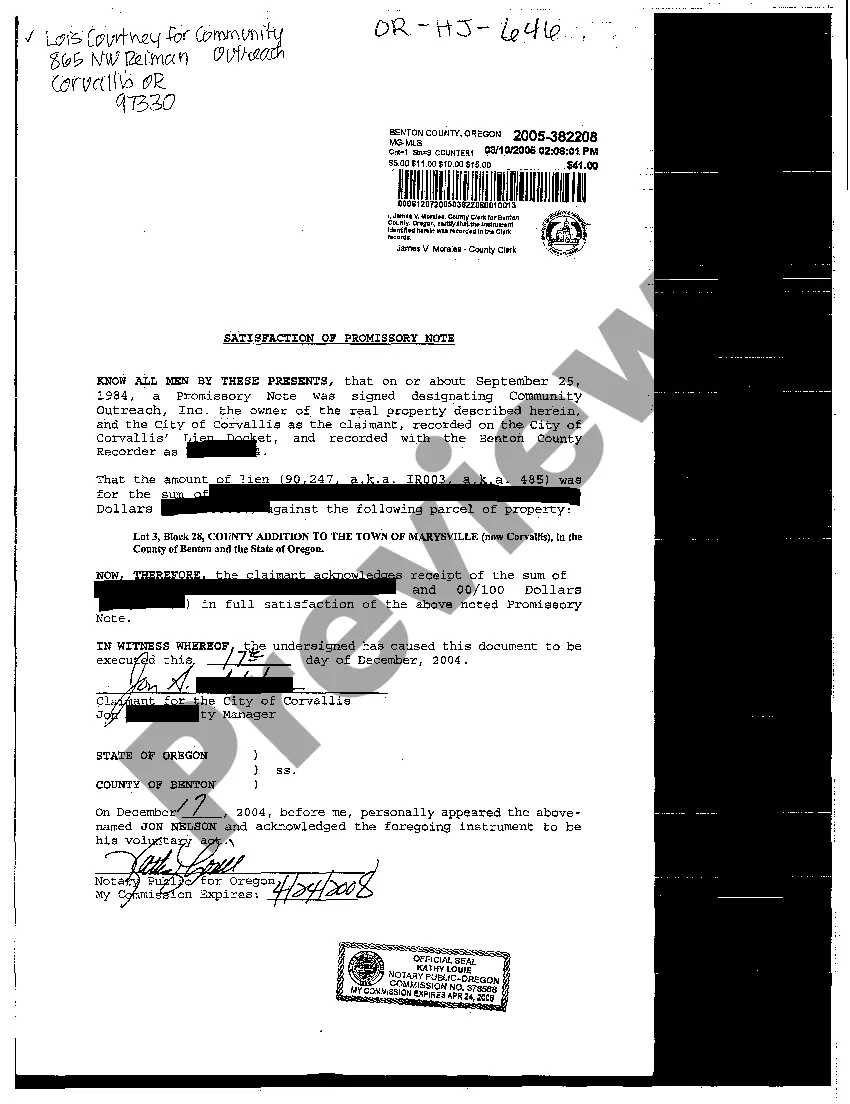

Cancellation And Satisfaction Of Promissory Note Form

Description

How to fill out Oregon Satisfaction Of Promissory Note?

Navigating through the red tape of official documents and templates can be arduous, particularly when one does not engage in that professionally.

Even selecting the appropriate template for the Cancellation And Satisfaction Of Promissory Note Form will be labor-intensive, as it should be authentic and accurate to the very last numeral.

However, you will require significantly less time locating a suitable template if it originates from a source you can depend on.

Acquire the correct form in a few straightforward steps: Enter the title of the document in the search area. Find the right Cancellation And Satisfaction Of Promissory Note Form among the outcomes. Review the description of the sample or open its preview. If the template meets your needs, click Buy Now. Proceed to choose your subscription plan. Use your email and create a password to register an account at US Legal Forms. Select a credit card or PayPal payment option. Save the template file on your device in the format of your choice.

- US Legal Forms is a service that streamlines the process of searching for the correct forms online.

- US Legal Forms is a single destination you need to acquire the most recent samples of documents, seek their application, and download these samples to complete them.

- It is a repository with over 85K forms that apply to various professional fields.

- When searching for a Cancellation And Satisfaction Of Promissory Note Form, you will not have to doubt its legitimacy as all the forms are authenticated.

- An account at US Legal Forms will guarantee you have all the necessary samples within your grasp.

- Store them in your history or add those to the My documents directory.

- You can retrieve your saved forms from any gadget by simply clicking Log In at the library site.

- If you still lack an account, you can always search for the template you require.

Form popularity

FAQ

Keep the original promissory note. Once a lender executes a promissory note, he keeps the original of the promissory note.Accept full payment of the loan.Mark paid in full on the promissory note.Place a signature beside the paid in full notation.Mail the original promissory note to the borrower.

Give the borrower the original promissory note, with a notation on it that says CANCELLED or PAID IN FULL. Keep a copy of this note for your records.

Give the borrower the original promissory note, with a notation on it that says CANCELLED or PAID IN FULL. Keep a copy of this note for your records.

The lender holds the promissory note while the loan is being repaid. Then the note is marked as paid. It's returned to the borrower when the loan is satisfied.

Multiply 750 by 0.75 to equal 562.50. Likewise, for a daily time period, multiply the product by the ratio of days to years. For example, for a 90-day promissory note, divide 90 by 365 (the number of days in a year) to equal 0.25. Multiply 750 by 0.25 to equal 187.50.