Oregon Probate Forms For Executors

Description

Form popularity

FAQ

While hiring an attorney is not mandatory for probate in Oregon, it can be beneficial, especially when navigating complex situations. An attorney can guide you through the required Oregon probate forms for executors, ensuring you meet all legal requirements. If you feel confident handling the process independently, you may not need legal representation. However, consulting with a lawyer can provide peace of mind during such a challenging time.

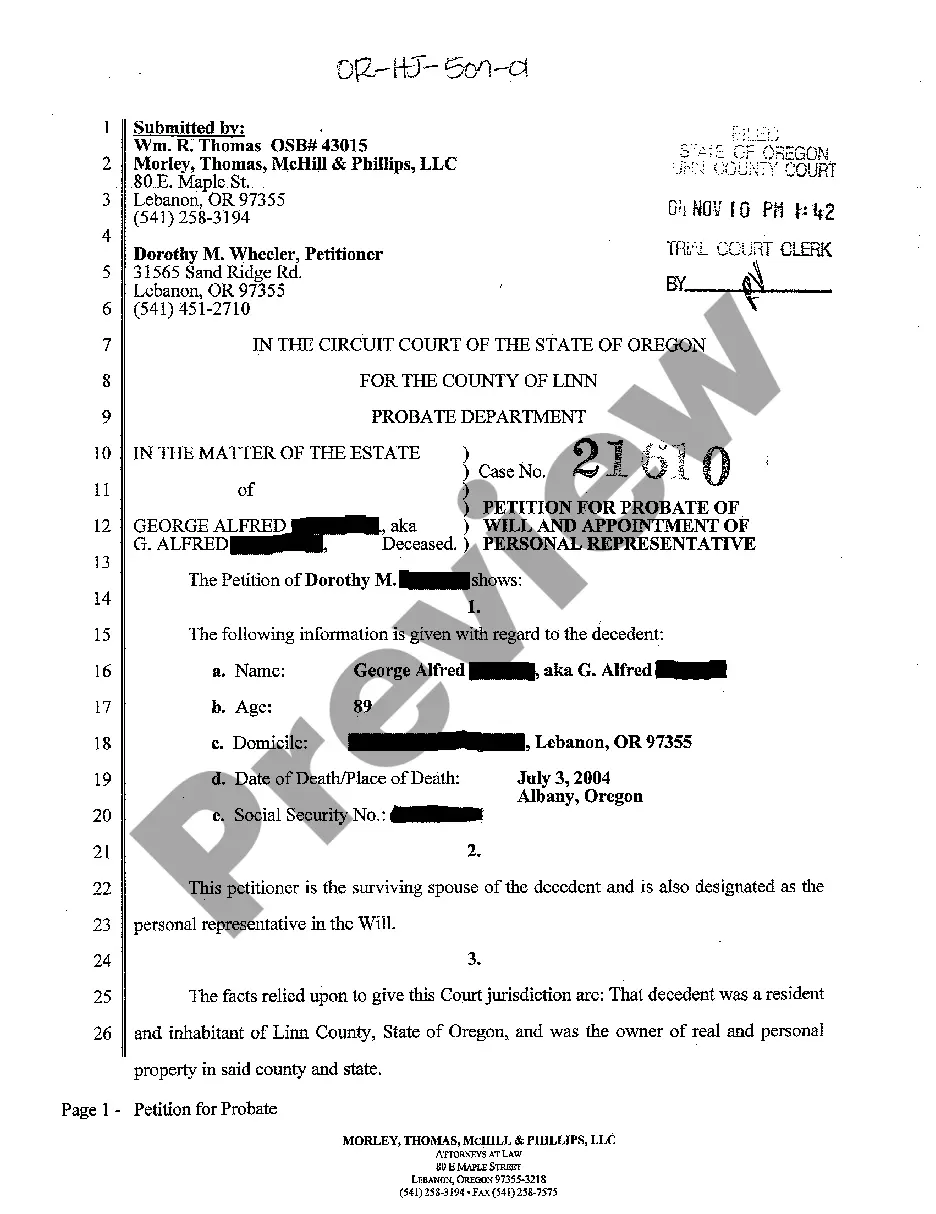

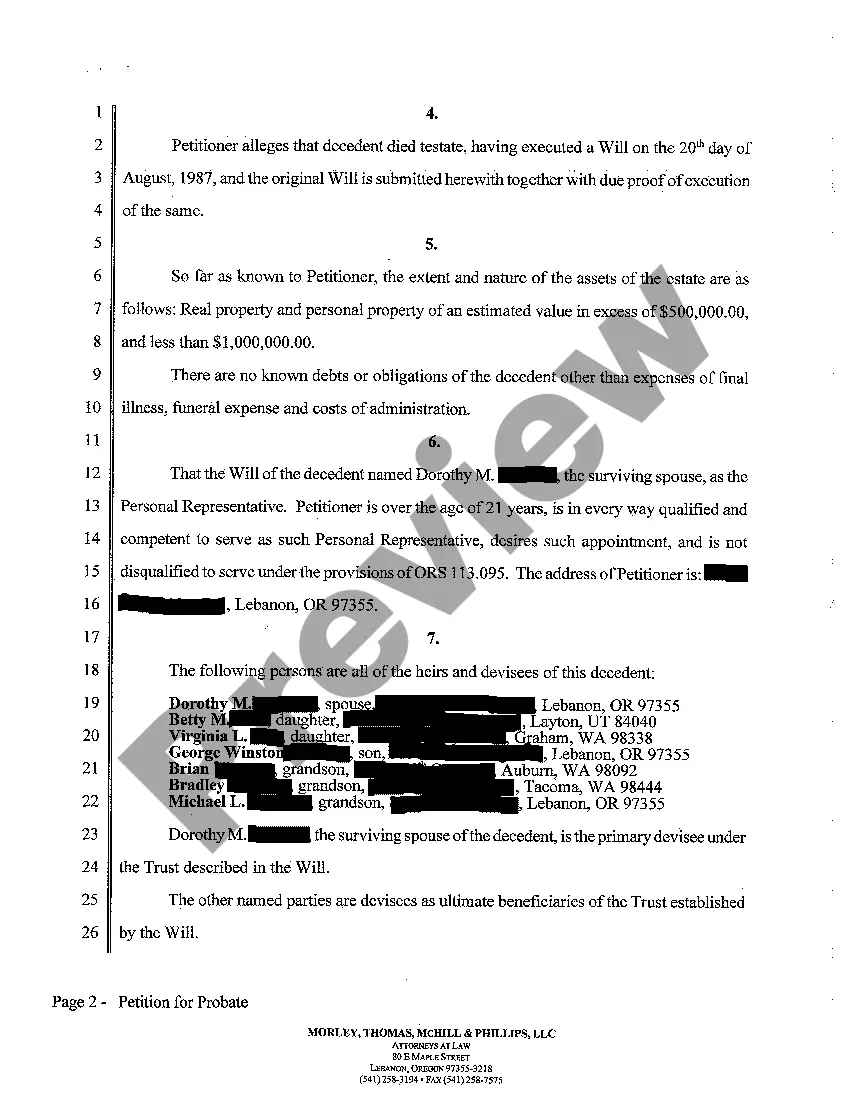

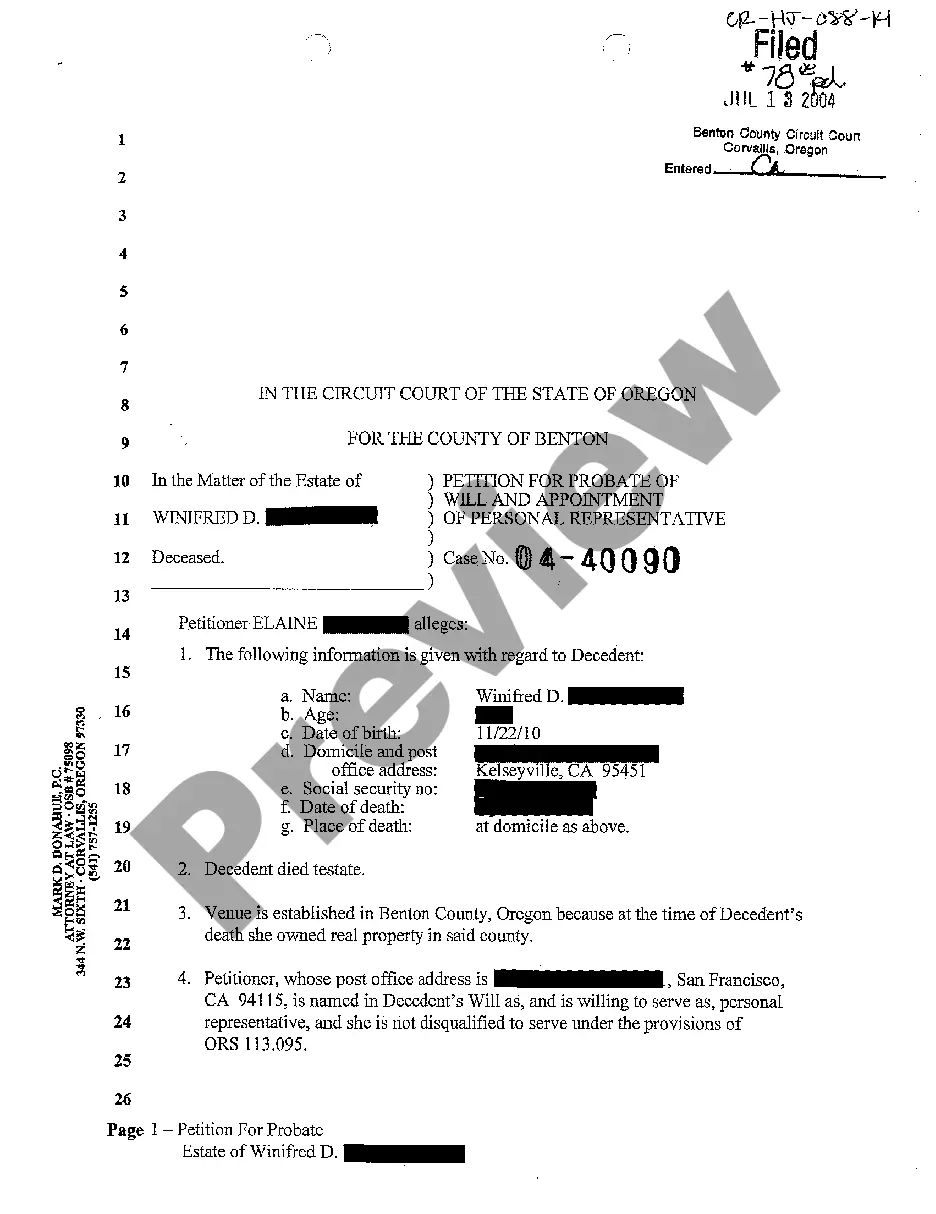

The probate process in Oregon begins with filing the will, if available, along with the necessary Oregon probate forms for executors in the local probate court. After the court appoints the executor, it is essential to notify all heirs and beneficiaries. The executor manages the estate's assets, pays debts, and resolves any claims. Finally, the executor distributes the remaining assets according to the will, while ensuring compliance with state laws.

