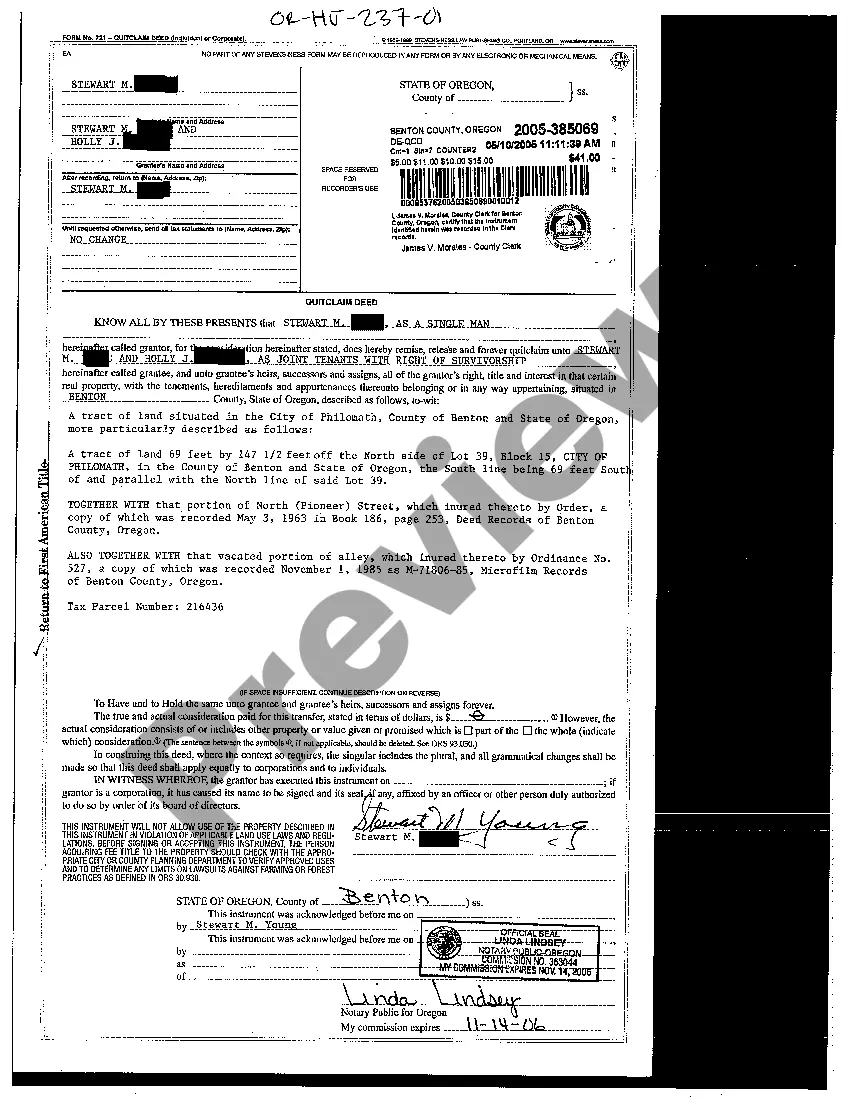

Joint Tenants In Entirety

Description

Form popularity

FAQ

A disadvantage of joint tenancy ownership is that it can lead to unintentional gifts upon death. When one joint tenant passes away, their interest automatically transfers to the surviving tenant, which may not align with the deceased's wishes. Understanding the implications of joint ownership is essential, and using a platform like USLegalForms can help you draft a clear estate plan to reflect your intentions.

Avoiding joint ownership may be wise as it can limit your individual rights and access to the property. Joint tenants in entirety can face complications from disagreements about property management, selling, or division of expenses. To maintain greater control and flexibility over assets, consider exploring other ownership options that suit your unique situation.

The pitfalls of joint ownership include potential disputes among owners, which can lead to costly legal battles. Furthermore, joint tenants in entirety share equal rights, but their financial responsibilities can differ, causing tension. It is crucial to communicate openly with co-owners and consider formal agreements to mitigate these issues.

One significant disadvantage of joint tenancy is that it does not allow for individual control over one's share of the property. If one joint tenant wishes to sell or mortgage their interest, they may face barriers due to the needs of the other tenants. Additionally, any debts or liabilities incurred by one joint tenant can jeopardize the entire property, impacting all owners.

The main difference between joint tenants and tenants by entirety lies in the ownership rights and liability. Joint tenants can be any individuals co-owning a property, whereas tenants by entirety specifically apply to married couples, providing additional legal protections. Joint tenants can transfer their ownership without the consent of the other, while tenants by entirety require both spouses to act together for any changes. Choosing the right form of ownership can significantly impact your legal standing.

One significant downside of tenants by entirety is that it may limit the ability to sell or mortgage the property without the consent of both spouses. If the relationship ends, it can lead to complicated legal proceedings to determine ownership rights. Moreover, if one spouse is heavily in debt, creditors might target marital assets with certain exceptions. Understanding these nuances is critical when considering property ownership options.

Declaring joint tenancy involves specific steps to ensure that both parties have rights to the property. You typically need to draft a deed that specifies the property ownership as joint tenants in entirety and both owners must sign the deed. Once completed, file this document with your local government office to make the ownership official. For further assistance, consider using platforms like USLegalForms which can guide you through the process.

While tenancy by the entirety offers many benefits for married couples, it has some disadvantages as well. For instance, if one spouse incurs significant debt, creditors may still be able to threaten the property under certain circumstances. Additionally, divorce can complicate ownership, sometimes necessitating a sale or division of assets. It’s essential to consider these factors when deciding on this form of ownership.

For married couples, joint tenants in entirety often represent the best choice in property ownership. This arrangement allows both partners to have equal rights to the property, providing a smooth transfer of ownership in the event of one spouse's death. Additionally, it protects the property from the claims of creditors, which adds a layer of financial security. Opting for this tenancy type can promote unity and shared responsibility.