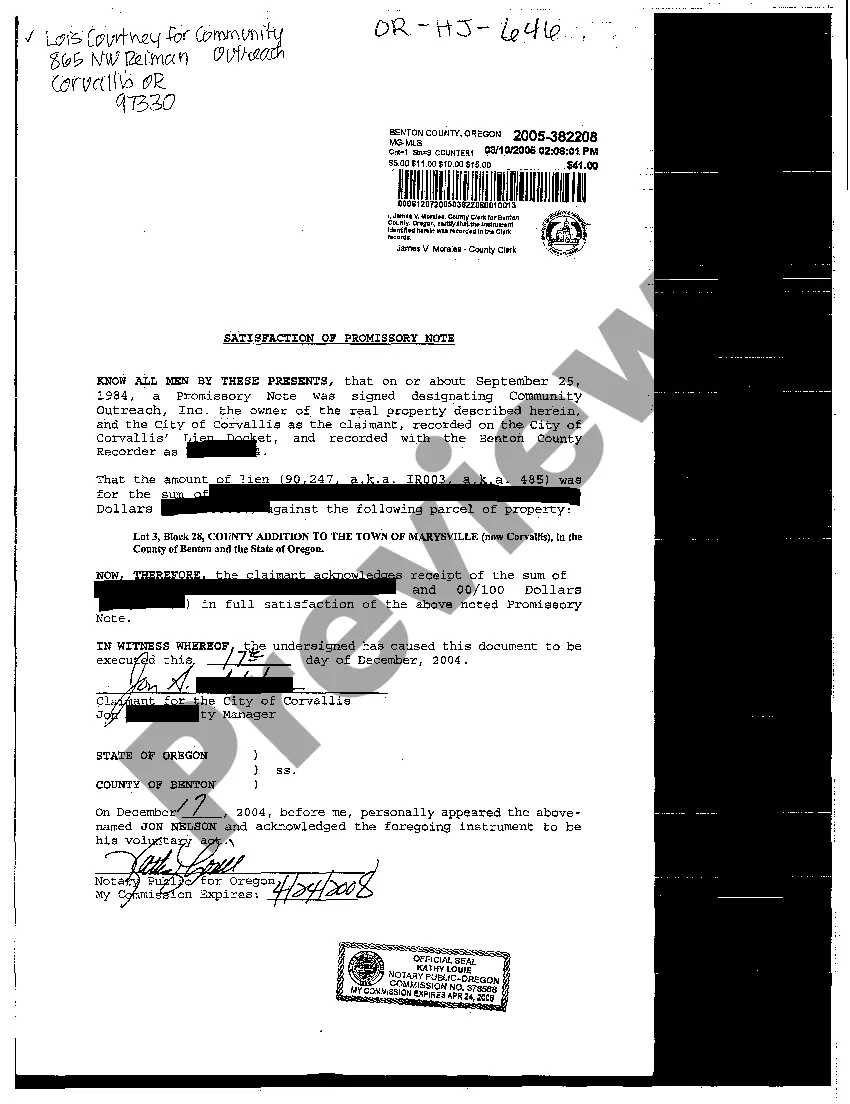

Satisfaction Of Promissory Note With Example

Description

How to fill out Oregon Satisfaction Of Promissory Note?

There’s no longer a requirement to squander hours searching for legal documents to meet your local state regulations. US Legal Forms has gathered all of them in a single location and enhanced their accessibility.

Our platform offers over 85,000 templates for various business and personal legal situations organized by state and area of application. All forms are accurately drafted and verified for legitimacy, ensuring you can trust that you are obtaining a current Satisfaction Of Promissory Note With Example.

If you are acquainted with our service and already possess an account, ensure your subscription is active before acquiring any templates. Log In to your account, select the document, and click Download. You can also access all acquired documents whenever needed by visiting the My documents section in your profile.

Print your form to fill it out by hand or upload the template if you prefer to do it in an online editor. Creating formal paperwork under federal and state regulations is quick and easy with our platform. Try US Legal Forms today to organize your documentation!

- If you have never utilized our service before, the procedure will involve a few more steps to complete.

- Read the page content thoroughly to confirm it contains the sample you require.

- To achieve this, use the form description and preview options if available.

- Employ the search field above to look for another sample if the current one does not suit your needs.

- Click Buy Now next to the template name once you locate the correct one.

- Select the preferred subscription plan and either register for an account or sign in.

- Make a payment for your subscription using a credit card or via PayPal to proceed.

- Select the file format for your Satisfaction Of Promissory Note With Example and download it to your device.

Form popularity

FAQ

Multiply 750 by 0.75 to equal 562.50. Likewise, for a daily time period, multiply the product by the ratio of days to years. For example, for a 90-day promissory note, divide 90 by 365 (the number of days in a year) to equal 0.25. Multiply 750 by 0.25 to equal 187.50.

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark paid in full on the promissory note.Place a signature beside the paid in full notation.Mail the original promissory note to the borrower.

Forgiving a promissory note is as straightforward as destroying the document or returning it to the debtor. In court, a promissory note is a legal document that proves a debt, and without that document, there is generally no proof of the agreement.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

How to Create a Promissory Note (5 steps)Step 1 Agree to Terms.Step 2 Run a Credit Report.Step 3 Security and Co-Signers.Step 4 Writing the Note.Step 5 Paying Back the Money.