Oregon Data Match Tax Liens Memorandum Of Agreement For Payment Of Debt

Description

How to fill out Oregon Memorandum Of Contract?

There's no longer a need to waste time searching for legal documents to comply with your local state's laws.

US Legal Forms has gathered all of them in one location and made them easier to access.

Our platform provides over 85k templates for various business and personal legal situations organized by state and area of use.

Prepare official documentation in accordance with federal and state regulations quickly and easily using our library. Experience US Legal Forms today to keep your paperwork organized!

- All forms are expertly created and validated for legality, so you can be confident in acquiring an up-to-date Oregon Data Match Tax Liens Memorandum Of Agreement For Payment Of Debt.

- If you are acquainted with our platform and have an account, make sure your subscription is active before obtaining any templates.

- Log In to your account, choose the document, and click Download.

- You can also revisit all obtained documents whenever necessary by opening the My documents tab in your profile.

- For those unfamiliar with our platform, the process will require a few additional steps to complete.

- Here's how new users can secure the Oregon Data Match Tax Liens Memorandum Of Agreement For Payment Of Debt from our library.

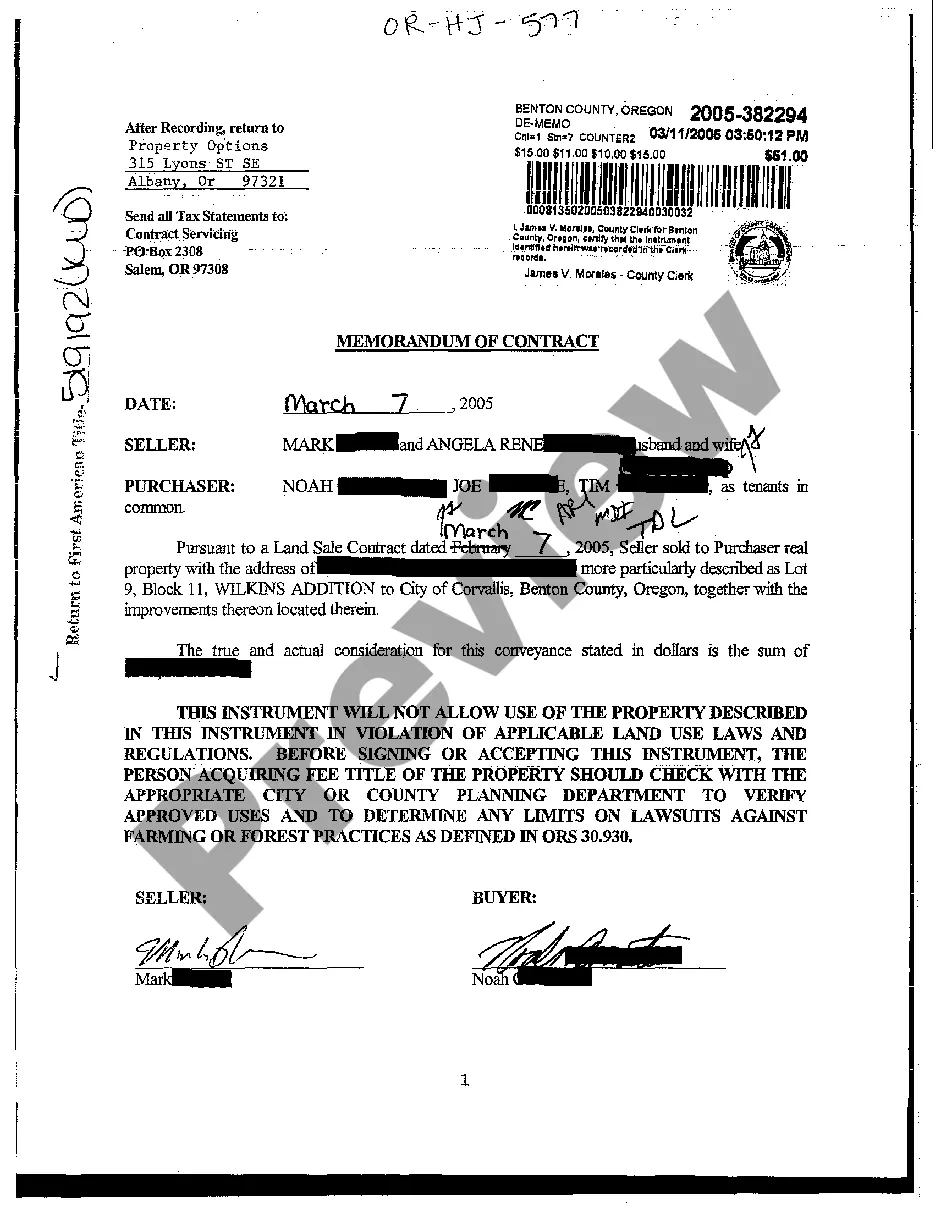

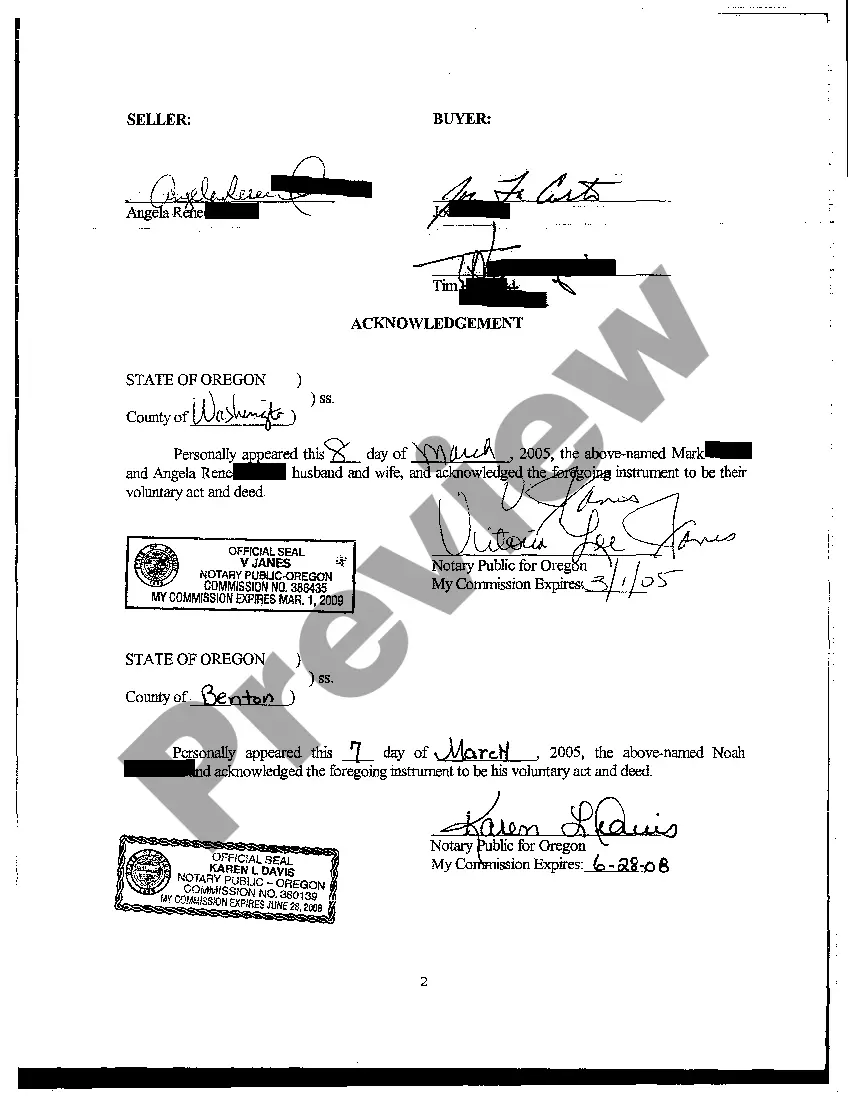

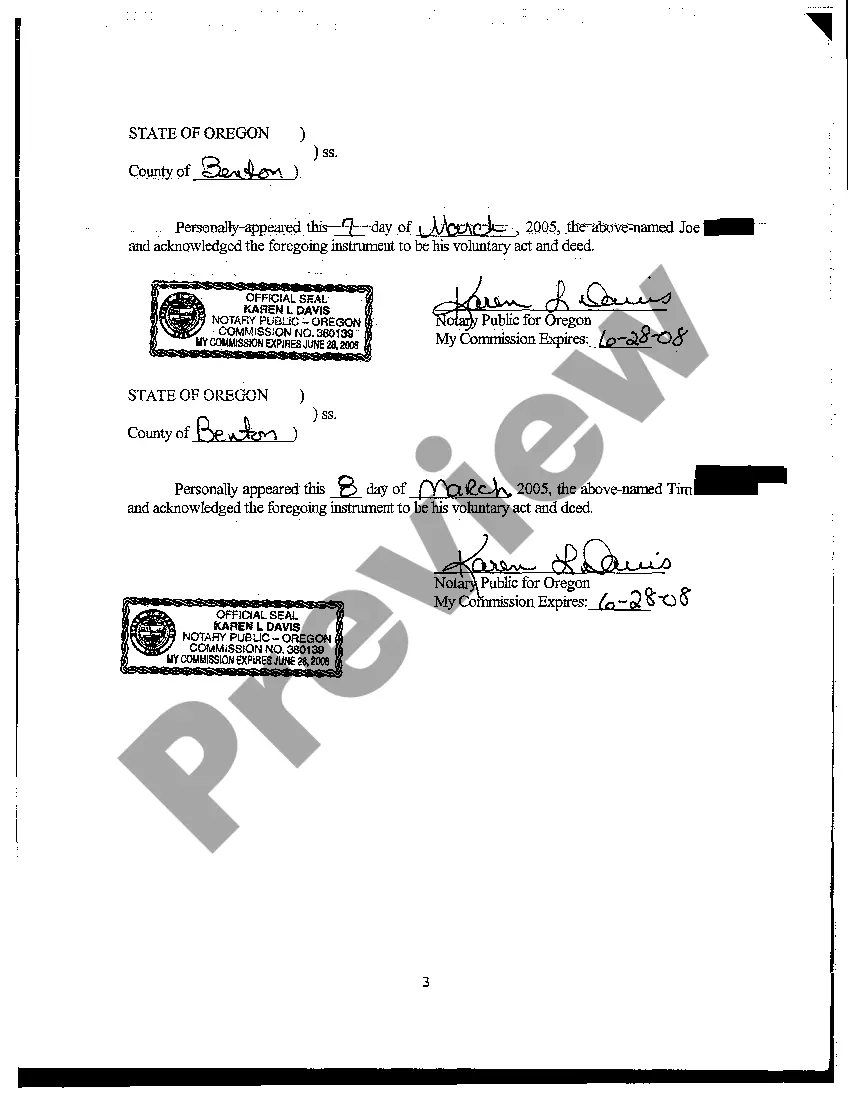

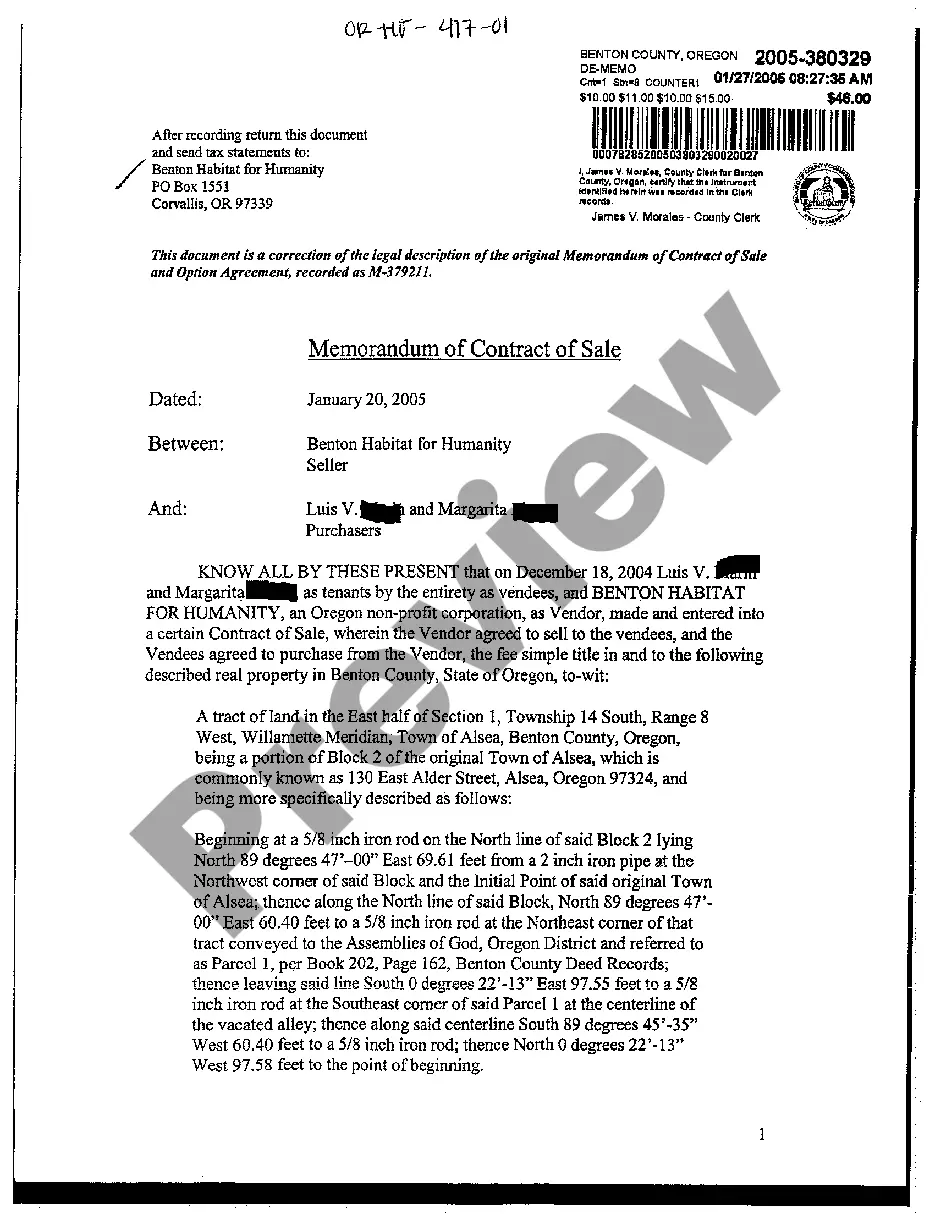

- Thoroughly review the page content to verify it contains the sample you require.

- To assist with this, make use of the form description and preview options if available.

Form popularity

FAQ

Set up a payment planCall us at 503-945-8200.Or sign in to Revenue Online.

Set up a payment planCall us at 503-945-8200.Or sign in to Revenue Online.

The statute of limitations to collect on a debt in Oregon is generally six years.

Oregon's statute of limitations is three years after the return is actually filed, regardless of whether it's filed on or after the due date. 6 For example, if the return is filed earlier than April 15, the limitations period will end earlier as well.

A state tax lien is the government's legal claim against your property when you don't pay your tax debt in full. Your property includes real estate, personal property and other financial assets. When a lien is issued by us, it gets recorded in the county records where you live.