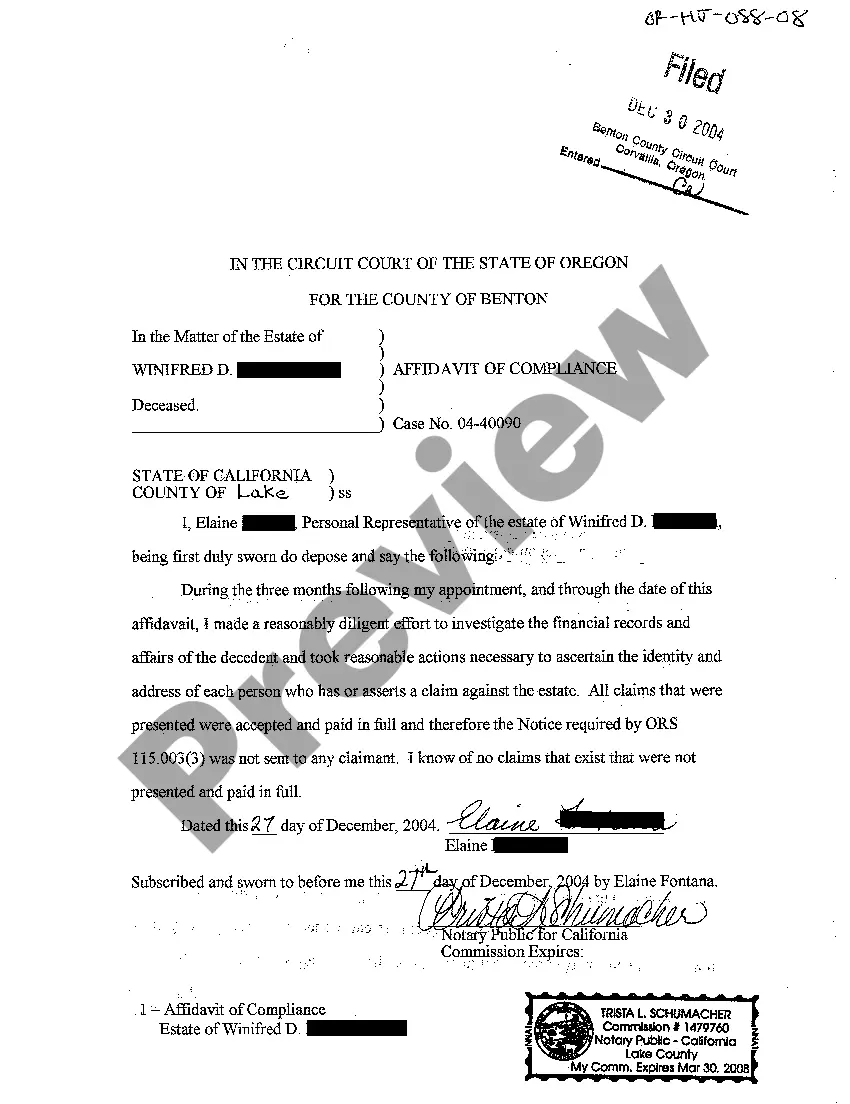

Oregon Probate Affidavit Of Compliance Without

Description

How to fill out Oregon Probate Affidavit Of Compliance Without?

Administration necessitates exactness and correctness.

If you are not accustomed to completing forms like Oregon Probate Affidavit Of Compliance Without on a daily basis, it may lead to some misunderstanding.

Selecting the appropriate template from the outset will guarantee that your documentation submission proceeds smoothly and avert any complications of re-submitting a form or undertaking the same task entirely from the beginning.

If you are not a registered user, locating the desired template will involve a few additional steps.

- You can always acquire the correct template for your documentation at US Legal Forms.

- US Legal Forms is the largest online template repository offering over 85 thousand samples across various sectors.

- You can find the latest and most relevant version of the Oregon Probate Affidavit Of Compliance Without simply by browsing the platform.

- Identify, store, and save templates within your account or refer to the description to confirm you possess the right one at your disposal.

- With a US Legal Forms account, you can effortlessly obtain, maintain in one place, and browse through your saved templates for easy access.

- When on the site, click the Log In button to sign in.

- Next, navigate to the My documents page, where your list of forms is kept.

- Review the descriptions of the forms and save those you require at any moment.

Form popularity

FAQ

An affidavit can be filed if the fair market value of the estate is $275,000 or less. Of that amount, no more than $200,000 can be attributable to real property and no more than $75,000 can be attributable to personal property.

An Oregon small estate affidavit is a document that can be used to claim property from a deceased person's estate, so long as the estate meets certain criteria. The person completing the affidavit is known as an affiant, and the deceased person is known as the decedent.

Probate law doesn't stipulate how personal items should be divided among beneficiaries unless they've been specifically named in the Will. Such things are called specific legacies. A mother, for example, might wish her eldest daughter to receive her wedding and engagement rings.

Step 1 Wait Thirty (30) Days. The small estate affidavit can only be filed after thirty (30) days have passed since the decedent's death.Step 2 No Personal Representative.Step 3 Complete Forms.Step 4 File With Court.Step 5 Send to Estate Recipients.

Under Oregon inheritance laws, If you have a spouse but no descendants (children, grandchildren), your spouse will inherit everything. If you have children but no spouse, your children will inherit everything. If you have a spouse and descendants (with that spouse), your spouse inherits everything.