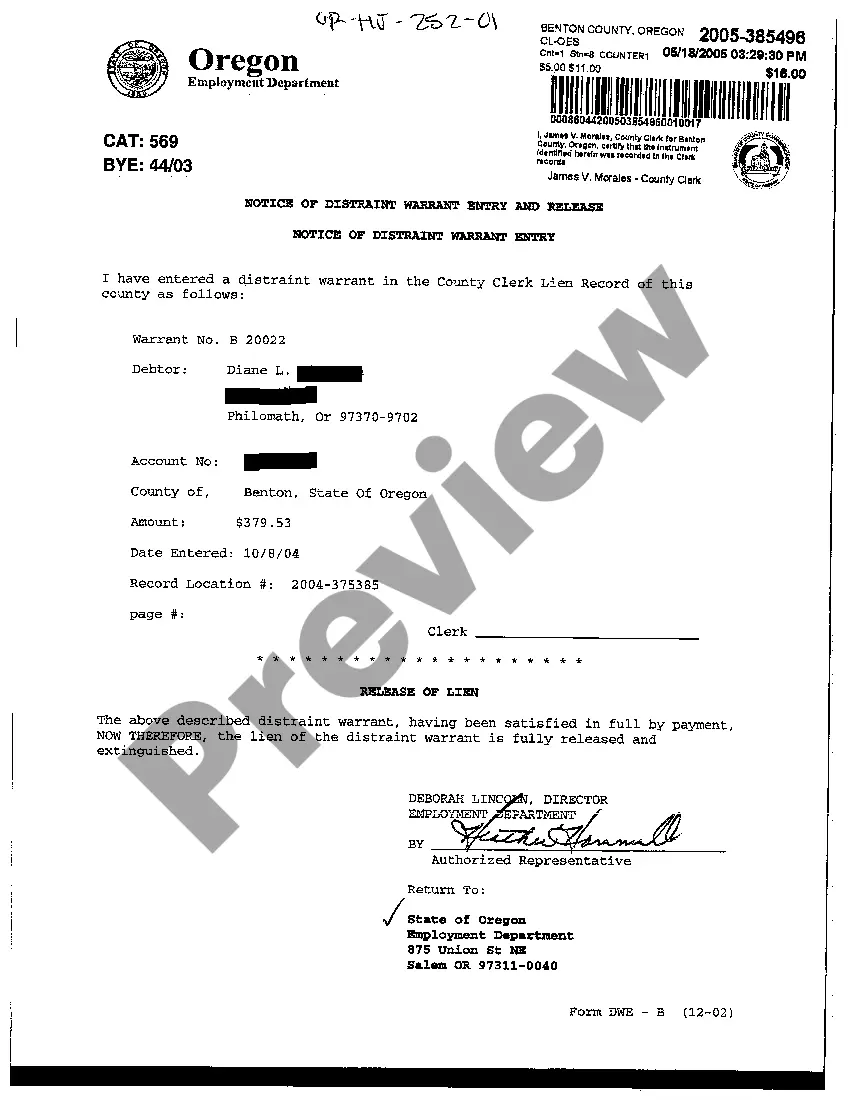

Distraint Warrant Oregon Withholding

Description

How to fill out Oregon Notice Of Distraint Warrant Entry And Release For An Individual?

Managing legal documents and procedures can be a lengthy addition to your whole day.

Distraint Warrant Oregon Withholding and forms of a similar nature generally require you to look for them and grasp the most effective way to fill them out correctly.

Thus, whether you are handling financial, legal, or personal matters, having a comprehensive and useful online collection of forms available will be highly beneficial.

US Legal Forms is the leading online platform for legal templates, offering over 85,000 state-specific documents and various tools to help you complete your paperwork swiftly.

Is this your first time using US Legal Forms? Sign up and create an account in just a few minutes, and you’ll gain access to the form library and Distraint Warrant Oregon Withholding. Then, follow the steps outlined below to complete your form.

