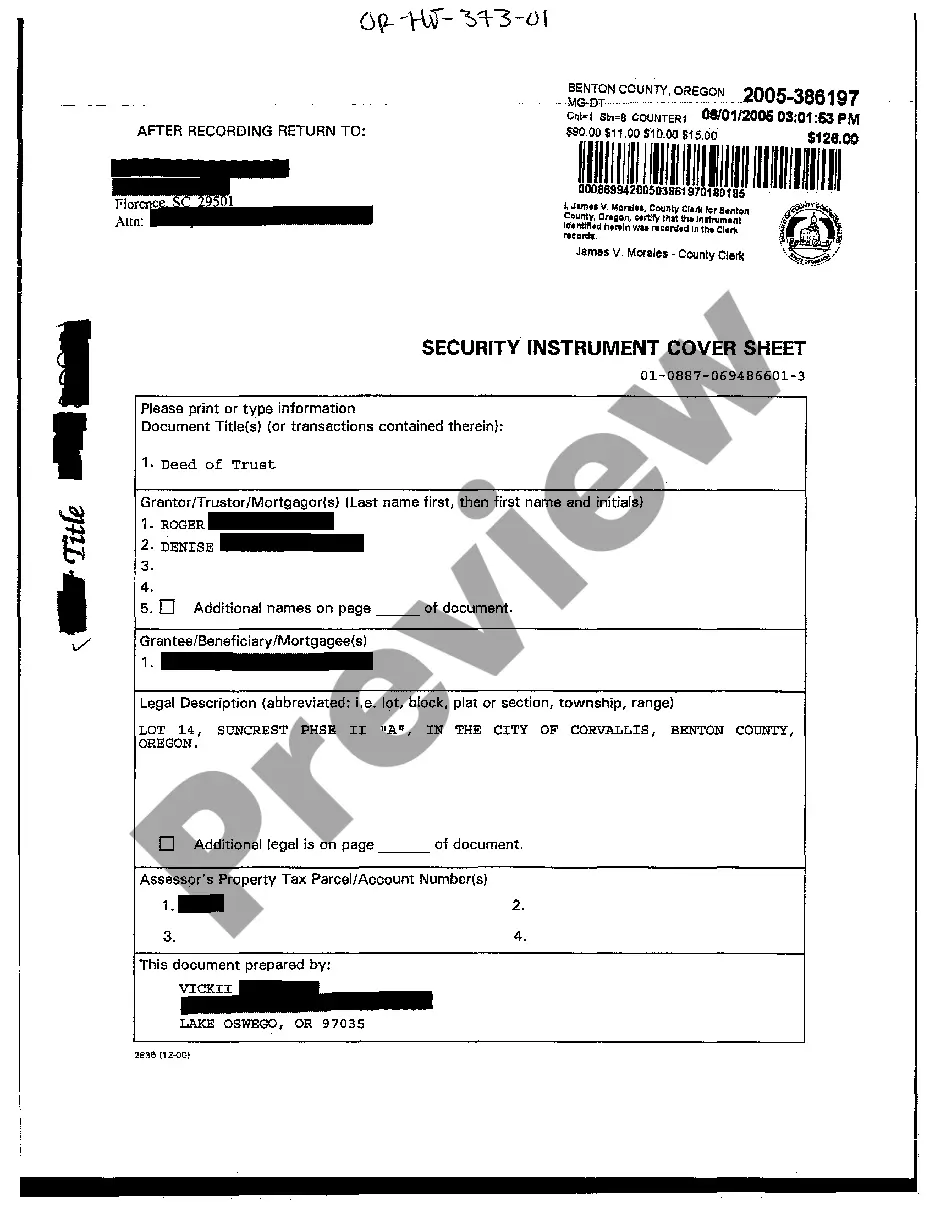

Oregon Deed Of Trust Withdrawal

Description

How to fill out Oregon Deed Of Trust Withdrawal?

How to locate professional legal documents that comply with your state regulations and create the Oregon Deed Of Trust Withdrawal without consulting a lawyer.

Numerous services online offer templates to address different legal circumstances and requirements. However, it might take some time to figure out which of the existing samples fulfill both your specific needs and legal standards.

US Legal Forms is a reliable platform that assists you in finding official papers crafted in accordance with the latest updates in state legislation, helping you save on legal costs.

If you are not registered on US Legal Forms, follow the steps outlined below: Review the webpage you have opened and confirm if the form meets your requirements. Utilize the form description and preview options if accessible. Search for additional samples in the header listing your state, if needed. Press the Buy Now button once you identify the appropriate document. Select the most fitting pricing plan, then Log In or register for an account. Determine the payment method (either by credit card or through PayPal). Choose the file format for your Oregon Deed Of Trust Withdrawal and click Download. The retrieved documents will remain yours; you can always access them in the My documents section of your profile. Join our platform and create legal documents on your own like a seasoned legal professional!

- US Legal Forms is not a typical online directory.

- It is a repository of over 85,000 verified templates for various business and personal situations.

- All documents are categorized by area and state to expedite your search process and simplify things.

- Additionally, it comes with powerful tools for PDF editing and eSignature, enabling users with a Premium subscription to swiftly finalize their paperwork online.

- Acquiring the necessary forms requires minimal time and effort.

- If you already possess an account, Log In and verify that your subscription is active.

- Download the Oregon Deed Of Trust Withdrawal using the corresponding button next to the filename.

Form popularity

FAQ

The 120-day rule in Oregon requires lenders to wait at least 120 days from the first missed payment before initiating foreclosure. This rule provides homeowners a window to explore alternatives, such as an Oregon deed of trust withdrawal, giving you time to work out a solution. Being aware of this timeframe can help you plan your next steps.