Filling out the importer identity form requires you to provide your principal business address, your taxpayer identification number, and other detailed information about your import activities. It’s essential to provide accurate details for compliance. When it comes to Oregon probate forms for executors, clarity and precision in documentation can make a significant difference.

Form 350ES is a payment voucher for estimated tax payments in Oregon. To fill it out, enter your personal information, calculate your estimated tax, and submit the payment according to the instructions. Knowing how to correctly fill out related forms, including Oregon probate forms for executors, can minimize your tax-related concerns during probate.

The inventory for probate must include all assets of the deceased, such as real estate, bank accounts, stocks, and personal property. You should also note any debts owed by the estate. By accurately recording these assets, you will streamline the process and ensure compliance with Oregon probate forms for executors.

In Oregon, a personal representative and an executor serve similar roles, as both manage the probate process. However, a personal representative is appointed by the court, while an executor is named in the will. Understanding these distinctions can help you effectively complete your Oregon probate forms for executors.

In Oregon, certain assets are exempt from probate, such as life insurance policies with named beneficiaries and retirement accounts. Additionally, property held in a living trust typically bypasses probate. Being informed about these exemptions can be crucial when preparing your Oregon probate forms for executors.

Completing an assessment form typically requires you to provide specific details related to the subject being assessed. This may include financial information, property descriptions, or other relevant data. While dealing with Oregon probate forms for executors, ensure all information is accurate to avoid potential issues in the probate process.

To fill out paperwork for probate, start by gathering all necessary information about the deceased's assets and liabilities. You will need to complete the appropriate Oregon probate forms for executors, which will include details about the estate. If you encounter challenges, consider using platforms like uslegalforms for comprehensive guidance.

Filling out the US Customs Declaration form requires you to provide information about the items you are bringing into the country. You will need to list your goods and declare their value accurately. Additionally, when completing your Oregon probate forms for executors, understanding the importance of proper documentation can aid in smoother processes down the line.