- Browse the collection of relevant documents accessible to you with just a single click.

- US Legal Forms gives you access to state- and county-specific forms available at any time for download.

- Protect your document management processes by utilizing a premium service that enables you to create any form in minutes with no extra or hidden costs.

- Simply Log In to your account, find Distraint Warrant Oregon Withholding, and download it instantly in the My documents section.

- You can also retrieve previously downloaded forms.

Form popularity

FAQ

Oregon withholding is the practice of deducting a portion of an employee's wages for state taxes before they receive their paycheck. This ensures that the state collects taxes in a timely manner, ultimately affecting your financial planning. If you ever face a distraint warrant Oregon withholding, it's vital to understand your rights and responsibilities regarding these withholdings. Platforms like USLegalForms can provide you with the necessary information and forms to manage this process smoothly.

The Oregon 2025 deduction refers to the tax reduction measure designed to offer relief to individuals and businesses in the state. It helps lower taxable income, which may ultimately ease the financial burden of expenses such as debts or obligations. Understanding how this deduction impacts your finances is crucial, especially when dealing with issues like a distraint warrant Oregon withholding. Utilizing resources such as the USLegalForms platform can assist you in navigating these deductions effectively.

The 200-day rule in Oregon refers to the time limit within which the state must commence action to collect on a tax warrant. It essentially mandates that if the state does not take action to collect within 200 days, the warrant may become less effective. Being aware of this rule can significantly impact your situation if you are dealing with a distraint warrant, as it could open avenues for resolution. For detailed support and options, consider using the resources available at US Legal Forms.

A distraint warrant in Oregon is a formal notification indicating that the state will seize property to settle unpaid taxes. This process usually follows a series of notices and attempts to collect the debt amicably. Understanding how distraint warrants work, especially regarding Oregon withholding, is vital to safeguarding your assets. Utilizing services from US Legal Forms can offer you the guidance needed to address a distraint warrant correctly.

An Oregon distraint warrant is a legal document that grants the state authority to collect unpaid taxes by seizing your property or assets. This warrant is issued when other collection methods fail, and it is part of the collection process for state taxes. If you receive notice of a distraint warrant, it's crucial to act quickly to address the situation. You can find valuable resources and assistance on platforms like US Legal Forms to navigate potential repercussions of an Oregon distraint warrant.

To obtain a tax warrant in Oregon, you must first owe back taxes to the state. The Oregon Department of Revenue will typically issue a distraint warrant after exhausting all collection options, such as payment plans or negotiations. This warrant allows the state to take action against your assets, including property, to satisfy the tax debt. Understanding the process and implications of a distraint warrant in Oregon withholding can help you deal with potential tax issues proactively.

Addressing a tax warrant requires immediate attention to avoid additional penalties. Begin by contacting the Oregon Department of Revenue to clarify your situation and discuss payment options. You may also consider legal assistance to navigate your options effectively. Employing tools like US Legal Forms can help you prepare the necessary documentation and responses related to your distraint warrant.

Oregon determines residency for tax purposes based on various factors, including physical presence and the intention to remain in the state. If you stay in Oregon for more than 200 days in a year, you are generally considered a resident. Understanding residency can impact your tax liabilities, especially if you face a distraint warrant. Always keep your documentation and intentions clear to avoid misunderstandings.

When you receive a letter from the Oregon Department of Revenue, read it carefully to understand the actions required. Typically, you may need to provide additional information or settle your tax obligations. Respond promptly, as delays can lead to enforcement actions like a distraint warrant. Using resources from US Legal Forms can assist you in crafting an appropriate response.

If you withdraw funds from an Oregon IRA before age 59½, you will likely face a 10% early withdrawal penalty. Additionally, the withdrawn amount will be subject to state and federal income taxes. It’s crucial to consider these penalties when planning your withdrawals. Keeping your financial health in mind can help mitigate issues related to distraint warrants.