Trust Transfer Deed Form

Description

How to fill out Trust Transfer Deed Form?

Individuals often link legal documentation with something intricate that solely an expert can manage.

In a certain manner, it's valid, as creating a Trust Transfer Deed Form requires considerable knowledge of subject matter criteria, including regional and municipal legislation.

However, with US Legal Forms, everything has become easier: pre-made legal templates for any personal and professional circumstance specific to state laws are compiled in a single online database and are now accessible to everyone.

Print your document or upload it to an online editor for a faster completion. All templates in our collection are reusable: after purchase, they remain stored in your profile. You can access them whenever necessary via the My documents tab. Explore all advantages of utilizing the US Legal Forms platform. Enroll today!

- Scrutinize the page content carefully to ensure it meets your requirements.

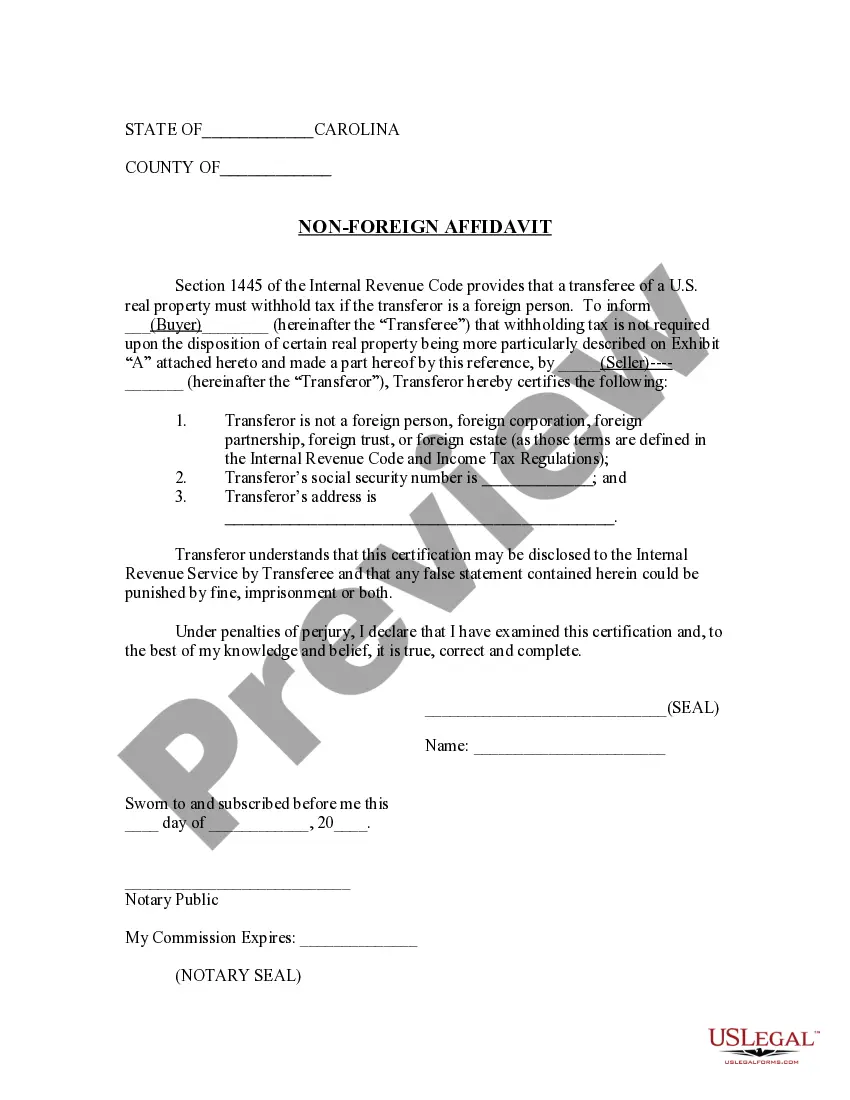

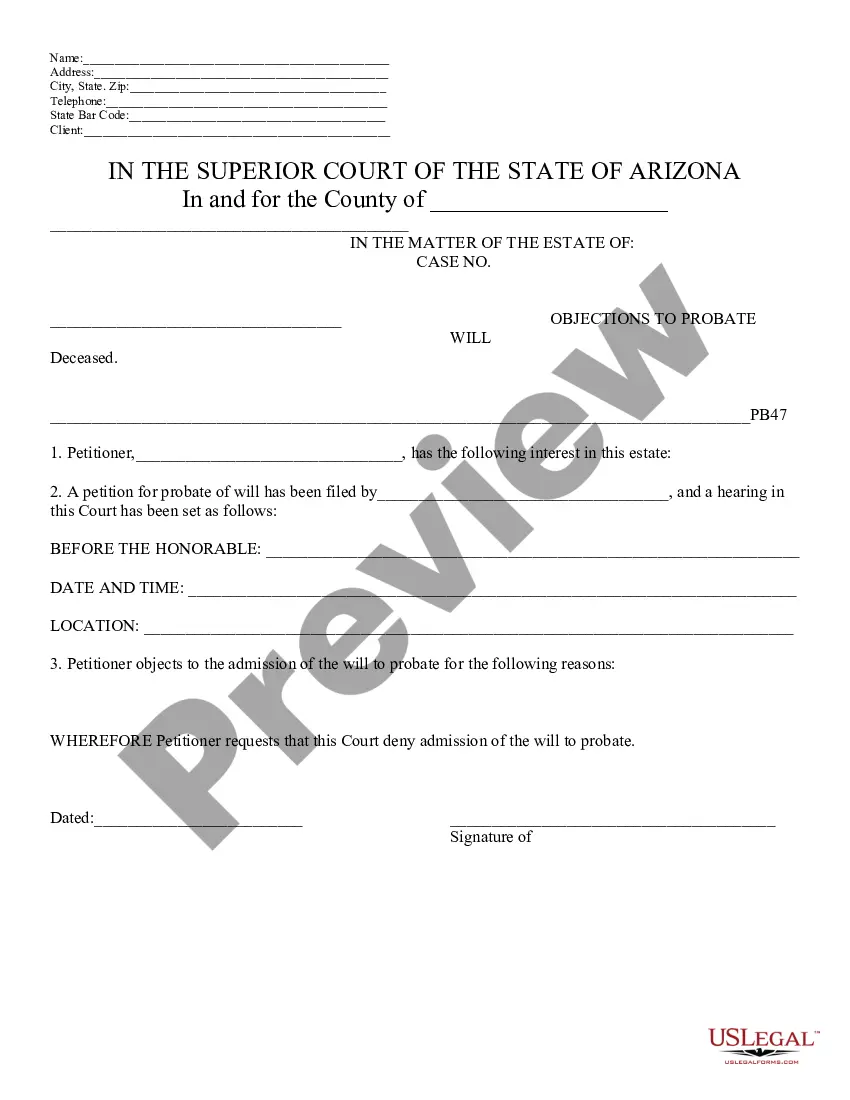

- Review the form description or view it through the Preview option.

- Find another template using the Search field in the header if the previous one doesn't meet your needs.

- Click Buy Now when you identify the right Trust Transfer Deed Form.

- Select a pricing plan that aligns with your needs and budget.

- Sign up for an account or Log In to proceed to the payment page.

- Complete your subscription payment via PayPal or with your credit card.

- Choose the format for your file and click Download.