A bank may start the foreclosure process as soon as you fall behind on your mortgage payments, usually after three consecutive missed payments. However, it is essential to note that the entire process can take several months. For those facing difficulties, resources like US Legal Forms can assist you with understanding your options related to Oregon deed of trust withdrawal.

In Oregon, lenders usually initiate foreclosure proceedings after three missed payments. This timeline can vary depending on the lender's policies and your specific situation. To prevent issues related to an Oregon deed of trust withdrawal, it is important to communicate with your lender if you anticipate difficulty making payments.

In Oregon, the foreclosure process typically takes around six to twelve months, depending on various factors. After you miss a payment, the lender often sends a formal notice, initiating the timeline toward potential foreclosure. Understanding the timeline is crucial for properties under an Oregon deed of trust withdrawal, as it allows homeowners to explore options.

The foreclosure process in Oregon typically takes around 8 to 12 months, depending on several factors. Once a default occurs, lenders file foreclosure actions that follow a legal timeline, often allowing for a grace period. Understanding this timeline is crucial for homeowners facing financial difficulties and considering an Oregon deed of trust withdrawal.

Trust deeds can complicate the property ownership process. If a borrower defaults, the foreclosure process can move quickly, potentially leading to a loss of the property. Additionally, because the trust deed is a legally binding document, making changes or leniency often requires a formal process, which may be cumbersome. It’s crucial to understand these factors when considering the Oregon deed of trust withdrawal.

To locate forms for releasing a deed of trust lien, you can visit reputable legal websites such as USLegalForms. They provide easy access to essential documents tailored for the Oregon deed of trust withdrawal process. These forms are designed to simplify your journey, ensuring you have everything you need to handle the withdrawal efficiently.

Getting out of a trust deed involves a few steps, including paying off the debt secured by the deed or having the trust deed reconveyed. You must also ensure that you complete the required legal forms and file them appropriately. For effective results, consider using US Legal Forms, as it offers resources tailored to facilitate your Oregon deed of trust withdrawal.

To remove a beneficiary from a trust deed, you generally need to amend the trust document, which may involve legal procedures. This process requires you to provide proper notice and possibly obtain consent from the remaining beneficiaries. Utilizing platforms like US Legal Forms can streamline your experience and guide you through the steps needed for your Oregon deed of trust withdrawal.

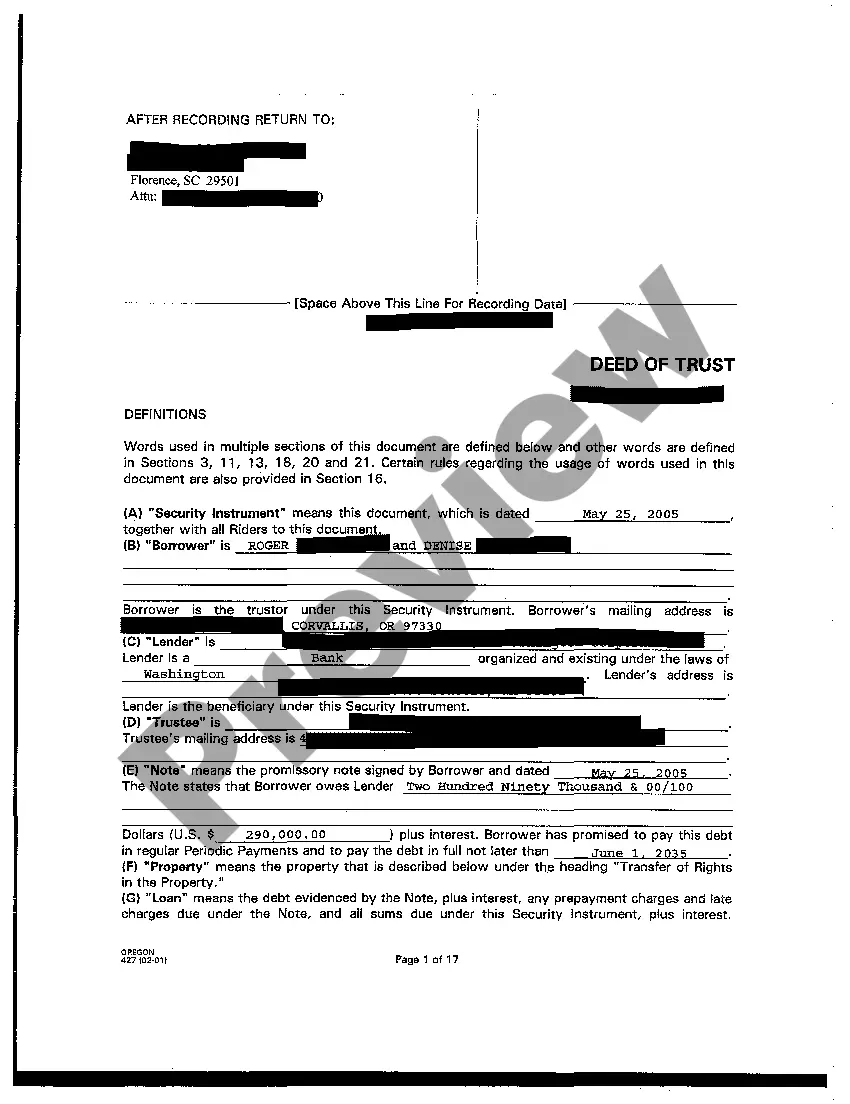

Yes, Oregon is a deed of trust state. This means that lenders often use deed of trust agreements as security for loans instead of mortgages. Understanding this is important for homeowners, as it affects how the Oregon deed of trust withdrawal process works in the event of foreclosure or refinancing.