Form popularity

FAQ

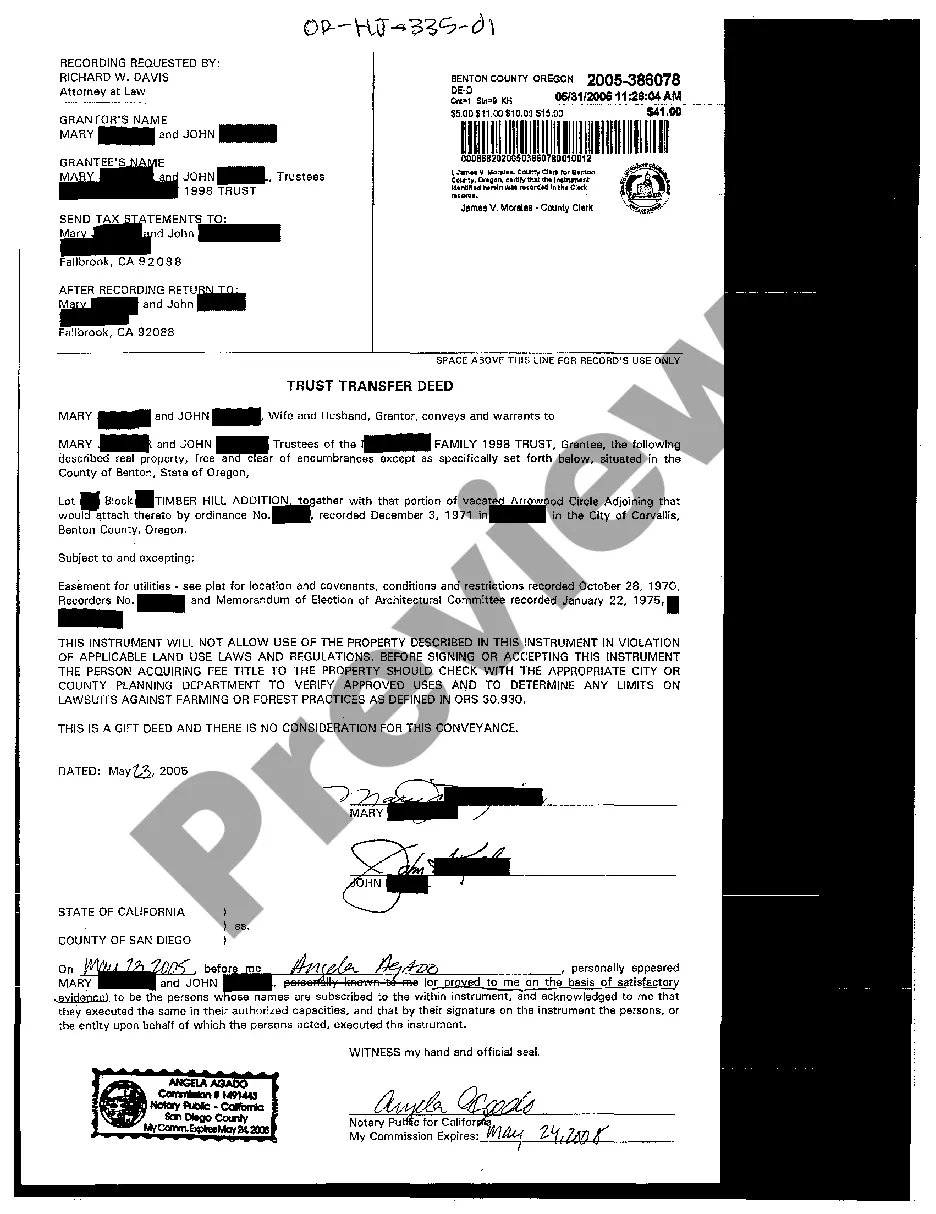

A trust transfer refers to the process of moving property or assets into a trust. This action can help protect the asset from probate and estate taxes, ensuring that distributions adhere to the grantor's wishes. A trust transfer deed form is essential in documenting this process, providing a clear record of the asset's transition into the trust. For assistance with trust transfers, explore options on uslegalforms.

A Transfer on Death (TOD) deed allows property owners to transfer their real estate directly to beneficiaries upon their passing, bypassing probate. In contrast, a trust requires a more comprehensive setup, where assets are managed according to specific guidelines during the trustee's lifetime and after their death. Both methods serve to streamline asset transfers but cater to different needs and preferences. The trust transfer deed form is a valuable tool for those opting for trusts.

In the UK, a trust deed is a legal document that outlines the terms under which property is held in trust. This document specifies the trustees, the beneficiaries, and their respective rights. Trust deeds help in managing assets while ensuring compliance with legal requirements. While the terminology may differ, trust transfer deed forms in the US serve a similar purpose in asset management.

A California trust transfer deed is a legal document that facilitates the transfer of property into a trust. This form ensures that the property is managed according to the terms set forth in the trust agreement. Using this deed allows individuals to retain control of their assets while simplifying the transfer process upon their passing. For clarity, you can find a reliable trust transfer deed form on platforms like uslegalforms.

In California, the two main types of deeds used to transfer property are grant deeds and quitclaim deeds. A grant deed states that the seller owns the property and has the right to transfer it, while a quitclaim deed transfers whatever interest the seller has without guaranteeing ownership. Both types effectively convey property, but they serve different purposes. Consider using a trust transfer deed form for more structured property transfers.

An example of a trust deed might include a situation where a parent establishes a trust for their child, specifying how the assets will be managed until the child reaches adulthood. In this scenario, the trust deed would outline the trustee's powers and the conditions under which the beneficiaries can access the trust assets. A trust transfer deed form can help formalize this arrangement, providing legal backing for the parent’s intentions.

The primary purpose of a trust deed is to provide clear instructions regarding asset management and distribution among beneficiaries. This document protects the interests of both the trustee and beneficiaries by detailing how the assets should be handled. When creating a trust transfer deed form, you ensure that your intentions are formally recorded, reducing the potential for disputes in the future.

A trust is a fiduciary arrangement that allows a third party, known as a trustee, to hold assets on behalf of beneficiaries. On the other hand, a trust deed is the document that outlines how the trust operates and details the rights and responsibilities of all parties involved. By utilizing a trust transfer deed form, you can clarify these distinctions and ensure proper management of your assets.

A trust deed is a legal document that outlines the terms and conditions under which a trust operates. Essentially, it establishes the relationship between the trustee, who holds legal title to the trust property, and the beneficiaries who benefit from that property. When considering a trust transfer deed form, this document becomes the foundation for managing trust assets and ensuring compliance with state laws.

In California, you can obtain a copy of a deed by visiting the county recorder’s office, where the property is located. Many counties offer online services to request copies as well. Make sure you have the property information ready to help expedite your request. For additional resources and trust transfer deed forms that can help, check out US Legal Forms.